Hugh Hendry's hedge fund, Eclectica Asset Management, is profiting handsomely from the ailing Greek economy. How can he defend cashing in on the misfortunes of others? Easily, he tells Simon Usborne

A stack of hardbacks sits on the windowsill in the office of hedge fund manager Hugh Hendry. They make up a reading list perhaps now common in London's embattled financial community.

The Volatility Machine: Emerging Economics and the Threat of Financial Collapse sits under a copy of Lords of Finance: The Bankers Who Broke the World, a timely examination of the Great Depression. On top of the pile, lies a dog-eared dictionary open at the page with words beginning "sco-". What was Hendry looking up? He bounds around his desk. "Oh, yes," he says, running his finger down the page, "it was for an article I wrote about hedge fund managers last week. I was looking up 'scourge', as in 'scourge on society'."

Hendry does not see himself as "a person who harasses or causes destruction", but he is painfully aware that that is how many of us see him. Originally a byword for staggering personal wealth apparently derived from having licences to print money, hedge funds have become, after the recession, a symbol of something more sinister. When I canvass opinions of Hendry before our interview, they are generally negative. One knowledgeable denizen of Wall Street, who prefers not to be named, writes in an email: "Hendry is the Person I'd Most Like To Punch." It's the same story in Europe. Poul Rasmussen, the former prime minster of Denmark, who is waging a war against speculators like Hendry by pushing for more EU regulation, tells me on the phone from Brussels: "Hedge funds are like vultures, or hunting dogs. When a state is in trouble, you can be sure that in a nano-second they'll make attacks."

Related articles

Chancellor will resist call for tax on banks in Budget

£2bn 'green bank' plan to be at heart of Darling's Budget

Nicholas Jones: The way to control the banks is through their accounts

Search the news archive for more stories

It's an ugly characterisation that Hendry hears more and more. And he's had enough. Combining staggering self-assurance – the product of more than 20 years in investment finance – with the zeal of a preacher and a remarkable facility for extended metaphors, the 41-year-old Scot has become the self-appointed defender-in-chief for a secretive profession under siege. "Of course it bothers me that I'm hated," Hendry says. "I listen to some of the things people say on debates on Radio 4 and it terrifies me to hear such hostility. What bothers me is that the silence of rich guys who are embarrassed about being rich helps whip up this frenzy that makes us seem like villains." Hendry, who will later argue that hedge fund managers offer a "social service", says the public "is being fed a line that preys on their ignorance. The person who would like to punch me doesn't have that insight."

*****

Hendry is the boss at Eclectica Asset Management, which he launched five years ago. Like all hedge funds, it takes money from investors and uses it to make bets on their behalf. A good bet means a healthy return for investors – and, of course, a fat fee for the fund manager. Eclectica is, by his own admission, a hedge fund minnow. "The total size of the assets we have under management is about £450m," he says. "There are funds that manage $20bn [£13bn]." Leading a team of a dozen or so fund managers, analysts and traders, Hendry asks his clients (most of whom he says are individuals) to invest a minimum of 100,000 dollars, pounds or euros. He says that most funds demand at least $5m. Talking later about the real big hitters, Hendry says, "Some of these guys, I should be shining their shoes."

But it's clear that Hendry does okay. He responds to enquiries about his personal wealth (and many other questions about his private life) with a polite "fuck off", but his financier's uniform of well-cut blue shirt, navy tie, Gucci specs and a chunky Louis Vuitton watch shouts money. Not that all areas of his life conform to the stereotype. His stark, mahogany-free office is not in Mayfair or Knightsbridge but in the shadow of the Whiteleys shopping centre in Bayswater, a short hop in his G-Wiz electric car from his Notting Hill home. Sure, he has a house in the country ("a Cotswolds caricature"), but he reaches it, with his wife and three young children, in a second-hand Land Rover Discovery.

Whether or not his relatively modest lifestyle is something studied rather than a product of a tight budget, Hendry has carved out a nice life. And he's terrified that a backlash against his profession will force him out. "I don't want to go and live in Switzerland or some Caribbean island," he says. "I like it here." But for many people, Hendry has become persona non grata. Poul Rasmussen, who is now an MEP and president of the Party of European Socialists, has been the driving force behind proposed EU regulation of the hedge fund industry that would significantly trim its powers.

The Alternative Investment Fund Managers directive and the popular, speculators-as-devils sentiment it represents, amounts to such a significant attack on the largely Anglo-American hedge fund industry that it has almost sparked a diplomatic crisis.

First Timothy Geithner, the US Treasury Secretary, made a veiled threat of US retaliation if the directive were pursued. Then, on the eve of a meeting of EU finance ministers last Tuesday, at which the reforms were due to be discussed, Prime Minister Gordon Brown made a late-night telephone call to his Spanish counterpart, José Luis Rodríguez Zapatero, also appealing for restraint. Spain, which holds the EU presidency, then dropped the directive from the agenda. Rasmussen calls the Spanish retreat, after "incredibly heavy lobbying" by the London hedge fund community, "a disgrace".

Rasmussen and Hendry have come to represent two sides in an increasingly bitter and, at times, personal war of words about the moral and financial value of the hedge fund in a post-recession society. The two came head-to-head on the BBC's Newsnight earlier this month. While Rasmussen kept it civil, his disdain was palpable. Hendry, meanwhile, listened to his foe while wearing a permanent sneer, before suggesting that Rasmussen was a "champagne socialist travelling business class on the back of money created by risk-takers like me".

*****

So who's right? Both sides see answers in a nation on its knees. Greece's economy is in meltdown after years of massive borrowing and spending. Now, as the banks that lent to Greece scramble to shore up their finances after the global economic crisis, they want their money back. Greece can't pay. That means it risks going into default, which means banks would have to take massive write-offs, which would affect lending, hammer the euro and send economic shockwaves across the world. What has this got to do with Hendry? "As Greece spends less, its economy will prove weaker and it could go back into recession," he explains. "In that event, it seems unlikely that the European Central Bank would raise interest rates, because if it did, it would precipitate further financial duress and strain upon a vulnerable country. I have substantial investments which are betting that interest rates will not go up this year. If they do, I will lose money, but if I'm right, I could make a return of about 20 per cent of the size of my fund." He adds: "I don't think that makes me a bad guy."

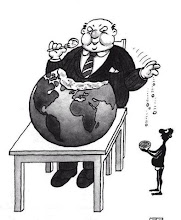

Others do, however. Hendry's is one example of many positions held by hedge fund managers that mean they and their clients will profit as the Greek economy sinks. Rasmussen and his supporters believe that some of these positions make things worse for Greece by forcing up interest rates on the debt it is already struggling to repay. The country's Prime Minister, George Papandreou, said in a speech in Washington earlier this month, "An elected government, making huge changes with the consent of its people, is being undermined by concentrated powers in unregulated markets – powers which go beyond those of any individual government."

Hendry is in effect being accused by a Prime Minister and a leading MEP of exacerbating the suffering of people, of causing mass unemployment and widespread strikes that have seen the closure of schools, and violent clashes on the streets of Athens. He has a lot to answer for.

But is Rasmussen right? Hugh, are you a vulture? "It wouldn't be a pretty metaphor," he replies, "but you could say that when you see a vulture picking the bones of a springbok, it's picking the bones on a dead carcass. The vulture wasn't responsible for the death."

Okay, so it's not his fault. Hendry did not bring down Greece, whose trials have been widely blamed on reckless lending by banks, reckless borrowing by Greece, and book-fiddling in Athens to hide the scale of public debt. But when did vultures start offering a social service? To illustrate one of his more surprising arguments, the hedge fund manager moves from the savannah to my house: "Say I buy insurance on your house burning down. I don't live in your house, so why on earth would I want to have anything to do with any future outcome there? Well, I'm not dumb. I give great consideration to spending mine and my clients' money. So if I'm buying insurance that pays out on your house burning down, then there's a strong probability there's a fire hazard. I suggest you do something about it. You would perhaps discover your wiring was faulty and replace it. If you do, my curiosity and information has helped to prevent a catastrophe."

Hendry goes further. He says it's common for hedge fund managers to write letters to company bosses, telling them what they are doing wrong and what they should do to fix it. So, less vulture and more canary in the coal mine. A prettier metaphor, but one that, in many minds, doesn't fly. Company bosses appreciate his input about as much as the Greek Prime Minister does. "We are their worst nightmare because we're well-financed, we're intelligent and the problem is that, right now, the message we have is rather unpalatable," Hendry says. "Our business is to say that the emperor has no clothes."

But surely Hendry's biggest hurdle in convincing us he does good is that, when hedge fund managers make millions at the same time that others lose millions, it looks bad. Hendry saw it for himself when he dropped his kids at their private school the day after the 2008 Lehman Brothers collapse. "A lot of parents were immediately affected, because the majority of senior employees at Lehman's had most of their savings invested in the stock," he recalls. "Suddenly they woke up and it was zero and they were wondering if their children could still go to school. The misery was palpable and I was shocked by the human cost. But it was weird, because I knew my fund was up 20 per cent that day. I was cockahoop."

*****

Hendry's conviction and antagonistic tendency are the result of a life in which he has never conformed. The son of a Glasgow lorry driver, he always wanted out: "I knew that if I knuckled down I'd be in control of my destiny... and, for a kid from that background, your ticket into the middle classes was law or accountancy." He chose accountancy, becoming the first member of his family and one of few pupils from his school to go to university (at Strathclyde). He was then the first non-Oxbridge graduate to get a job at the prestigious Edinburgh investment management firm, Baillie Gifford. But, as fearless then as he is now, he was labelled a troublemaker. After a move to the City, he became a frustrated nobody on a floor of 400 traders. Still he spoke up, but his voice wasn't welcome and he was fired inside a month. It was only after a chance meeting with Crispin Odey, the millionaire grandee of the London hedge fund scene, that Hendry felt he belonged. "It was a meeting of minds," says Hendry, who won awards as a fund manager with Odey's outfit, after being hired in 1999. "He checked my references, got the message that I was a troublemaker, and said, 'You're one of us, you're one of the pirates'."

Now in charge at Eclectica, which he launched in 2005, Hendry says it's his job to operate outside the herd. During our 90-minute interview, his phone, which he says is not on divert, hasn't rung once. His desk isn't scattered with company reports and spreadsheets but instead with books, a pile of CDs and a Chronicles of Narnia DVD. His day begins with the school run, followed by a visit to his local coffee shop and a 10am start. He attends a Spinning class and does yoga. He writes commentary, published on his website, which is as colourful as his language and quotes anyone from Keynes to Roald Dahl. He says he has "no dialogue" with anyone else in the City: "I make the greatest profit from contentious posturing. But because that posturing is deemed now to be no longer economically contentious but also politically contentious, I feel as if I have gone into a conflict with society at large."

Perhaps the pirate/vulture imagery isn't helping. Neither beast is renowned for its emotion or compassion. It can make Hendry appear cold-hearted as well as infuriatingly self-assured. The man who wants to punch him was moved by another notorious Newsnight clash. Last month, Hendry came up against Joseph Stiglitz, the Nobel prize-winning American economist and former chief economist of the World Bank. When Stiglitz was being, in Hendry's words, "egregiously wrong" about Greece's woes, Hendry delivered a finger-pointing rebuke that began with the words: "Erm, hello. Can I tell you about the real world?"

But if emotion is one luxury Hendry can rarely afford, he says it's because, in global finance, it comes at too high a price. He springs from the table back over to the window, where the dictionary is now closed, and pulls out a copy of The Economic Consequences of the Peace, by the visionary British economist, John Maynard Keynes. Published in 1919, the book argues that the massive reparations demanded of Germany after the First World War jeopardised the European economy. Keynes prescribed forgiveness, economically at least. Hendry draws parallels between the Allies and today's banks. "They should be generous," he says. "By insisting that Greece, for example, should repay everything they are impoverishing us all."

But it's a message not heard by the banks, which leaves countries like Greece relying on official bailouts. Hendry says that's damaging. "German and French banks have got billions of euros in Greece, even though everyone knew Greece was using its credit card too much. And now they're stuck and want to pull the money out. But if they do, you'll get a bank failure in Greece and the whole thing unravels. And so you've got the politicians on the other side who keep rescuing them with your money – that impoverishes you. If Keynes were alive today he would write a book called "The Economic Consequences of the Bailout".

So, what, just let everything go up in flames – savers, bankers, Greeks be damned? "I believe in tough love. Let's look at Iceland. I didn't invest money in Icesave because they took risks I would never take to offer very high interest rates. You take a risk, you get it wrong, you pay. Instead the government says, don't worry, here's my friend the taxpayer with a cheque. You're impoverishing us all to bail out people who make bad decisions." Hendry says it's the same in Greece, where "the champagne socialists I refer to want to bail out the bankers not the people. But they can confuse the people by saying, look, here are these evil speculators – it's their fault."

*****

And so it comes back to the war with Rasmussen, who's still hell-bent on cutting hedge funds down to size. You get the sense that it's Hendry's character as much as his argument that enrages his enemies. Why should I listen to this jumped-up financier?

"This isn't personal," Rasmussen says. "It's about fundamental ethics. Compare ordinary, hard-working families earning their money to what these guys in the hedge fund industry are doing. We want to tell these guys, you have to behave in accordance with what's decided by society. If I were in the hedge fund industry I would feel a bit lonely."

But Hendry doesn't feel lonely, and is hopeful that Rasmussen's directive, which he says would ultimately cause greater inflation and make us poorer, will fail. He says he has had messages of support from other managers unable, or unwilling, to speak out. "I got an email from a financial journalist telling me there was now an acronym for me – BHFMTFH, or 'boutique hedge fund manager turned folk hero'. I don't think it will take off." Hendry has found an instant audience for his voice because it's rare for anyone from his profession to speak out, never mind become a minor celebrity with a following on YouTube (that Stiglitz take-down has 35,000 views). He claims his openness is bad for business. "A lot of guys play golf or shoot furry animals," he says. "I don't. My vice is speaking to fuckers like you."

Leaving his office, Hendry shows me to the main floor, where young men in polo shirts are eating lunch hunched over their monitors. Bolted to the far wall, a giant plasma screen sporting a spreadsheet offers a live update of Eclectica's funds. "Can you imagine having a screen on your wall saying, every minute, 'you're a great journalist, you're a shit journalist, you're a shit journalist, you're a good journalist'? I have that. I risk my money and my clients' money every day."

Right now, Hendry is just an average fund manager – the figures on the screen show he's losing money, albeit a fraction of a per cent of his funds (and it's only 1pm). "If I get things wrong, don't worry about me – I'm not going to get bailed out. I'll lose everything and you'll never hear from me again."

In the meantime, what remains is that nagging question about the moral implications of the work of hedge funds, which is only growing in the popular imagination, even if Hendry doesn't see it. "PEOPLE DO NOT SUFFER WHEN I SUCCEED," he 'shouts' when I press him in an email the day after our interview. Taking him back to my house, which has now burned down because, presumably, I haven't heeded his warnings and haven't checked my (faulty) wiring, I ask if, before cashing in, he stops to think about my lost possessions and memories – the fact that I'm now homeless. "I guess that if I retain my UK citizenship and therefore am subject to paying taxes, then when the fire engines come to hose down your house, you know what? I paid for the fire brigade."

Long and short of it: What are hedge funds?

Machiavellian manipulators of markets, or successful servants of savers? The truth is that the term 'hedge fund' covers a multitude of sins. In a nutshell, a hedge fund is a professionally run investment vehicle that takes in money from a group of savers – usually high-net-worth individuals or institutions such as pension funds – and makes bets on their behalf.

Assuming the bets pay off, the hedge fund manager gets a generous fee and investors earn a good return on their money.

Different hedge funds pursue very different strategies and invest in all sorts of different assets, from shares to commodities to debt. But the sector is associated with two trading techniques in particular: short selling and leverage.

Short selling means selling an asset you don't own in the hope of being able to buy it back at a cheaper price later. It's a way to bet on the price of something falling. Leverage, meanwhile, means borrowing extra money to invest; it can make winning bets many times more profitable, but losing wagers are correspondingly painful.

Much of the notoriety that surrounds the hedge fund industry stems from the fact that as private funds, usually off-limits to ordinary savers, they are lightly regulated and don't have to tell the world too much about what they're up to. Many funds are highly secretive and committed to keeping a low profile.

For conspiracy theorists, that makes the sector an easy target. European officials, for example, have accused hedge funds of conspiring to use the Greek crisis as an opportunity to provoke a run on the euro. Two years ago, hedge funds were accused of planting false rumours during the banking crisis.

There's no doubt that some hedge funds, worth billions of pounds, are very powerful. For example George Soros, the best-known of all hedge fund managers, made £1bn by aiding and abetting the UK's exit from the Exchange Rate Mechanism in 1992. But the sector has no more bad eggs than any other part of the financial services industry. And it played almost no part in causing the financial crisis of the past three years.

http://www.independent.co.uk/news/business/analysis-and-features/master-of-the-universe-can-hugh-hendry-teach-us-to-love-hedge-funds-1924913.html

No comments:

Post a Comment