In a little-noticed but potentially explosive remark last Friday, Senator Dick Durbin (D-Ill.) accused Republican leadership of signing a political pact withthe banking industry: in exchange for help defeating a measure that would makeit easier for homeowners to restructure failing mortgages, GOP leadership in the Senate would help banks defeat any additional efforts at regulatory reform.The allegation of a quid pro quo was based on an email that Durbin received last spring after his amendment to allow judges to modify mortgages for homeowners who enter bankruptcy was defeated on the Senate floor. During a discussion to promote publicly-financed elections on Friday, the Illinois Democrat relayed that, shortly after the defeat of his "cram-down" amendment, a "banker friend"forwarded him the note from Tanya Wheeless, president & CEO of Arizona BankersAssociation."I have contacted the market presidents for each of the three banks (Chase,Wells and Bank of America) and explained that in my humble opinion it's a big mistake to cut a deal with Durbin and alienate our (in Arizona) Senator,"Wheeless's email reads. "I also told them that I thought this would drive awedge in our industry. [Senator Jon] Kyl has pointedly told them not to make a deal with Durbin and then come looking to Republicans when they need help on something like regulatory restructuring or systemic risk regulation.""I know the (sic) every state association will have to do what's best for its members, but I have told my largest three members that if they cut this deal,AzBA will fight them on it. They may be willing to alienate Republican leadership, but I'm not quite there yet."The email, (pasted into the original article and accessable in the link below), was passed to the Huffington Post by Durbin's office.The implication seems fairly clear: banks were being warned that if they negotiated with Durbin on cram-down, they were risking GOP support on regulatory reform. That the banking industry would take such a stance isn't entirely surprising, when one considers the narrow financial interests that influence theindustry. But the willingness of the GOP leadership to, apparently, use regulatory reform as a cudgel to pressure banks is illuminating of the horse-trading process that occurs behind the legislative curtains.At the very least, it shows just how stacked the deck is against passing consumer-oriented reforms. In the end, cram-down was defeated not once but twice on the Senate floor.Durbin said on Friday that, back then "I talked about the fact that when it comes to the banking lobby, they own the place. It might have been an overstatement. But not by much. One of the people I ran into afterwards said[the statement] was like a bolt of lightening in a swimming pool. It just woke everybody up that something is going on, on Capitol Hill."The email, he added, "is a total smoking gun as far as I'm concerned. It tells the whole story and it is in writing as to what is happening behind the scenes... So when people say I don't know if we should have public financing because that is my tax dollars, I can tell them that their resources, whether tax dollars or personal wealth, are being impacted every day by decisions being made by the special interest groups."

Click here to go to original article and for readable copy of Durbins email;

http://www.huffingtonpost.com/2009/12/08/durbin-banks-and-gop-made_n_383872.html

Wednesday, December 9, 2009

Sunday, November 8, 2009

More Small Town Banks Bought Out by The Big Ones

More Big Banks Sucking Up / Absorbing the Small

November 6, 2009

AMCORE Bank's Monroe and Argyle Branches Sold to First National Bank and Trust

GlobeNewswire

ROCKFORD, Ill., Nov 6, 2009 (GlobeNewswire via COMTEX) - AMCORE Bank, N.A., a wholly-owned subsidiary of AMCORE Financial, Inc. (AMFI), today announced that it has completed the sale of its branches in the Wisconsin communities of Monroe and Argyle to First National Bank and Trust Company of Beloit, WI. The sale included approximately $70 million in loans, $135 million in deposits and sweep accounts, and up to $45 million in related trust accounts. The 401(k) plan business was not part of the sale and remains with AMCORE. The financial terms of the transaction were not disclosed.

In making the announcement, AMCORE Chairman and Chief Executive Officer William McManaman said: "The sale of these branches is another step in AMCORE's strategic efforts to raise capital as we continue to focus on serving our core markets. We are pleased that First National Bank and Trust Company has a strong community banking philosophy and we believe it will continue to serve customers with the high quality service that AMCORE proudly provided."

Steven M. Eldred, President and Chief Executive Officer of First National Bank and Trust, expressed his optimism for the potential new opportunities made possible by the acquisition. "For more than 127 years we've provided great service and sound financial advice to the Stateline. Our goal is simple; to help our customers succeed financially. In doing this we build a brighter future for our employees, customers and the communities we serve. We are proud to bring our brand of community banking to Monroe and Argyle."

ABOUT First National

First National Bank and Trust Company, headquartered in Beloit, WI, operates 11 banking locations in Southern Wisconsin and Northern Illinois. The bank has total assets of $631 million and offers full service banking to its customers, including consumer mortgage services, trust, brokerage and retirement services. Additional information about First National Bank and Trust Company is available on the company's website at www.bankatfirstnational.com.

ABOUT AMCORE

AMCORE Financial, Inc. is headquartered in Northern Illinois and has banking assets of $4.4 billion with 69 locations in Illinois and Wisconsin, (excluding Argyle and Monroe). AMCORE provides a full range of consumer and commercial banking services, a variety of mortgage lending products and wealth management services including trust, brokerage, private banking, financial planning, investment management, insurance and comprehensive retirement plan services.

AMCORE common stock is listed on The NASDAQ Stock Market under the symbol "AMFI." Further information about AMCORE Financial, Inc. can be found at the Company's website at www.AMCORE.com.

FORWARD LOOKING STATEMENTS

This news release contains, and our periodic filings with the Securities and Exchange Commission and written or oral statements made by the Company's officers and directors to the press, potential investors, securities analysts and others will contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934, and the Company intends that such forward-looking statements be subject to the safe harbors created thereby with respect to, among other things, the financial condition, results of operations, plans, objectives, future performance and business of AMCORE. Statements that are not historical facts, including statements about beliefs and expectations, are forward-looking statements. These statements are based upon beliefs and assumptions of AMCORE's management and on information currently available to such management. The use of the words "believe", "expect", "anticipate", "plan", "estimate", "should", "may", "will" or similar expressions identify forward-looking statements. Forward-looking statements speak only as of the date they are made, and AMCORE undertakes no obligation to update publicly any forward-looking statements in light of new information or future events.

Contemplated, projected, forecasted or estimated results in such forward-looking statements involve certain inherent risks and uncertainties. A number of factors - many of which are beyond the ability of the Company to control or predict - could cause actual results to differ materially from those in its forward-looking statements. These factors include, among others, the following possibilities: (I) heightened competition, including specifically the intensification of price competition, the entry of new competitors and the formation of new products by new or existing competitors; (II) adverse state, local and federal legislation and regulation or adverse findings or rulings made by local, state or federal regulators or agencies regarding AMCORE and its operations; (III) failure to obtain new customers and retain existing customers and related deposit relationships; (IV) inability to carry out marketing and/or expansion plans; (V) ability to attract and retain key executives or personnel; (VI) changes in interest rates including the effect of prepayments; (VII) general economic and business conditions which are less favorable than expected; (VIII) equity and fixed income market fluctuations; (IX) unanticipated changes in industry trends; (X) unanticipated changes in credit quality and risk factors; (XI) success in gaining regulatory approvals when required; (XII) changes in Federal Reserve Board monetary policies; (XIII) unexpected outcomes on existing or new litigation in which AMCORE, its subsidiaries, officers, directors or employees are named defendants; (XIV) technological changes; (XV) changes in accounting principles generally accepted in the United States of America; (XVI) changes in assumptions or conditions affecting the application of "critical accounting estimates"; (XVII) inability of third-party vendors to perform critical services for the Company or its customers; (XVIII) disruption of operations caused by the conversion and installation of data processing systems; (XIX) adverse economic or business conditions affecting specific loan portfolio types in which the Company has a concentration, such as construction and land development loans; (XX) zoning restrictions or other limitations at the local level, which could prevent limited branch offices from transitioning to full-service facilities; (XXI) possible changes in the creditworthiness of customers and value of collateral and the possible impairment of collectibility of loans; (XXII) changes in lending terms to the Company and the Bank by the Federal Reserve, Federal Home Loan Bank, or any other regulatory agency or third party; (XXIII) the recently enacted Emergency Economic Stabilization Act of 2008, and the various programs the U.S. Treasury and the banking regulators are implementing to address capital and liquidity issues in the banking system, all of which may have significant effects on the Company and the financial services industry, the exact nature and extent of which cannot be determined at this time; and (XXIV) failure by the company to comply with the provisions of any regulatory order or agreement to which the Company is subject could result in additional and material enforcement actions by the applicable regulatory agencies.

This news release was distributed by GlobeNewswire, www.globenewswire.com

SOURCE: AMCORE Financial, Inc.

CONTACT: AMCORE Financial, Inc.

Media Inquiries:

Katherine Taylor

815-961-7164

First National Bank and Trust

Media Inquiries:

Laura Pomerene

608-363-8048

http://license.icopyright.net/user/viewContent.act?clipid=395839215&mode=cnc&tag=3.8218%3Ficx_id%3DNewsfeed103811471

November 6, 2009

AMCORE Bank's Monroe and Argyle Branches Sold to First National Bank and Trust

GlobeNewswire

ROCKFORD, Ill., Nov 6, 2009 (GlobeNewswire via COMTEX) - AMCORE Bank, N.A., a wholly-owned subsidiary of AMCORE Financial, Inc. (AMFI), today announced that it has completed the sale of its branches in the Wisconsin communities of Monroe and Argyle to First National Bank and Trust Company of Beloit, WI. The sale included approximately $70 million in loans, $135 million in deposits and sweep accounts, and up to $45 million in related trust accounts. The 401(k) plan business was not part of the sale and remains with AMCORE. The financial terms of the transaction were not disclosed.

In making the announcement, AMCORE Chairman and Chief Executive Officer William McManaman said: "The sale of these branches is another step in AMCORE's strategic efforts to raise capital as we continue to focus on serving our core markets. We are pleased that First National Bank and Trust Company has a strong community banking philosophy and we believe it will continue to serve customers with the high quality service that AMCORE proudly provided."

Steven M. Eldred, President and Chief Executive Officer of First National Bank and Trust, expressed his optimism for the potential new opportunities made possible by the acquisition. "For more than 127 years we've provided great service and sound financial advice to the Stateline. Our goal is simple; to help our customers succeed financially. In doing this we build a brighter future for our employees, customers and the communities we serve. We are proud to bring our brand of community banking to Monroe and Argyle."

ABOUT First National

First National Bank and Trust Company, headquartered in Beloit, WI, operates 11 banking locations in Southern Wisconsin and Northern Illinois. The bank has total assets of $631 million and offers full service banking to its customers, including consumer mortgage services, trust, brokerage and retirement services. Additional information about First National Bank and Trust Company is available on the company's website at www.bankatfirstnational.com.

ABOUT AMCORE

AMCORE Financial, Inc. is headquartered in Northern Illinois and has banking assets of $4.4 billion with 69 locations in Illinois and Wisconsin, (excluding Argyle and Monroe). AMCORE provides a full range of consumer and commercial banking services, a variety of mortgage lending products and wealth management services including trust, brokerage, private banking, financial planning, investment management, insurance and comprehensive retirement plan services.

AMCORE common stock is listed on The NASDAQ Stock Market under the symbol "AMFI." Further information about AMCORE Financial, Inc. can be found at the Company's website at www.AMCORE.com.

FORWARD LOOKING STATEMENTS

This news release contains, and our periodic filings with the Securities and Exchange Commission and written or oral statements made by the Company's officers and directors to the press, potential investors, securities analysts and others will contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934, and the Company intends that such forward-looking statements be subject to the safe harbors created thereby with respect to, among other things, the financial condition, results of operations, plans, objectives, future performance and business of AMCORE. Statements that are not historical facts, including statements about beliefs and expectations, are forward-looking statements. These statements are based upon beliefs and assumptions of AMCORE's management and on information currently available to such management. The use of the words "believe", "expect", "anticipate", "plan", "estimate", "should", "may", "will" or similar expressions identify forward-looking statements. Forward-looking statements speak only as of the date they are made, and AMCORE undertakes no obligation to update publicly any forward-looking statements in light of new information or future events.

Contemplated, projected, forecasted or estimated results in such forward-looking statements involve certain inherent risks and uncertainties. A number of factors - many of which are beyond the ability of the Company to control or predict - could cause actual results to differ materially from those in its forward-looking statements. These factors include, among others, the following possibilities: (I) heightened competition, including specifically the intensification of price competition, the entry of new competitors and the formation of new products by new or existing competitors; (II) adverse state, local and federal legislation and regulation or adverse findings or rulings made by local, state or federal regulators or agencies regarding AMCORE and its operations; (III) failure to obtain new customers and retain existing customers and related deposit relationships; (IV) inability to carry out marketing and/or expansion plans; (V) ability to attract and retain key executives or personnel; (VI) changes in interest rates including the effect of prepayments; (VII) general economic and business conditions which are less favorable than expected; (VIII) equity and fixed income market fluctuations; (IX) unanticipated changes in industry trends; (X) unanticipated changes in credit quality and risk factors; (XI) success in gaining regulatory approvals when required; (XII) changes in Federal Reserve Board monetary policies; (XIII) unexpected outcomes on existing or new litigation in which AMCORE, its subsidiaries, officers, directors or employees are named defendants; (XIV) technological changes; (XV) changes in accounting principles generally accepted in the United States of America; (XVI) changes in assumptions or conditions affecting the application of "critical accounting estimates"; (XVII) inability of third-party vendors to perform critical services for the Company or its customers; (XVIII) disruption of operations caused by the conversion and installation of data processing systems; (XIX) adverse economic or business conditions affecting specific loan portfolio types in which the Company has a concentration, such as construction and land development loans; (XX) zoning restrictions or other limitations at the local level, which could prevent limited branch offices from transitioning to full-service facilities; (XXI) possible changes in the creditworthiness of customers and value of collateral and the possible impairment of collectibility of loans; (XXII) changes in lending terms to the Company and the Bank by the Federal Reserve, Federal Home Loan Bank, or any other regulatory agency or third party; (XXIII) the recently enacted Emergency Economic Stabilization Act of 2008, and the various programs the U.S. Treasury and the banking regulators are implementing to address capital and liquidity issues in the banking system, all of which may have significant effects on the Company and the financial services industry, the exact nature and extent of which cannot be determined at this time; and (XXIV) failure by the company to comply with the provisions of any regulatory order or agreement to which the Company is subject could result in additional and material enforcement actions by the applicable regulatory agencies.

This news release was distributed by GlobeNewswire, www.globenewswire.com

SOURCE: AMCORE Financial, Inc.

CONTACT: AMCORE Financial, Inc.

Media Inquiries:

Katherine Taylor

815-961-7164

First National Bank and Trust

Media Inquiries:

Laura Pomerene

608-363-8048

http://license.icopyright.net/user/viewContent.act?clipid=395839215&mode=cnc&tag=3.8218%3Ficx_id%3DNewsfeed103811471

Saturday, November 7, 2009

Vaccines for the rich! Wall Street gets H1N1 vaccine bailout while school children told to wait

Friday, November 06, 2009 by: Mike Adams, the Health Ranger, NaturalNews Editor

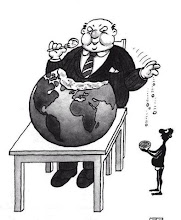

(NaturalNews) It seems the financial bailout isn't the only bailout happening on Wall Street these days. News has now leaked that investment firms Goldman Sachs and Citigroup both received preferential H1N1 swine flu vaccines even while local clinics that treat school children had no supply. The uproar is reminding the public just how much special treatment Wall Street banks get -- both financially and medically -- while everyday people are hung out to dry.

Not only that, but taxpayers got to foot the bill for those H1N1 vaccines handed to Wall Street insiders. It's yet one more way in which the general public is being screwed over (yet again) by the swine flu vaccine agenda.

There's one politically incorrect question in all this that's just begging to be asked, and let's assume for the moment that H1N1 vaccines actually work to save lives even though they don't: If a dangerous viral pandemic sweeps through the nation, killing people left and right, are Wall Street investment bankers really the people we want to save first?

Seriously. Doesn't it seem that school children should get the medicine first and Wall Street insiders should get it last?

The CDC claims that the vaccines sent to these Wall Street companies should have only been given to "high-risk people" who worked there. Sure they were, because we all know that Wall Street companies adhere to the highest standards of ethics, morality and civic responsibility. These people are shining examples of glorious human beings who always do the right thing, even if it requires giving up something for the benefit of someone else, right? And if they were on a sinking Titanic, they'd give up the life boats to the poor women and children, right?

But the real story here isn't that H1N1 vaccines are now being preferentially given to the rich instead of the school children. The real story is that people are panicking to get their hands on a complete joke of a vaccine -- a chemical cocktail that has never been subjected to even a single scientific test proving it actually works. People are lining up, in other words, to attain supply of something that's totally useless.

The crumbling social fabric of America

At the same time, this fabricated emergency reveals to us the complete lack of ethics in the distribution of these vaccines to the Wall Street rich, even while everyday poor people stand in line waiting for their turn.

It's yet another powerful commentary on the crumbling social fabric of America -- a nation that puts its morally bankrupt money slingers as a higher priority than everyone else. It's the Wall Streeters who get the trillion-dollar bailouts that the rest of us must someday pay out of our pockets. It's the Wall Streeters who get preferential treatment by Washington. And it's the Wall Streeters who are now getting the medicine that should be going to our children.

Of course, the medicine itself is a joke, too, but that's beside the point: These people THINK the vaccines are valuable, so their decisions on where to send them first reveal their true intentions.

There's a huge moral lesson in all this, by the way: Even those who get the H1N1 vaccine receive no benefit from it. People whose immune systems adaptively respond to the vaccine by building antibodies are the very people who could have done the same thing automatically in response to influenza exposure. Meanwhile, those with suppressed immune systems that are vulnerable to H1N1 have no ability to adaptively produce H1N1 antibodies anyway. In other words, even if you believe the H1N1 vaccine actually works, it only works on the people who don't need it!

This is the ultimate comedy. People are desperately fighting over a chemical injection that will help no one. And the only reason they're so desperate about it is because the hysteria has been entirely fabricated precisely to create irrational demand (http://www.naturalnews.com/027404_h...).

Maybe we should send all the vaccines to Wall Street anyway. Let everybody else stand outside, waiting in lines and soaking up a little sunshine so that their bodies create the only thing that will really save them from influenza in the first place: Vitamin D.

Or better yet, We the People should charge Wall Street for these vaccines we paid for. And the price? One trillion dollars.

Sources for this story include:

WSJ

http://online.wsj.com/article/SB125...

Washington Post

http://www.washingtonpost.com/wp-dy... Buzz up!8 votes

http://www.naturalnews.com/027415_Wall_Street_vaccines_H1N1.html

(NaturalNews) It seems the financial bailout isn't the only bailout happening on Wall Street these days. News has now leaked that investment firms Goldman Sachs and Citigroup both received preferential H1N1 swine flu vaccines even while local clinics that treat school children had no supply. The uproar is reminding the public just how much special treatment Wall Street banks get -- both financially and medically -- while everyday people are hung out to dry.

Not only that, but taxpayers got to foot the bill for those H1N1 vaccines handed to Wall Street insiders. It's yet one more way in which the general public is being screwed over (yet again) by the swine flu vaccine agenda.

There's one politically incorrect question in all this that's just begging to be asked, and let's assume for the moment that H1N1 vaccines actually work to save lives even though they don't: If a dangerous viral pandemic sweeps through the nation, killing people left and right, are Wall Street investment bankers really the people we want to save first?

Seriously. Doesn't it seem that school children should get the medicine first and Wall Street insiders should get it last?

The CDC claims that the vaccines sent to these Wall Street companies should have only been given to "high-risk people" who worked there. Sure they were, because we all know that Wall Street companies adhere to the highest standards of ethics, morality and civic responsibility. These people are shining examples of glorious human beings who always do the right thing, even if it requires giving up something for the benefit of someone else, right? And if they were on a sinking Titanic, they'd give up the life boats to the poor women and children, right?

But the real story here isn't that H1N1 vaccines are now being preferentially given to the rich instead of the school children. The real story is that people are panicking to get their hands on a complete joke of a vaccine -- a chemical cocktail that has never been subjected to even a single scientific test proving it actually works. People are lining up, in other words, to attain supply of something that's totally useless.

The crumbling social fabric of America

At the same time, this fabricated emergency reveals to us the complete lack of ethics in the distribution of these vaccines to the Wall Street rich, even while everyday poor people stand in line waiting for their turn.

It's yet another powerful commentary on the crumbling social fabric of America -- a nation that puts its morally bankrupt money slingers as a higher priority than everyone else. It's the Wall Streeters who get the trillion-dollar bailouts that the rest of us must someday pay out of our pockets. It's the Wall Streeters who get preferential treatment by Washington. And it's the Wall Streeters who are now getting the medicine that should be going to our children.

Of course, the medicine itself is a joke, too, but that's beside the point: These people THINK the vaccines are valuable, so their decisions on where to send them first reveal their true intentions.

There's a huge moral lesson in all this, by the way: Even those who get the H1N1 vaccine receive no benefit from it. People whose immune systems adaptively respond to the vaccine by building antibodies are the very people who could have done the same thing automatically in response to influenza exposure. Meanwhile, those with suppressed immune systems that are vulnerable to H1N1 have no ability to adaptively produce H1N1 antibodies anyway. In other words, even if you believe the H1N1 vaccine actually works, it only works on the people who don't need it!

This is the ultimate comedy. People are desperately fighting over a chemical injection that will help no one. And the only reason they're so desperate about it is because the hysteria has been entirely fabricated precisely to create irrational demand (http://www.naturalnews.com/027404_h...).

Maybe we should send all the vaccines to Wall Street anyway. Let everybody else stand outside, waiting in lines and soaking up a little sunshine so that their bodies create the only thing that will really save them from influenza in the first place: Vitamin D.

Or better yet, We the People should charge Wall Street for these vaccines we paid for. And the price? One trillion dollars.

Sources for this story include:

WSJ

http://online.wsj.com/article/SB125...

Washington Post

http://www.washingtonpost.com/wp-dy... Buzz up!8 votes

http://www.naturalnews.com/027415_Wall_Street_vaccines_H1N1.html

AIG Gets Another ($4.2) BILLION Dollar BailOut @ Txpyrs Expnse

American International Group Inc., the insurer rescued by the U.S., tapped the Treasury Department for another $4.2 billion to help restructure its money-losing mortgage guarantor and the plane unit it’s trying to sell.

AIG accessed about $2.1 billion from its Treasury facility on Aug. 13 and told the government today it would draw down another $2.1 billion, the New York-based company said in a regulatory filing. AIG got the $29.8 billion facility in April as part of its fourth bailout.

“It shows that they’re still having trouble getting cash to continue to run their operations” without government support, said Sandler O’Neill Partners LP analyst Paul Newsome. “That’s despite the fact you’ve had some really favorable things happen, like the credit markets getting better.”

AIG was bailed out in September 2008 to prevent losses at banks that bought derivatives from the insurer. The $182.3 billion rescue includes a $60 billion Federal Reserve credit line, up to $52.5 billion to buy mortgage-backed securities owned or backed by the insurer, and a Treasury investment of as much as $69.8 billion in two facilities. AIG has already drained one of the Treasury programs, valued at $40 billion.

AIG is using Treasury funds to buy shares of International Lease Finance Corp. held by one of its insurance units, the company said in the filing. The transfer may ease the eventual sale of Los Angeles-based ILFC or its assets, Newsome said.

But wait, I thought OMG AIG turned a profit?!

CNN Money:

AIG reported its second profitable quarter in a row early Friday, as stabilization in its insurance businesses, and the credit and mortgage markets helped boost results.

The troubled insurer said its net income rose to $455 million, or 68 cents per share, an improvement over the $24.5 billion loss from a year earlier. Results included a one-time net charge of $1.5 billion for capital losses and hedging.

Without the charge, AIG would have earned $1.9 billion in the quarter, or $2.85 per share. Analysts polled by Thomson Reuters, who typically exclude one-time events, forecasted earnings of $1.98 per share.

Sales for the New York-based company rose 189% to $26 billion, topping analysts' forecasts of $23 billion.

"Our results reflect continued stabilization in performance and market trends," said AIG Chief Executive Robert Benmosche in a statement. "AIG employees are working to preserve the strength of our insurance businesses in a challenging market."

In August, AIG reported that it had returned to profitability after six straight losing quarters, a stretch in which the company lost more than $100 billion.

AIG accessed about $2.1 billion from its Treasury facility on Aug. 13 and told the government today it would draw down another $2.1 billion, the New York-based company said in a regulatory filing. AIG got the $29.8 billion facility in April as part of its fourth bailout.

“It shows that they’re still having trouble getting cash to continue to run their operations” without government support, said Sandler O’Neill Partners LP analyst Paul Newsome. “That’s despite the fact you’ve had some really favorable things happen, like the credit markets getting better.”

AIG was bailed out in September 2008 to prevent losses at banks that bought derivatives from the insurer. The $182.3 billion rescue includes a $60 billion Federal Reserve credit line, up to $52.5 billion to buy mortgage-backed securities owned or backed by the insurer, and a Treasury investment of as much as $69.8 billion in two facilities. AIG has already drained one of the Treasury programs, valued at $40 billion.

AIG is using Treasury funds to buy shares of International Lease Finance Corp. held by one of its insurance units, the company said in the filing. The transfer may ease the eventual sale of Los Angeles-based ILFC or its assets, Newsome said.

But wait, I thought OMG AIG turned a profit?!

CNN Money:

AIG reported its second profitable quarter in a row early Friday, as stabilization in its insurance businesses, and the credit and mortgage markets helped boost results.

The troubled insurer said its net income rose to $455 million, or 68 cents per share, an improvement over the $24.5 billion loss from a year earlier. Results included a one-time net charge of $1.5 billion for capital losses and hedging.

Without the charge, AIG would have earned $1.9 billion in the quarter, or $2.85 per share. Analysts polled by Thomson Reuters, who typically exclude one-time events, forecasted earnings of $1.98 per share.

Sales for the New York-based company rose 189% to $26 billion, topping analysts' forecasts of $23 billion.

"Our results reflect continued stabilization in performance and market trends," said AIG Chief Executive Robert Benmosche in a statement. "AIG employees are working to preserve the strength of our insurance businesses in a challenging market."

In August, AIG reported that it had returned to profitability after six straight losing quarters, a stretch in which the company lost more than $100 billion.

Monday, October 26, 2009

McDonalds Pulls Up Stakes in Iceland; Will Consumers Survive Big Mac Attacks?

Iceland says goodbye to McDonalds as Customers Wonder Where to Get Help for Their Next Big Mac Attack

McDonald's closes in Iceland as currency collapse takes a bite out of Big Mac profits

By Gudjon Helgason and Jane Wardell, Associated Press Writers

On 3:41 pm EDT, Monday October 26, 2009

REYKJAVIK, Iceland (AP) -- The Big Mac, long a symbol of globalization, has become the latest victim of this tiny island nation's overexposure to the world financial crisis.

Iceland's three McDonald's restaurants -- all in the capital Reykjavik -- will close next weekend, as the franchise owner gives in to falling profits caused by the collapse in the Icelandic krona.

"The economic situation has just made it too expensive for us," Magnus Ogmundsson, the managing director of Lyst Hr., McDonald's franchise holder in Iceland, told The Associated Press by telephone on Monday.

Lyst was bound by McDonald's requirement that it import all the goods required for its restaurants -- from packaging to meat and cheeses -- from Germany.

Costs had doubled over the past year because of the fall in the krona currency and high import tariffs on imported goods, Ogmundsson said, making it impossible for the company to raise prices further and remain competitive with competitors that use locally sourced produce.

A Big Mac in Reykjavik already retails for 650 krona ($5.29). But the 20 percent increase needed to make a decent profit would have pushed that to 780 krona ($6.36), he said.

That would have made the Icelandic version of the burger the most expensive in the world, a title currently held jointly by Switzerland and Norway where it costs $5.75, according to The Economist magazine's 2009 Big Mac index.

The decision to shutter the Icelandic franchise was taken in agreement with McDonald's Inc., Ogmundsson said, after a review of several months.

"The unique operational complexity of doing business in Iceland combined with the very challenging economic climate in the country makes it financially prohibitive to continue the business," Theresa Riley, a spokeswoman at McDonald's headquarters in Oak Brook, Illinois, said in a statement. "This complex set of challenges means we have no plans to seek a new partner in Iceland."

McDonald's, the world's largest chain of hamburger fast food restaurants, arrived in Reykjavik in 1993 when the country was on an upward trajectory of wealth and expansion.

The first person to take a bite out of a Big Mac on the island was then-Prime Minister David Oddsson. Oddsson went on to become governor of the country's central bank, Sedlabanki, a position that he was forced out of by lawmakers earlier this year after a public outcry about his inability to prevent Iceland's financial crisis.

Lyst plans to reopen the stores under a new brand name, Metro, using locally sourced materials and produce and retaining the franchise's current 90-strong staff.

Ogmundsson said it was unlikely that Lyst would ever seek to regain the McDonald's franchise with Iceland still struggling to get back on its feet after the credit crisis crippled its overweight banking system, damaging the rest of its economy, last October.

"I don't think anything will happen that will change the situation in any significant way in the next few years," Ogmundsson said.

It is not the first time that McDonald's, which currently operates in more than 119 countries on six continents, has exited a country. Its one and only restaurant in Barbados closed after just six months in 1996 because of slow sales. In 2002, the company pulled out of seven countries, including Bolivia, that had poor profit margins as part of an international cost-cutting exercise.

BLOGGERS NOTE: What the good folks at Big Mac Inc do not tell us is the fact that they are opening 33,000 new stores in China within the next 10 years....so, er, ah,..how bad can they really be hurting? Hummmmm. Anyways, makes sense to me that they would choose China to expand their operations as McDonald Corp has been buying all their beef from them for all their stores as they DO NOT trust USA beef, - although, it is roumored that they maintain a small supply of USDA Inspected beef and will soon offer a burger made from USA beef and will call it The McMadCow Burger, made specifically for their American tourists and others of the like who simply dont give a dam what they eat or feed their children.

AP Business Writer Jane Wardell reported from London. AP Retail Writer Ashley Heher

http://finance.yahoo.com/news/Iceland-says-goodbye-to-the-apf-2609404079.html?x=0&.v=6

Friday, October 16, 2009

Billionaire among 6 nabbed in inside trading case

Wall Street wake-up call: Hedge fund boss, 5 others charged in $25M-plus insider trading case

By Larry Neumeister and Candice Choi, Associated Press Writers

On 6:21 pm EDT, Friday October 16, 2009

Buzz up! 26

NEW YORK (AP) -- One of America's wealthiest men was among six hedge fund managers and corporate executives arrested Friday in a hedge fund insider trading case that authorities say generated more than $25 million in illegal profits and was a wake-up call for Wall Street.

Raj Rajaratnam, a portfolio manager for Galleon Group, a hedge fund with up to $7 billion in assets under management, was accused of conspiring with others to use insider information to trade securities in several publicly traded companies, including Google Inc.

U.S. Magistrate Judge Douglas F. Eaton set bail at $100 million to be secured by $20 million in collateral despite a request by prosecutors to deny bail. He also ordered Rajaratnam, who has both U.S. and Sri Lankan citizenship, to stay within 110 miles of New York City. The judge gave prosecutors until shortly after 6 p.m. to consider appealing his bail ruling.

U.S. Attorney Preet Bharara told a news conference it was the largest hedge fund case ever prosecuted and marked the first use of court-authorized wiretaps to capture conversations by suspects in an insider trading case.

He said the case should cause financial professionals considering insider trades in the future to wonder whether law enforcement is listening.

"Greed is not good," Bharara said. "This case should be a wake-up call for Wall Street."

Joseph Demarest Jr., the head of the New York FBI office, said it was clear that "the 20 million dollars in illicit profits come at the expense of the average public investor."

The Securities and Exchange Commission, which brought separate civil charges, said the scheme generated more than $25 million in illegal profits.

Robert Khuzami, director of enforcement at the SEC, said the charges show Rajaratnam's "secret of success was not genius trading strategies."

"He is not the master of the universe. He is a master of the Rolodex," Khuzami said.

Galleon Group LLP said in a statement it was shocked to learn of Rajaratnam's arrest at his apartment. "We had no knowledge of the investigation before it was made public and we intend to cooperate fully with the relevant authorities," the statement said.

The firm added that Galleon "continues to operate and is highly liquid."

Rajaratnam, 52, was ranked No. 559 by Forbes magazine this year among the world's wealthiest billionaires, with a $1.3 billion net worth.

According to the Federal Election Commission, he is a generous contributor to Democratic candidates and causes. The FEC said he made over $87,000 in contributions to President Barack Obama's campaign, the Democratic National Committee and various campaigns on behalf of Hillary Rodham Clinton, U.S. Sen. Charles Schumer and New Jersey U.S. Sen. Robert Menendez in the past five years. The Center for Responsive Politics, a watchdog group, said he has given a total of $118,000 since 2004 -- all but one contribution, for $5,000, to Democrats.

The Associated Press has learned that even before his arrest, Rajaratnam was under scrutiny for helping bankroll Sri Lankan militants notorious for suicide bombings.

Papers filed in U.S. District Court in Brooklyn allege that Rajaratnam worked closely with a phony charity that channeled funds to the Tamil Tiger terrorist organization. Those papers refer to him only as "Individual B." But U.S. law enforcement and government officials familiar with the case have confirmed that the individual is Rajaratnam.

At an initial court appearance in U.S. District Court in Manhattan, Assistant U.S. Attorney Josh Klein sought detention for Rajaratnam, saying there was "a grave concern about flight risk" given Rajaratnam's wealth and his frequent travels around the world.

His lawyer, Jim Walden, called his client a "citizen of the world," who has made more than $20 million in charitable donations in the last five years and had risen from humble beginnings in the finance profession to oversee hedge funds responsible for nearly $8 billion.

Walden promised "there's a lot more to this case" and his client was ready to prepare for it from home. Rajaratnam lives in a $10 million condominium with his wife of 20 years, their three children and two elderly parents. Walden noted that many of his employees were in court ready to sign a bail package on his behalf.

Rajaratnam -- born in Sri Lanka and a graduate of University of Pennsylvania's Wharton School of Business -- has been described as a savvy manager of billions of dollars in technology and health care hedge funds at Galleon, which he started in 1996. The firm is based in New York City with offices in California, China, Taiwan and India. He lives in New York.

According to a criminal complaint filed in U.S. District Court in Manhattan, Rajaratnam obtained insider information and then caused the Galleon Technology Funds to execute trades that earned a profit of more than $12.7 million between January 2006 and July 2007. Other schemes garnered millions more and continued into this year, authorities said.

Bharara said the defendants benefited from tips about the earnings, earnings guidance and acquisition plans of various companies. Sometimes, those who provided tips received financial benefits and sometimes they just traded tips for more inside information, he added.

The timing of the arrests might be explained by a footnote in the complaint against Rajaratnam. In it, an FBI agent said he had learned that Rajaratnam had been warned to be careful and that Rajaratnam, in response, had said that a former employee of the Galleon Group was likely to be wearing a "wire."

The agent said he learned from federal authorities that Rajaratnam had a ticket to fly from Kennedy International Airport to London on Friday and to return to New York from Geneva, Switzerland next Thursday.

Also charged in the scheme are Rajiv Goel, 51, of Los Altos, Calif., a director of strategic investments at Intel Capital, the investment arm of Intel Corp., Anil Kumar, 51, of Santa Clara, Calif., a director at McKinsey & Co. Inc., a global management consulting firm, and Robert Moffat, 53, of Ridgefield, Conn., senior vice president and group executive at International Business Machines Corp.'s Systems and Technology Group.

The others charged in the case were identified as Danielle Chiesi, 43, of New York City, and Mark Kurland, 60, also of New York City.

Bail for Kurland was set at $3 million while bail for Moffat and Chiesi was set at $2 million each. Lawyers for Moffat and Chiesi said their clients will plead not guilty.

According to court papers, Chiesi worked for New Castle, the equity hedge fund group of Bear Stearns Asset Management Inc. that had assets worth about $1 billion under management. Kurland is a top executive at New Castle.

Kumar's lawyer, Isabelle Kirshner, said of her client: "He's distraught." He was freed on $5 million bail, secured in part by his $2.5 million California home.

Kerry Lawrence, an attorney representing Moffat, said: "He's shocked by the charges."

It was not immediately clear who would represent the others in their initial court appearances.

A criminal complaint filed in the case shows that an unidentified person involved in the insider trading scheme began cooperating and authorities obtained wiretaps of conversations between the defendants.

In one conversation about a pending deal that was described in a criminal complaint, Chiesi is quoted as saying: "I'm dead if this leaks. I really am. ... and my career is over. I'll be like Martha (expletive) Stewart."

Stewart, the homemaking maven, was convicted in 2004 of lying to the government about the sale of her shares in a friend's company whose stock plummeted after a negative public announcement. She served five months in prison and five months of home confinement.

Prosecutors charged those arrested Friday with conspiracy and securities fraud.

A separate criminal complaint in the case said Chiesi and Moffat conspired to engage in insider trading in the securities of International Business Machines Corp.

According to another criminal complaint in the case, Chiesi and Rajaratnam were heard on a government wiretap of a Sept. 26, 2008, phone conversation discussing whether Chiesi's friend Moffat should move from IBM to a different technology company to aid the scheme.

"Put him in some company where we can trade well," Rajaratnam was quoted in the court papers as saying.

The complaint said Chiesi replied: "I know, I know. I'm thinking that too. Or just keep him at IBM, you know, because this guy is giving me more information. ... I'd like to keep him at IBM right now because that's a very powerful place for him. For us, too."

According to the court papers, Rajaratnam replied: "Only if he becomes CEO." And Chiesi was quoted as replying: "Well, not really. I mean, come on. ... you know, we nailed it."

The criminal complaints in the case also captured what authorities said were efforts by the defendants to hide their conversations from authorities.

In one conversation, Chiesi was heard telling Rajaratnam that she was "glad that we talk on a secure line, I appreciate that," to which Rajaratnam replied: "I never call you on my cell phone," the complaint said. It added that Chiesi said she was "nervous" about being investigated.

Associated Press Writers Tom Hays in Riverside, Calif., and Beth Fouhy in New York contributed to this story.

http://finance.yahoo.com/news/Billionaire-among-6-nabbed-in-apf-2808194948.html?x=0

By Larry Neumeister and Candice Choi, Associated Press Writers

On 6:21 pm EDT, Friday October 16, 2009

Buzz up! 26

NEW YORK (AP) -- One of America's wealthiest men was among six hedge fund managers and corporate executives arrested Friday in a hedge fund insider trading case that authorities say generated more than $25 million in illegal profits and was a wake-up call for Wall Street.

Raj Rajaratnam, a portfolio manager for Galleon Group, a hedge fund with up to $7 billion in assets under management, was accused of conspiring with others to use insider information to trade securities in several publicly traded companies, including Google Inc.

U.S. Magistrate Judge Douglas F. Eaton set bail at $100 million to be secured by $20 million in collateral despite a request by prosecutors to deny bail. He also ordered Rajaratnam, who has both U.S. and Sri Lankan citizenship, to stay within 110 miles of New York City. The judge gave prosecutors until shortly after 6 p.m. to consider appealing his bail ruling.

U.S. Attorney Preet Bharara told a news conference it was the largest hedge fund case ever prosecuted and marked the first use of court-authorized wiretaps to capture conversations by suspects in an insider trading case.

He said the case should cause financial professionals considering insider trades in the future to wonder whether law enforcement is listening.

"Greed is not good," Bharara said. "This case should be a wake-up call for Wall Street."

Joseph Demarest Jr., the head of the New York FBI office, said it was clear that "the 20 million dollars in illicit profits come at the expense of the average public investor."

The Securities and Exchange Commission, which brought separate civil charges, said the scheme generated more than $25 million in illegal profits.

Robert Khuzami, director of enforcement at the SEC, said the charges show Rajaratnam's "secret of success was not genius trading strategies."

"He is not the master of the universe. He is a master of the Rolodex," Khuzami said.

Galleon Group LLP said in a statement it was shocked to learn of Rajaratnam's arrest at his apartment. "We had no knowledge of the investigation before it was made public and we intend to cooperate fully with the relevant authorities," the statement said.

The firm added that Galleon "continues to operate and is highly liquid."

Rajaratnam, 52, was ranked No. 559 by Forbes magazine this year among the world's wealthiest billionaires, with a $1.3 billion net worth.

According to the Federal Election Commission, he is a generous contributor to Democratic candidates and causes. The FEC said he made over $87,000 in contributions to President Barack Obama's campaign, the Democratic National Committee and various campaigns on behalf of Hillary Rodham Clinton, U.S. Sen. Charles Schumer and New Jersey U.S. Sen. Robert Menendez in the past five years. The Center for Responsive Politics, a watchdog group, said he has given a total of $118,000 since 2004 -- all but one contribution, for $5,000, to Democrats.

The Associated Press has learned that even before his arrest, Rajaratnam was under scrutiny for helping bankroll Sri Lankan militants notorious for suicide bombings.

Papers filed in U.S. District Court in Brooklyn allege that Rajaratnam worked closely with a phony charity that channeled funds to the Tamil Tiger terrorist organization. Those papers refer to him only as "Individual B." But U.S. law enforcement and government officials familiar with the case have confirmed that the individual is Rajaratnam.

At an initial court appearance in U.S. District Court in Manhattan, Assistant U.S. Attorney Josh Klein sought detention for Rajaratnam, saying there was "a grave concern about flight risk" given Rajaratnam's wealth and his frequent travels around the world.

His lawyer, Jim Walden, called his client a "citizen of the world," who has made more than $20 million in charitable donations in the last five years and had risen from humble beginnings in the finance profession to oversee hedge funds responsible for nearly $8 billion.

Walden promised "there's a lot more to this case" and his client was ready to prepare for it from home. Rajaratnam lives in a $10 million condominium with his wife of 20 years, their three children and two elderly parents. Walden noted that many of his employees were in court ready to sign a bail package on his behalf.

Rajaratnam -- born in Sri Lanka and a graduate of University of Pennsylvania's Wharton School of Business -- has been described as a savvy manager of billions of dollars in technology and health care hedge funds at Galleon, which he started in 1996. The firm is based in New York City with offices in California, China, Taiwan and India. He lives in New York.

According to a criminal complaint filed in U.S. District Court in Manhattan, Rajaratnam obtained insider information and then caused the Galleon Technology Funds to execute trades that earned a profit of more than $12.7 million between January 2006 and July 2007. Other schemes garnered millions more and continued into this year, authorities said.

Bharara said the defendants benefited from tips about the earnings, earnings guidance and acquisition plans of various companies. Sometimes, those who provided tips received financial benefits and sometimes they just traded tips for more inside information, he added.

The timing of the arrests might be explained by a footnote in the complaint against Rajaratnam. In it, an FBI agent said he had learned that Rajaratnam had been warned to be careful and that Rajaratnam, in response, had said that a former employee of the Galleon Group was likely to be wearing a "wire."

The agent said he learned from federal authorities that Rajaratnam had a ticket to fly from Kennedy International Airport to London on Friday and to return to New York from Geneva, Switzerland next Thursday.

Also charged in the scheme are Rajiv Goel, 51, of Los Altos, Calif., a director of strategic investments at Intel Capital, the investment arm of Intel Corp., Anil Kumar, 51, of Santa Clara, Calif., a director at McKinsey & Co. Inc., a global management consulting firm, and Robert Moffat, 53, of Ridgefield, Conn., senior vice president and group executive at International Business Machines Corp.'s Systems and Technology Group.

The others charged in the case were identified as Danielle Chiesi, 43, of New York City, and Mark Kurland, 60, also of New York City.

Bail for Kurland was set at $3 million while bail for Moffat and Chiesi was set at $2 million each. Lawyers for Moffat and Chiesi said their clients will plead not guilty.

According to court papers, Chiesi worked for New Castle, the equity hedge fund group of Bear Stearns Asset Management Inc. that had assets worth about $1 billion under management. Kurland is a top executive at New Castle.

Kumar's lawyer, Isabelle Kirshner, said of her client: "He's distraught." He was freed on $5 million bail, secured in part by his $2.5 million California home.

Kerry Lawrence, an attorney representing Moffat, said: "He's shocked by the charges."

It was not immediately clear who would represent the others in their initial court appearances.

A criminal complaint filed in the case shows that an unidentified person involved in the insider trading scheme began cooperating and authorities obtained wiretaps of conversations between the defendants.

In one conversation about a pending deal that was described in a criminal complaint, Chiesi is quoted as saying: "I'm dead if this leaks. I really am. ... and my career is over. I'll be like Martha (expletive) Stewart."

Stewart, the homemaking maven, was convicted in 2004 of lying to the government about the sale of her shares in a friend's company whose stock plummeted after a negative public announcement. She served five months in prison and five months of home confinement.

Prosecutors charged those arrested Friday with conspiracy and securities fraud.

A separate criminal complaint in the case said Chiesi and Moffat conspired to engage in insider trading in the securities of International Business Machines Corp.

According to another criminal complaint in the case, Chiesi and Rajaratnam were heard on a government wiretap of a Sept. 26, 2008, phone conversation discussing whether Chiesi's friend Moffat should move from IBM to a different technology company to aid the scheme.

"Put him in some company where we can trade well," Rajaratnam was quoted in the court papers as saying.

The complaint said Chiesi replied: "I know, I know. I'm thinking that too. Or just keep him at IBM, you know, because this guy is giving me more information. ... I'd like to keep him at IBM right now because that's a very powerful place for him. For us, too."

According to the court papers, Rajaratnam replied: "Only if he becomes CEO." And Chiesi was quoted as replying: "Well, not really. I mean, come on. ... you know, we nailed it."

The criminal complaints in the case also captured what authorities said were efforts by the defendants to hide their conversations from authorities.

In one conversation, Chiesi was heard telling Rajaratnam that she was "glad that we talk on a secure line, I appreciate that," to which Rajaratnam replied: "I never call you on my cell phone," the complaint said. It added that Chiesi said she was "nervous" about being investigated.

Associated Press Writers Tom Hays in Riverside, Calif., and Beth Fouhy in New York contributed to this story.

http://finance.yahoo.com/news/Billionaire-among-6-nabbed-in-apf-2808194948.html?x=0

Ding-Dong the Dollar is Dead

From freedoms Phoenix; Posted: 15 Oct 2009 04:51 PM PDT

Oh dude. The dollar is fucked! I sincerely hope you've long since diversified away from greenbacks and if you haven't, please don't come near me as I don't want to catch whatever brain-eating disease it is you've got that would compel you to stick with the funniest of the funny money.

WC Varones has some sound advice on investments and was kind enough to extend his expertise to my good friend Exuberant Accountant. See? Isn't it great when we can all play nice together?

Anyway. Pay attention, this stuff is important. Put down the remote and grab the scissors, we're debt-free from here on out.

Bloomberg:

The dollar may drop to 50 yen next year and eventually lose its role as the global reserve currency, Sumitomo Mitsui Banking Corp.’s chief strategist said, citing trading patterns and a likely double dip in the U.S. economy.

“The U.S. economy will deteriorate into 2011 as the effects of excess consumption and the financial bubble linger,” said Daisuke Uno at Sumitomo Mitsui, a unit of Japan’s third- biggest bank. “The dollar’s fall won’t stop until there’s a change to the global currency system.”

The dollar last week dropped to the lowest in almost a year against the yen as record U.S. government borrowings and interest rates near zero sapped demand for the U.S. currency. The Dollar Index, which tracks the greenback against the currencies of six major U.S. trading partners, has fallen 15 percent from its peak this year to as low as 75.211 today, the lowest since August 2008.

The gauge is about five points away from its record low in March 2008, and the dollar is 2.5 percent away from a 14-year low against the yen.

“We can no longer stop the big wave of dollar weakness,” said Uno, who correctly predicted the dollar would fall under 100 yen and the Dow Jones Industrial Average would sink below 7,000 after the bankruptcy of Lehman Brothers Holdings Inc. last year. If the U.S. currency breaks through record levels, “there will be no downside limit, and even coordinated intervention won’t work,” he said.

China, India, Brazil and Russia this year called for a replacement to the dollar as the main reserve currency. Hossein Ghazavi, Iran’s deputy central bank chief, said on Sept. 13 the euro has overtaken the dollar as the main currency of Iran’s foreign reserves.

This is, in essence, a big bitchslap for our buddy Zimbabwe Ben who is probably stunned by this news. What do you mean dollar fears?! Huh?!

Check it out, ZB, I'm a fucking genius too you know. Like could have kicked your ass on the SATs if I hadn't have been hungover when I took mine (and still came pretty damn close). And I can speak from experience when I say that some of the most brilliant people I know are total idiots. Personally, I am often confused by broken escalators. I know, stupid, right?! So, Dr Bernanke, I've got your damn card. I know how it is, you're probably sitting there scratching your bald little head going "well wait, why do these people not buy Geithner's line about a strong dollar policy?!"

Well allow me to answer that question for you, my dear money-printing maniac, it's because actions speak louder than words and your actions say "Holy fuck I'm out of my God-forsaken mind and will be over here imploding the dollar if anyone needs me, thanks!!"

You're welcome. Bitch.

Oh dude. The dollar is fucked! I sincerely hope you've long since diversified away from greenbacks and if you haven't, please don't come near me as I don't want to catch whatever brain-eating disease it is you've got that would compel you to stick with the funniest of the funny money.

WC Varones has some sound advice on investments and was kind enough to extend his expertise to my good friend Exuberant Accountant. See? Isn't it great when we can all play nice together?

Anyway. Pay attention, this stuff is important. Put down the remote and grab the scissors, we're debt-free from here on out.

Bloomberg:

The dollar may drop to 50 yen next year and eventually lose its role as the global reserve currency, Sumitomo Mitsui Banking Corp.’s chief strategist said, citing trading patterns and a likely double dip in the U.S. economy.

“The U.S. economy will deteriorate into 2011 as the effects of excess consumption and the financial bubble linger,” said Daisuke Uno at Sumitomo Mitsui, a unit of Japan’s third- biggest bank. “The dollar’s fall won’t stop until there’s a change to the global currency system.”

The dollar last week dropped to the lowest in almost a year against the yen as record U.S. government borrowings and interest rates near zero sapped demand for the U.S. currency. The Dollar Index, which tracks the greenback against the currencies of six major U.S. trading partners, has fallen 15 percent from its peak this year to as low as 75.211 today, the lowest since August 2008.

The gauge is about five points away from its record low in March 2008, and the dollar is 2.5 percent away from a 14-year low against the yen.

“We can no longer stop the big wave of dollar weakness,” said Uno, who correctly predicted the dollar would fall under 100 yen and the Dow Jones Industrial Average would sink below 7,000 after the bankruptcy of Lehman Brothers Holdings Inc. last year. If the U.S. currency breaks through record levels, “there will be no downside limit, and even coordinated intervention won’t work,” he said.

China, India, Brazil and Russia this year called for a replacement to the dollar as the main reserve currency. Hossein Ghazavi, Iran’s deputy central bank chief, said on Sept. 13 the euro has overtaken the dollar as the main currency of Iran’s foreign reserves.

This is, in essence, a big bitchslap for our buddy Zimbabwe Ben who is probably stunned by this news. What do you mean dollar fears?! Huh?!

Check it out, ZB, I'm a fucking genius too you know. Like could have kicked your ass on the SATs if I hadn't have been hungover when I took mine (and still came pretty damn close). And I can speak from experience when I say that some of the most brilliant people I know are total idiots. Personally, I am often confused by broken escalators. I know, stupid, right?! So, Dr Bernanke, I've got your damn card. I know how it is, you're probably sitting there scratching your bald little head going "well wait, why do these people not buy Geithner's line about a strong dollar policy?!"

Well allow me to answer that question for you, my dear money-printing maniac, it's because actions speak louder than words and your actions say "Holy fuck I'm out of my God-forsaken mind and will be over here imploding the dollar if anyone needs me, thanks!!"

You're welcome. Bitch.

Wednesday, October 14, 2009

JP Morgan Reports $3.6 Billion Profits in 3Q - What Were Your Profits so Far this Year?

It pays to be President Obama's favorite banker. Both Bear Stearns and Washington Mutual were gifted to JPMorgan by the United States government, and the results are showing.

Net income for the third quarter climbed to $3.6bn, or 82 cents a share, from $527m, or 9 cents, in the same period a year ago.

JPMorgan, itself, said it had continued to benefit from its acquisition of Washington Mutual and that it had seen fewer markdowns on legacy leveraged lending and mortgage positions.

Investment banking was also strong. No doubt helped by the fact that, as NyPo reported, JPM is scoring lead mandates to help both troubled auto companies restructure as well as handling the planned merger of Chrysler's finance arm with GMAC, resulting in lucrative fees for the bank... END

Comment mine (Lori Smith) readers prepared to be shocked take a look at the MIND BOGGLING amount of the Derivatives held by JP Morgan here...

http://www.zerohedge.com/article/independent-look-jp-morgan

For a more detailed look at the connection of JPM obamas favorite banker with a video that really helps to explain the ties here...

http://bluelori.blogspot.com/2009/08/in-case-you-missed-connection-between.html

And this is a MUST READ

http://market-ticker.denninger.net/archives/1510-Waterboard-JP-Morgan-and-The-Mortgage-Bankers-Assn.html

Read Full Story

Reported by Lori Smith

Click on title above to read full story;

http://www.economicpolicyjournal.com/2009/10/jpmorgan-reports-36-billion-3q-profit.html

Thursday, October 8, 2009

Greyson & Paul Solicit Todd, Banking Commitee re: Bernanke Confirmation

Click on title above to read "The Letter"

Wednesday, October 7, 2009

Why Did Goldman Get A $3 Million Gov't Gift For "National Security"

Lawrence Delevingne|Oct. 7, 2009, 3:17 PM | 902 |5

GS Oct 7 2009, 06:40 PM EDT

WIth all the company's riches, why is a Goldman Sachs (GS) subsidiary getting a $3 million earmark from Washington?

Politico: A mining company owned by Goldman Sachs and two private equity funds is in line to get a $3 million earmark for work at a rare earth elements mine in Mountain Pass, Calif. — raising questions as to why Congress would take on some of the risk for a bailed-out investment giant that’s already making a profit.

As the article notes, Molycorp's mine is a rich source of elements used to produce powerful magnets for precision-guided weapons, hand-held communication devices, wind turbines and hybrid cars.

California Republican Rep. Jerry Lewis inserted the earmark for the mine into the House Defense appropriations bill, reasoning that it's a national security concern. The other major source for the minerals, China, could cut exports.

This concern is fair, though probably overblown. There's a lot of hype about China limiting exports of so-called rare earth metals, but that's far from clear -- plus, how does the taxpayer subsidizing Goldman Sachs change anything?

Of course, the chance to line up at the government trough is a big reason why companies get into areas relating to green or weaponry.

Goldman and Molycorp didn't immediately respond to our requests for comment.

http://www.businessinsider.com/why-is-goldman-sachs-getting-congressional-earmarks-2009-10?utm_source=Triggermail&utm_medium=email&utm_campaign=Clusterstock%20Chart%20of%20the%20Day%2C%20Wednesday%2C%2010%2F7%2F09

GS Oct 7 2009, 06:40 PM EDT

WIth all the company's riches, why is a Goldman Sachs (GS) subsidiary getting a $3 million earmark from Washington?

Politico: A mining company owned by Goldman Sachs and two private equity funds is in line to get a $3 million earmark for work at a rare earth elements mine in Mountain Pass, Calif. — raising questions as to why Congress would take on some of the risk for a bailed-out investment giant that’s already making a profit.

As the article notes, Molycorp's mine is a rich source of elements used to produce powerful magnets for precision-guided weapons, hand-held communication devices, wind turbines and hybrid cars.

California Republican Rep. Jerry Lewis inserted the earmark for the mine into the House Defense appropriations bill, reasoning that it's a national security concern. The other major source for the minerals, China, could cut exports.

This concern is fair, though probably overblown. There's a lot of hype about China limiting exports of so-called rare earth metals, but that's far from clear -- plus, how does the taxpayer subsidizing Goldman Sachs change anything?

Of course, the chance to line up at the government trough is a big reason why companies get into areas relating to green or weaponry.

Goldman and Molycorp didn't immediately respond to our requests for comment.

http://www.businessinsider.com/why-is-goldman-sachs-getting-congressional-earmarks-2009-10?utm_source=Triggermail&utm_medium=email&utm_campaign=Clusterstock%20Chart%20of%20the%20Day%2C%20Wednesday%2C%2010%2F7%2F09

Labels:

Congress,

Goldman Sachs,

Politics,

Wall Street

Wednesday, September 30, 2009

Filthy Rich are Getting Poorer (But not by Much)

The Forbes 400 Richest Americans

Wednesday, September 30, 2009provided by

Almost all of America's wealthiest citizens are poorer this year.

America's super rich are getting poorer. For only the fifth time since 1982, the collective net worth of The Forbes 400 — our annual tally of the nation's richest people — has declined, falling $300 billion in the past 12 months from $1.57 trillion to $1.27 trillion.

Faltering capital markets and real estate prices, along with divorce and fraud, pushed the fortunes of 314 members down and drove 32 plutocrats off the rankings.

Hurt the most: Warren Buffett, America's second-richest citizen. The Oracle of Omaha dropped $10 billion from his personal balance sheet as shares of Berkshire Hathaway fell 20% in 12 months. He is now worth (only) $40 billion.

Beating out Buffett for the 16th straight year as America's richest man is Microsoft co-founder Bill Gates. Sluggish Microsoft shares and declining outside investments pushed the software visionary's net worth down $7 billion in 12 months.

Rounding out the top 10 on The Forbes 400: Oracle founder Larry Ellison ($27 billion); Wal-Mart heirs Christy Walton ($21.5 billion), Jim C. Walton ($19.6 billion), Alice Walton ($19.3 billion), and S. Robson Walton ($19 billion); media maven Michael Bloomberg ($17.5 billion) and energy titans Charles and David Koch ($16 billion each).

The 10 richest Americans lost a combined $39.2 billion in the past 12 months, a 14% decline.

Other big losers include casino mogul Kirk Kerkorian, whose nest egg shed $8.2 billion in the past year. Shares of his gambling giant MGM Mirage have fallen 90% from their October 2007 high.

Also hitting the brakes: Enterprise Rent-A-Car founder Jack C. Taylor. The rental car titan's fortune is down $7 billion in a year as the travel industry slows and private-company valuations fall.

The biggest gainer is banker Andrew Beal, who tripled his net worth to $4.5 billion buying up cheap loans and assets as the markets crumbled last fall.

Membership on the list was made easier as the price of admission dropped $350 million, from $1.3 billion last year to $950 million this year, paving the way for 19 new members and 19 returnees.

Newcomers to the list include Marvel Entertainment chief Isaac Perlmutter, whose net worth soared to $1.55 billion after Disney agreed to buy the superhero outfit in August for $4 billion in cash and stock.

Other new members include Bloomberg LP co-founder Charles Zegar ($1 billion), mapping-software magnate Jack Dangermond ($2 billion) and trading titan Steven Schonfeld ($1 billion).

Former New York lawyer and accountant Jeffry Picower makes his debut on The Forbes 400 with a net worth of $1 billion. A longtime investor with Bernard Madoff, he is likely worth billions more (Picower is alleged to have extracted billions of dollars from Madoff's fund before it collapsed).

Picower and his foundation are named in a lawsuit by the liquidator for Madoff's investment business, who is seeking to recover funds allegedly obtained through "fraudulent activity." Picower claims if he knew Madoff was a fraud he would not have transferred money into Madoff accounts.

In December 2008, the Picower Foundation shut down after losing its $1 billion endowment in Madoff's Ponzi scheme. The charity had given millions to MIT, Human Rights First and the New York Public Library. Picower made his first fortune selling medical device maker Alaris in 2004.

Among those returning is venture capitalist Michael Moritz, who rode Amazon's purchase of online shoe retailer Zappos and surging Google stock back onto the list.

Divorce forced Google exec Omid Kordestani from the rankings, while R. Allen Stanford lost his billionaire status when the feds froze his assets after charging him with allegedly running an $8 billion Ponzi scheme.

Several Forbes 400 mainstays also fell off the list, including former Citigroup czar Sanford Weill, mall developer Matthew Bucksbaum and condo kingpin Jorge Perez.

Six members died, including glass giant William Davidson and newspaper maven Frank Batten Sr.

The Forbes 400 is a snapshot of wealth on Sept. 10, 2009. Gap co-founder Donald Fisher, who ranks No. 296 on our list, died Sept. 27 at his home in San Francisco at age 81.

Edited by Matthew Miller and Duncan Greenberg

The Top 21 Richest Americans

© Ryan Pierse/Getty Images 1. William H. Gates III

Net Worth: $50 billion

Source: Microsoft

Residence: Medina, Wash.

Age: 53

Despite losing $7 billion in 12 months, software man retains his title as America’s richest person for the 16th straight year.

Microsoft shares down 8% in past year but up 65% from March lows. He sells stock every quarter, redeploys proceeds via personal investment outfit Cascade.

More than 60% of fortune held outside Microsoft; investments include Four Seasons hotels, Televisa, AutoNation.

Stepped down from day-to-day duties at Microsoft last summer to focus on philanthropy.

Bill & Melinda Gates Foundation dedicated to fighting hunger, improving education in America’s high schools, developing vaccines against malaria, tuberculosis and AIDS. Endowment: $30 billion.

Penned first report on foundation’s projects in January. Touted progress made on preventing fatal childhood diseases; confessed frustration at challenge of creating an affordable, effective AIDS vaccine.

Ramping up personal contributions: donating $3.8 billion this year, $500 million more than in 2008.

--------------------------------------------------------------------------------

© Michael Buckner/Getty Images 2. Warren Buffett

Net Worth: $40 billion

Source: Berkshire Hathaway

Residence: Omaha

Age: 79

America’s favorite investor lost $10 billion in past 12 months on his Berkshire Hathaway shares.

Provided calming guidance to panic-stricken investors during financial crisis last fall; avowed enduring faith in U.S. economy, advised bargain hunting: “Be fearful when others are greedy, and be greedy when others are fearful.”

Shrewdly invested $5 billion in Goldman Sachs and $3 billion in General Electric last fall.

Suffered a $1.5 billion loss in first-quarter 2009; Berkshire notched $3.3 billion profit in second quarter thanks in part to bet on Goldman.

Son of Nebraska politician filed first tax return at age 13, claiming $35 deduction for bicycle bought for paper route.

Met value investor Benjamin Graham while studying economics at Columbia.

Took over textile firm Berkshire Hathaway 1965, used as vehicle to invest in insurance (Geico), food (Dairy Queen), utilities (MidAmerican Energy) and recently green tech (electric-car maker BYD).

Believed to be grooming NetJets Chief David Sokol to eventually take over Berkshire.

Appearing in cartoon form on upcoming online-tutor series The Secret Millionaires Club.

Page 1 | 2 | 3 | 4 | 5

Click on title above for full article

http://finance.yahoo.com/career-work/article/107844/the-forbes-400.html?mod=career-leadership

Wednesday, September 30, 2009provided by

Almost all of America's wealthiest citizens are poorer this year.

America's super rich are getting poorer. For only the fifth time since 1982, the collective net worth of The Forbes 400 — our annual tally of the nation's richest people — has declined, falling $300 billion in the past 12 months from $1.57 trillion to $1.27 trillion.

Faltering capital markets and real estate prices, along with divorce and fraud, pushed the fortunes of 314 members down and drove 32 plutocrats off the rankings.

Hurt the most: Warren Buffett, America's second-richest citizen. The Oracle of Omaha dropped $10 billion from his personal balance sheet as shares of Berkshire Hathaway fell 20% in 12 months. He is now worth (only) $40 billion.

Beating out Buffett for the 16th straight year as America's richest man is Microsoft co-founder Bill Gates. Sluggish Microsoft shares and declining outside investments pushed the software visionary's net worth down $7 billion in 12 months.

Rounding out the top 10 on The Forbes 400: Oracle founder Larry Ellison ($27 billion); Wal-Mart heirs Christy Walton ($21.5 billion), Jim C. Walton ($19.6 billion), Alice Walton ($19.3 billion), and S. Robson Walton ($19 billion); media maven Michael Bloomberg ($17.5 billion) and energy titans Charles and David Koch ($16 billion each).

The 10 richest Americans lost a combined $39.2 billion in the past 12 months, a 14% decline.

Other big losers include casino mogul Kirk Kerkorian, whose nest egg shed $8.2 billion in the past year. Shares of his gambling giant MGM Mirage have fallen 90% from their October 2007 high.