Capitalisim Helps the Poor? http://freedomkeys.com/gap.htm

Sunday, June 27, 2010

Tuesday, June 22, 2010

Friday, June 11, 2010

Fed. Scientists Request More Info From BP & Are Ignored

I just saw a piece on CNN Wolf Blitzers "Situation Room," where one of the scientists appointed by the federal govt to make an independant accessment of the true rate of flow of BPs undersea gusher was on, and he said that the figures they arrived at (as indicated in the article in the link below) were basically based on wide ranging approximations because their request to BP for more information has gone unheeded and he says, lacking that information, they can only guess at what the actual flow rate may be. Why wont BP release the relevant info to the federal scientists so they can do their job and tell US what the real rate of flow is? What could they possibly have to hide?

The Leak: Approximate Rates; http://latimesblogs.latimes.com/greenspace/

The Federal Scientists & BPs With-holding of Information;

http://www.cbsnews.com/stories/2010/06/09/eveningnews/main6565944.shtml

The Leak: Approximate Rates; http://latimesblogs.latimes.com/greenspace/

The Federal Scientists & BPs With-holding of Information;

http://www.cbsnews.com/stories/2010/06/09/eveningnews/main6565944.shtml

Taxpayers to Foot Part of Bill for BP Oil-Spill Clean-Up?

How is this for outrageous? Republican Leader John Boehner actually suggested that American taxpayers should be hit with the bill to help clean up Big Oil giant BP's spill in the Gulf of Mexico. And it gets worse...

In making this outrageous suggestion, Boehner was agreeing with one of the Republicans' biggest shadow groups - a group that has pledged to spend more than $50 million this cycle attacking Democrats and trying to elect other Big Oil protecting Republicans to Congress. But it gets even worse than that...

Boehner's suggestion of a taxpayer-funded bailout for Big Oil giant BP came after he and other Republicans accepted more than $188 million combined in campaign contributions from the oil and gas industry. This calls for an immediate response from Grassroots Democrats.

Visit our newly-launched website, BoehnerBPBailout.com to sign our petition denouncing John Boehner's Taxpayer Funded Bailout for Big Oil giant BP; http://boehnerbpbailout.com/

In making this outrageous suggestion, Boehner was agreeing with one of the Republicans' biggest shadow groups - a group that has pledged to spend more than $50 million this cycle attacking Democrats and trying to elect other Big Oil protecting Republicans to Congress. But it gets even worse than that...

Boehner's suggestion of a taxpayer-funded bailout for Big Oil giant BP came after he and other Republicans accepted more than $188 million combined in campaign contributions from the oil and gas industry. This calls for an immediate response from Grassroots Democrats.

Visit our newly-launched website, BoehnerBPBailout.com to sign our petition denouncing John Boehner's Taxpayer Funded Bailout for Big Oil giant BP; http://boehnerbpbailout.com/

- then help spread the word on Facebook and Twitter.

A clairification, of sorts; http://thecaucus.blogs.nytimes.com/2010/06/10/boehner-on-who-must-pay-what-for-spill/

A clairification, of sorts; http://thecaucus.blogs.nytimes.com/2010/06/10/boehner-on-who-must-pay-what-for-spill/

Thursday, June 10, 2010

Anger Mounts as BP Too Slow to Pay Claims

The reefs that David Walter makes for anglers to drop into the Gulf of Mexico are fake, but his frustration as he tries to win compensation from BP for lost income is real.

State regulators stopped issuing permits for the reefs on May 4 because of the oil spill, effectively killing off $350,000 in Walter's expected business. It sent him into a labyrinth of archived invoices and documents lost by BP. Finally, an offer came: $5,000.

"I said that's not fair because if you say that, then I have to go out of business and I lose everything," said Walter, whose company is based in Alabama.

Special Section: Disaster in the Gulf

Fishermen, property owners and businesspeople who have filed damage claims with BP are angrily complaining of delays, excessive paperwork and skimpy payments that have put them on the verge of going under as the financial and environmental toll of the seven-week-old disaster grows.

Out in the Gulf, meanwhile, the oil company on Wednesday captured more of the crude that's been gushing from the bottom of the sea since April and began bringing in more heavy equipment to handle it.

The containment effort played out as BP stock continued to plunge amid fears that the company might be forced to suspend dividends and find itself overwhelmed by the cleanup costs, penalties, damage claims and lawsuits generated by the biggest oil spill in U.S. history.

State regulators stopped issuing permits for the reefs on May 4 because of the oil spill, effectively killing off $350,000 in Walter's expected business. It sent him into a labyrinth of archived invoices and documents lost by BP. Finally, an offer came: $5,000.

"I said that's not fair because if you say that, then I have to go out of business and I lose everything," said Walter, whose company is based in Alabama.

Special Section: Disaster in the Gulf

Fishermen, property owners and businesspeople who have filed damage claims with BP are angrily complaining of delays, excessive paperwork and skimpy payments that have put them on the verge of going under as the financial and environmental toll of the seven-week-old disaster grows.

Out in the Gulf, meanwhile, the oil company on Wednesday captured more of the crude that's been gushing from the bottom of the sea since April and began bringing in more heavy equipment to handle it.

The containment effort played out as BP stock continued to plunge amid fears that the company might be forced to suspend dividends and find itself overwhelmed by the cleanup costs, penalties, damage claims and lawsuits generated by the biggest oil spill in U.S. history.

An Austrian Perspective on the History of Economic Thought,

Murray N. Rothbard Volume I: Economic Thought Before Adam Smith

The appearance of the famous (and massive) volumes of Rothbard's History of Economic Thought in a new edition is cause for great celebration. They have been out of print for many years, and were previously only available at a price exceeding $200 for the set. They are at last accessible again, in beautiful hardcover, and at an affordable price.

In Economic Thought Before Adam Smith, Murray Rothbard traces economic ideas from ancient sources to show that laissez-faire liberalism and economic thought itself began with the scholastics and early Roman, Greek, and canon law. He celebrates Aristotle and Democritus, for example, but loathes Plato and Diogenes. He is kind toward Taoism and Stoicism. He is no fan of Tertullian but very much likes St. Jerome, who defended the merchant class. Now, that takes us only to page 33, just the beginning of a wild ride through the middle ages and renaissance and modern times through 1870.

Classical Economics offers new perspectives on both Ricardo and Say and their followers. The author suggests that Ricardianism declined after 1820 and was only revived with the work of John Stuart Mill. The book also resurrects the important Anglo-Irish school of thought at Trinity College, Dublin under Archbishop Richard Whatley. Later chapters focus on the roots of Karl Marx and the nature of his doctrines, and laissez-faire thought in France including the work of Frederic Bastiat. Also included is a comprehensive treatment of the bullionist versus the anti-bullionist and the currency versus banking school controversies in the first half of the nineteenth century, and their influence outside Great Britain.

These are indeed the books that Mises himself longed to see: "A real history of economic thought," he said in 1955, "would have to point out the development of the doctrines and not merely list every book."

When these volumes first appeared, they were celebrated in Barron's and by top scholars around the world. They succeeded in changing the way people think about economic doctrine: the beginnings (not Adam Smith, but the Spanish theologians), the dead ends (Marx), the great triumphs (Bastiat, for example), and the truly great minds (Turgot and many others he rescued from near obscurity).

Rothbard read deeply in thinkers dating back hundreds and thousands of years, and spotted every promising line of thought — and every unfortunate one. He knew when an idea would lead to prosperity, and when it would lead to calamity. He could spot a proto-Keynesian or proto-Marxist idea in the middle ages, just as he could find free-market lines of thought in ancient manuscripts.

Many scholars believe this was his most important work. The irony is that it is not the work it was supposed to be, and thank goodness. He was asked to do a short overview of the modern era. He ended up writing more than 1,000 pages of original ideas that remade the whole of intellectual history up through the late 19th century.

Once Rothbard got into the project, he found that most all historians have made the same error: they have believed that the history of thought was a long history of progress. He found that sound ideas ebb and flow in history. So he set out to rescue the great ideas from the past and compare them with the bad ideas of the "new economics."

His demolition of Karl Marx is more complete and in depth than any other ever published. His reconstruction of 19th-century banking debates has provided enough new ideas for a dozen dissertations, and contemporary real-money reform. His surprising evisceration of John Stuart Mill is cause to rethink the whole history of classical liberalism.

Most famously, Rothbard demonstrated that Adam Smith's economic theories were, in many ways, a comedown from his predecessors in France and Spain. For example, Smith puzzled over the source of value and finally tagged labor as the source (a mistake Marx built on). But for centuries prior, the earliest economists knew that value came from within the human mind. It was a human estimation, not an objective construct.

The unfinished 3rd volume in audio

Rothbard was a pioneer in incorporating the sociology of religion into the history of economic ideas. He saw that the advent of Christianity had a huge impact on the theory of the state. He observed the rise of absolutism and theory of nationalism that came with the reformation. He traced the changes in the Western view toward lending and interest payments over the course of a thousand years.

The number of insights in these volumes are countless. Every page, every paragraph, bursts with intellectual energy and the author's fiery passion to tell the reader the remarkable story of economics. Many reviewers have remarked that Rothbard's accomplishment seems super-human. He seems to have read everything. His originality is overwhelming. His passion for liberty and integrity in science is evident. His disdain toward those who sell out to the state is manifest as well.

Rothbard worked on these volumes in the ten years before his death. He also gave a series of lectures on his ongoing research. As a result, we all had very high expectations. But nothing could have prepared us for what eventually appeared.

This set is a monument to Rothbard's genius, a resource that will be valuable to intellectuals for generations, and a great read too!

Read entire article in PDF File;

The appearance of the famous (and massive) volumes of Rothbard's History of Economic Thought in a new edition is cause for great celebration. They have been out of print for many years, and were previously only available at a price exceeding $200 for the set. They are at last accessible again, in beautiful hardcover, and at an affordable price.

In Economic Thought Before Adam Smith, Murray Rothbard traces economic ideas from ancient sources to show that laissez-faire liberalism and economic thought itself began with the scholastics and early Roman, Greek, and canon law. He celebrates Aristotle and Democritus, for example, but loathes Plato and Diogenes. He is kind toward Taoism and Stoicism. He is no fan of Tertullian but very much likes St. Jerome, who defended the merchant class. Now, that takes us only to page 33, just the beginning of a wild ride through the middle ages and renaissance and modern times through 1870.

Classical Economics offers new perspectives on both Ricardo and Say and their followers. The author suggests that Ricardianism declined after 1820 and was only revived with the work of John Stuart Mill. The book also resurrects the important Anglo-Irish school of thought at Trinity College, Dublin under Archbishop Richard Whatley. Later chapters focus on the roots of Karl Marx and the nature of his doctrines, and laissez-faire thought in France including the work of Frederic Bastiat. Also included is a comprehensive treatment of the bullionist versus the anti-bullionist and the currency versus banking school controversies in the first half of the nineteenth century, and their influence outside Great Britain.

These are indeed the books that Mises himself longed to see: "A real history of economic thought," he said in 1955, "would have to point out the development of the doctrines and not merely list every book."

When these volumes first appeared, they were celebrated in Barron's and by top scholars around the world. They succeeded in changing the way people think about economic doctrine: the beginnings (not Adam Smith, but the Spanish theologians), the dead ends (Marx), the great triumphs (Bastiat, for example), and the truly great minds (Turgot and many others he rescued from near obscurity).

Rothbard read deeply in thinkers dating back hundreds and thousands of years, and spotted every promising line of thought — and every unfortunate one. He knew when an idea would lead to prosperity, and when it would lead to calamity. He could spot a proto-Keynesian or proto-Marxist idea in the middle ages, just as he could find free-market lines of thought in ancient manuscripts.

Many scholars believe this was his most important work. The irony is that it is not the work it was supposed to be, and thank goodness. He was asked to do a short overview of the modern era. He ended up writing more than 1,000 pages of original ideas that remade the whole of intellectual history up through the late 19th century.

Once Rothbard got into the project, he found that most all historians have made the same error: they have believed that the history of thought was a long history of progress. He found that sound ideas ebb and flow in history. So he set out to rescue the great ideas from the past and compare them with the bad ideas of the "new economics."

His demolition of Karl Marx is more complete and in depth than any other ever published. His reconstruction of 19th-century banking debates has provided enough new ideas for a dozen dissertations, and contemporary real-money reform. His surprising evisceration of John Stuart Mill is cause to rethink the whole history of classical liberalism.

Most famously, Rothbard demonstrated that Adam Smith's economic theories were, in many ways, a comedown from his predecessors in France and Spain. For example, Smith puzzled over the source of value and finally tagged labor as the source (a mistake Marx built on). But for centuries prior, the earliest economists knew that value came from within the human mind. It was a human estimation, not an objective construct.

The unfinished 3rd volume in audio

Rothbard was a pioneer in incorporating the sociology of religion into the history of economic ideas. He saw that the advent of Christianity had a huge impact on the theory of the state. He observed the rise of absolutism and theory of nationalism that came with the reformation. He traced the changes in the Western view toward lending and interest payments over the course of a thousand years.

The number of insights in these volumes are countless. Every page, every paragraph, bursts with intellectual energy and the author's fiery passion to tell the reader the remarkable story of economics. Many reviewers have remarked that Rothbard's accomplishment seems super-human. He seems to have read everything. His originality is overwhelming. His passion for liberty and integrity in science is evident. His disdain toward those who sell out to the state is manifest as well.

Rothbard worked on these volumes in the ten years before his death. He also gave a series of lectures on his ongoing research. As a result, we all had very high expectations. But nothing could have prepared us for what eventually appeared.

This set is a monument to Rothbard's genius, a resource that will be valuable to intellectuals for generations, and a great read too!

Read entire article in PDF File;

Monday, June 7, 2010

A Warning From Noam Chomsky on the Threat of Elites

Jun 7, 2010

By Fred Branfman

It was not by making yourself heard but by staying sane that you carried on the human heritage. ... [Doublethink is] to hold simultaneously two opinions which cancelled out, knowing them to be contradictory and believing in both, to repudiate morality while laying claim to it. ... [Continuous] war involves very small numbers of people, mostly highly trained specialists. … The fighting … takes place on the vague frontiers whose whereabouts the average man can only guess at. …

—George Orwell, “1984”

[The treatment of the] hapless race of native Americans, which we are exterminating with such merciless and perfidious cruelty, [is] among the heinous sins of this nation, for which I believe God will one day bring [it] to judgment.

—John Quincy Adams, cited in Noam Chomsky’s new book, “Hopes and Prospects”

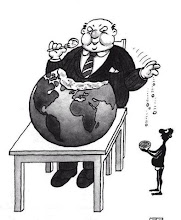

Noam Chomsky’s description of the dangers posed by U.S. elites’ “Imperial Mentality” was recently given a boost in credibility by a surprising source—Bill Clinton. As America’s economy, foreign policy and politics continue to unravel, it is clear that this mentality and the system it has created will produce an increasing number of victims in the years to come. Clinton startlingly testified to that effect on March 10 to the Senate Foreign Relations Committee:

Since 1981 the United States has followed a policy until the last year or so, when we started rethinking it, that we rich countries that produce a lot of food should sell it to poor countries and relieve them of the burden of producing their own food so thank goodness they can lead directly into the industrial era. It has not worked. It may have been good for some of my farmers in Arkansas, but it has not worked. It was a mistake. It was a mistake that I was a party to. I am not pointing the finger at anybody. I did that. I have to live every day with the consequences of the lost capacity to produce a rice crop in Haiti to feed those people, because of what I did, nobody else.

Advertisement

Clinton is to be praised for being the first U.S. president to take personal responsibility for impoverishing an entire nation rather than ignoring his misdeeds or falsely blaming local U.S.-imposed regimes. But his confession also means that his embrace of the International Monetary Fund, the World Bank, the World Trade Organization and NAFTA “neo-liberalization” destroyed the lives of many more millions well beyond Haiti, as U.S. support for heavily subsidized U.S. agribusiness damaged local agricultural economies throughout Latin America and beyond. This led to mass migration into urban slums and destitution, as well as increased emigration to the U.S.—which then led Clinton to militarize the border in 1994—and thus accelerated the “illegal immigration” issue that so poisons U.S. politics today.

Clinton might also have added that he and other U.S. leaders imposed such policies by force, installing military dictators and vicious police and paramilitary forces. Chomsky reports in “Hopes and Prospects” that in Haiti, semiofficial thugs empowered by a U.S.-supported coup murdered 8,000 people and raped 35,000 women in 2004 and 2005 alone, while a tiny local elite reaps most of the benefits from U.S. policies.

Clinton’s testimony reminded me of one of my visits with Chomsky, back in 1988, when, after talking for an hour or so, he smiled and said he had to stop to get back to writing about the children of Haiti.

I was struck both by his concern for forgotten Haitians and because his comment so recalled my experience with him in 1970 as he spent a week researching U.S. war-making in Laos. I had taken dozens of journalists, peace activists, diplomats, experts and others out to camps of refugees who had fled U.S. saturation bombing. Chomsky was one of only two who wept openly upon learning how these innocent villagers had seen their beloved grandmothers burned alive, their children slowly suffocated, their spouses cut to ribbons, during five years of merciless, pitiless and illegal U.S. bombing for which U.S. leaders would have been executed had international law protecting civilians in wartime been applied to their actions. It was obvious that he was above all driven by a deep feeling for the world’s victims, those he calls the “unpeople” in his new book. No U.S. policymakers I knew in Laos, nor the many I have met since, have shared such concerns.

Bill Clinton’s testimony also reminded me of the accuracy of Chomsky writings on Haiti—before, during and after Clinton’s reign—as summed up in “Hopes and Prospects”:

The Clinton doctrine, presented to Congress, was that the US is entitled to resort to “unilateral use of military power” to ensure “uninhibited access to key markets, energy supplies and strategic resources.” In Haiti, Clinton [imposed] harsh neoliberal rules that were guaranteed to crush what remained of the economy, as they did.

Clinton would have a cleaner conscience today had he listened to Chomsky then. Many more Americans may also benefit by heeding Chomsky today, as U.S. elites’ callousness toward unpeople abroad is now affecting increasing numbers of their fellow citizens back home. Nothing symbolizes this more than investment bankers tricking countless Americans out of their life savings by luring them into buying homes they could not afford that were then foreclosed on.

http://www.truthdig.com/report/item/a_warning_from_noam_chomsky_on_the_threat_of_elites_20100607/

Jun 7, 2010

By Fred Branfman

It was not by making yourself heard but by staying sane that you carried on the human heritage. ... [Doublethink is] to hold simultaneously two opinions which cancelled out, knowing them to be contradictory and believing in both, to repudiate morality while laying claim to it. ... [Continuous] war involves very small numbers of people, mostly highly trained specialists. … The fighting … takes place on the vague frontiers whose whereabouts the average man can only guess at. …

—George Orwell, “1984”

[The treatment of the] hapless race of native Americans, which we are exterminating with such merciless and perfidious cruelty, [is] among the heinous sins of this nation, for which I believe God will one day bring [it] to judgment.

—John Quincy Adams, cited in Noam Chomsky’s new book, “Hopes and Prospects”

Noam Chomsky’s description of the dangers posed by U.S. elites’ “Imperial Mentality” was recently given a boost in credibility by a surprising source—Bill Clinton. As America’s economy, foreign policy and politics continue to unravel, it is clear that this mentality and the system it has created will produce an increasing number of victims in the years to come. Clinton startlingly testified to that effect on March 10 to the Senate Foreign Relations Committee:

Since 1981 the United States has followed a policy until the last year or so, when we started rethinking it, that we rich countries that produce a lot of food should sell it to poor countries and relieve them of the burden of producing their own food so thank goodness they can lead directly into the industrial era. It has not worked. It may have been good for some of my farmers in Arkansas, but it has not worked. It was a mistake. It was a mistake that I was a party to. I am not pointing the finger at anybody. I did that. I have to live every day with the consequences of the lost capacity to produce a rice crop in Haiti to feed those people, because of what I did, nobody else.

Advertisement

Clinton is to be praised for being the first U.S. president to take personal responsibility for impoverishing an entire nation rather than ignoring his misdeeds or falsely blaming local U.S.-imposed regimes. But his confession also means that his embrace of the International Monetary Fund, the World Bank, the World Trade Organization and NAFTA “neo-liberalization” destroyed the lives of many more millions well beyond Haiti, as U.S. support for heavily subsidized U.S. agribusiness damaged local agricultural economies throughout Latin America and beyond. This led to mass migration into urban slums and destitution, as well as increased emigration to the U.S.—which then led Clinton to militarize the border in 1994—and thus accelerated the “illegal immigration” issue that so poisons U.S. politics today.

Clinton might also have added that he and other U.S. leaders imposed such policies by force, installing military dictators and vicious police and paramilitary forces. Chomsky reports in “Hopes and Prospects” that in Haiti, semiofficial thugs empowered by a U.S.-supported coup murdered 8,000 people and raped 35,000 women in 2004 and 2005 alone, while a tiny local elite reaps most of the benefits from U.S. policies.

Clinton’s testimony reminded me of one of my visits with Chomsky, back in 1988, when, after talking for an hour or so, he smiled and said he had to stop to get back to writing about the children of Haiti.

I was struck both by his concern for forgotten Haitians and because his comment so recalled my experience with him in 1970 as he spent a week researching U.S. war-making in Laos. I had taken dozens of journalists, peace activists, diplomats, experts and others out to camps of refugees who had fled U.S. saturation bombing. Chomsky was one of only two who wept openly upon learning how these innocent villagers had seen their beloved grandmothers burned alive, their children slowly suffocated, their spouses cut to ribbons, during five years of merciless, pitiless and illegal U.S. bombing for which U.S. leaders would have been executed had international law protecting civilians in wartime been applied to their actions. It was obvious that he was above all driven by a deep feeling for the world’s victims, those he calls the “unpeople” in his new book. No U.S. policymakers I knew in Laos, nor the many I have met since, have shared such concerns.

Bill Clinton’s testimony also reminded me of the accuracy of Chomsky writings on Haiti—before, during and after Clinton’s reign—as summed up in “Hopes and Prospects”:

The Clinton doctrine, presented to Congress, was that the US is entitled to resort to “unilateral use of military power” to ensure “uninhibited access to key markets, energy supplies and strategic resources.” In Haiti, Clinton [imposed] harsh neoliberal rules that were guaranteed to crush what remained of the economy, as they did.

Clinton would have a cleaner conscience today had he listened to Chomsky then. Many more Americans may also benefit by heeding Chomsky today, as U.S. elites’ callousness toward unpeople abroad is now affecting increasing numbers of their fellow citizens back home. Nothing symbolizes this more than investment bankers tricking countless Americans out of their life savings by luring them into buying homes they could not afford that were then foreclosed on.

http://www.truthdig.com/report/item/a_warning_from_noam_chomsky_on_the_threat_of_elites_20100607/

Thursday, June 3, 2010

Nigeria's agony dwarfs the Gulf oil spill. The US and Europe ignore it

The Deepwater Horizon disaster caused headlines around the world, yet the people who live in the Niger delta have had to live with environmental catastrophes for decades

John Vidal, environment editor The Observer, Sunday 30 May 2010

We reached the edge of the oil spill near the Nigerian village of Otuegwe after a long hike through cassava plantations. Ahead of us lay swamp. We waded into the warm tropical water and began swimming, cameras and notebooks held above our heads. We could smell the oil long before we saw it – the stench of garage forecourts and rotting vegetation hanging thickly in the air.

The farther we travelled, the more nauseous it became. Soon we were swimming in pools of light Nigerian crude, the best-quality oil in the world. One of the many hundreds of 40-year-old pipelines that crisscross the Niger delta had corroded and spewed oil for several months.

Forest and farmland were now covered in a sheen of greasy oil. Drinking wells were polluted and people were distraught. No one knew how much oil had leaked. "We lost our nets, huts and fishing pots," said Chief Promise, village leader of Otuegwe and our guide. "This is where we fished and farmed. We have lost our forest. We told Shell of the spill within days, but they did nothing for six months."

That was the Niger delta a few years ago, where, according to Nigerian academics, writers and environment groups, oil companies have acted with such impunity and recklessness that much of the region has been devastated by leaks.

In fact, more oil is spilled from the delta's network of terminals, pipes, pumping stations and oil platforms every year than has been lost in the Gulf of Mexico, the site of a major ecological catastrophe caused by oil that has poured from a leak triggered by the explosion that wrecked BP's Deepwater Horizon rig last month.

That disaster, which claimed the lives of 11 rig workers, has made headlines round the world. By contrast, little information has emerged about the damage inflicted on the Niger delta. Yet the destruction there provides us with a far more accurate picture of the price we have to pay for drilling oil today.

On 1 May this year a ruptured ExxonMobil pipeline in the state of Akwa Ibom spilled more than a million gallons into the delta over seven days before the leak was stopped. Local people demonstrated against the company but say they were attacked by security guards. Community leaders are now demanding $1bn in compensation for the illness and loss of livelihood they suffered. Few expect they will succeed. In the meantime, thick balls of tar are being washed up along the coast.

Within days of the Ibeno spill, thousands of barrels of oil were spilled when the nearby Shell Trans Niger pipeline was attacked by rebels. A few days after that, a large oil slick was found floating on Lake Adibawa in Bayelsa state and another in Ogoniland. "We are faced with incessant oil spills from rusty pipes, some of which are 40 years old," said Bonny Otavie, a Bayelsa MP.

This point was backed by Williams Mkpa, a community leader in Ibeno: "Oil companies do not value our life; they want us to all die. In the past two years, we have experienced 10 oil spills and fishermen can no longer sustain their families. It is not tolerable."

With 606 oilfields, the Niger delta supplies 40% of all the crude the United States imports and is the world capital of oil pollution. Life expectancy in its rural communities, half of which have no access to clean water, has fallen to little more than 40 years over the past two generations. Locals blame the oil that pollutes their land and can scarcely believe the contrast with the steps taken by BP and the US government to try to stop the Gulf oil leak and to protect the Louisiana shoreline from pollution.

"If this Gulf accident had happened in Nigeria, neither the government nor the company would have paid much attention," said the writer Ben Ikari, a member of the Ogoni people. "This kind of spill happens all the time in the delta."

"The oil companies just ignore it. The lawmakers do not care and people must live with pollution daily. The situation is now worse than it was 30 years ago. Nothing is changing. When I see the efforts that are being made in the US I feel a great sense of sadness at the double standards. What they do in the US or in Europe is very different."

"We see frantic efforts being made to stop the spill in the US," said Nnimo Bassey, Nigerian head of Friends of the Earth International. "But in Nigeria, oil companies largely ignore their spills, cover them up and destroy people's livelihood and environments. The Gulf spill can be seen as a metaphor for what is happening daily in the oilfields of Nigeria and other parts of Africa.

"This has gone on for 50 years in Nigeria. People depend completely on the environment for their drinking water and farming and fishing. They are amazed that the president of the US can be making speeches daily, because in Nigeria people there would not hear a whimper," he said.

It is impossible to know how much oil is spilled in the Niger delta each year because the companies and the government keep that secret. However, two major independent investigations over the past four years suggest that as much is spilled at sea, in the swamps and on land every year as has been lost in the Gulf of Mexico so far.

One report, compiled by WWF UK, the World Conservation Union and representatives from the Nigerian federal government and the Nigerian Conservation Foundation, calculated in 2006 that up to 1.5m tons of oil – 50 times the pollution unleashed in the Exxon Valdez tanker disaster in Alaska – has been spilled in the delta over the past half century. Last year Amnesty calculated that the equivalent of at least 9m barrels of oil was spilled and accused the oil companies of a human rights outrage.

According to Nigerian federal government figures, there were more than 7,000 spills between 1970 and 2000, and there are 2,000 official major spillages sites, many going back decades, with thousands of smaller ones still waiting to be cleared up. More than 1,000 spill cases have been filed against Shell alone.

Last month Shell admitted to spilling 14,000 tonnes of oil in 2009. The majority, said the company, was lost through two incidents – one in which the company claims that thieves damaged a wellhead at its Odidi field and another where militants bombed the Trans Escravos pipeline.

Shell, which works in partnership with the Nigerian government in the delta, says that 98% of all its oil spills are caused by vandalism, theft or sabotage by militants and only a minimal amount by deteriorating infrastructure. "We had 132 spills last year, as against 175 on average. Safety valves were vandalised; one pipe had 300 illegal taps. We found five explosive devices on one. Sometimes communities do not give us access to clean up the pollution because they can make more money from compensation," said a spokesman.

"We have a full-time oil spill response team. Last year we replaced 197 miles of pipeline and are using every known way to clean up pollution, including microbes. We are committed to cleaning up any spill as fast as possible as soon as and for whatever reason they occur."

These claims are hotly disputed by communities and environmental watchdog groups. They mostly blame the companies' vast network of rusting pipes and storage tanks, corroding pipelines, semi-derelict pumping stations and old wellheads, as well as tankers and vessels cleaning out tanks.

The scale of the pollution is mind-boggling. The government's national oil spill detection and response agency (Nosdra) says that between 1976 and 1996 alone, more than 2.4m barrels contaminated the environment. "Oil spills and the dumping of oil into waterways has been extensive, often poisoning drinking water and destroying vegetation. These incidents have become common due to the lack of laws and enforcement measures within the existing political regime," said a spokesman for Nosdra.

The sense of outrage is widespread. "There are more than 300 spills, major and minor, a year," said Bassey. "It happens all the year round. The whole environment is devastated. The latest revelations highlight the massive difference in the response to oil spills. In Nigeria, both companies and government have come to treat an extraordinary level of oil spills as the norm."

A spokesman for the Stakeholder Democracy Network in Lagos, which works to empower those in communities affected by the oil companies' activities, said: "The response to the spill in the United States should serve as a stiff reminder as to how far spill management in Nigeria has drifted from standards across the world."

Other voices of protest point out that the world has overlooked the scale of the environmental impact. Activist Ben Amunwa, of the London-based oil watch group Platform, said: "Deepwater Horizon may have exceed Exxon Valdez, but within a few years in Nigeria offshore spills from four locations dwarfed the scale of the Exxon Valdez disaster many times over. Estimates put spill volumes in the Niger delta among the worst on the planet, but they do not include the crude oil from waste water and gas flares. Companies such as Shell continue to avoid independent monitoring and keep key data secret."

Worse may be to come. One industry insider, who asked not to be named, said: "Major spills are likely to increase in the coming years as the industry strives to extract oil from increasingly remote and difficult terrains. Future supplies will be offshore, deeper and harder to work. When things go wrong, it will be harder to respond."

Judith Kimerling, a professor of law and policy at the City University of New York and author of Amazon Crude, a book about oil development in Ecuador, said: "Spills, leaks and deliberate discharges are happening in oilfields all over the world and very few people seem to care."

There is an overwhelming sense that the big oil companies act as if they are beyond the law. Bassey said: "What we conclude from the Gulf of Mexico pollution incident is that the oil companies are out of control.

"It is clear that BP has been blocking progressive legislation, both in the US and here. In Nigeria, they have been living above the law. They are now clearly a danger to the planet. The dangers of this happening again and again are high. They must be taken to the international court of justice."

Goldman Sachs Spies A Way Out Of Fraud Claims

Published: Tuesday, 1 Jun 2010 11:53 AM EST

by John Carney

Goldman Sachs may have found a way to compromise with the Securities and Exchange Commission that will allow both sides to declare victory.

The clock is ticking on the SEC’s case against Goldman Sachs. Sometime in the next few weeks, Goldman will either go to federal court with a substantive denial of the SEC’s allegations or agree to a settlement.

The two sides are still far apart. Goldman Sachs is unwilling to enter into the typical Wall Street settlement—paying a fine and agreeing not to commit further violations, while neither admitting nor denying the accusations—because it insists on denying that it intentionally committed fraud, sources familiar with the matter say. The SEC has accused Goldman of fraud under both the Securities Act of 1933 and Exchange Act of 1934 and is unwilling to abandon those claims for lesser offenses, those sources say.

Goldman is wary of settling any case while the accusation of fraud is outstanding. Part of this wariness is rooted in the reputational damage that could come from seeming to give up resisting the fraud accusation. More importantly, the company is concerned about the host of private class-action lawsuits that would surely follow any SEC settlement.

The SEC, however, cannot afford to be seen going easy on Goldman. It has managed to avoid having its authority stripped away in the financial reform process—the bills passed by both the House and the Senate largely keep the SEC independent and its authority intact—but it has been stung by criticism that lax enforcement of securities laws contributed to the financial crisis.

Despite this gap between the SEC and Goldman [GS 144.04 -0.79 (-0.55%) ] , a compromise position might not be completely out of reach. A technical legal difference in the fraud sections of the Securities Act and Exchange Act may allow both the SEC and Goldman to walk away happy.

The SEC accused Goldman with violating Section 10(b) of the Exchange Act and Section 17(a) of the Securities Act. Both are anti-fraud provisions. Like most anti-fraud statutes, Section 10(b) requires the government to prove a fraudulent intent. The first subsection of Section 17(a) also requires proof of fraudulent intent. But the second and third subsections of 17(a) do not require any proof of intent to defraud. This makes accusations based on the second and third subsections much easier to prove—and perhaps easier for Goldman to stomach.

In fact, subsection 17(a)(2) does not even employ any form of the word “fraud” or “deceit.” It makes the sale of a security or a derivative unlawful if a material omission renders the sale merely “misleading.”

The SEC’s claim against Goldman based on this subsection is its strongest and easiest to prove.

Goldman might accept a settlement if the civil charges requiring fraudulent intent or claiming a scheme that operated as fraud were dropped, a source said. That would leave open the charge of merely negligently “misleading” the investors in the Abacus deal. A source close to the matter indicated that this would be far more palatable to the company since it does not explicitly implicate Goldman in fraud.

The SEC has recently shown a willingness to cut this kind of deal. In February, the SEC settled a backdating case against Michael Byrd, the former CFO and later COO of Brocade Communications Systems, Inc.

Initially, the SEC had charged Byrd with violating both Section 10(b) and Section 17(a). In the settlement, the Section 10(b) charges were dropped, as was any charge based on the first part of Section 17(a).

The only surviving allegations--including a number of charges not involved in the Goldman case--were those that do not require proof of fraudulent intent. An earlier Brocade backdating settlement followed a similar pattern.

When it comes to the Goldman case, however, the SEC is playing its cards very close to its vest. It surprised Goldman by filing the lawsuit without pursuing further settlement negotiations. And virtually nothing about the settlement terms it is seeking have leaked out to the media.

Importantly for Goldman, most federal courts hold that Section 17(a) does not give rise to private actions. This means that Goldman would not be making itself more vulnerable to class-action lawsuits from outside investors even if it actually admitted to the charge of misleading omissions in the Abacus deal. Only the SEC is empowered to bring suit under Section 17(a).

The extent of Goldman’s monetary liability will not necessarily be affected by the exact charge it settles. So Goldman could still wind up paying a huge fine—some have estimated the fine could amount to $1 billion, the highest ever paid by a single firm. But if Goldman could avoid copping a plea to fraud, while perhaps limiting its vulnerability to class action investor lawsuits, it would likely agree to a deal.

Goldman does not seem confident that a deal will definitely be reached. As CNBC.com reported last week, sources say Goldman is still preparing a full-fledged defense even as talks with the SEC continue. The firm has been posturing behind the scenes, indicating that it believes it could uncover weaknesses in the government’s case during the pre-trial discovery phase. But it would prefer a settlement that dropped the fraud charges under the terms outlined above, sources say.

http://www.cnbc.com/id/37449088

by John Carney

Goldman Sachs may have found a way to compromise with the Securities and Exchange Commission that will allow both sides to declare victory.

The clock is ticking on the SEC’s case against Goldman Sachs. Sometime in the next few weeks, Goldman will either go to federal court with a substantive denial of the SEC’s allegations or agree to a settlement.

The two sides are still far apart. Goldman Sachs is unwilling to enter into the typical Wall Street settlement—paying a fine and agreeing not to commit further violations, while neither admitting nor denying the accusations—because it insists on denying that it intentionally committed fraud, sources familiar with the matter say. The SEC has accused Goldman of fraud under both the Securities Act of 1933 and Exchange Act of 1934 and is unwilling to abandon those claims for lesser offenses, those sources say.

Goldman is wary of settling any case while the accusation of fraud is outstanding. Part of this wariness is rooted in the reputational damage that could come from seeming to give up resisting the fraud accusation. More importantly, the company is concerned about the host of private class-action lawsuits that would surely follow any SEC settlement.

The SEC, however, cannot afford to be seen going easy on Goldman. It has managed to avoid having its authority stripped away in the financial reform process—the bills passed by both the House and the Senate largely keep the SEC independent and its authority intact—but it has been stung by criticism that lax enforcement of securities laws contributed to the financial crisis.

Despite this gap between the SEC and Goldman [GS 144.04 -0.79 (-0.55%) ] , a compromise position might not be completely out of reach. A technical legal difference in the fraud sections of the Securities Act and Exchange Act may allow both the SEC and Goldman to walk away happy.

The SEC accused Goldman with violating Section 10(b) of the Exchange Act and Section 17(a) of the Securities Act. Both are anti-fraud provisions. Like most anti-fraud statutes, Section 10(b) requires the government to prove a fraudulent intent. The first subsection of Section 17(a) also requires proof of fraudulent intent. But the second and third subsections of 17(a) do not require any proof of intent to defraud. This makes accusations based on the second and third subsections much easier to prove—and perhaps easier for Goldman to stomach.

In fact, subsection 17(a)(2) does not even employ any form of the word “fraud” or “deceit.” It makes the sale of a security or a derivative unlawful if a material omission renders the sale merely “misleading.”

The SEC’s claim against Goldman based on this subsection is its strongest and easiest to prove.

Goldman might accept a settlement if the civil charges requiring fraudulent intent or claiming a scheme that operated as fraud were dropped, a source said. That would leave open the charge of merely negligently “misleading” the investors in the Abacus deal. A source close to the matter indicated that this would be far more palatable to the company since it does not explicitly implicate Goldman in fraud.

The SEC has recently shown a willingness to cut this kind of deal. In February, the SEC settled a backdating case against Michael Byrd, the former CFO and later COO of Brocade Communications Systems, Inc.

Initially, the SEC had charged Byrd with violating both Section 10(b) and Section 17(a). In the settlement, the Section 10(b) charges were dropped, as was any charge based on the first part of Section 17(a).

The only surviving allegations--including a number of charges not involved in the Goldman case--were those that do not require proof of fraudulent intent. An earlier Brocade backdating settlement followed a similar pattern.

When it comes to the Goldman case, however, the SEC is playing its cards very close to its vest. It surprised Goldman by filing the lawsuit without pursuing further settlement negotiations. And virtually nothing about the settlement terms it is seeking have leaked out to the media.

Importantly for Goldman, most federal courts hold that Section 17(a) does not give rise to private actions. This means that Goldman would not be making itself more vulnerable to class-action lawsuits from outside investors even if it actually admitted to the charge of misleading omissions in the Abacus deal. Only the SEC is empowered to bring suit under Section 17(a).

The extent of Goldman’s monetary liability will not necessarily be affected by the exact charge it settles. So Goldman could still wind up paying a huge fine—some have estimated the fine could amount to $1 billion, the highest ever paid by a single firm. But if Goldman could avoid copping a plea to fraud, while perhaps limiting its vulnerability to class action investor lawsuits, it would likely agree to a deal.

Goldman does not seem confident that a deal will definitely be reached. As CNBC.com reported last week, sources say Goldman is still preparing a full-fledged defense even as talks with the SEC continue. The firm has been posturing behind the scenes, indicating that it believes it could uncover weaknesses in the government’s case during the pre-trial discovery phase. But it would prefer a settlement that dropped the fraud charges under the terms outlined above, sources say.

http://www.cnbc.com/id/37449088

Tuesday, June 1, 2010

President of Germany, Horst Kohler Resigns

http://www.nytimes.com/2010/06/01/world/europe/01germany.html

Kohler is also an ex-President of the International Monatary Fund

(The People Who Rule The World Bank & The World)

http://en.wikipedia.org/wiki/Horst_Köhler

Kohler is also an ex-President of the International Monatary Fund

(The People Who Rule The World Bank & The World)

http://en.wikipedia.org/wiki/Horst_Köhler

Subscribe to:

Posts (Atom)