Wall Street wake-up call: Hedge fund boss, 5 others charged in $25M-plus insider trading case

By Larry Neumeister and Candice Choi, Associated Press Writers

On 6:21 pm EDT, Friday October 16, 2009

Buzz up! 26

NEW YORK (AP) -- One of America's wealthiest men was among six hedge fund managers and corporate executives arrested Friday in a hedge fund insider trading case that authorities say generated more than $25 million in illegal profits and was a wake-up call for Wall Street.

Raj Rajaratnam, a portfolio manager for Galleon Group, a hedge fund with up to $7 billion in assets under management, was accused of conspiring with others to use insider information to trade securities in several publicly traded companies, including Google Inc.

U.S. Magistrate Judge Douglas F. Eaton set bail at $100 million to be secured by $20 million in collateral despite a request by prosecutors to deny bail. He also ordered Rajaratnam, who has both U.S. and Sri Lankan citizenship, to stay within 110 miles of New York City. The judge gave prosecutors until shortly after 6 p.m. to consider appealing his bail ruling.

U.S. Attorney Preet Bharara told a news conference it was the largest hedge fund case ever prosecuted and marked the first use of court-authorized wiretaps to capture conversations by suspects in an insider trading case.

He said the case should cause financial professionals considering insider trades in the future to wonder whether law enforcement is listening.

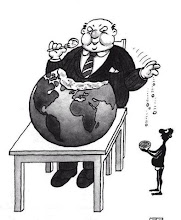

"Greed is not good," Bharara said. "This case should be a wake-up call for Wall Street."

Joseph Demarest Jr., the head of the New York FBI office, said it was clear that "the 20 million dollars in illicit profits come at the expense of the average public investor."

The Securities and Exchange Commission, which brought separate civil charges, said the scheme generated more than $25 million in illegal profits.

Robert Khuzami, director of enforcement at the SEC, said the charges show Rajaratnam's "secret of success was not genius trading strategies."

"He is not the master of the universe. He is a master of the Rolodex," Khuzami said.

Galleon Group LLP said in a statement it was shocked to learn of Rajaratnam's arrest at his apartment. "We had no knowledge of the investigation before it was made public and we intend to cooperate fully with the relevant authorities," the statement said.

The firm added that Galleon "continues to operate and is highly liquid."

Rajaratnam, 52, was ranked No. 559 by Forbes magazine this year among the world's wealthiest billionaires, with a $1.3 billion net worth.

According to the Federal Election Commission, he is a generous contributor to Democratic candidates and causes. The FEC said he made over $87,000 in contributions to President Barack Obama's campaign, the Democratic National Committee and various campaigns on behalf of Hillary Rodham Clinton, U.S. Sen. Charles Schumer and New Jersey U.S. Sen. Robert Menendez in the past five years. The Center for Responsive Politics, a watchdog group, said he has given a total of $118,000 since 2004 -- all but one contribution, for $5,000, to Democrats.

The Associated Press has learned that even before his arrest, Rajaratnam was under scrutiny for helping bankroll Sri Lankan militants notorious for suicide bombings.

Papers filed in U.S. District Court in Brooklyn allege that Rajaratnam worked closely with a phony charity that channeled funds to the Tamil Tiger terrorist organization. Those papers refer to him only as "Individual B." But U.S. law enforcement and government officials familiar with the case have confirmed that the individual is Rajaratnam.

At an initial court appearance in U.S. District Court in Manhattan, Assistant U.S. Attorney Josh Klein sought detention for Rajaratnam, saying there was "a grave concern about flight risk" given Rajaratnam's wealth and his frequent travels around the world.

His lawyer, Jim Walden, called his client a "citizen of the world," who has made more than $20 million in charitable donations in the last five years and had risen from humble beginnings in the finance profession to oversee hedge funds responsible for nearly $8 billion.

Walden promised "there's a lot more to this case" and his client was ready to prepare for it from home. Rajaratnam lives in a $10 million condominium with his wife of 20 years, their three children and two elderly parents. Walden noted that many of his employees were in court ready to sign a bail package on his behalf.

Rajaratnam -- born in Sri Lanka and a graduate of University of Pennsylvania's Wharton School of Business -- has been described as a savvy manager of billions of dollars in technology and health care hedge funds at Galleon, which he started in 1996. The firm is based in New York City with offices in California, China, Taiwan and India. He lives in New York.

According to a criminal complaint filed in U.S. District Court in Manhattan, Rajaratnam obtained insider information and then caused the Galleon Technology Funds to execute trades that earned a profit of more than $12.7 million between January 2006 and July 2007. Other schemes garnered millions more and continued into this year, authorities said.

Bharara said the defendants benefited from tips about the earnings, earnings guidance and acquisition plans of various companies. Sometimes, those who provided tips received financial benefits and sometimes they just traded tips for more inside information, he added.

The timing of the arrests might be explained by a footnote in the complaint against Rajaratnam. In it, an FBI agent said he had learned that Rajaratnam had been warned to be careful and that Rajaratnam, in response, had said that a former employee of the Galleon Group was likely to be wearing a "wire."

The agent said he learned from federal authorities that Rajaratnam had a ticket to fly from Kennedy International Airport to London on Friday and to return to New York from Geneva, Switzerland next Thursday.

Also charged in the scheme are Rajiv Goel, 51, of Los Altos, Calif., a director of strategic investments at Intel Capital, the investment arm of Intel Corp., Anil Kumar, 51, of Santa Clara, Calif., a director at McKinsey & Co. Inc., a global management consulting firm, and Robert Moffat, 53, of Ridgefield, Conn., senior vice president and group executive at International Business Machines Corp.'s Systems and Technology Group.

The others charged in the case were identified as Danielle Chiesi, 43, of New York City, and Mark Kurland, 60, also of New York City.

Bail for Kurland was set at $3 million while bail for Moffat and Chiesi was set at $2 million each. Lawyers for Moffat and Chiesi said their clients will plead not guilty.

According to court papers, Chiesi worked for New Castle, the equity hedge fund group of Bear Stearns Asset Management Inc. that had assets worth about $1 billion under management. Kurland is a top executive at New Castle.

Kumar's lawyer, Isabelle Kirshner, said of her client: "He's distraught." He was freed on $5 million bail, secured in part by his $2.5 million California home.

Kerry Lawrence, an attorney representing Moffat, said: "He's shocked by the charges."

It was not immediately clear who would represent the others in their initial court appearances.

A criminal complaint filed in the case shows that an unidentified person involved in the insider trading scheme began cooperating and authorities obtained wiretaps of conversations between the defendants.

In one conversation about a pending deal that was described in a criminal complaint, Chiesi is quoted as saying: "I'm dead if this leaks. I really am. ... and my career is over. I'll be like Martha (expletive) Stewart."

Stewart, the homemaking maven, was convicted in 2004 of lying to the government about the sale of her shares in a friend's company whose stock plummeted after a negative public announcement. She served five months in prison and five months of home confinement.

Prosecutors charged those arrested Friday with conspiracy and securities fraud.

A separate criminal complaint in the case said Chiesi and Moffat conspired to engage in insider trading in the securities of International Business Machines Corp.

According to another criminal complaint in the case, Chiesi and Rajaratnam were heard on a government wiretap of a Sept. 26, 2008, phone conversation discussing whether Chiesi's friend Moffat should move from IBM to a different technology company to aid the scheme.

"Put him in some company where we can trade well," Rajaratnam was quoted in the court papers as saying.

The complaint said Chiesi replied: "I know, I know. I'm thinking that too. Or just keep him at IBM, you know, because this guy is giving me more information. ... I'd like to keep him at IBM right now because that's a very powerful place for him. For us, too."

According to the court papers, Rajaratnam replied: "Only if he becomes CEO." And Chiesi was quoted as replying: "Well, not really. I mean, come on. ... you know, we nailed it."

The criminal complaints in the case also captured what authorities said were efforts by the defendants to hide their conversations from authorities.

In one conversation, Chiesi was heard telling Rajaratnam that she was "glad that we talk on a secure line, I appreciate that," to which Rajaratnam replied: "I never call you on my cell phone," the complaint said. It added that Chiesi said she was "nervous" about being investigated.

Associated Press Writers Tom Hays in Riverside, Calif., and Beth Fouhy in New York contributed to this story.

http://finance.yahoo.com/news/Billionaire-among-6-nabbed-in-apf-2808194948.html?x=0