Heller Questions Car Company’s Super Bowl Ad

January 28, 2010 by Tom Darby

Congressman Dean Heller says Chrysler shouldn’t be spending money on advertisements during next month’s Super Bowl after receiving a $15 billion taxpayer bailout. Heller says while some advertising is necessary to restore confidence in the Chrysler brand, the pricey Super Bowl ads are extravagant.

Damn straight…

http://tomdarby.wordpress.com/2010/01/28/heller-questions-car-companys-super-bowl-ad/

Sunday, January 31, 2010

Saturday, January 30, 2010

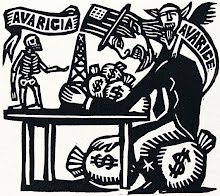

Corruption in Washington is smothering America's future

How do you regulate banks effectively, if the Senate is owned by Wall Street?

Friday, 29 January 2010

This week, a disaster hit the United States, and the after-shocks will be shaking and breaking global politics for years. It did not grab the same press attention as the fall of liberal Kennedy-licking Massachusetts to a pick-up truck Republican, or President Obama's first State of the Union address, or the possible break-up of Brangelina and their United Nations of adopted infants. But it took the single biggest problem dragging American politics towards brutality and dysfunction – and made it much, much worse. Yet it also showed the only path that Obama can now take to salvage his Presidency.

For more than a century, the US has slowly put some limits – too few, too feeble – on how much corporations can bribe, bully or intimidate politicians. On Tuesday, they were burned away in one whoosh. The Supreme Court ruled that corporations can suddenly run political adverts during an election campaign – and there is absolutely no limit on how many, or how much they can spend. So if you anger the investment bankers by supporting legislation to break up the too-big-to-fail banks, you will smack into a wall of 24/7 ads exposing your every flaw. If you displease oil companies by supporting legislation to deal with global warming, you will now be hit by a tsunami of advertising saying you are opposed to jobs and the American Way. If you rile the defence contractors by opposing the gargantuan war budget, you will face a smear-campaign calling you Soft on Terror.

Representative Alan Grayson says: "It basically institutionalises and legalises bribery on the largest scale imaginable. Corporations will now be able to reward the politicians that play ball with them – and beat to death the politicians that don't... You won't even hear any more about the Senator from Kansas. It'll be the Senator from General Electric or the Senator from Microsoft."

Related articles

Obama gets down to business on the economy first

Bernanke survives Senate protest vote

Search the news archive for more stories

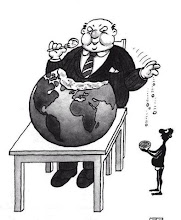

To understand the impact this will have, you need to grasp how smaller sums of corporate money have already hijacked American democracy. Let's look at a case that is simple and immediate and every American can see in front of them: healthcare. The United States is the only major industrialised democracy that doesn't guarantee healthcare for all its citizens. The result is that, according to a detailed study by Harvard University, some 45,000 Americans die needlessly every year. That's equivalent to 15 9/11s every year, or two Haitian earthquakes every decade.

This isn't because the American people like it this way. Gallup has found in polls for a decade now that two-thirds believe the government should guarantee care for every American: they are as good and decent and concerned for each other as any European. No: it is because private insurance companies make a fortune today out of a system that doesn't cover the profit-less poor, and can turn away the sickest people as "uninsurable". So they pay for politicians to keep the system broken. They fund the election campaigns of politicians on both sides of the aisle and employ an army of lobbyists, and for their part those politicians veto any system that doesn't serve their paymasters.

Look for example at Joe Lieberman, the former Democratic candidate for Vice-President. He has taken $448,066 in campaign contributions from private healthcare companies while his wife raked in $2m as one of their chief lobbyists, and he has blocked any attempt in the Senate to break the stranglehold of the health insurance companies and broaden coverage.

The US political system now operates within a corporate cage. If you want to run for office, you have to take corporate cash – and so you have to serve corporate interests. Corporations are often blatant in their corruption: it's not unusual for them to give to both competing candidates in a Senate race, to ensure all sides are indebted to them. It has reached the point that lobbyists now often write the country's laws. Not metaphorically; literally. The former Republican congressman Walter Jones spoke out in disgust in 2006 when he found that drug company lobbyists were actually authoring the words of the Medicare prescription bill, and puppet-politicians were simply nodding it through.

But what happens if politicians are serving the short-term profit-hunger of corporations, and not the public interest? You only have to look at the shuttered shops outside your window for the answer. The banks were rapidly deregulated from the Eighties through the Noughties because their lobbyists paid politicians on all sides, and demanded their payback in rolled-back rules and tossed-away laws. As Senator Dick Durbin says simply: "The banks own the Senate," so they had to obey.

It is this corruption that has prevented Barack Obama from achieving anything substantial in his first year in office. How do you re-regulate the banks, if the Senate is owned by Wall Street? How do you launch a rapid transition away from oil and coal to wind and solar, if the fossil fuel industry owns Congress? How do you break with a grab-the-oil foreign policy if Big Oil provides the invitation that gets you into the party of American politics?

His attempt at healthcare reform is dying because he thought he could only get through the Senate a system that the giant healthcare corporations and drug companies pre-approved. So he promised to keep the ban on bringing cheap drugs down from Canada, he pledged not to bargain over prices, and he dumped the idea of having a public option that would make sure ordinary Americans could actually afford it. The result was a Quasimodo healthcare proposal so feeble and misshapen that even the people of Massachusetts turned away in disgust.

Yet the corporations that caused this crisis are now being given yet more power. Bizarrely, the Supreme Court has decided that corporations are "persons", so they have the "right" to speak during elections. But corporations are not people. Should they have the right to bear arms, or to vote? It would make as much sense. They are a legal fiction, invented by the state – and they can be fairly regulated to stop them devouring their creator. This is the same Supreme Court that ruled that the detainees at Guantanomo Bay are not "persons" under the constitution deserving basic protections. A court that says a living breathing human is less of a "persons" than Lockheed Martin has gone badly awry.

Obama now faces two paths – the Clinton road, or the FDR highway. After he lost his healthcare battle, Clinton decided to serve the corporate interests totally. He is the one who carried out the biggest roll-back of banking laws, and saw the largest explosion of inequality since the 1920s. Some of Obama's advisers are now nudging him down that path: the appalling anti-Keynesian pledge for a spending freeze on social programmes for the next three years to pay down the deficit is one of their triumphs.

But there is another way. Franklin Roosevelt began his Presidency trying to appease corporate interests – but he faced huge uproar and disgust at home when it became clear this left ordinary Americans stranded. He switched course. He turned his anger on "the malefactors of great wealth" and bragged: "I welcome the hatred... of the economic royalists." He put in place tough regulations that prevented economic disaster and spiralling inequality for three generations.

There were rare flashes of what Franklin Delano Obama would look like in his reaction to the Supreme Court decision. He said: "It is a major victory for big oil, Wall Street banks, health insurance companies, and other powerful interests that marshal their power every day in Washington to drown out the voices of everyday Americas." But he has spent far more time coddling those interests than taking them on. The great pressure of strikes and protests put on FDR hasn't yet arisen from a public dissipated into hopelessness by an appalling media that convinces them they are powerless and should wait passively for a Messiah.

Very little positive change can happen in the US until they clear out the temple of American democracy. In the State of the Union, Obama spent one minute on this problem, and proposed restrictions on lobbyists – but that's only the tiniest of baby steps. He evaded the bigger issue. If Americans want a democratic system, they have to pay for it – and that means fair state funding for political candidates. Candidates are essential for the system to work: you may as well begrudge paying for the polling booths, or the lever you pull. At the same time, the Supreme Court needs to be confronted: when the court tried to stymie the new deal, FDR tried to pack it with justices on the side of the people. Obama needs to be pressured by Americans to be as radical in democratising the Land of the Fee (CRCT).

None of the crises facing us all – from the global banking system to global warming – can be dealt with if a tiny number of super-rich corporations have a veto over every inch of progress. If Obama funks this challenge, he may as well put the US government on e-Bay – and sell it to the highest bidder. How would we spot the difference?

j.hari@independent.co.uk

More from Johann Hari

http://www.independent.co.uk/opinion/commentators/johann-hari/johann-hari-this-corruption-in-washington-is-smothering-americas-future-1882349.html

Friday, January 29, 2010

Tired of Farmers & Ranchers Crying Poor Mouth? Wait til You Get a Load of This

UPDATE  FARM BILL PASSED

FARM BILL PASSED

In Recession, Modest Help for Most Americans, But Big Bucks for Big Farms

WASHINGTON, April 14, 2008. Over the next few weeks, some American couples will get $1,200 of their own money back from Washington. This is the maximum, one-time tax rebate Congress provided last February in their desperate attempt to revive our faltering economy that has since been declared in recession.

By contrast, in a few months some other American couples, who operate some of the largest, most profitable farms in the country or merely own huge swaths of farmland, could be receiving 100 times that amount from the government-$120,000. That's what could happen if the House version of the 2008 farm bill becomes law later this week.

What's more, $120,000 will just be the first of five guaranteed annual crop subsidy payments that will bring them $600,000 through 2012.

The disparity owes much to the decades-old momentum behind farm subsidies which delivered $13.4 billion to farmers in 2006, according to the latest update of the Environmental Working Group's Farm Subsidy Database website (site and analysis).

Now including 2006 USDA data, the new website shows that from 1995 to 2006 or the past 12 years, taxpayers have sent over $177 billion in subsidies to farmers. Taxpayers will continue to send billions more, even as the farm economy posts record prices for many crops, and record incomes for most farmers.

To put this crop subsidy largesse in perspective, at median home prices reported by the National Association of Realtors for the last quarter of 2007, $600,000 would buy eight or more homes in places like Youngstown, OH, Saginaw, MI and Decatur, IL.

Under the House bill, a couple receiving the new maximum direct payment ($120,000 per couple per year or $600,000 for 5 years) will receive taxpayer dollars equivalent to five or more median-priced houses--one per year--in 26 metropolitan areas.

Without the increase in the subsidy limit from the House bill and merely an extension of the current maximum payment of $80,000 per couple per year over five years ($400,000 total), you could still buy 3 or more median-priced homes in 44 metro areas.

"You can't have a policy discussion in Washington without asking, how will it play in Peoria?" said Ken Cook, president of the Environmental Working Group.

"That will depend on how people living there feel about big farmers all around them, raking in record incomes and still getting enough in subsidies to buy three median-priced Peoria homes with the existing direct payment limit over five years," Cook added.

"If the House bill becomes law, big farmers would be able to buy 5 median-priced Peoria homes since it, gives couples an extra $40,000 each, every year for the next five. We can imagine how the American public may respond to the stunning unfairness of such a policy," said Cook.

Other findings:

Top 2006 Recipients - Riceland Foods, a rice cooperative, received $7.7 million in 2006.

Corn is King - Over the past twelve years, taxpayers have spent $56 billion on corn subsidies paid to over 1.5 million recipients, making it the top crop for federal assistance.

Concentration of Payments - 50% of all subsidies go to just 9 states while 22 of the nation's 435 congressional districts collect over half of all subsidy payments.

Senate and House Agriculture Committees -The 19 states currently represented on the Senate Agriculture Committee take home 59 percent of all subsidies paid over the last 12 years while the 45 congressional districts currently represented on the House Agriculture Committee accounted for 42 percent of the national subsidy total.

Full URL for 2006 farm subsidy data: http://farm.ewg.org/farm/

# # #

The EWG is a nonprofit research organization based in Washington, DC that uses the power of information to protect human health and the environment. The group's farm subsidy database can be found at www.mulchblog.com

FACTOID: 70% of all our available croplands are used for the growing of cattle feed!

Click on title above to go to the data-base to see who is getting paid and how much

http://farm.ewg.org/newsrelease.php

Also, check out the info in the link below to read all about "Welfare Ranching," the Subsidized Destruction of Our American West;

http://www.publiclandsranching.org/book.htm

FARM BILL PASSED

FARM BILL PASSEDIn Recession, Modest Help for Most Americans, But Big Bucks for Big Farms

WASHINGTON, April 14, 2008. Over the next few weeks, some American couples will get $1,200 of their own money back from Washington. This is the maximum, one-time tax rebate Congress provided last February in their desperate attempt to revive our faltering economy that has since been declared in recession.

By contrast, in a few months some other American couples, who operate some of the largest, most profitable farms in the country or merely own huge swaths of farmland, could be receiving 100 times that amount from the government-$120,000. That's what could happen if the House version of the 2008 farm bill becomes law later this week.

What's more, $120,000 will just be the first of five guaranteed annual crop subsidy payments that will bring them $600,000 through 2012.

The disparity owes much to the decades-old momentum behind farm subsidies which delivered $13.4 billion to farmers in 2006, according to the latest update of the Environmental Working Group's Farm Subsidy Database website (site and analysis).

Now including 2006 USDA data, the new website shows that from 1995 to 2006 or the past 12 years, taxpayers have sent over $177 billion in subsidies to farmers. Taxpayers will continue to send billions more, even as the farm economy posts record prices for many crops, and record incomes for most farmers.

To put this crop subsidy largesse in perspective, at median home prices reported by the National Association of Realtors for the last quarter of 2007, $600,000 would buy eight or more homes in places like Youngstown, OH, Saginaw, MI and Decatur, IL.

Under the House bill, a couple receiving the new maximum direct payment ($120,000 per couple per year or $600,000 for 5 years) will receive taxpayer dollars equivalent to five or more median-priced houses--one per year--in 26 metropolitan areas.

Without the increase in the subsidy limit from the House bill and merely an extension of the current maximum payment of $80,000 per couple per year over five years ($400,000 total), you could still buy 3 or more median-priced homes in 44 metro areas.

"You can't have a policy discussion in Washington without asking, how will it play in Peoria?" said Ken Cook, president of the Environmental Working Group.

"That will depend on how people living there feel about big farmers all around them, raking in record incomes and still getting enough in subsidies to buy three median-priced Peoria homes with the existing direct payment limit over five years," Cook added.

"If the House bill becomes law, big farmers would be able to buy 5 median-priced Peoria homes since it, gives couples an extra $40,000 each, every year for the next five. We can imagine how the American public may respond to the stunning unfairness of such a policy," said Cook.

Other findings:

Top 2006 Recipients - Riceland Foods, a rice cooperative, received $7.7 million in 2006.

Corn is King - Over the past twelve years, taxpayers have spent $56 billion on corn subsidies paid to over 1.5 million recipients, making it the top crop for federal assistance.

Concentration of Payments - 50% of all subsidies go to just 9 states while 22 of the nation's 435 congressional districts collect over half of all subsidy payments.

Senate and House Agriculture Committees -The 19 states currently represented on the Senate Agriculture Committee take home 59 percent of all subsidies paid over the last 12 years while the 45 congressional districts currently represented on the House Agriculture Committee accounted for 42 percent of the national subsidy total.

Full URL for 2006 farm subsidy data: http://farm.ewg.org/farm/

# # #

The EWG is a nonprofit research organization based in Washington, DC that uses the power of information to protect human health and the environment. The group's farm subsidy database can be found at www.mulchblog.com

FACTOID: 70% of all our available croplands are used for the growing of cattle feed!

Click on title above to go to the data-base to see who is getting paid and how much

http://farm.ewg.org/newsrelease.php

Also, check out the info in the link below to read all about "Welfare Ranching," the Subsidized Destruction of Our American West;

http://www.publiclandsranching.org/book.htm

Thursday, January 28, 2010

Porker of the Year Award / Nominees'

Our public officials in Washington spent tax dollars like a bunch of drunken sailors in 2009, leaving taxpayers with a monstrous $12 trillion national debt hanging over their future. But who truly stood out as the worst custodian of your hard-earned money last year? Cast your vote for CAGW’s 2009 Porker of the Year!

Chosen by CAGW staff from among the 2009 Porkers of the Month, the nominees are:

Rep. Neil Abercrombie (D-Hawaii), for posing a multiple threat to taxpayers: He ranked first in earmarks in the House in fiscal year 2009 with 44 projects costing $256.8 million; routinely abuses an already-stretched defense budget to reward favored contractors; and has obstinately supported funding a wasteful and unnecessary alternate engine for the Joint Strike Fighter over the Pentagon’s objections.

Rep. Russ Carnahan (D-Mo.), for grossly misrepresenting the costs of healthcare reform legislation, which elicited loud guffaws at a town hall meeting with his constituents last summer.

Rep. Barney Frank (D-Mass.), for expressing outrage that AIG employee bonuses “rewarded failure,” while championing the TARP financial bailout and for years defending the shoddy business practices of Fannie Mae and Freddie Mac, which are now in taxpayer conservatorship.

Sen. Kay Bailey Hutchison (R-Texas), for requesting 149 pork-barrel projects at a cost to taxpayers of $1.6 billion in authorization and appropriations bills for fiscal year 2010 -- thereby personifying the tiresome hypocrisy of some members of Congress who want to claim the badge of fiscal conservatism while continuing to abscond with billions of dollars in wasteful pork projects.

Transportation Secretary Ray LaHood, for presiding over the distribution of tens of billions of tax dollars for transportation projects in the economic stimulus package, despite his long-standing reputation as a top porker while serving in the House of Representatives from 1995 until 2008.

Rep. Maxine Waters (D-Calif.), for reminding taxpayers that members of Congress still have not banned the practice of naming projects after themselves after she provoked a tussle with House Appropriations Committee Chairman David Obey (D-Wis.) over her intention to build a "Monument to Me" by obtaining an earmark for the Maxine Waters Employment Preparation Center.

Christine, CNBC promoted our 2009 Porker of the Year poll on Monday, January 11, and the network plans to broadcast the results in early February, so cast your vote by January 31 to help CAGW decide who will receive the “dishonor” of being named 2009 Porker of the Year!

Sincerely,

Thomas A. Schatz

President

P.S. Christine, help us get as many taxpaying Americans as possible to take part in our poll. Forward this message to your friends, neighbors, and colleagues.

***

Citizens Against Government Waste is the nation's largest taxpayer watchdog group with more than one million members and supporters nationwide. It is a 501(c)(3) nonpartisan, nonprofit organization dedicated to eliminating waste, fraud, abuse, and mismanagement in government. Donations to CAGW are tax-deductible as charitable contributions to the extent permitted by law. For more information about CAGW, visit our website at www.cagw.org. Make a tax-deductible contribution today to support CAGW’s waste-fighting efforts that have saved taxpayers $1.08 trillion.

Chosen by CAGW staff from among the 2009 Porkers of the Month, the nominees are:

Rep. Neil Abercrombie (D-Hawaii), for posing a multiple threat to taxpayers: He ranked first in earmarks in the House in fiscal year 2009 with 44 projects costing $256.8 million; routinely abuses an already-stretched defense budget to reward favored contractors; and has obstinately supported funding a wasteful and unnecessary alternate engine for the Joint Strike Fighter over the Pentagon’s objections.

Rep. Russ Carnahan (D-Mo.), for grossly misrepresenting the costs of healthcare reform legislation, which elicited loud guffaws at a town hall meeting with his constituents last summer.

Rep. Barney Frank (D-Mass.), for expressing outrage that AIG employee bonuses “rewarded failure,” while championing the TARP financial bailout and for years defending the shoddy business practices of Fannie Mae and Freddie Mac, which are now in taxpayer conservatorship.

Sen. Kay Bailey Hutchison (R-Texas), for requesting 149 pork-barrel projects at a cost to taxpayers of $1.6 billion in authorization and appropriations bills for fiscal year 2010 -- thereby personifying the tiresome hypocrisy of some members of Congress who want to claim the badge of fiscal conservatism while continuing to abscond with billions of dollars in wasteful pork projects.

Transportation Secretary Ray LaHood, for presiding over the distribution of tens of billions of tax dollars for transportation projects in the economic stimulus package, despite his long-standing reputation as a top porker while serving in the House of Representatives from 1995 until 2008.

Rep. Maxine Waters (D-Calif.), for reminding taxpayers that members of Congress still have not banned the practice of naming projects after themselves after she provoked a tussle with House Appropriations Committee Chairman David Obey (D-Wis.) over her intention to build a "Monument to Me" by obtaining an earmark for the Maxine Waters Employment Preparation Center.

Christine, CNBC promoted our 2009 Porker of the Year poll on Monday, January 11, and the network plans to broadcast the results in early February, so cast your vote by January 31 to help CAGW decide who will receive the “dishonor” of being named 2009 Porker of the Year!

Sincerely,

Thomas A. Schatz

President

P.S. Christine, help us get as many taxpaying Americans as possible to take part in our poll. Forward this message to your friends, neighbors, and colleagues.

***

Citizens Against Government Waste is the nation's largest taxpayer watchdog group with more than one million members and supporters nationwide. It is a 501(c)(3) nonpartisan, nonprofit organization dedicated to eliminating waste, fraud, abuse, and mismanagement in government. Donations to CAGW are tax-deductible as charitable contributions to the extent permitted by law. For more information about CAGW, visit our website at www.cagw.org. Make a tax-deductible contribution today to support CAGW’s waste-fighting efforts that have saved taxpayers $1.08 trillion.

Obombas' "Middle Class" - Who R They?

With Obomba getting ready to launch a new "Middle Class Initative," it would seem the first REASONABLE thing to do before setting out any new policies or expenditures would be to clearly define who and/or what is middle-class. As you will see after reading the article below, the term is ambigious.

---------------

What is an Average Middle Class Salary Range?

By Stephanie Chandler

eHow Contributing Writer

What is the middle class, and who defines it? There is no solid description with clear salary ranges that define the middle class, but U.S. agencies and economists do try to put numbers to this seemingly abstract group of people

The Poverty Line

As of 2009, the poverty threshold as determined by the U.S. Census Bureau had not changed since 2006. For a family of four it is $21,203. For a family of three it is $16,530. For a family of two and unrelated individuals it is $13,540 and $10,590 respectively.

U.S. Census Quintiles

The U.S. Census Bureau breaks down the reported household incomes into quintiles (or five divisions). In 2007, the middle quintile reported an income range of $36,000 to $57,660. Many economists and politicians alike believe this range is too narrow to encompass the true middle class of America. Therefore a more generous range would include the middle three quintiles, which makes the range from $19,178 to $91,705. This range accounts for 60% of all households, and with the lower end balancing near the poverty threshold, this range may not be completely accurate.

Median Income

The 2008 census reported the medium income as $50,233. The Pew Research Center suggests that the middle income range is 75 percent to 150 percent of the median income. This makes the current middle class income range $37,675 to $75,350. To most, this range seems small and surveys conducted by the Pew Research Center find that many who fall outside this range still consider themselves middle class.

Economist Views

Economist Gary Burtless of Brookings Institution indicates that the middle class encompasses from one-half the median income to twice the median income. This makes the middle class income range $25,117 to $100,466.

MIT economist Frank Levy believes that those in the middle class have enough money to afford the basic building blocks of a good life including a house, a car and money to pay necessary bills. He suggests that families in their prime earning years are middle class if they fall between $30,000 and $90,000.

More Than Just Income

Surveys conducted by the PewResearch Center confirm that salary, or income, range is not the only determining factor of what class a person considers him/herself. Four out of 10 Americans with incomes below $20,000 classify themselves as middle class. On the other end, 1/3 of those who enjoy incomes over $150,000 say they are middle class. Being middle class is just as much a feeling of well-being as it is an income label.

http://www.ehow.com/about_5212740_average-middle-class-salary-range_.html

Wednesday, January 27, 2010

CHART OF THE DAY: How The AIG Bailout REALLY Worked

Joe Weisenthal and Kamelia Angelova | Jan. 27, 2010, 4:12 PM | 2,349 | 8

Print

Tags: Wall Street, Chart Of The Day, AIG, Bailout

Confused about the ongoing AIG controversy?

Don't be any longer.

Professor Linus Wilson has put together this helpful chart showing exactly how the bailout went down, complete with which banks got how much. (Click on chart to enlarge)

Two things stand out: The Treasury's overpayment for preferred stock was a crucial part of the bailout, and though Goldman Sachs is usually held up as the bad guy here, SocGen received $2.5 billion more.

Hope the Europeans appreciate your (the taxpayer) ponying up.

http://www.businessinsider.com/chart-of-the-day-how-the-aig-bailout-worked-2010-1?utm_source=Triggermail

Tags: Wall Street, Chart Of The Day, AIG, Bailout

Confused about the ongoing AIG controversy?

Don't be any longer.

Professor Linus Wilson has put together this helpful chart showing exactly how the bailout went down, complete with which banks got how much. (Click on chart to enlarge)

Two things stand out: The Treasury's overpayment for preferred stock was a crucial part of the bailout, and though Goldman Sachs is usually held up as the bad guy here, SocGen received $2.5 billion more.

Hope the Europeans appreciate your (the taxpayer) ponying up.

http://www.businessinsider.com/chart-of-the-day-how-the-aig-bailout-worked-2010-1?utm_source=Triggermail

How to End an Abusive Relationship with Yer Bank($ters)

From Bill Maher;

Stop the Abuse: It's Time to Break Up With Your Big Bank

Hello, I'd like to take a moment to address the millions and millions of you all across America who are currently stuck in an abusive relationship.

Now I know what some of you are thinking: Who is Bill Maher to give me relationship advice?

But that doesn't mean I don't know a dysfunctional relationship when I see one. Especially when it's staring me right in the face.

You know who you are. Those of you staying in a relationship long after it's turned bad. Sticking around despite the abuse -- even as it's gotten worse and worse over the years. Sticking around only because it seems easier than breaking up -- and besides, where else are you going to go?

That's right, I'm talking to all of you that keep doing your banking at the giant, too big to fail, Wall Street banks that brought our economy to the brink of disaster, were rescued by trillions of dollars of our taxpayer money, then paid us back by using that money to hire lobbyists to convince our lawmakers in Washington to kill financial reform.

They took our money... but cut back on lending.

They took our money... and made record profits -- and paid themselves record bonuses.

They took our money... then returned to the risky behavior that led to the worst financial crisis since the Great Depression, with record unemployment, bankruptcies, and foreclosures.

They took our money... but kept on with all the greedy, abusive, ruthless, and cold-blooded practices that have earned them untold billions of dollars a year -- year after year after year. Things like charging you outrageous fees for anything and everything, jacking up your credit card interest rate to 30 percent for being late on one payment (it's a good thing sodomy is legal!), and refusing to renegotiate your mortgage after the housing bubble they helped create burst.

These big banks, deemed "Too Big To Fail" by our Wall Street-friendly leaders in Washington, are convinced that they can get away with anything -- because they always have.

But here's the thing. You don't have to put up with this nonsense. You don't have to stay in a loveless, abusive relationship with your Big Bank.

In fact, it's easy to get out -- and into something much, much better.

My friend Arianna Huffington has started a campaign designed to convince people to move their money out of these big banks and put them into smaller, local, community banks and credit unions that are more likely to see you as a person, not as an account number... and also to reinvest in the community where they are.

It's a pretty simple idea: If enough people who have money in one of the Big Six banks -- that is, JP Morgan/Chase, Citi, Wells Fargo, Bank of America, Morgan Stanley, and Goldman Sachs -- move it into a local community bank or credit union, then collectively we, the people, will have taken a big step toward fixing our broken financial system.

It's easy, and painless, and will send a powerful message to Wall Street and to our leaders in Washington.

Face it: Real change is not going to come from Congress. It's not going to come from the White House. And it's certainly not going to come from the lobbyists Wall Street hires to make sure their special interests keep beating out the public interest.

We've got to do it ourselves. And moving your money is a great way to start.

This is not a conservative idea or a liberal idea. It's not left or right. It's populism at it's best -- and it's already attracted people from all walks of life who are sick and tired of the Big Banks and are ready to do something about it.

So it's time to go break up with your banker and get the hell out. Go to MoveYourMoney.info and see just how easy it is to end your abusive relationship and find true banking love. Or, at least hot, sweaty, monkey, banking sex.

MoveYourMoney.info. Tell 'em Dr. Bill sent you...

------------------------------

To watch a video of Bill on Moving You Money, click on title above;

http://www.huffingtonpost.com/bill-maher/stop-the-abuse-its-time-t_b_422068.html

Stop the Abuse: It's Time to Break Up With Your Big Bank

Hello, I'd like to take a moment to address the millions and millions of you all across America who are currently stuck in an abusive relationship.

Now I know what some of you are thinking: Who is Bill Maher to give me relationship advice?

But that doesn't mean I don't know a dysfunctional relationship when I see one. Especially when it's staring me right in the face.

You know who you are. Those of you staying in a relationship long after it's turned bad. Sticking around despite the abuse -- even as it's gotten worse and worse over the years. Sticking around only because it seems easier than breaking up -- and besides, where else are you going to go?

That's right, I'm talking to all of you that keep doing your banking at the giant, too big to fail, Wall Street banks that brought our economy to the brink of disaster, were rescued by trillions of dollars of our taxpayer money, then paid us back by using that money to hire lobbyists to convince our lawmakers in Washington to kill financial reform.

They took our money... but cut back on lending.

They took our money... and made record profits -- and paid themselves record bonuses.

They took our money... then returned to the risky behavior that led to the worst financial crisis since the Great Depression, with record unemployment, bankruptcies, and foreclosures.

They took our money... but kept on with all the greedy, abusive, ruthless, and cold-blooded practices that have earned them untold billions of dollars a year -- year after year after year. Things like charging you outrageous fees for anything and everything, jacking up your credit card interest rate to 30 percent for being late on one payment (it's a good thing sodomy is legal!), and refusing to renegotiate your mortgage after the housing bubble they helped create burst.

These big banks, deemed "Too Big To Fail" by our Wall Street-friendly leaders in Washington, are convinced that they can get away with anything -- because they always have.

But here's the thing. You don't have to put up with this nonsense. You don't have to stay in a loveless, abusive relationship with your Big Bank.

In fact, it's easy to get out -- and into something much, much better.

My friend Arianna Huffington has started a campaign designed to convince people to move their money out of these big banks and put them into smaller, local, community banks and credit unions that are more likely to see you as a person, not as an account number... and also to reinvest in the community where they are.

It's a pretty simple idea: If enough people who have money in one of the Big Six banks -- that is, JP Morgan/Chase, Citi, Wells Fargo, Bank of America, Morgan Stanley, and Goldman Sachs -- move it into a local community bank or credit union, then collectively we, the people, will have taken a big step toward fixing our broken financial system.

It's easy, and painless, and will send a powerful message to Wall Street and to our leaders in Washington.

Face it: Real change is not going to come from Congress. It's not going to come from the White House. And it's certainly not going to come from the lobbyists Wall Street hires to make sure their special interests keep beating out the public interest.

We've got to do it ourselves. And moving your money is a great way to start.

This is not a conservative idea or a liberal idea. It's not left or right. It's populism at it's best -- and it's already attracted people from all walks of life who are sick and tired of the Big Banks and are ready to do something about it.

So it's time to go break up with your banker and get the hell out. Go to MoveYourMoney.info and see just how easy it is to end your abusive relationship and find true banking love. Or, at least hot, sweaty, monkey, banking sex.

MoveYourMoney.info. Tell 'em Dr. Bill sent you...

------------------------------

To watch a video of Bill on Moving You Money, click on title above;

http://www.huffingtonpost.com/bill-maher/stop-the-abuse-its-time-t_b_422068.html

Tuesday, January 26, 2010

The Message in a Crooked Broker's Reduced Sentence

DANIEL SOLIN Posted 9:00 PM 01/24/10 Columns, People, Investing

Eric Butler, a former broker with Credit Suisse, had a lot to be worried about when he walked into the U.S. District Court in Brooklyn, N.Y., on Friday for sentencing. A jury had found him guilty of misleading his clients into believing they were purchasing low-risk, auction rate securities backed by student loans, with federal guarantees. Instead, the hapless clients were sold high-risk, high-commission auction rate securities backed by home mortgage assets.

Butler altered the trade confirmations to make them appear to reflect securities backed by student loans. But the scheme fell apart when the auction rate securities market collapsed.

The government claimed losses exceeded $1.12 billion and asked for a sentence of 45 years in prison, plus significant monetary penalties. But Butler caught a major break. U.S. District Court Judge Jack Weinstein sentenced him to only five years in prison and fined him $5 million.

Judge Weinstein isn't your run-of-the-mill jurist. He has been a federal judge for 43 years, is a prolific author and one of the most experienced and respected judges in this country. After the jury returned its guilty verdict, Judge Weinstein signaled his concern about allocating all of the blame for these misdeeds to Butler. Said Weinstein: "What becomes evident in a trial like the present one, and in recent mortgage fraud cases, is how pernicious and pervasive is the culture of corruption" in the securities industry.

He repeated these views on Friday, noting the reduced sentence took into consideration "the pernicious and pervasive culture of corruption in the financial-services industry," which is "beset by avarice."

Wake-Up Call to Investors

Weinstein left no doubt about his view of Credit Suisse's culpability, stating that "[T]he blame for this condition is shared not only by individual defendants like Butler, but also the institutions that employ them."

This judicial validation of the pervasive greed and dishonesty in the securities industry should be a wake-up call to investors. It's difficult to understand why investors continue to trust their assets to members of this industry. It's bad enough that brokers generally lack the expertise to manage your assets. It's worse that, if you're a victim of broker misconduct, the mandatory, industry-run arbitration process is rigged to ensure you won't recover any meaningful portion of your losses.

I appreciate Judge Weinstein taking corruption and greed in the securities industry into account as an argument against a long prison sentence for Butler. What's your argument for continuing to place your trust in the securities industry?

http://www.dailyfinance.com/story/investing/the-message-in-a-crooked-brokers-reduced-sentence/19328974/?icid=main|hp-desktop|dl5|link6|http://www.dailyfinance.com/story/investing/the-message-in-a-crooked-brokers-reduced-sentence/19328974/

Wednesday, January 20, 2010

Vacationing in Hell: Cruise Ships Land in Haiti

Vacationing in Hell: Cruise Ships Land in Haiti

Updated: 1 day 4 hours ago

Dave Thier

Contributor

(Jan. 18) -- It would seem that nothing, not even a devastating earthquake that has claimed tens of thousands of lives, can deter the American vacationer's drive to unwind. To prove the point, one cruise ship from Florida-based Royal Caribbean International landed in Haiti on Friday, the Guardian reports, and three more are due in this week.

Royal Caribbean cruise passengers visit Labadee Beach, a walled resort only 60 miles from the epicenter of the quake. On its Web site, the company advertises "pristine beaches," "breathtaking scenery" and "native charm." Armed guards patrol the perimeter, even under normal conditions.

Caribbean vacations have always provided a stark contrast between decadent resorts and the impoverished countries that house them, but not even the magic of the cruise ship could hide the horror at this uncommon port of call.

Joe Kafka, AP

Royal Caribbean is continuing to ferry passengers to its Haitian resort at Labadee despite the misery wrought by the earthquake in Port-au-Prince.

"I just can't see myself sunning on the beach, playing in the water, eating a barbecue and enjoying a cocktail while there are tens of thousands of dead people being piled up on the streets," one commenter wrote on an Internet forum about cruises.

While Royal Caribbean's decision to cruise on to the destroyed country might seem callous, the company defends its decision, saying its ships are transporting not just cruise passengers but also foodstuffs for Haitians. The company has promised to use 100 percent of the proceeds from its cruise visits to Labadee to benefit victims of the quake.

More Coverage:

- Miraculous Rescues Continue

- Quake Orphans Thousands

- Aid Follows Refugees Into Jacmel

- Dad Found Alive With Goodbye Note

- New Satellite Photos

- Quake Stirs Painful Memories

- Did Katrina Spur Haiti Donations?

- DJ Hits Airwaves for Aid Mission

- Dead Left Where They Lie

- General Downplays Violence

- How You Can Help

"In the end, Labadee is critical to Haiti's recovery; hundreds of people rely on Labadee for their livelihood," Vice President John Weis told The Guardian. "In our conversations with [Haiti's special envoy to the U.N.] Leslie Voltaire, he notes that Haiti will benefit from the revenues that are generated from each call."

Cruises and resorts suffer from the same moral difficulties as sweatshops. On one hand, the symbolism behind impoverished workers slaving to provide luxuries to Western consumers is repulsive, while on the other hand, those industries are vital to the economies of developing nations. Guardian columnist Gwyn Topham points out that Friday's visit was really just business as usual -- the only difference was scale.

"Tourism provides a microcosm of modern globalized inequality, with all the advantages or injustices it bestows on those on different sides of the divide," he wrote. "From the Caribbean to Southeast Asia, cheap labor and land allow holidaymakers to relax in style for less."

Some passengers are determined to make the best of their sunny day in hell. "I'll be there on Tuesday, and I plan on enjoying my zip line excursion as well as the time on the beach," one told The Guardian.

Royal Caribbean says it is providing "at least $1 million in humanitarian relief" to Haiti.

Disaster in HaitiGerald Herbert, AP30 photos A market area in Port-au-Prince looks otherworldly as people walk past burning debris Monday, six days after the magnitude 7.0 earthquake that devastated Haiti.

Sunday, January 10, 2010

"Winning" the trial, losing your home

Banks at risk in Minnesota from housing crisis

StarTribune.com

Banks at risk in Minnesota from housing crisis

Experts fear more bank failures in 2010 with the commercial real estate meltdown finally hitting home for many Minnesota banks.

By CHRIS SERRES, Star Tribune

Last update: January 10, 2010 - 7:30 AM

Warren Smith, chief financial officer of 1st American State Bank of Minnesota in Hancock, Minn., sounded exasperated as he rattled off a long list of loans for commercial real estate projects that threaten to sink his bank.

There was "Gold Mountain," a planned community of million-dollar homes just north of Phoenix that never got off the ground because it lacked a reliable water source; three condominium projects in and near Miami now in default; and a troubled condo and retail development, called "Founders Circle," in Apple Valley.

For tiny 1st American, a bank with about $18 million in assets four hours west of the Twin Cities, losses on these and about 20 other syndicated commercial real estate loans -- loans that are sliced up among multiple lenders -- have wiped out nearly all its capital. "We're trying everything imaginable to get out of these deals without taking a loss," Smith said. "But increasingly, that's just not possible."

Nearly two years after the economic crisis began, losses on commercial real estate remain the biggest threat to the financial health of Minnesota's community banks. Projects that were launched during the final years of the real estate boom are now hobbled with huge amounts of unoccupied space. Developers and deal makers that took out loans to buy or build these properties are no longer able to service their debt payments.

From unfinished housing projects in the far northern suburbs to emptying office parks in Edina, developers are walking away from their debts -- forcing banks to take large write-downs. Last week, for instance, a commercial broker began marketing 186 acres of raw land in Ramsey, intended for 600 houses, that was taken over by a Wisconsin bank. And later this month, a 200,000-square-foot portion of the Twin Cities' first suburban office park -- Pentagon Park in Edina -- will be sold at a foreclosure auction after its owners defaulted this summer on an $18.5 million mortgage.

Experts predict that rising losses on commercial real estate projects could topple up to a dozen of Minnesota's community banks this year, on top of the six banks that failed last year. The Minnesota Department of Commerce, which regulates banks and credit unions in Minnesota, estimates that its "watch list" of banks that are at greater risk of failure has reached 90 institutions, up from 50 a year ago and a mere 26 in June 2007.

"The banking industry, in general, has been waiting for commercial real estate to be the next shoe to drop," said Dennie Emmans, executive director of the Bank Holding Company Association, a trade association of about 250 bank holding companies in the Upper Midwest. "Well, now the shoe is dropping, and it's dropping pretty hard."

The delinquency rate on commercial real estate loans made by Minnesota banks has nearly doubled over the past two years. As of the third quarter, 6.3 percent of these loans were more than 30 days past due, up from 3.1 percent two years ago, according to Foresight Analytics, a California research firm.

Unlike the plunge in housing prices, which rippled through the financial sector immediately, the crisis in commercial real estate has taken longer to unfold. One reason, say experts, is that banks have built-in mechanisms in their lending agreements with developers that give them more flexibility in case of default. Many banks require borrowers to dip into reserve accounts when they fall behind on payments.

But if high vacancies persist for more than a year, as they have in the Twin Cities, the cash ultimately runs out. Landlords are often unable to afford both the debt payment and the cost of taxes, insurance and upkeep on vacant properties. Banks then have to order new appraisals, and add more to their reserves if the property has declined in value.

As a result of this long process, it can take a year or longer for a bad loan to actually appear as a loss on a bank's balance sheet, said Robert Viering, a bank consultant from Monticello. "Bankers, for the most part, are an optimistic bunch, and they're going to wait until they're absolutely certain that loan won't perform until they write it down," he said.

The woes in the commercial real estate sector are showing no signs of abating, and all sectors -- office, retail and industrial -- are struggling. Yet, bankers say they have been hit particularly hard by rising vacancy rates in strip centers. The retail vacancy rate for the metro area hit 10.1 percent last year -- the highest level since NorthMarq, a commercial real estate company based in Bloomington, began tracking the data more than a decade ago.

Many banks, fearing a surge in defaults, have taken a proactive approach, and have been scrubbing their loan portfolios of delinquent loans before the losses become more severe.

Dan Klein, chairman of KleinBank in Chaska, said his bank conducted a "top-to-bottom" review of its loan portfolio, reviewing every loan over a certain dollar amount. In some cases where a borrower may have been "underwater" -- that is, the property was worth less than the loan amount -- the bank set aside additional money to cover potential losses. The result was that KleinBank ended the year with a small loss, but the bank will be better insulated against future losses, Klein said.

As for Smith, the CFO at 1st American in Hancock, the struggle to recover money from failed commercial real estate projects has become a full-time job. Smith said he spends "100 percent" of his time trying to sort out loans that have gone bad, leaving him no time for developing new business.

"I've got so much going on that it's hard to keep track," he said. "It's just a matter of coming to work and hoping that I can get through it."

Chris Serres • 612-673-4308

Click on title above for original article

Banks at risk in Minnesota from housing crisis

Experts fear more bank failures in 2010 with the commercial real estate meltdown finally hitting home for many Minnesota banks.

By CHRIS SERRES, Star Tribune

Last update: January 10, 2010 - 7:30 AM

Warren Smith, chief financial officer of 1st American State Bank of Minnesota in Hancock, Minn., sounded exasperated as he rattled off a long list of loans for commercial real estate projects that threaten to sink his bank.

There was "Gold Mountain," a planned community of million-dollar homes just north of Phoenix that never got off the ground because it lacked a reliable water source; three condominium projects in and near Miami now in default; and a troubled condo and retail development, called "Founders Circle," in Apple Valley.

For tiny 1st American, a bank with about $18 million in assets four hours west of the Twin Cities, losses on these and about 20 other syndicated commercial real estate loans -- loans that are sliced up among multiple lenders -- have wiped out nearly all its capital. "We're trying everything imaginable to get out of these deals without taking a loss," Smith said. "But increasingly, that's just not possible."

Nearly two years after the economic crisis began, losses on commercial real estate remain the biggest threat to the financial health of Minnesota's community banks. Projects that were launched during the final years of the real estate boom are now hobbled with huge amounts of unoccupied space. Developers and deal makers that took out loans to buy or build these properties are no longer able to service their debt payments.

From unfinished housing projects in the far northern suburbs to emptying office parks in Edina, developers are walking away from their debts -- forcing banks to take large write-downs. Last week, for instance, a commercial broker began marketing 186 acres of raw land in Ramsey, intended for 600 houses, that was taken over by a Wisconsin bank. And later this month, a 200,000-square-foot portion of the Twin Cities' first suburban office park -- Pentagon Park in Edina -- will be sold at a foreclosure auction after its owners defaulted this summer on an $18.5 million mortgage.

Experts predict that rising losses on commercial real estate projects could topple up to a dozen of Minnesota's community banks this year, on top of the six banks that failed last year. The Minnesota Department of Commerce, which regulates banks and credit unions in Minnesota, estimates that its "watch list" of banks that are at greater risk of failure has reached 90 institutions, up from 50 a year ago and a mere 26 in June 2007.

"The banking industry, in general, has been waiting for commercial real estate to be the next shoe to drop," said Dennie Emmans, executive director of the Bank Holding Company Association, a trade association of about 250 bank holding companies in the Upper Midwest. "Well, now the shoe is dropping, and it's dropping pretty hard."

The delinquency rate on commercial real estate loans made by Minnesota banks has nearly doubled over the past two years. As of the third quarter, 6.3 percent of these loans were more than 30 days past due, up from 3.1 percent two years ago, according to Foresight Analytics, a California research firm.

Unlike the plunge in housing prices, which rippled through the financial sector immediately, the crisis in commercial real estate has taken longer to unfold. One reason, say experts, is that banks have built-in mechanisms in their lending agreements with developers that give them more flexibility in case of default. Many banks require borrowers to dip into reserve accounts when they fall behind on payments.

But if high vacancies persist for more than a year, as they have in the Twin Cities, the cash ultimately runs out. Landlords are often unable to afford both the debt payment and the cost of taxes, insurance and upkeep on vacant properties. Banks then have to order new appraisals, and add more to their reserves if the property has declined in value.

As a result of this long process, it can take a year or longer for a bad loan to actually appear as a loss on a bank's balance sheet, said Robert Viering, a bank consultant from Monticello. "Bankers, for the most part, are an optimistic bunch, and they're going to wait until they're absolutely certain that loan won't perform until they write it down," he said.

The woes in the commercial real estate sector are showing no signs of abating, and all sectors -- office, retail and industrial -- are struggling. Yet, bankers say they have been hit particularly hard by rising vacancy rates in strip centers. The retail vacancy rate for the metro area hit 10.1 percent last year -- the highest level since NorthMarq, a commercial real estate company based in Bloomington, began tracking the data more than a decade ago.

Many banks, fearing a surge in defaults, have taken a proactive approach, and have been scrubbing their loan portfolios of delinquent loans before the losses become more severe.

Dan Klein, chairman of KleinBank in Chaska, said his bank conducted a "top-to-bottom" review of its loan portfolio, reviewing every loan over a certain dollar amount. In some cases where a borrower may have been "underwater" -- that is, the property was worth less than the loan amount -- the bank set aside additional money to cover potential losses. The result was that KleinBank ended the year with a small loss, but the bank will be better insulated against future losses, Klein said.

As for Smith, the CFO at 1st American in Hancock, the struggle to recover money from failed commercial real estate projects has become a full-time job. Smith said he spends "100 percent" of his time trying to sort out loans that have gone bad, leaving him no time for developing new business.

"I've got so much going on that it's hard to keep track," he said. "It's just a matter of coming to work and hoping that I can get through it."

Chris Serres • 612-673-4308

Click on title above for original article

Thursday, January 7, 2010

U.S. T Notes Take a Dive in Sovereign Markets / WORST Preformer of All

Click on title and see report, and ya had better fasten yer seat belts. I think we are in for a very long, hard and bumpy ride - and sooner than we think. Best to stock up on canned goods and batteries and other survival stuff while you still can. I read somewhere that our USDA is going give our grocery overstock to 3rd world countries as (another) favor to BigAg. The idea is to create more of a demand for their products so the prices will go up. You can read more about that here;

http://exposingfdanusda.blogspot.com/2009/12/fw-win-lose-proposition-for-farmers-and.html

Click on title above to go to original "T Note Nose Dive" article;

http://www.openyoureyesnews.com/2010/01/08/u-s-treasuries-post-worst-performance-among-sovereign-markets/

http://exposingfdanusda.blogspot.com/2009/12/fw-win-lose-proposition-for-farmers-and.html

Click on title above to go to original "T Note Nose Dive" article;

http://www.openyoureyesnews.com/2010/01/08/u-s-treasuries-post-worst-performance-among-sovereign-markets/

Subscribe to:

Posts (Atom)