Wednesday, December 29, 2010

Monday, December 27, 2010

Friday, December 24, 2010

A Plea From and a Plug For Pro-Med

Keeping US Informed of Infectious Disease Outbreaks Throughout the World / Performing a Much Needed Service That Our Government Should Provide;

LIVE AS A BANKER

******************

A ProMED-mail post

ProMED-mail is a program of the

International Society for Infectious Diseases

Date: 20 Dec 2007

From: Stuart Handysides

Times are hard, I know. Jobs are less secure than they were. The

pension you've worked for looks a less certain prospect than it did.

Your trousers (pants/pantalon/hosen) keep falling down, not in a

farcical way, but because you need to make another hole in the belt

to hold them up.

And ProMED-mail is asking you for money.

Before you tell me to "Get real!" (do people still say that?),

consider this opportunity. Giving to causes like ProMED-mail places

you alongside other famous philanthropists -- Andrew Carnegie, John D

Rockefeller, Paul Getty, Bill and Melinda Gates people who have

nurtured valuable causes over the years. These people were not

bankers, you say (apologies to Mr and Mrs Gates, who still aren't

bankers). No, but they were philanthropists (apologies to the Gates,

who still are philanthropists), and no famous banker philanthropists

came to mind.

If any bankers read ProMED-mail, hello to you, you're not our obvious

target readership, but you are most welcome, especially if reading

and responding generously to this appeal. Many people disapprove of

your bonuses, but we will take the view that some of our best bankers

are friends if you choose to share them with us.

In appreciation I have a present for you. It's a little job I did

this morning. It took at least a minute -- ought to be worth USD 1000

or so. I am sure you are familiar with the verb "to google", meaning

to command the genie of the Internet in its Google persona to search

cyberspace. I googled "philanthropist AND banker" and found 178 000

entries. Now doesn't that give you bankers a warm glow inside, just

like hot chocolate with brandy on a snowy day, or too much chilli on

your barbie (for those of you in the southern hemisphere)? That's a

USD 5000 glow if ever I felt one.

So, gentle readers, if you want that philanthropic banker glow,

please send ProMED-mail some money. There are no limits -- it doesn't

have to be as much as USD 1000 or as little as USD 5000. Send what

you can afford, to reflect the value you feel ProMED-mail adds to

your life, your institution, the world. I believe we send our

generous donors mugs or something -- quite handy if things go

belly-up and you're reduced to singing "Brother can you spare a

dime". The passing public will know you gave to good causes in better

times and look kindly upon you.

Your gift is tax deductible in the United States [perhaps elsewhere,

too]. In addition, as a small token of our appreciation, each donor

of USD 250 will be entered into a prize draw to win a new iPad (a

gift of USD 500 gets 2 entries into the drawing, USD 1000 gets 4 entries, etc).

Donors of USD 100 receive a ProMED-mail water bottle, and donations

of USD 50 are eligible to receive an environmentally friendly ProMED

shopping bag.

Our goal this year is to raise USD 145 000 through the year-end

Internet-a-thon. Please go to the Internet-a-thon donation webpage

now and please give generously.

Yours, in grateful anticipation

Stuart Handysides

Associate Editor, ProMED-mail

Buntingford, England, United Kingdom

PS We welcome contributions to support our work from organisations

that benefit from the service we provide. To learn more about

institutional giving, contact Amy Galblum at.

PPS In the interest of human filiality I omitted to mention that

"banker AND jokes" yielded 818 000 results.

...................sh/lm/ejp/mpp

*##########################################################*

************************************************************

ProMED-mail makes every effort to verify the reports that

are posted, but the accuracy and completeness of the

information, and of any statements or opinions based

thereon, are not guaranteed. The reader assumes all risks in

using information posted or archived by ProMED-mail. ISID

and its associated service providers shall not be held

responsible for errors or omissions or held liable for any

damages incurred as a result of use or reliance upon posted

or archived material.

************************************************************

Donate to ProMED-mail. Details available at:

************************************************************

Visit ProMED-mail's web site at.

Send all items for posting to: promed@promedmail.org (NOT to

an individual moderator). If you do not give your full name

name and affiliation, it may not be posted. You may unsub-

scribe at.

For assistance from a human being, send mail to:

.

############################################################

############################################################

LIVE AS A BANKER

******************

A ProMED-mail post

ProMED-mail is a program of the

International Society for Infectious Diseases

Date: 20 Dec 2007

From: Stuart Handysides

Times are hard, I know. Jobs are less secure than they were. The

pension you've worked for looks a less certain prospect than it did.

Your trousers (pants/pantalon/hosen) keep falling down, not in a

farcical way, but because you need to make another hole in the belt

to hold them up.

And ProMED-mail is asking you for money.

Before you tell me to "Get real!" (do people still say that?),

consider this opportunity. Giving to causes like ProMED-mail places

you alongside other famous philanthropists -- Andrew Carnegie, John D

Rockefeller, Paul Getty, Bill and Melinda Gates people who have

nurtured valuable causes over the years. These people were not

bankers, you say (apologies to Mr and Mrs Gates, who still aren't

bankers). No, but they were philanthropists (apologies to the Gates,

who still are philanthropists), and no famous banker philanthropists

came to mind.

If any bankers read ProMED-mail, hello to you, you're not our obvious

target readership, but you are most welcome, especially if reading

and responding generously to this appeal. Many people disapprove of

your bonuses, but we will take the view that some of our best bankers

are friends if you choose to share them with us.

In appreciation I have a present for you. It's a little job I did

this morning. It took at least a minute -- ought to be worth USD 1000

or so. I am sure you are familiar with the verb "to google", meaning

to command the genie of the Internet in its Google persona to search

cyberspace. I googled "philanthropist AND banker" and found 178 000

entries. Now doesn't that give you bankers a warm glow inside, just

like hot chocolate with brandy on a snowy day, or too much chilli on

your barbie (for those of you in the southern hemisphere)? That's a

USD 5000 glow if ever I felt one.

So, gentle readers, if you want that philanthropic banker glow,

please send ProMED-mail some money. There are no limits -- it doesn't

have to be as much as USD 1000 or as little as USD 5000. Send what

you can afford, to reflect the value you feel ProMED-mail adds to

your life, your institution, the world. I believe we send our

generous donors mugs or something -- quite handy if things go

belly-up and you're reduced to singing "Brother can you spare a

dime". The passing public will know you gave to good causes in better

times and look kindly upon you.

Your gift is tax deductible in the United States [perhaps elsewhere,

too]. In addition, as a small token of our appreciation, each donor

of USD 250 will be entered into a prize draw to win a new iPad (a

gift of USD 500 gets 2 entries into the drawing, USD 1000 gets 4 entries, etc).

Donors of USD 100 receive a ProMED-mail water bottle, and donations

of USD 50 are eligible to receive an environmentally friendly ProMED

shopping bag.

Our goal this year is to raise USD 145 000 through the year-end

Internet-a-thon. Please go to the Internet-a-thon donation webpage

now and please give generously.

Yours, in grateful anticipation

Stuart Handysides

Associate Editor, ProMED-mail

Buntingford, England, United Kingdom

PS We welcome contributions to support our work from organisations

that benefit from the service we provide. To learn more about

institutional giving, contact Amy Galblum at

PPS In the interest of human filiality I omitted to mention that

"banker AND jokes" yielded 818 000 results.

...................sh/lm/ejp/mpp

*##########################################################*

************************************************************

ProMED-mail makes every effort to verify the reports that

are posted, but the accuracy and completeness of the

information, and of any statements or opinions based

thereon, are not guaranteed. The reader assumes all risks in

using information posted or archived by ProMED-mail. ISID

and its associated service providers shall not be held

responsible for errors or omissions or held liable for any

damages incurred as a result of use or reliance upon posted

or archived material.

************************************************************

Donate to ProMED-mail. Details available at:

************************************************************

Visit ProMED-mail's web site at

Send all items for posting to: promed@promedmail.org (NOT to

an individual moderator). If you do not give your full name

name and affiliation, it may not be posted. You may unsub-

scribe at

For assistance from a human being, send mail to:

############################################################

############################################################

Thursday, December 2, 2010

Wednesday, December 1, 2010

Saturday, November 27, 2010

Tuesday, November 23, 2010

If the President Wuz Honest

Here is what he would say to US;

My Fellow Americans,

In the past two months our government debt has suffered catastrophic losses in the global bond market. Whereas a few months ago interest rates for 2 year Treasury notes were around ½ of 1%, they are now 3%, and this type of drastic increase has occurred in every maturity of our debt. Our thirty year bonds had a yield of 4% at the start of this crisis, and now yield over 8%. As this has been happening, the US dollar has experienced a collapse in the foreign exchange markets.

Some people say this sell-off of our government debt was an attack planned and executed by China. We have no evidence of this, and all the evidence we do have tells us that the sell-off began spontaneously in several market centers and escalated as more and more investors sold their Treasuries rather than take further losses in their portfolio. Besides, the U.K., Germany, Japan and other major countries have had similar problems with their government debt.

If it were true that one country orchestrated a financial attack on the US – and it is not true – you would be entitled to ask “How did our country ever get into such a vulnerable financial position.” The fact is, for over fifty years the United States has turned to debt to finance its current needs, rather than raise taxes to pay for the things we wanted. This attitude to “just charge it” persisted no matter which party was in power in the White House or Congress. Our politicians kept making promises to you about your retirement, your health care, your security, your shelter, and the availability of food and energy, that we could not ultimately meet. There was no discipline to our borrowing and spending because the financial markets indulged us, and because everyone thought our children’s children would ultimately pay down this bill. No one thought that we would see in our own lifetime the financial markets suspend our credit line.

Nor is our debt problem restricted just to the federal government. Most of our state legislatures are grappling with budget deficits that can only be mended with steep cuts in services. Our high yield bond markets – trading what is known as junk debt for heavily-indebted companies – have seized up. We as politicians sat back quietly while the financial industry aggressively marketed debt to you and your family, and we find out now that the banks and mortgage companies often broke the law in the process. As a consequence of this irresponsible and illegal behavior, our major banks are now in receivership and creditors as well as large depositors have experienced billions of dollars of losses. Most importantly, the average American consumer is burdened with mortgage, credit card, student loan, automobile, and other debts, and increasing numbers of you cannot meet the interest or principal payments. Consumer defaults are skyrocketing as a consequence of this crisis.

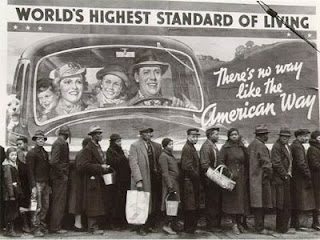

Mark this well – as a result of this crisis your standard of living is going to go down. There are major long term trends that are contributing to this decline in our living standards. Our population is aging and more people are heading into retirement hoping that the few who are working will support the many who are not. About one-third of the planet’s population in India and China are now aggressively working to achieve our lifestyle, and as they succeed in underpricing us in goods and services, we lose jobs and income. The essentials of modern life, such as energy and commodities to support our transportation and food needs, are becoming scarcer. But we made these problems much worse by ignoring them, by allowing our political system to be corrupted by huge donations from corporations and wealthy individuals, by refusing to vote because “it wouldn’t make any difference”, and by masking over the decline in our living standards by the analgesic of debt.

My friends, the era of pain avoidance is over. The era of pain management is upon us. It is now the role of government to manage this transition to a lower standard of living so that the pain is shared equably in our society. This means that government must concentrate first and foremost on the essentials – food, shelter, and fuel for our people. Very soon, nearly 50% of our population will be classified as poor by official standards, and they will necessarily receive priority attention from my administration. For those who are fortunate to have a job or the resources to support themselves for an extended period of time, we will attempt to fairly distribute the inevitable cuts in social services that are to follow.

Let me assure the financial markets that rumors about a default by the United States on its debt are completely unfounded. We will make every effort to continue to meet our financial obligations. It is true, though, that whereas at the start of this year one out of every ten dollars in taxes was used to pay interest on our debt, now – given the substantial increase in interest rates – that burden consumes four out of every ten dollars in tax receipts. This is why major cuts are now required in our national budget.

Because our priority must be on meeting the basic needs of our people, it is time to look seriously at scaling back our enormous military obligations overseas and the defense budget that takes up one-fourth of all of our spending. We will accelerate our departure from Iraq and Afghanistan. We will be looking at scaling back our defense footprint around the globe by closing hundreds of bases and cancelling many weapons systems that are not essential to national defense. There will be many job losses in the military and the defense industry as a result of these actions, and many Congressmen will fight to preserve their local defense component, but we cannot survive as a nation by maintaining anything like our existing defense establishment while half our people starve and are homeless, and the other half struggle to avoid their fate. We must recognize that the enormous scope and size of our defense establishment has in some ways secured our safety from overseas enemies, but at the cost of destroying our well-being domestically. Our new goal will be to secure our safety from overseas enemies with a smaller and more focused Department of Defense, and where possible we will continue to fund local police and fire departments, as well as the national guard and Homeland Security, to ensure domestic security.

Similarly, the time has come to recognize that there are only two segments of our society capable of providing additional tax revenues: wealthy individuals, and large corporations. Both of these groups have benefited enormously over the past 40 years from a shift of wealth and productive resources to them, at the expense of the middle and lower classes. We must and we will redress these imbalances. No doubt some of these people or corporations will threaten to leave the US. In some respects we don’t want them here if they are not willing to put up a fair share in support of our people and our economy, but we will make it difficult for them to take their money and run. Accordingly, we will continue to work with other governments overseas to standardize tax rates and reduce inducements for hot money to move from country to country.

All of these actions by your government are going to increase unemployment in the immediate term. This is unavoidable, but we are going to make every effort to ameliorate the problems of the unemployed. You can, as a result of these actions and what I am telling you today, choose to vote us out of office at the next election. That is your right, but I ask you first and foremost not to fall victim to the politicians who tell you there are easy or quick solutions to our problems. You should demand candor from all government officials at all levels of government, and a candid review of our problems will reveal that it will take years to fix them. We have lost a substantial part of our manufacturing and productive capabilities in this country by misguiding these activities overseas, and falling for the illusion that financial services was somehow a valued contributor to the economy.

To rebuild our productive economy – to create goods and services that people at home and abroad wish to buy – will take imagination, entrepreneurial spirit, market discipline that rewards investment in successful enterprises, and some government help along the way. This can and will be done, in the traditional spirit of America where hard work is valued and easy money rejected. Our parents, and their parents before them, lived simpler lives than we do, and we would consider them materially “poorer”, but they were not necessarily less happy. There are advantages to a simpler life – more time for your family and your personal development – and the goal of a reduced standard of living does not mean we must be less happy as a result. The transition to a simpler life, however, will be painful for many, and as I said, our job in government is to ensure that all of us will at least have food, shelter, and fuel during the years ahead.

Finally, none of this will matter in the long run without a major reform of our campaign finance system. We must get big money out of politics at the federal and state level. Please join me in urging your state legislature to vote in favor of a Constitutional amendment that limits campaign contributions to individuals who reside in the district or state of the candidate seeking funds, and which puts a $5,000 cap per individual. Campaign contributions from corporations, foundations, out of district individuals, foreigners, from special interest groups, or in the form of in-kind donations, must be forbidden by Constitutional amendment.

We are embarking on perilous times – a time of severe trial for all of us and for our country. The journey may take many years, but there is a brighter future at the end of our troubles. We can succeed if we help each other on this journey, and if your government directs resources to the most needy among us.

May God bless and keep America.

First posted at The Agonist

From "The People's Voice." For full article;

http://www.thepeoplesvoice.org/TPV3/Voices.php/2010/11/22/nopainnogain#more14840

My Fellow Americans,

In the past two months our government debt has suffered catastrophic losses in the global bond market. Whereas a few months ago interest rates for 2 year Treasury notes were around ½ of 1%, they are now 3%, and this type of drastic increase has occurred in every maturity of our debt. Our thirty year bonds had a yield of 4% at the start of this crisis, and now yield over 8%. As this has been happening, the US dollar has experienced a collapse in the foreign exchange markets.

Some people say this sell-off of our government debt was an attack planned and executed by China. We have no evidence of this, and all the evidence we do have tells us that the sell-off began spontaneously in several market centers and escalated as more and more investors sold their Treasuries rather than take further losses in their portfolio. Besides, the U.K., Germany, Japan and other major countries have had similar problems with their government debt.

If it were true that one country orchestrated a financial attack on the US – and it is not true – you would be entitled to ask “How did our country ever get into such a vulnerable financial position.” The fact is, for over fifty years the United States has turned to debt to finance its current needs, rather than raise taxes to pay for the things we wanted. This attitude to “just charge it” persisted no matter which party was in power in the White House or Congress. Our politicians kept making promises to you about your retirement, your health care, your security, your shelter, and the availability of food and energy, that we could not ultimately meet. There was no discipline to our borrowing and spending because the financial markets indulged us, and because everyone thought our children’s children would ultimately pay down this bill. No one thought that we would see in our own lifetime the financial markets suspend our credit line.

Nor is our debt problem restricted just to the federal government. Most of our state legislatures are grappling with budget deficits that can only be mended with steep cuts in services. Our high yield bond markets – trading what is known as junk debt for heavily-indebted companies – have seized up. We as politicians sat back quietly while the financial industry aggressively marketed debt to you and your family, and we find out now that the banks and mortgage companies often broke the law in the process. As a consequence of this irresponsible and illegal behavior, our major banks are now in receivership and creditors as well as large depositors have experienced billions of dollars of losses. Most importantly, the average American consumer is burdened with mortgage, credit card, student loan, automobile, and other debts, and increasing numbers of you cannot meet the interest or principal payments. Consumer defaults are skyrocketing as a consequence of this crisis.

Mark this well – as a result of this crisis your standard of living is going to go down. There are major long term trends that are contributing to this decline in our living standards. Our population is aging and more people are heading into retirement hoping that the few who are working will support the many who are not. About one-third of the planet’s population in India and China are now aggressively working to achieve our lifestyle, and as they succeed in underpricing us in goods and services, we lose jobs and income. The essentials of modern life, such as energy and commodities to support our transportation and food needs, are becoming scarcer. But we made these problems much worse by ignoring them, by allowing our political system to be corrupted by huge donations from corporations and wealthy individuals, by refusing to vote because “it wouldn’t make any difference”, and by masking over the decline in our living standards by the analgesic of debt.

My friends, the era of pain avoidance is over. The era of pain management is upon us. It is now the role of government to manage this transition to a lower standard of living so that the pain is shared equably in our society. This means that government must concentrate first and foremost on the essentials – food, shelter, and fuel for our people. Very soon, nearly 50% of our population will be classified as poor by official standards, and they will necessarily receive priority attention from my administration. For those who are fortunate to have a job or the resources to support themselves for an extended period of time, we will attempt to fairly distribute the inevitable cuts in social services that are to follow.

Let me assure the financial markets that rumors about a default by the United States on its debt are completely unfounded. We will make every effort to continue to meet our financial obligations. It is true, though, that whereas at the start of this year one out of every ten dollars in taxes was used to pay interest on our debt, now – given the substantial increase in interest rates – that burden consumes four out of every ten dollars in tax receipts. This is why major cuts are now required in our national budget.

Because our priority must be on meeting the basic needs of our people, it is time to look seriously at scaling back our enormous military obligations overseas and the defense budget that takes up one-fourth of all of our spending. We will accelerate our departure from Iraq and Afghanistan. We will be looking at scaling back our defense footprint around the globe by closing hundreds of bases and cancelling many weapons systems that are not essential to national defense. There will be many job losses in the military and the defense industry as a result of these actions, and many Congressmen will fight to preserve their local defense component, but we cannot survive as a nation by maintaining anything like our existing defense establishment while half our people starve and are homeless, and the other half struggle to avoid their fate. We must recognize that the enormous scope and size of our defense establishment has in some ways secured our safety from overseas enemies, but at the cost of destroying our well-being domestically. Our new goal will be to secure our safety from overseas enemies with a smaller and more focused Department of Defense, and where possible we will continue to fund local police and fire departments, as well as the national guard and Homeland Security, to ensure domestic security.

Similarly, the time has come to recognize that there are only two segments of our society capable of providing additional tax revenues: wealthy individuals, and large corporations. Both of these groups have benefited enormously over the past 40 years from a shift of wealth and productive resources to them, at the expense of the middle and lower classes. We must and we will redress these imbalances. No doubt some of these people or corporations will threaten to leave the US. In some respects we don’t want them here if they are not willing to put up a fair share in support of our people and our economy, but we will make it difficult for them to take their money and run. Accordingly, we will continue to work with other governments overseas to standardize tax rates and reduce inducements for hot money to move from country to country.

All of these actions by your government are going to increase unemployment in the immediate term. This is unavoidable, but we are going to make every effort to ameliorate the problems of the unemployed. You can, as a result of these actions and what I am telling you today, choose to vote us out of office at the next election. That is your right, but I ask you first and foremost not to fall victim to the politicians who tell you there are easy or quick solutions to our problems. You should demand candor from all government officials at all levels of government, and a candid review of our problems will reveal that it will take years to fix them. We have lost a substantial part of our manufacturing and productive capabilities in this country by misguiding these activities overseas, and falling for the illusion that financial services was somehow a valued contributor to the economy.

To rebuild our productive economy – to create goods and services that people at home and abroad wish to buy – will take imagination, entrepreneurial spirit, market discipline that rewards investment in successful enterprises, and some government help along the way. This can and will be done, in the traditional spirit of America where hard work is valued and easy money rejected. Our parents, and their parents before them, lived simpler lives than we do, and we would consider them materially “poorer”, but they were not necessarily less happy. There are advantages to a simpler life – more time for your family and your personal development – and the goal of a reduced standard of living does not mean we must be less happy as a result. The transition to a simpler life, however, will be painful for many, and as I said, our job in government is to ensure that all of us will at least have food, shelter, and fuel during the years ahead.

Finally, none of this will matter in the long run without a major reform of our campaign finance system. We must get big money out of politics at the federal and state level. Please join me in urging your state legislature to vote in favor of a Constitutional amendment that limits campaign contributions to individuals who reside in the district or state of the candidate seeking funds, and which puts a $5,000 cap per individual. Campaign contributions from corporations, foundations, out of district individuals, foreigners, from special interest groups, or in the form of in-kind donations, must be forbidden by Constitutional amendment.

We are embarking on perilous times – a time of severe trial for all of us and for our country. The journey may take many years, but there is a brighter future at the end of our troubles. We can succeed if we help each other on this journey, and if your government directs resources to the most needy among us.

May God bless and keep America.

First posted at The Agonist

From "The People's Voice." For full article;

http://www.thepeoplesvoice.org/TPV3/Voices.php/2010/11/22/nopainnogain#more14840

Friday, November 19, 2010

Tuesday, November 16, 2010

Under Attack, Feds Get Defensive about More Bonds

From the NY Times Today;

With the Federal Reserve under attack at home and abroad, it is making an unusual public bid to keep itself away from the political crossfire.

After a barrage of criticism over the last week — including from foreign leaders, Congressional officials, economists and Alan Greenspan, the former Fed chairman — the Fed came out to explain its efforts to inject $600 billion more into the sagging economy.

One worry of Fed watchers as well as its defenders is that some of the domestic criticism may have the subtext of challenging the Fed’s traditional independence in deciding monetary policy without political interference.

In a rare on-the-record interview, William C. Dudley, president of the Federal Reserve Bank of New York, said that the Fed’s move was not intended to affect the value of the dollar, but rather to encourage a faster, stronger recovery that will also assist international growth.

“We have no goal in terms of pushing the dollar up or down,” Mr. Dudley said. “Our goal is to ease financial conditions and to stimulate a stronger economic expansion and more rapid employment growth.”

And in an interview with The Wall Street Journal, the Fed’s new vice chairwoman, Janet L. Yellen, defended the decision in broadly similar terms. “I’m having a hard time seeing where really robust growth can come from,” she said. “And I see inflation lingering around current levels for a long time.” Ms. Yellen said she was “not happy to see us caught up in a political debate."

The comments by Mr. Dudley, who is also the vice chairman of the Federal Open Market Committee, which sets monetary policy, and by Ms. Yellen amounted to an unusual rebuttal, the first by top Fed officials, of criticism of its decision this month to pump money into the banking system. The plan is to spur the recovery by buying government securities to lower long-term interest rates.

Kenneth A. Froot, who teaches international finance at Harvard Business School, said, “The Fed needs to get the word out more clearly” because of the politically volatile times. Mr. Froot added, “This is a very rare circumstance where the basic authority we vest in institutions like the Fed has, more than ever, been challenged,” by politicians and economists who are often identified with political parties.

The bond markets have been increasingly uneasy about the Fed’s actions. On Monday, bond prices fell and yields jumped as a result of the concerns.

The criticism has tended to fall along three lines. Some have accused the Fed of deliberately weakening the dollar to make American exports more competitive. Others fear the Fed’s decision could ignite inflation down the road. Still others say the policy will be ineffective absent additional fiscal stimulus.

Fed officials were clearly unsettled by an opinion piece by Mr. Greenspan in The Financial Times on Thursday, at the start of meetings of the Group of 20 nations in Seoul, South Korea. Mr. Greenspan said the United States was “pursuing a policy of currency weakening” and increasing the risks of trade protectionism.

In an open letter to Ben S. Bernanke, the Fed chairman, on Monday, a group of conservative economists, writers and investors urged that the Fed’s action “be reconsidered and discontinued,” arguing that the bond purchases “risk currency debasement and inflation.” The group included Michael J. Boskin, a former chairman of the White House Council of Economic Advisers; the historian Niall Ferguson; Douglas Holtz-Eakin, a former director of the Congressional Budget Office; and the economist John B. Taylor, one of Mr. Bernanke’s most prominent critics.

Mr. Dudley did not single out any critic, but suggested that the criticisms were unfounded.

“There is no long-term conflict between what the U.S. is trying to accomplish and what other countries are trying to accomplish,” Mr. Dudley said, echoing statements by President Obama and Treasury Secretary Timothy F. Geithner. “A strong economic recovery in the U.S. is in the interests of the global economy.”

While Mr. Dudley said the effect on the dollar was not a consideration, he acknowledged that when interest rates adjust, “oftentimes there will be consequences for the dollar.” He added, “We have seen some dollar weakness in this period, but it doesn’t seem to be unusual, given the changes that we’ve seen in interest rates in the U.S. compared to interest rates abroad.”

Mr. Dudley rejected the idea that the Fed might be setting the stage for uncontrollable inflation in years to come. He said the Fed had tools for draining the bank reserves sitting on its balance sheet.

“We are very, very confident that those tools will be completely effective at keeping inflation in check,” he said. “We are completely willing to use those tools, when the time comes, to prevent an inflation problem. Higher inflation is not a way out. It is not a solution.”

Mr. Dudley argued that the Fed’s efforts had their intended effect. Since August, when the Fed first hinted that it might take further steps to spur the recovery, stock prices have risen and long-term interest rates have fallen. That makes it easier for consumers to buy homes or refinance mortgages, and for businesses to borrow and invest.

“You’ve seen a significant easing of financial conditions over that time period,” he said. “I have to believe that the expectation of a second large-scale asset purchase program was the primary driver of those changes.”

Even so, Mr. Dudley cautioned, “One shouldn’t view this instrument as a panacea or a magic wand that’s going to make the economy recover rapidly.” He said the Fed’s action, known as quantitative easing, was “not going to be extremely powerful” but was nonetheless necessary to reduce the risk, however slim, of a double-dip recession.

“It’s going to be a long and bumpy road to a strong and vigorous expansion, but this will be helpful rather than hurtful,” he said.

Uncertainty about fiscal policy — whether the Bush-era tax cuts will be extended, and in the long term, how the nation will rein in its record deficits — has complicated the recovery, Mr. Dudley said.

Asked whether fiscal gridlock had forced the Fed to act, he said, “We’re going to worry about what we can worry about, which is monetary policy.” The Fed, he said, has to “take the world as it is.”

Mr. Dudley, who joined the New York Fed in 2007 from Goldman Sachs, where he was the chief United States economist, also provided details about how the Fed’s outlook had evolved.

“We were going into the year expecting the economy to pick up steam,” Mr. Dudley said. In the spring, “We were starting to see the glimmers” of a healthy recovery in private-sector employment, he said. But by the summer, growth began to stall; it is now estimated at an annualized rate of 2 percent. Inflation, already low, fell further.

The economy was “vulnerable to a shock that could tip us into deflation,” he said.

In recent speeches, Mr. Dudley and Charles L. Evans, president of the Chicago Fed, mentioned the possibility of allowing inflation to run higher in the future to make up for inflation’s being too low today, an approach known as price-level targeting. But in the interview, Mr. Dudley emphasized that he had not endorsed that approach.

“The problem with a price-level target is that it’s difficult to explain what you’re doing in a way that doesn’t create larger anxiety about the long-term inflation target,” he said. “We clearly want people to understand that we are committed to price stability over the long run.”

Mr. Dudley declined to discuss the deliberations of the committee, but acknowledged that the decision was not easy.

“Reasonable people can disagree about how big the costs are versus how big the benefits are,” he said. “It’s completely reasonable to expect that not everyone is going to see it exactly the same way, because these policies have not been used much on a historical basis.”

http://www.nytimes.com/2010/11/16/business/economy/16fed.html?_r=1&src=twt&twt=nytimes

Labels:

Banking,

Economics,

Federal Reserve,

U.S. Treasury

Monday, November 15, 2010

Argentinas Debt

I think US economists got alot of nerve talking about other countries not paying their bills....lol. What about US?

http://www.youtube.com/watch?v=wPL9LG9w87A&list=PL58F91A02FF7860F5&index=2&playnext=1

How about a blanket-debt forgiveness for everyone? How do you think the Bank$ter$ and Wall St Investors would like that> ? ROFLAO

http://www.youtube.com/watch?v=wPL9LG9w87A&list=PL58F91A02FF7860F5&index=2&playnext=1

How about a blanket-debt forgiveness for everyone? How do you think the Bank$ter$ and Wall St Investors would like that> ? ROFLAO

Thursday, November 11, 2010

Big-Banks Create a Kizillion New Jobs....

and create Entire New Profession: Robo-Signers exactly like this one that got caught up in the net and is being grilled on the hot seat in this wonderful lawyers deposition vid;

Hooray

Forrest Law Firm!

http://www.youtube.com/user/TheForrestLawFirm#p/a/u/1/tflJhn0cly4

and these are the kinds of "professionals" they created; http://news.yahoo.com/s/ap/20101013/ap_on_bi_ge/us_foreclosure_robosigners

Hooray

Forrest Law Firm!

http://www.youtube.com/user/TheForrestLawFirm#p/a/u/1/tflJhn0cly4

and these are the kinds of "professionals" they created; http://news.yahoo.com/s/ap/20101013/ap_on_bi_ge/us_foreclosure_robosigners

Wednesday, November 10, 2010

Friday, November 5, 2010

Thursday, October 28, 2010

Overdose: The Next Financial Crisis

Bombs & Bubbles Bursting All Over the World - Thank you Rating Sellers & Brokers of Securities & Big Bank$ & Bank$ters in Bed With Them.

Click on link below to see an interesting vid.

http://www.youtube.com/watch?v=4ECi6WJpbzE&feature=player_embedded

In the words of one of the worlds Largest Capitalist Pigs,.....

Monday, October 25, 2010

Tuesday, October 19, 2010

Friday, October 15, 2010

Is Not Nice to Steal, Especially from Family

You hear that Robert Jubic, Defendant in Jubic v. Jubic el. al; http://www.cnn.com/2010/SHOWBIZ/celebrity.news.gossip/10/14/dane.cook.brother.jailed.ppl/index.html

Thursday, October 7, 2010

S&E Charges Internationally Syndicated Radio Host Wth Fraud

Defrauding investors on mortgage securities; http://www.sec.gov/news/press/2010/2010-186.htm

Tuesday, October 5, 2010

Thursday, September 16, 2010

Sunday, September 12, 2010

Message to the 1% -

A message to the Super Rich and the Multi-National CEOs frum the World Wide Digital Protest; http://www.youtube.com/user/eelli2945#p/u/6/mACx0-a3KyI

Saturday, September 4, 2010

Thursday, August 26, 2010

Monday, August 23, 2010

Monday, August 16, 2010

Thursday, August 12, 2010

Thursday, July 29, 2010

If Ye Love Wealth......

"If ye love wealth better than liberty, the tranquility of servitude better than the animating contest of freedom, go home from us in peace. We ask not your counsels or arms. Crouch down and lick the hands, which feed you. May your chains set lightly upon you, and may posterity forget that ye were our countrymen."

- Samuel Adams, speech at the Philadelphia

State House, August 1, 1776

- Samuel Adams, speech at the Philadelphia

State House, August 1, 1776

Thursday, July 15, 2010

Sunday, June 27, 2010

Tuesday, June 22, 2010

Friday, June 11, 2010

Fed. Scientists Request More Info From BP & Are Ignored

I just saw a piece on CNN Wolf Blitzers "Situation Room," where one of the scientists appointed by the federal govt to make an independant accessment of the true rate of flow of BPs undersea gusher was on, and he said that the figures they arrived at (as indicated in the article in the link below) were basically based on wide ranging approximations because their request to BP for more information has gone unheeded and he says, lacking that information, they can only guess at what the actual flow rate may be. Why wont BP release the relevant info to the federal scientists so they can do their job and tell US what the real rate of flow is? What could they possibly have to hide?

The Leak: Approximate Rates; http://latimesblogs.latimes.com/greenspace/

The Federal Scientists & BPs With-holding of Information;

http://www.cbsnews.com/stories/2010/06/09/eveningnews/main6565944.shtml

The Leak: Approximate Rates; http://latimesblogs.latimes.com/greenspace/

The Federal Scientists & BPs With-holding of Information;

http://www.cbsnews.com/stories/2010/06/09/eveningnews/main6565944.shtml

Taxpayers to Foot Part of Bill for BP Oil-Spill Clean-Up?

How is this for outrageous? Republican Leader John Boehner actually suggested that American taxpayers should be hit with the bill to help clean up Big Oil giant BP's spill in the Gulf of Mexico. And it gets worse...

In making this outrageous suggestion, Boehner was agreeing with one of the Republicans' biggest shadow groups - a group that has pledged to spend more than $50 million this cycle attacking Democrats and trying to elect other Big Oil protecting Republicans to Congress. But it gets even worse than that...

Boehner's suggestion of a taxpayer-funded bailout for Big Oil giant BP came after he and other Republicans accepted more than $188 million combined in campaign contributions from the oil and gas industry. This calls for an immediate response from Grassroots Democrats.

Visit our newly-launched website, BoehnerBPBailout.com to sign our petition denouncing John Boehner's Taxpayer Funded Bailout for Big Oil giant BP; http://boehnerbpbailout.com/

In making this outrageous suggestion, Boehner was agreeing with one of the Republicans' biggest shadow groups - a group that has pledged to spend more than $50 million this cycle attacking Democrats and trying to elect other Big Oil protecting Republicans to Congress. But it gets even worse than that...

Boehner's suggestion of a taxpayer-funded bailout for Big Oil giant BP came after he and other Republicans accepted more than $188 million combined in campaign contributions from the oil and gas industry. This calls for an immediate response from Grassroots Democrats.

Visit our newly-launched website, BoehnerBPBailout.com to sign our petition denouncing John Boehner's Taxpayer Funded Bailout for Big Oil giant BP; http://boehnerbpbailout.com/

- then help spread the word on Facebook and Twitter.

A clairification, of sorts; http://thecaucus.blogs.nytimes.com/2010/06/10/boehner-on-who-must-pay-what-for-spill/

A clairification, of sorts; http://thecaucus.blogs.nytimes.com/2010/06/10/boehner-on-who-must-pay-what-for-spill/

Thursday, June 10, 2010

Anger Mounts as BP Too Slow to Pay Claims

The reefs that David Walter makes for anglers to drop into the Gulf of Mexico are fake, but his frustration as he tries to win compensation from BP for lost income is real.

State regulators stopped issuing permits for the reefs on May 4 because of the oil spill, effectively killing off $350,000 in Walter's expected business. It sent him into a labyrinth of archived invoices and documents lost by BP. Finally, an offer came: $5,000.

"I said that's not fair because if you say that, then I have to go out of business and I lose everything," said Walter, whose company is based in Alabama.

Special Section: Disaster in the Gulf

Fishermen, property owners and businesspeople who have filed damage claims with BP are angrily complaining of delays, excessive paperwork and skimpy payments that have put them on the verge of going under as the financial and environmental toll of the seven-week-old disaster grows.

Out in the Gulf, meanwhile, the oil company on Wednesday captured more of the crude that's been gushing from the bottom of the sea since April and began bringing in more heavy equipment to handle it.

The containment effort played out as BP stock continued to plunge amid fears that the company might be forced to suspend dividends and find itself overwhelmed by the cleanup costs, penalties, damage claims and lawsuits generated by the biggest oil spill in U.S. history.

State regulators stopped issuing permits for the reefs on May 4 because of the oil spill, effectively killing off $350,000 in Walter's expected business. It sent him into a labyrinth of archived invoices and documents lost by BP. Finally, an offer came: $5,000.

"I said that's not fair because if you say that, then I have to go out of business and I lose everything," said Walter, whose company is based in Alabama.

Special Section: Disaster in the Gulf

Fishermen, property owners and businesspeople who have filed damage claims with BP are angrily complaining of delays, excessive paperwork and skimpy payments that have put them on the verge of going under as the financial and environmental toll of the seven-week-old disaster grows.

Out in the Gulf, meanwhile, the oil company on Wednesday captured more of the crude that's been gushing from the bottom of the sea since April and began bringing in more heavy equipment to handle it.

The containment effort played out as BP stock continued to plunge amid fears that the company might be forced to suspend dividends and find itself overwhelmed by the cleanup costs, penalties, damage claims and lawsuits generated by the biggest oil spill in U.S. history.

An Austrian Perspective on the History of Economic Thought,

Murray N. Rothbard Volume I: Economic Thought Before Adam Smith

The appearance of the famous (and massive) volumes of Rothbard's History of Economic Thought in a new edition is cause for great celebration. They have been out of print for many years, and were previously only available at a price exceeding $200 for the set. They are at last accessible again, in beautiful hardcover, and at an affordable price.

In Economic Thought Before Adam Smith, Murray Rothbard traces economic ideas from ancient sources to show that laissez-faire liberalism and economic thought itself began with the scholastics and early Roman, Greek, and canon law. He celebrates Aristotle and Democritus, for example, but loathes Plato and Diogenes. He is kind toward Taoism and Stoicism. He is no fan of Tertullian but very much likes St. Jerome, who defended the merchant class. Now, that takes us only to page 33, just the beginning of a wild ride through the middle ages and renaissance and modern times through 1870.

Classical Economics offers new perspectives on both Ricardo and Say and their followers. The author suggests that Ricardianism declined after 1820 and was only revived with the work of John Stuart Mill. The book also resurrects the important Anglo-Irish school of thought at Trinity College, Dublin under Archbishop Richard Whatley. Later chapters focus on the roots of Karl Marx and the nature of his doctrines, and laissez-faire thought in France including the work of Frederic Bastiat. Also included is a comprehensive treatment of the bullionist versus the anti-bullionist and the currency versus banking school controversies in the first half of the nineteenth century, and their influence outside Great Britain.

These are indeed the books that Mises himself longed to see: "A real history of economic thought," he said in 1955, "would have to point out the development of the doctrines and not merely list every book."

When these volumes first appeared, they were celebrated in Barron's and by top scholars around the world. They succeeded in changing the way people think about economic doctrine: the beginnings (not Adam Smith, but the Spanish theologians), the dead ends (Marx), the great triumphs (Bastiat, for example), and the truly great minds (Turgot and many others he rescued from near obscurity).

Rothbard read deeply in thinkers dating back hundreds and thousands of years, and spotted every promising line of thought — and every unfortunate one. He knew when an idea would lead to prosperity, and when it would lead to calamity. He could spot a proto-Keynesian or proto-Marxist idea in the middle ages, just as he could find free-market lines of thought in ancient manuscripts.

Many scholars believe this was his most important work. The irony is that it is not the work it was supposed to be, and thank goodness. He was asked to do a short overview of the modern era. He ended up writing more than 1,000 pages of original ideas that remade the whole of intellectual history up through the late 19th century.

Once Rothbard got into the project, he found that most all historians have made the same error: they have believed that the history of thought was a long history of progress. He found that sound ideas ebb and flow in history. So he set out to rescue the great ideas from the past and compare them with the bad ideas of the "new economics."

His demolition of Karl Marx is more complete and in depth than any other ever published. His reconstruction of 19th-century banking debates has provided enough new ideas for a dozen dissertations, and contemporary real-money reform. His surprising evisceration of John Stuart Mill is cause to rethink the whole history of classical liberalism.

Most famously, Rothbard demonstrated that Adam Smith's economic theories were, in many ways, a comedown from his predecessors in France and Spain. For example, Smith puzzled over the source of value and finally tagged labor as the source (a mistake Marx built on). But for centuries prior, the earliest economists knew that value came from within the human mind. It was a human estimation, not an objective construct.

The unfinished 3rd volume in audio

Rothbard was a pioneer in incorporating the sociology of religion into the history of economic ideas. He saw that the advent of Christianity had a huge impact on the theory of the state. He observed the rise of absolutism and theory of nationalism that came with the reformation. He traced the changes in the Western view toward lending and interest payments over the course of a thousand years.

The number of insights in these volumes are countless. Every page, every paragraph, bursts with intellectual energy and the author's fiery passion to tell the reader the remarkable story of economics. Many reviewers have remarked that Rothbard's accomplishment seems super-human. He seems to have read everything. His originality is overwhelming. His passion for liberty and integrity in science is evident. His disdain toward those who sell out to the state is manifest as well.

Rothbard worked on these volumes in the ten years before his death. He also gave a series of lectures on his ongoing research. As a result, we all had very high expectations. But nothing could have prepared us for what eventually appeared.

This set is a monument to Rothbard's genius, a resource that will be valuable to intellectuals for generations, and a great read too!

Read entire article in PDF File;

The appearance of the famous (and massive) volumes of Rothbard's History of Economic Thought in a new edition is cause for great celebration. They have been out of print for many years, and were previously only available at a price exceeding $200 for the set. They are at last accessible again, in beautiful hardcover, and at an affordable price.

In Economic Thought Before Adam Smith, Murray Rothbard traces economic ideas from ancient sources to show that laissez-faire liberalism and economic thought itself began with the scholastics and early Roman, Greek, and canon law. He celebrates Aristotle and Democritus, for example, but loathes Plato and Diogenes. He is kind toward Taoism and Stoicism. He is no fan of Tertullian but very much likes St. Jerome, who defended the merchant class. Now, that takes us only to page 33, just the beginning of a wild ride through the middle ages and renaissance and modern times through 1870.

Classical Economics offers new perspectives on both Ricardo and Say and their followers. The author suggests that Ricardianism declined after 1820 and was only revived with the work of John Stuart Mill. The book also resurrects the important Anglo-Irish school of thought at Trinity College, Dublin under Archbishop Richard Whatley. Later chapters focus on the roots of Karl Marx and the nature of his doctrines, and laissez-faire thought in France including the work of Frederic Bastiat. Also included is a comprehensive treatment of the bullionist versus the anti-bullionist and the currency versus banking school controversies in the first half of the nineteenth century, and their influence outside Great Britain.

These are indeed the books that Mises himself longed to see: "A real history of economic thought," he said in 1955, "would have to point out the development of the doctrines and not merely list every book."

When these volumes first appeared, they were celebrated in Barron's and by top scholars around the world. They succeeded in changing the way people think about economic doctrine: the beginnings (not Adam Smith, but the Spanish theologians), the dead ends (Marx), the great triumphs (Bastiat, for example), and the truly great minds (Turgot and many others he rescued from near obscurity).

Rothbard read deeply in thinkers dating back hundreds and thousands of years, and spotted every promising line of thought — and every unfortunate one. He knew when an idea would lead to prosperity, and when it would lead to calamity. He could spot a proto-Keynesian or proto-Marxist idea in the middle ages, just as he could find free-market lines of thought in ancient manuscripts.

Many scholars believe this was his most important work. The irony is that it is not the work it was supposed to be, and thank goodness. He was asked to do a short overview of the modern era. He ended up writing more than 1,000 pages of original ideas that remade the whole of intellectual history up through the late 19th century.

Once Rothbard got into the project, he found that most all historians have made the same error: they have believed that the history of thought was a long history of progress. He found that sound ideas ebb and flow in history. So he set out to rescue the great ideas from the past and compare them with the bad ideas of the "new economics."

His demolition of Karl Marx is more complete and in depth than any other ever published. His reconstruction of 19th-century banking debates has provided enough new ideas for a dozen dissertations, and contemporary real-money reform. His surprising evisceration of John Stuart Mill is cause to rethink the whole history of classical liberalism.

Most famously, Rothbard demonstrated that Adam Smith's economic theories were, in many ways, a comedown from his predecessors in France and Spain. For example, Smith puzzled over the source of value and finally tagged labor as the source (a mistake Marx built on). But for centuries prior, the earliest economists knew that value came from within the human mind. It was a human estimation, not an objective construct.

The unfinished 3rd volume in audio

Rothbard was a pioneer in incorporating the sociology of religion into the history of economic ideas. He saw that the advent of Christianity had a huge impact on the theory of the state. He observed the rise of absolutism and theory of nationalism that came with the reformation. He traced the changes in the Western view toward lending and interest payments over the course of a thousand years.

The number of insights in these volumes are countless. Every page, every paragraph, bursts with intellectual energy and the author's fiery passion to tell the reader the remarkable story of economics. Many reviewers have remarked that Rothbard's accomplishment seems super-human. He seems to have read everything. His originality is overwhelming. His passion for liberty and integrity in science is evident. His disdain toward those who sell out to the state is manifest as well.

Rothbard worked on these volumes in the ten years before his death. He also gave a series of lectures on his ongoing research. As a result, we all had very high expectations. But nothing could have prepared us for what eventually appeared.

This set is a monument to Rothbard's genius, a resource that will be valuable to intellectuals for generations, and a great read too!

Read entire article in PDF File;

Monday, June 7, 2010

A Warning From Noam Chomsky on the Threat of Elites

Jun 7, 2010

By Fred Branfman

It was not by making yourself heard but by staying sane that you carried on the human heritage. ... [Doublethink is] to hold simultaneously two opinions which cancelled out, knowing them to be contradictory and believing in both, to repudiate morality while laying claim to it. ... [Continuous] war involves very small numbers of people, mostly highly trained specialists. … The fighting … takes place on the vague frontiers whose whereabouts the average man can only guess at. …

—George Orwell, “1984”

[The treatment of the] hapless race of native Americans, which we are exterminating with such merciless and perfidious cruelty, [is] among the heinous sins of this nation, for which I believe God will one day bring [it] to judgment.

—John Quincy Adams, cited in Noam Chomsky’s new book, “Hopes and Prospects”

Noam Chomsky’s description of the dangers posed by U.S. elites’ “Imperial Mentality” was recently given a boost in credibility by a surprising source—Bill Clinton. As America’s economy, foreign policy and politics continue to unravel, it is clear that this mentality and the system it has created will produce an increasing number of victims in the years to come. Clinton startlingly testified to that effect on March 10 to the Senate Foreign Relations Committee:

Since 1981 the United States has followed a policy until the last year or so, when we started rethinking it, that we rich countries that produce a lot of food should sell it to poor countries and relieve them of the burden of producing their own food so thank goodness they can lead directly into the industrial era. It has not worked. It may have been good for some of my farmers in Arkansas, but it has not worked. It was a mistake. It was a mistake that I was a party to. I am not pointing the finger at anybody. I did that. I have to live every day with the consequences of the lost capacity to produce a rice crop in Haiti to feed those people, because of what I did, nobody else.

Advertisement

Clinton is to be praised for being the first U.S. president to take personal responsibility for impoverishing an entire nation rather than ignoring his misdeeds or falsely blaming local U.S.-imposed regimes. But his confession also means that his embrace of the International Monetary Fund, the World Bank, the World Trade Organization and NAFTA “neo-liberalization” destroyed the lives of many more millions well beyond Haiti, as U.S. support for heavily subsidized U.S. agribusiness damaged local agricultural economies throughout Latin America and beyond. This led to mass migration into urban slums and destitution, as well as increased emigration to the U.S.—which then led Clinton to militarize the border in 1994—and thus accelerated the “illegal immigration” issue that so poisons U.S. politics today.

Clinton might also have added that he and other U.S. leaders imposed such policies by force, installing military dictators and vicious police and paramilitary forces. Chomsky reports in “Hopes and Prospects” that in Haiti, semiofficial thugs empowered by a U.S.-supported coup murdered 8,000 people and raped 35,000 women in 2004 and 2005 alone, while a tiny local elite reaps most of the benefits from U.S. policies.

Clinton’s testimony reminded me of one of my visits with Chomsky, back in 1988, when, after talking for an hour or so, he smiled and said he had to stop to get back to writing about the children of Haiti.

I was struck both by his concern for forgotten Haitians and because his comment so recalled my experience with him in 1970 as he spent a week researching U.S. war-making in Laos. I had taken dozens of journalists, peace activists, diplomats, experts and others out to camps of refugees who had fled U.S. saturation bombing. Chomsky was one of only two who wept openly upon learning how these innocent villagers had seen their beloved grandmothers burned alive, their children slowly suffocated, their spouses cut to ribbons, during five years of merciless, pitiless and illegal U.S. bombing for which U.S. leaders would have been executed had international law protecting civilians in wartime been applied to their actions. It was obvious that he was above all driven by a deep feeling for the world’s victims, those he calls the “unpeople” in his new book. No U.S. policymakers I knew in Laos, nor the many I have met since, have shared such concerns.

Bill Clinton’s testimony also reminded me of the accuracy of Chomsky writings on Haiti—before, during and after Clinton’s reign—as summed up in “Hopes and Prospects”:

The Clinton doctrine, presented to Congress, was that the US is entitled to resort to “unilateral use of military power” to ensure “uninhibited access to key markets, energy supplies and strategic resources.” In Haiti, Clinton [imposed] harsh neoliberal rules that were guaranteed to crush what remained of the economy, as they did.

Clinton would have a cleaner conscience today had he listened to Chomsky then. Many more Americans may also benefit by heeding Chomsky today, as U.S. elites’ callousness toward unpeople abroad is now affecting increasing numbers of their fellow citizens back home. Nothing symbolizes this more than investment bankers tricking countless Americans out of their life savings by luring them into buying homes they could not afford that were then foreclosed on.

http://www.truthdig.com/report/item/a_warning_from_noam_chomsky_on_the_threat_of_elites_20100607/

Jun 7, 2010

By Fred Branfman

It was not by making yourself heard but by staying sane that you carried on the human heritage. ... [Doublethink is] to hold simultaneously two opinions which cancelled out, knowing them to be contradictory and believing in both, to repudiate morality while laying claim to it. ... [Continuous] war involves very small numbers of people, mostly highly trained specialists. … The fighting … takes place on the vague frontiers whose whereabouts the average man can only guess at. …

—George Orwell, “1984”

[The treatment of the] hapless race of native Americans, which we are exterminating with such merciless and perfidious cruelty, [is] among the heinous sins of this nation, for which I believe God will one day bring [it] to judgment.

—John Quincy Adams, cited in Noam Chomsky’s new book, “Hopes and Prospects”

Noam Chomsky’s description of the dangers posed by U.S. elites’ “Imperial Mentality” was recently given a boost in credibility by a surprising source—Bill Clinton. As America’s economy, foreign policy and politics continue to unravel, it is clear that this mentality and the system it has created will produce an increasing number of victims in the years to come. Clinton startlingly testified to that effect on March 10 to the Senate Foreign Relations Committee:

Since 1981 the United States has followed a policy until the last year or so, when we started rethinking it, that we rich countries that produce a lot of food should sell it to poor countries and relieve them of the burden of producing their own food so thank goodness they can lead directly into the industrial era. It has not worked. It may have been good for some of my farmers in Arkansas, but it has not worked. It was a mistake. It was a mistake that I was a party to. I am not pointing the finger at anybody. I did that. I have to live every day with the consequences of the lost capacity to produce a rice crop in Haiti to feed those people, because of what I did, nobody else.

Advertisement

Clinton is to be praised for being the first U.S. president to take personal responsibility for impoverishing an entire nation rather than ignoring his misdeeds or falsely blaming local U.S.-imposed regimes. But his confession also means that his embrace of the International Monetary Fund, the World Bank, the World Trade Organization and NAFTA “neo-liberalization” destroyed the lives of many more millions well beyond Haiti, as U.S. support for heavily subsidized U.S. agribusiness damaged local agricultural economies throughout Latin America and beyond. This led to mass migration into urban slums and destitution, as well as increased emigration to the U.S.—which then led Clinton to militarize the border in 1994—and thus accelerated the “illegal immigration” issue that so poisons U.S. politics today.

Clinton might also have added that he and other U.S. leaders imposed such policies by force, installing military dictators and vicious police and paramilitary forces. Chomsky reports in “Hopes and Prospects” that in Haiti, semiofficial thugs empowered by a U.S.-supported coup murdered 8,000 people and raped 35,000 women in 2004 and 2005 alone, while a tiny local elite reaps most of the benefits from U.S. policies.

Clinton’s testimony reminded me of one of my visits with Chomsky, back in 1988, when, after talking for an hour or so, he smiled and said he had to stop to get back to writing about the children of Haiti.

I was struck both by his concern for forgotten Haitians and because his comment so recalled my experience with him in 1970 as he spent a week researching U.S. war-making in Laos. I had taken dozens of journalists, peace activists, diplomats, experts and others out to camps of refugees who had fled U.S. saturation bombing. Chomsky was one of only two who wept openly upon learning how these innocent villagers had seen their beloved grandmothers burned alive, their children slowly suffocated, their spouses cut to ribbons, during five years of merciless, pitiless and illegal U.S. bombing for which U.S. leaders would have been executed had international law protecting civilians in wartime been applied to their actions. It was obvious that he was above all driven by a deep feeling for the world’s victims, those he calls the “unpeople” in his new book. No U.S. policymakers I knew in Laos, nor the many I have met since, have shared such concerns.

Bill Clinton’s testimony also reminded me of the accuracy of Chomsky writings on Haiti—before, during and after Clinton’s reign—as summed up in “Hopes and Prospects”:

The Clinton doctrine, presented to Congress, was that the US is entitled to resort to “unilateral use of military power” to ensure “uninhibited access to key markets, energy supplies and strategic resources.” In Haiti, Clinton [imposed] harsh neoliberal rules that were guaranteed to crush what remained of the economy, as they did.

Clinton would have a cleaner conscience today had he listened to Chomsky then. Many more Americans may also benefit by heeding Chomsky today, as U.S. elites’ callousness toward unpeople abroad is now affecting increasing numbers of their fellow citizens back home. Nothing symbolizes this more than investment bankers tricking countless Americans out of their life savings by luring them into buying homes they could not afford that were then foreclosed on.

http://www.truthdig.com/report/item/a_warning_from_noam_chomsky_on_the_threat_of_elites_20100607/

Thursday, June 3, 2010

Nigeria's agony dwarfs the Gulf oil spill. The US and Europe ignore it

The Deepwater Horizon disaster caused headlines around the world, yet the people who live in the Niger delta have had to live with environmental catastrophes for decades

John Vidal, environment editor The Observer, Sunday 30 May 2010

We reached the edge of the oil spill near the Nigerian village of Otuegwe after a long hike through cassava plantations. Ahead of us lay swamp. We waded into the warm tropical water and began swimming, cameras and notebooks held above our heads. We could smell the oil long before we saw it – the stench of garage forecourts and rotting vegetation hanging thickly in the air.

The farther we travelled, the more nauseous it became. Soon we were swimming in pools of light Nigerian crude, the best-quality oil in the world. One of the many hundreds of 40-year-old pipelines that crisscross the Niger delta had corroded and spewed oil for several months.

Forest and farmland were now covered in a sheen of greasy oil. Drinking wells were polluted and people were distraught. No one knew how much oil had leaked. "We lost our nets, huts and fishing pots," said Chief Promise, village leader of Otuegwe and our guide. "This is where we fished and farmed. We have lost our forest. We told Shell of the spill within days, but they did nothing for six months."

That was the Niger delta a few years ago, where, according to Nigerian academics, writers and environment groups, oil companies have acted with such impunity and recklessness that much of the region has been devastated by leaks.

In fact, more oil is spilled from the delta's network of terminals, pipes, pumping stations and oil platforms every year than has been lost in the Gulf of Mexico, the site of a major ecological catastrophe caused by oil that has poured from a leak triggered by the explosion that wrecked BP's Deepwater Horizon rig last month.

That disaster, which claimed the lives of 11 rig workers, has made headlines round the world. By contrast, little information has emerged about the damage inflicted on the Niger delta. Yet the destruction there provides us with a far more accurate picture of the price we have to pay for drilling oil today.

On 1 May this year a ruptured ExxonMobil pipeline in the state of Akwa Ibom spilled more than a million gallons into the delta over seven days before the leak was stopped. Local people demonstrated against the company but say they were attacked by security guards. Community leaders are now demanding $1bn in compensation for the illness and loss of livelihood they suffered. Few expect they will succeed. In the meantime, thick balls of tar are being washed up along the coast.

Within days of the Ibeno spill, thousands of barrels of oil were spilled when the nearby Shell Trans Niger pipeline was attacked by rebels. A few days after that, a large oil slick was found floating on Lake Adibawa in Bayelsa state and another in Ogoniland. "We are faced with incessant oil spills from rusty pipes, some of which are 40 years old," said Bonny Otavie, a Bayelsa MP.

This point was backed by Williams Mkpa, a community leader in Ibeno: "Oil companies do not value our life; they want us to all die. In the past two years, we have experienced 10 oil spills and fishermen can no longer sustain their families. It is not tolerable."

With 606 oilfields, the Niger delta supplies 40% of all the crude the United States imports and is the world capital of oil pollution. Life expectancy in its rural communities, half of which have no access to clean water, has fallen to little more than 40 years over the past two generations. Locals blame the oil that pollutes their land and can scarcely believe the contrast with the steps taken by BP and the US government to try to stop the Gulf oil leak and to protect the Louisiana shoreline from pollution.

"If this Gulf accident had happened in Nigeria, neither the government nor the company would have paid much attention," said the writer Ben Ikari, a member of the Ogoni people. "This kind of spill happens all the time in the delta."

"The oil companies just ignore it. The lawmakers do not care and people must live with pollution daily. The situation is now worse than it was 30 years ago. Nothing is changing. When I see the efforts that are being made in the US I feel a great sense of sadness at the double standards. What they do in the US or in Europe is very different."

"We see frantic efforts being made to stop the spill in the US," said Nnimo Bassey, Nigerian head of Friends of the Earth International. "But in Nigeria, oil companies largely ignore their spills, cover them up and destroy people's livelihood and environments. The Gulf spill can be seen as a metaphor for what is happening daily in the oilfields of Nigeria and other parts of Africa.

"This has gone on for 50 years in Nigeria. People depend completely on the environment for their drinking water and farming and fishing. They are amazed that the president of the US can be making speeches daily, because in Nigeria people there would not hear a whimper," he said.

It is impossible to know how much oil is spilled in the Niger delta each year because the companies and the government keep that secret. However, two major independent investigations over the past four years suggest that as much is spilled at sea, in the swamps and on land every year as has been lost in the Gulf of Mexico so far.

One report, compiled by WWF UK, the World Conservation Union and representatives from the Nigerian federal government and the Nigerian Conservation Foundation, calculated in 2006 that up to 1.5m tons of oil – 50 times the pollution unleashed in the Exxon Valdez tanker disaster in Alaska – has been spilled in the delta over the past half century. Last year Amnesty calculated that the equivalent of at least 9m barrels of oil was spilled and accused the oil companies of a human rights outrage.

According to Nigerian federal government figures, there were more than 7,000 spills between 1970 and 2000, and there are 2,000 official major spillages sites, many going back decades, with thousands of smaller ones still waiting to be cleared up. More than 1,000 spill cases have been filed against Shell alone.

Last month Shell admitted to spilling 14,000 tonnes of oil in 2009. The majority, said the company, was lost through two incidents – one in which the company claims that thieves damaged a wellhead at its Odidi field and another where militants bombed the Trans Escravos pipeline.

Shell, which works in partnership with the Nigerian government in the delta, says that 98% of all its oil spills are caused by vandalism, theft or sabotage by militants and only a minimal amount by deteriorating infrastructure. "We had 132 spills last year, as against 175 on average. Safety valves were vandalised; one pipe had 300 illegal taps. We found five explosive devices on one. Sometimes communities do not give us access to clean up the pollution because they can make more money from compensation," said a spokesman.

"We have a full-time oil spill response team. Last year we replaced 197 miles of pipeline and are using every known way to clean up pollution, including microbes. We are committed to cleaning up any spill as fast as possible as soon as and for whatever reason they occur."

These claims are hotly disputed by communities and environmental watchdog groups. They mostly blame the companies' vast network of rusting pipes and storage tanks, corroding pipelines, semi-derelict pumping stations and old wellheads, as well as tankers and vessels cleaning out tanks.