Saturday, November 27, 2010

Tuesday, November 23, 2010

If the President Wuz Honest

Here is what he would say to US;

My Fellow Americans,

In the past two months our government debt has suffered catastrophic losses in the global bond market. Whereas a few months ago interest rates for 2 year Treasury notes were around ½ of 1%, they are now 3%, and this type of drastic increase has occurred in every maturity of our debt. Our thirty year bonds had a yield of 4% at the start of this crisis, and now yield over 8%. As this has been happening, the US dollar has experienced a collapse in the foreign exchange markets.

Some people say this sell-off of our government debt was an attack planned and executed by China. We have no evidence of this, and all the evidence we do have tells us that the sell-off began spontaneously in several market centers and escalated as more and more investors sold their Treasuries rather than take further losses in their portfolio. Besides, the U.K., Germany, Japan and other major countries have had similar problems with their government debt.

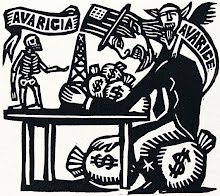

If it were true that one country orchestrated a financial attack on the US – and it is not true – you would be entitled to ask “How did our country ever get into such a vulnerable financial position.” The fact is, for over fifty years the United States has turned to debt to finance its current needs, rather than raise taxes to pay for the things we wanted. This attitude to “just charge it” persisted no matter which party was in power in the White House or Congress. Our politicians kept making promises to you about your retirement, your health care, your security, your shelter, and the availability of food and energy, that we could not ultimately meet. There was no discipline to our borrowing and spending because the financial markets indulged us, and because everyone thought our children’s children would ultimately pay down this bill. No one thought that we would see in our own lifetime the financial markets suspend our credit line.

Nor is our debt problem restricted just to the federal government. Most of our state legislatures are grappling with budget deficits that can only be mended with steep cuts in services. Our high yield bond markets – trading what is known as junk debt for heavily-indebted companies – have seized up. We as politicians sat back quietly while the financial industry aggressively marketed debt to you and your family, and we find out now that the banks and mortgage companies often broke the law in the process. As a consequence of this irresponsible and illegal behavior, our major banks are now in receivership and creditors as well as large depositors have experienced billions of dollars of losses. Most importantly, the average American consumer is burdened with mortgage, credit card, student loan, automobile, and other debts, and increasing numbers of you cannot meet the interest or principal payments. Consumer defaults are skyrocketing as a consequence of this crisis.

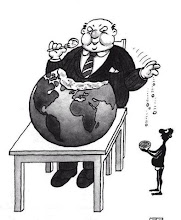

Mark this well – as a result of this crisis your standard of living is going to go down. There are major long term trends that are contributing to this decline in our living standards. Our population is aging and more people are heading into retirement hoping that the few who are working will support the many who are not. About one-third of the planet’s population in India and China are now aggressively working to achieve our lifestyle, and as they succeed in underpricing us in goods and services, we lose jobs and income. The essentials of modern life, such as energy and commodities to support our transportation and food needs, are becoming scarcer. But we made these problems much worse by ignoring them, by allowing our political system to be corrupted by huge donations from corporations and wealthy individuals, by refusing to vote because “it wouldn’t make any difference”, and by masking over the decline in our living standards by the analgesic of debt.

My friends, the era of pain avoidance is over. The era of pain management is upon us. It is now the role of government to manage this transition to a lower standard of living so that the pain is shared equably in our society. This means that government must concentrate first and foremost on the essentials – food, shelter, and fuel for our people. Very soon, nearly 50% of our population will be classified as poor by official standards, and they will necessarily receive priority attention from my administration. For those who are fortunate to have a job or the resources to support themselves for an extended period of time, we will attempt to fairly distribute the inevitable cuts in social services that are to follow.

Let me assure the financial markets that rumors about a default by the United States on its debt are completely unfounded. We will make every effort to continue to meet our financial obligations. It is true, though, that whereas at the start of this year one out of every ten dollars in taxes was used to pay interest on our debt, now – given the substantial increase in interest rates – that burden consumes four out of every ten dollars in tax receipts. This is why major cuts are now required in our national budget.

Because our priority must be on meeting the basic needs of our people, it is time to look seriously at scaling back our enormous military obligations overseas and the defense budget that takes up one-fourth of all of our spending. We will accelerate our departure from Iraq and Afghanistan. We will be looking at scaling back our defense footprint around the globe by closing hundreds of bases and cancelling many weapons systems that are not essential to national defense. There will be many job losses in the military and the defense industry as a result of these actions, and many Congressmen will fight to preserve their local defense component, but we cannot survive as a nation by maintaining anything like our existing defense establishment while half our people starve and are homeless, and the other half struggle to avoid their fate. We must recognize that the enormous scope and size of our defense establishment has in some ways secured our safety from overseas enemies, but at the cost of destroying our well-being domestically. Our new goal will be to secure our safety from overseas enemies with a smaller and more focused Department of Defense, and where possible we will continue to fund local police and fire departments, as well as the national guard and Homeland Security, to ensure domestic security.

Similarly, the time has come to recognize that there are only two segments of our society capable of providing additional tax revenues: wealthy individuals, and large corporations. Both of these groups have benefited enormously over the past 40 years from a shift of wealth and productive resources to them, at the expense of the middle and lower classes. We must and we will redress these imbalances. No doubt some of these people or corporations will threaten to leave the US. In some respects we don’t want them here if they are not willing to put up a fair share in support of our people and our economy, but we will make it difficult for them to take their money and run. Accordingly, we will continue to work with other governments overseas to standardize tax rates and reduce inducements for hot money to move from country to country.

All of these actions by your government are going to increase unemployment in the immediate term. This is unavoidable, but we are going to make every effort to ameliorate the problems of the unemployed. You can, as a result of these actions and what I am telling you today, choose to vote us out of office at the next election. That is your right, but I ask you first and foremost not to fall victim to the politicians who tell you there are easy or quick solutions to our problems. You should demand candor from all government officials at all levels of government, and a candid review of our problems will reveal that it will take years to fix them. We have lost a substantial part of our manufacturing and productive capabilities in this country by misguiding these activities overseas, and falling for the illusion that financial services was somehow a valued contributor to the economy.

To rebuild our productive economy – to create goods and services that people at home and abroad wish to buy – will take imagination, entrepreneurial spirit, market discipline that rewards investment in successful enterprises, and some government help along the way. This can and will be done, in the traditional spirit of America where hard work is valued and easy money rejected. Our parents, and their parents before them, lived simpler lives than we do, and we would consider them materially “poorer”, but they were not necessarily less happy. There are advantages to a simpler life – more time for your family and your personal development – and the goal of a reduced standard of living does not mean we must be less happy as a result. The transition to a simpler life, however, will be painful for many, and as I said, our job in government is to ensure that all of us will at least have food, shelter, and fuel during the years ahead.

Finally, none of this will matter in the long run without a major reform of our campaign finance system. We must get big money out of politics at the federal and state level. Please join me in urging your state legislature to vote in favor of a Constitutional amendment that limits campaign contributions to individuals who reside in the district or state of the candidate seeking funds, and which puts a $5,000 cap per individual. Campaign contributions from corporations, foundations, out of district individuals, foreigners, from special interest groups, or in the form of in-kind donations, must be forbidden by Constitutional amendment.

We are embarking on perilous times – a time of severe trial for all of us and for our country. The journey may take many years, but there is a brighter future at the end of our troubles. We can succeed if we help each other on this journey, and if your government directs resources to the most needy among us.

May God bless and keep America.

First posted at The Agonist

From "The People's Voice." For full article;

http://www.thepeoplesvoice.org/TPV3/Voices.php/2010/11/22/nopainnogain#more14840

My Fellow Americans,

In the past two months our government debt has suffered catastrophic losses in the global bond market. Whereas a few months ago interest rates for 2 year Treasury notes were around ½ of 1%, they are now 3%, and this type of drastic increase has occurred in every maturity of our debt. Our thirty year bonds had a yield of 4% at the start of this crisis, and now yield over 8%. As this has been happening, the US dollar has experienced a collapse in the foreign exchange markets.

Some people say this sell-off of our government debt was an attack planned and executed by China. We have no evidence of this, and all the evidence we do have tells us that the sell-off began spontaneously in several market centers and escalated as more and more investors sold their Treasuries rather than take further losses in their portfolio. Besides, the U.K., Germany, Japan and other major countries have had similar problems with their government debt.

If it were true that one country orchestrated a financial attack on the US – and it is not true – you would be entitled to ask “How did our country ever get into such a vulnerable financial position.” The fact is, for over fifty years the United States has turned to debt to finance its current needs, rather than raise taxes to pay for the things we wanted. This attitude to “just charge it” persisted no matter which party was in power in the White House or Congress. Our politicians kept making promises to you about your retirement, your health care, your security, your shelter, and the availability of food and energy, that we could not ultimately meet. There was no discipline to our borrowing and spending because the financial markets indulged us, and because everyone thought our children’s children would ultimately pay down this bill. No one thought that we would see in our own lifetime the financial markets suspend our credit line.

Nor is our debt problem restricted just to the federal government. Most of our state legislatures are grappling with budget deficits that can only be mended with steep cuts in services. Our high yield bond markets – trading what is known as junk debt for heavily-indebted companies – have seized up. We as politicians sat back quietly while the financial industry aggressively marketed debt to you and your family, and we find out now that the banks and mortgage companies often broke the law in the process. As a consequence of this irresponsible and illegal behavior, our major banks are now in receivership and creditors as well as large depositors have experienced billions of dollars of losses. Most importantly, the average American consumer is burdened with mortgage, credit card, student loan, automobile, and other debts, and increasing numbers of you cannot meet the interest or principal payments. Consumer defaults are skyrocketing as a consequence of this crisis.

Mark this well – as a result of this crisis your standard of living is going to go down. There are major long term trends that are contributing to this decline in our living standards. Our population is aging and more people are heading into retirement hoping that the few who are working will support the many who are not. About one-third of the planet’s population in India and China are now aggressively working to achieve our lifestyle, and as they succeed in underpricing us in goods and services, we lose jobs and income. The essentials of modern life, such as energy and commodities to support our transportation and food needs, are becoming scarcer. But we made these problems much worse by ignoring them, by allowing our political system to be corrupted by huge donations from corporations and wealthy individuals, by refusing to vote because “it wouldn’t make any difference”, and by masking over the decline in our living standards by the analgesic of debt.

My friends, the era of pain avoidance is over. The era of pain management is upon us. It is now the role of government to manage this transition to a lower standard of living so that the pain is shared equably in our society. This means that government must concentrate first and foremost on the essentials – food, shelter, and fuel for our people. Very soon, nearly 50% of our population will be classified as poor by official standards, and they will necessarily receive priority attention from my administration. For those who are fortunate to have a job or the resources to support themselves for an extended period of time, we will attempt to fairly distribute the inevitable cuts in social services that are to follow.

Let me assure the financial markets that rumors about a default by the United States on its debt are completely unfounded. We will make every effort to continue to meet our financial obligations. It is true, though, that whereas at the start of this year one out of every ten dollars in taxes was used to pay interest on our debt, now – given the substantial increase in interest rates – that burden consumes four out of every ten dollars in tax receipts. This is why major cuts are now required in our national budget.

Because our priority must be on meeting the basic needs of our people, it is time to look seriously at scaling back our enormous military obligations overseas and the defense budget that takes up one-fourth of all of our spending. We will accelerate our departure from Iraq and Afghanistan. We will be looking at scaling back our defense footprint around the globe by closing hundreds of bases and cancelling many weapons systems that are not essential to national defense. There will be many job losses in the military and the defense industry as a result of these actions, and many Congressmen will fight to preserve their local defense component, but we cannot survive as a nation by maintaining anything like our existing defense establishment while half our people starve and are homeless, and the other half struggle to avoid their fate. We must recognize that the enormous scope and size of our defense establishment has in some ways secured our safety from overseas enemies, but at the cost of destroying our well-being domestically. Our new goal will be to secure our safety from overseas enemies with a smaller and more focused Department of Defense, and where possible we will continue to fund local police and fire departments, as well as the national guard and Homeland Security, to ensure domestic security.

Similarly, the time has come to recognize that there are only two segments of our society capable of providing additional tax revenues: wealthy individuals, and large corporations. Both of these groups have benefited enormously over the past 40 years from a shift of wealth and productive resources to them, at the expense of the middle and lower classes. We must and we will redress these imbalances. No doubt some of these people or corporations will threaten to leave the US. In some respects we don’t want them here if they are not willing to put up a fair share in support of our people and our economy, but we will make it difficult for them to take their money and run. Accordingly, we will continue to work with other governments overseas to standardize tax rates and reduce inducements for hot money to move from country to country.

All of these actions by your government are going to increase unemployment in the immediate term. This is unavoidable, but we are going to make every effort to ameliorate the problems of the unemployed. You can, as a result of these actions and what I am telling you today, choose to vote us out of office at the next election. That is your right, but I ask you first and foremost not to fall victim to the politicians who tell you there are easy or quick solutions to our problems. You should demand candor from all government officials at all levels of government, and a candid review of our problems will reveal that it will take years to fix them. We have lost a substantial part of our manufacturing and productive capabilities in this country by misguiding these activities overseas, and falling for the illusion that financial services was somehow a valued contributor to the economy.

To rebuild our productive economy – to create goods and services that people at home and abroad wish to buy – will take imagination, entrepreneurial spirit, market discipline that rewards investment in successful enterprises, and some government help along the way. This can and will be done, in the traditional spirit of America where hard work is valued and easy money rejected. Our parents, and their parents before them, lived simpler lives than we do, and we would consider them materially “poorer”, but they were not necessarily less happy. There are advantages to a simpler life – more time for your family and your personal development – and the goal of a reduced standard of living does not mean we must be less happy as a result. The transition to a simpler life, however, will be painful for many, and as I said, our job in government is to ensure that all of us will at least have food, shelter, and fuel during the years ahead.

Finally, none of this will matter in the long run without a major reform of our campaign finance system. We must get big money out of politics at the federal and state level. Please join me in urging your state legislature to vote in favor of a Constitutional amendment that limits campaign contributions to individuals who reside in the district or state of the candidate seeking funds, and which puts a $5,000 cap per individual. Campaign contributions from corporations, foundations, out of district individuals, foreigners, from special interest groups, or in the form of in-kind donations, must be forbidden by Constitutional amendment.

We are embarking on perilous times – a time of severe trial for all of us and for our country. The journey may take many years, but there is a brighter future at the end of our troubles. We can succeed if we help each other on this journey, and if your government directs resources to the most needy among us.

May God bless and keep America.

First posted at The Agonist

From "The People's Voice." For full article;

http://www.thepeoplesvoice.org/TPV3/Voices.php/2010/11/22/nopainnogain#more14840

Friday, November 19, 2010

Tuesday, November 16, 2010

Under Attack, Feds Get Defensive about More Bonds

From the NY Times Today;

With the Federal Reserve under attack at home and abroad, it is making an unusual public bid to keep itself away from the political crossfire.

After a barrage of criticism over the last week — including from foreign leaders, Congressional officials, economists and Alan Greenspan, the former Fed chairman — the Fed came out to explain its efforts to inject $600 billion more into the sagging economy.

One worry of Fed watchers as well as its defenders is that some of the domestic criticism may have the subtext of challenging the Fed’s traditional independence in deciding monetary policy without political interference.

In a rare on-the-record interview, William C. Dudley, president of the Federal Reserve Bank of New York, said that the Fed’s move was not intended to affect the value of the dollar, but rather to encourage a faster, stronger recovery that will also assist international growth.

“We have no goal in terms of pushing the dollar up or down,” Mr. Dudley said. “Our goal is to ease financial conditions and to stimulate a stronger economic expansion and more rapid employment growth.”

And in an interview with The Wall Street Journal, the Fed’s new vice chairwoman, Janet L. Yellen, defended the decision in broadly similar terms. “I’m having a hard time seeing where really robust growth can come from,” she said. “And I see inflation lingering around current levels for a long time.” Ms. Yellen said she was “not happy to see us caught up in a political debate."

The comments by Mr. Dudley, who is also the vice chairman of the Federal Open Market Committee, which sets monetary policy, and by Ms. Yellen amounted to an unusual rebuttal, the first by top Fed officials, of criticism of its decision this month to pump money into the banking system. The plan is to spur the recovery by buying government securities to lower long-term interest rates.

Kenneth A. Froot, who teaches international finance at Harvard Business School, said, “The Fed needs to get the word out more clearly” because of the politically volatile times. Mr. Froot added, “This is a very rare circumstance where the basic authority we vest in institutions like the Fed has, more than ever, been challenged,” by politicians and economists who are often identified with political parties.

The bond markets have been increasingly uneasy about the Fed’s actions. On Monday, bond prices fell and yields jumped as a result of the concerns.

The criticism has tended to fall along three lines. Some have accused the Fed of deliberately weakening the dollar to make American exports more competitive. Others fear the Fed’s decision could ignite inflation down the road. Still others say the policy will be ineffective absent additional fiscal stimulus.

Fed officials were clearly unsettled by an opinion piece by Mr. Greenspan in The Financial Times on Thursday, at the start of meetings of the Group of 20 nations in Seoul, South Korea. Mr. Greenspan said the United States was “pursuing a policy of currency weakening” and increasing the risks of trade protectionism.

In an open letter to Ben S. Bernanke, the Fed chairman, on Monday, a group of conservative economists, writers and investors urged that the Fed’s action “be reconsidered and discontinued,” arguing that the bond purchases “risk currency debasement and inflation.” The group included Michael J. Boskin, a former chairman of the White House Council of Economic Advisers; the historian Niall Ferguson; Douglas Holtz-Eakin, a former director of the Congressional Budget Office; and the economist John B. Taylor, one of Mr. Bernanke’s most prominent critics.

Mr. Dudley did not single out any critic, but suggested that the criticisms were unfounded.

“There is no long-term conflict between what the U.S. is trying to accomplish and what other countries are trying to accomplish,” Mr. Dudley said, echoing statements by President Obama and Treasury Secretary Timothy F. Geithner. “A strong economic recovery in the U.S. is in the interests of the global economy.”

While Mr. Dudley said the effect on the dollar was not a consideration, he acknowledged that when interest rates adjust, “oftentimes there will be consequences for the dollar.” He added, “We have seen some dollar weakness in this period, but it doesn’t seem to be unusual, given the changes that we’ve seen in interest rates in the U.S. compared to interest rates abroad.”

Mr. Dudley rejected the idea that the Fed might be setting the stage for uncontrollable inflation in years to come. He said the Fed had tools for draining the bank reserves sitting on its balance sheet.

“We are very, very confident that those tools will be completely effective at keeping inflation in check,” he said. “We are completely willing to use those tools, when the time comes, to prevent an inflation problem. Higher inflation is not a way out. It is not a solution.”

Mr. Dudley argued that the Fed’s efforts had their intended effect. Since August, when the Fed first hinted that it might take further steps to spur the recovery, stock prices have risen and long-term interest rates have fallen. That makes it easier for consumers to buy homes or refinance mortgages, and for businesses to borrow and invest.

“You’ve seen a significant easing of financial conditions over that time period,” he said. “I have to believe that the expectation of a second large-scale asset purchase program was the primary driver of those changes.”

Even so, Mr. Dudley cautioned, “One shouldn’t view this instrument as a panacea or a magic wand that’s going to make the economy recover rapidly.” He said the Fed’s action, known as quantitative easing, was “not going to be extremely powerful” but was nonetheless necessary to reduce the risk, however slim, of a double-dip recession.

“It’s going to be a long and bumpy road to a strong and vigorous expansion, but this will be helpful rather than hurtful,” he said.

Uncertainty about fiscal policy — whether the Bush-era tax cuts will be extended, and in the long term, how the nation will rein in its record deficits — has complicated the recovery, Mr. Dudley said.

Asked whether fiscal gridlock had forced the Fed to act, he said, “We’re going to worry about what we can worry about, which is monetary policy.” The Fed, he said, has to “take the world as it is.”

Mr. Dudley, who joined the New York Fed in 2007 from Goldman Sachs, where he was the chief United States economist, also provided details about how the Fed’s outlook had evolved.

“We were going into the year expecting the economy to pick up steam,” Mr. Dudley said. In the spring, “We were starting to see the glimmers” of a healthy recovery in private-sector employment, he said. But by the summer, growth began to stall; it is now estimated at an annualized rate of 2 percent. Inflation, already low, fell further.

The economy was “vulnerable to a shock that could tip us into deflation,” he said.

In recent speeches, Mr. Dudley and Charles L. Evans, president of the Chicago Fed, mentioned the possibility of allowing inflation to run higher in the future to make up for inflation’s being too low today, an approach known as price-level targeting. But in the interview, Mr. Dudley emphasized that he had not endorsed that approach.

“The problem with a price-level target is that it’s difficult to explain what you’re doing in a way that doesn’t create larger anxiety about the long-term inflation target,” he said. “We clearly want people to understand that we are committed to price stability over the long run.”

Mr. Dudley declined to discuss the deliberations of the committee, but acknowledged that the decision was not easy.

“Reasonable people can disagree about how big the costs are versus how big the benefits are,” he said. “It’s completely reasonable to expect that not everyone is going to see it exactly the same way, because these policies have not been used much on a historical basis.”

http://www.nytimes.com/2010/11/16/business/economy/16fed.html?_r=1&src=twt&twt=nytimes

Labels:

Banking,

Economics,

Federal Reserve,

U.S. Treasury

Monday, November 15, 2010

Argentinas Debt

I think US economists got alot of nerve talking about other countries not paying their bills....lol. What about US?

http://www.youtube.com/watch?v=wPL9LG9w87A&list=PL58F91A02FF7860F5&index=2&playnext=1

How about a blanket-debt forgiveness for everyone? How do you think the Bank$ter$ and Wall St Investors would like that> ? ROFLAO

http://www.youtube.com/watch?v=wPL9LG9w87A&list=PL58F91A02FF7860F5&index=2&playnext=1

How about a blanket-debt forgiveness for everyone? How do you think the Bank$ter$ and Wall St Investors would like that> ? ROFLAO

Thursday, November 11, 2010

Big-Banks Create a Kizillion New Jobs....

and create Entire New Profession: Robo-Signers exactly like this one that got caught up in the net and is being grilled on the hot seat in this wonderful lawyers deposition vid;

Hooray

Forrest Law Firm!

http://www.youtube.com/user/TheForrestLawFirm#p/a/u/1/tflJhn0cly4

and these are the kinds of "professionals" they created; http://news.yahoo.com/s/ap/20101013/ap_on_bi_ge/us_foreclosure_robosigners

Hooray

Forrest Law Firm!

http://www.youtube.com/user/TheForrestLawFirm#p/a/u/1/tflJhn0cly4

and these are the kinds of "professionals" they created; http://news.yahoo.com/s/ap/20101013/ap_on_bi_ge/us_foreclosure_robosigners

Wednesday, November 10, 2010

Friday, November 5, 2010

Subscribe to:

Posts (Atom)