An old but still very relevant article - thing have only gottern worse for US

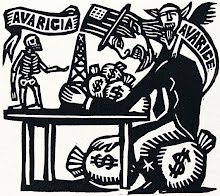

Corporate Wealth Share Rises for Top-Income Americans - Cause Working Class Wages to Fall

By DAVID CAY JOHNSTON

Published: January 29, 2006

New government data indicate that the concentration of corporate wealth among the highest-income Americans grew significantly in 2003, as a trend that began in 1991 accelerated in the first year that President Bush and Congress cut taxes on capital.

In 2003 the top 1 percent of households owned 57.5 percent of corporate wealth, up from 53.4 percent the year before, according to a Congressional Budget Office analysis of the latest income tax data. The top group's share of corporate wealth has grown by half since 1991, when it was 38.7 percent.

In 2003, incomes in the top 1 percent of households ranged from $237,000 to several billion dollars.

For every group below the top 1 percent, shares of corporate wealth have declined since 1991. These declines ranged from 12.7 percent for those on the 96th to 99th rungs on the income ladder to 57 percent for the poorest fifth of Americans, who made less than $16,300 and together owned 0.6 percent of corporate wealth in 2003, down from 1.4 percent in 1991.

The analysis did not measure wealth directly. It looked at taxes on capital gains, dividends, interest and rents. Income from securities owned by retirement plans and endowments was excluded, as were gains from noncorporate assets such as personal residences.

This technique for measuring wealth has long been used in standard economic studies, though critics have challenged that tradition.

Among them is Stephen J. Entin, president of the Institute for Research on the Economics of Taxation in Washington, which favors eliminating most taxes on capital and teaches that an unintended consequence of the corporate income tax is depressed wage rates. Mr. Entin said the report's approach was so flawed that the data were useless.

He said reduced tax rates on long-term capital gains may have prompted wealthy investors to sell profitable investments. That would show up in tax data as increased wealth that year, even though the increase may have built up over decades.

Long-term capital gains were taxed at 28 percent until 1997, and at 20 percent until 2003, when rates were cut to 15 percent. The top rate on dividends was cut to 15 percent from 35 percent that year.

The White House said it did not believe that the 2003 tax cuts had much influence on wealth shares. It also said that since wealth is transitory for many people, a more important issue is how incomes and wealth are influenced by the quality of education.

"We want to lift all incomes and wealth," said Trent Duffy, a White House spokesman. "We are starting to see that the income gap is largely an education gap."

"The president thinks we need to close the income gap, and he has talked about ways in which we can do that," especially through education, Mr. Duffy said.

The data showing increased concentration of corporate wealth were posted last month on the Congressional Budget Office Web site. Isaac Shapiro, associate director of the Center on Budget and Policy Priorities in Washington, spotted the information last week and wrote a report analyzing it.

Mr. Shapiro said the figures added to the center's "concerns over the increasingly regressive effects" of the reduced tax rates on capital. Continuing those rates will "exacerbate the long-term trend toward growing income inequality," he wrote.

The center, which studies how government affects the poor and supports policies that it believes help alleviate poverty, opposes Mr. Bush's tax policies.

The center plans to release its own report on Monday that questions the wisdom of continuing the reduced tax rates on dividends and capital gains, saying the Congressional Budget Office analysis indicates that the benefits flow directly to a relatively few Americans.

http://www.nytimes.com/2006/01/29/national/29rich.html?_r=1

Saturday, April 24, 2010

Monday, April 19, 2010

Shorting The Middle Class: The Real Wall Street Crime

Arianna Huffington

Posted: April 19, 2010 06:46 PM

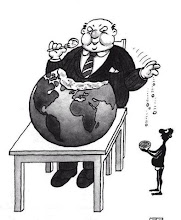

The press is all abuzz with news of the SEC suing Goldman Sachs for fraud. While this is certainly big news in itself, even more important is what it says about what the financial elite has been doing to America for the last 30 years: shorting the middle class.

The SEC's action is a perfect moment for us to look at the bigger picture of how the American people were sold on the promise of never-ending prosperity while Wall Street was overseeing a massive transfer of wealth from the middle class to the richest Americans.

The results have been devastating: a disappearing middle class, a precipitous drop in economic and social mobility, and ultimately, the undermining of the foundation of our democracy.

Thirty years ago, top executives at S&P 500 companies made an average of 30 times what their workers did -- now they make 300 times what their workers make. And between 2000 and 2008, the poverty rate in the suburbs of the largest metro areas in the U.S. grew by 25 percent -- making these suburbs home to the country's largest and fastest-growing segment of the poor.

The human toll of the shorting of the middle class is brought to life on sites like Recessionwire.com, LayoffSupportNetwork.com, and HowIGotLaidOff.com where the casualties of Wall Street's systemic scam share their personal stories.

Looking through these sites, I came upon a story that struck me as emblematic of where America's middle class finds itself these days. It feels like a dark reboot of the American Dream. Think Horatio Alger rewritten by O. Henry.

It's the story of Dean Blackburn of Alameda, California. The first part of his life was a classic American success story. Raised in Minnesota by a single mom, a teacher, he was "middle class by default." Through a combination of smarts and hard work, he made his way to Yale, then took a succession of jobs in the growing Internet world that had him steadily progressing up the economic ladder.

Then came February 2009, when he was laid off on the last day of the month. His boss chose that day because it meant the company wouldn't have to pay for another month of his health coverage. "Looking back on it," he told me, "that hurt more than the layoff itself -- just knowing that the president of the company was exactly that calculating and that unfeeling about my own, and my family's wellbeing." The timing, Blackburn continued, "put those 'family days' and company picnics in a weird new light."

Fourteen months later, he is still looking for a new job. As he, his wife, and their 2-year-old daughter deal with the immediate financial struggles his extended unemployment has brought, Blackburn has become acutely aware of the broader implications of the shorting of the middle class. "Ultimately," he says, "it's not about a dip in corporate profits, but a change in corporate attitude -- a change that means no one's job is safe, and never will be, ever again."

It's one of the reasons he's decided to try to start his own company, NaviDate, a data-driven twist on online dating sites: "It's no longer a trade-off between doing what you love and having stability. Stability is long gone, so you better do something you love!"

Achieving middle class stability and having your children do better than you, the way you had done better than your parents, has always been the American Dream, but, as Blackburn notes, mobility now is increasingly one way: "The plateaus of each step, which can be a great place to stop a bit and catch your breath, are gone. Now, it's climb, climb, climb, or start sliding back down immediately." The result: "the odds are you're going to wind up at the bottom eventually, unless you get lucky."

Luck. That's what the American Dream now rests on. It used to be about education, hard work and perseverance, but the system is rigged to such an extent now that the way to keep your head above water is to get lucky. The middle class life is now the prize on a scratch-off lottery ticket.

In November 2008, as the initial aftershocks of the economic earthquake were being felt, David Brooks predicted the rise of a new social class -- "the formerly middle class" -- made up of those who had joined the middle class at the end of the boom only to fall back due to the recession. "To them," he wrote, "the gap between where they are and where they used to be will seem wide and daunting."

But, in the year and a half since Brooks wrote this, the ranks of the formerly middle class have swelled far beyond those who joined at the tail end of the boom.

The evidence that the middle class has been consistently shorted is so overwhelming -- and the results so potentially damaging to our society -- that even bastions of establishment thinking are on alert. In a new strategy paper, The Hamilton Project -- the economic think tank founded by Robert Rubin (a big beneficiary of the shorting of the middle class) -- argues, in the Project's own words, "that the American tradition of expanding opportunity from one generation to the next is at risk because we are failing to make the necessary investments in human, physical, and environmental capital."

Of course, it's even worse than that. We are actually cutting back on our current investment in people (see the human cost of massive budget cuts in education, health care, and social services in state after state after state -- all across America).

After reading the details of the SEC's filing against Goldman Sachs, it's hard not to come away thinking: "Why would anyone ever do business with that firm again?" Likewise, after even a cursory examination of the treatment of the American middle class by the Wall Street/Washington class over the past few decades, one should also wonder why anyone would ever do business with that crowd again. And yet, there they are, still running things at the Treasury, the Fed, and the National Economic Council.

The urgent need for the reorganization of our financial system goes far beyond the upcoming debate on new financial regulations. And it goes far beyond the media's right versus left framing. It's a question about the future of our country, and whether we are going to stop the slide toward a Third World system in which there are just two classes: those at the bottom and those at the top.

A lot of people at the top of the economic food chain have done very well shorting the middle class. But the losers in those bets weren't Goldman Sachs investors -- they were millions of hard working Americans who had heard the pitch and bought into the American Dream, only to find it had been replaced by a sophisticated scam.

http://www.huffingtonpost.com/arianna-huffington/shorting-the-middle-class_b_543523.html

Posted: April 19, 2010 06:46 PM

The press is all abuzz with news of the SEC suing Goldman Sachs for fraud. While this is certainly big news in itself, even more important is what it says about what the financial elite has been doing to America for the last 30 years: shorting the middle class.

The SEC's action is a perfect moment for us to look at the bigger picture of how the American people were sold on the promise of never-ending prosperity while Wall Street was overseeing a massive transfer of wealth from the middle class to the richest Americans.

The results have been devastating: a disappearing middle class, a precipitous drop in economic and social mobility, and ultimately, the undermining of the foundation of our democracy.

Thirty years ago, top executives at S&P 500 companies made an average of 30 times what their workers did -- now they make 300 times what their workers make. And between 2000 and 2008, the poverty rate in the suburbs of the largest metro areas in the U.S. grew by 25 percent -- making these suburbs home to the country's largest and fastest-growing segment of the poor.

The human toll of the shorting of the middle class is brought to life on sites like Recessionwire.com, LayoffSupportNetwork.com, and HowIGotLaidOff.com where the casualties of Wall Street's systemic scam share their personal stories.

Looking through these sites, I came upon a story that struck me as emblematic of where America's middle class finds itself these days. It feels like a dark reboot of the American Dream. Think Horatio Alger rewritten by O. Henry.

It's the story of Dean Blackburn of Alameda, California. The first part of his life was a classic American success story. Raised in Minnesota by a single mom, a teacher, he was "middle class by default." Through a combination of smarts and hard work, he made his way to Yale, then took a succession of jobs in the growing Internet world that had him steadily progressing up the economic ladder.

Then came February 2009, when he was laid off on the last day of the month. His boss chose that day because it meant the company wouldn't have to pay for another month of his health coverage. "Looking back on it," he told me, "that hurt more than the layoff itself -- just knowing that the president of the company was exactly that calculating and that unfeeling about my own, and my family's wellbeing." The timing, Blackburn continued, "put those 'family days' and company picnics in a weird new light."

Fourteen months later, he is still looking for a new job. As he, his wife, and their 2-year-old daughter deal with the immediate financial struggles his extended unemployment has brought, Blackburn has become acutely aware of the broader implications of the shorting of the middle class. "Ultimately," he says, "it's not about a dip in corporate profits, but a change in corporate attitude -- a change that means no one's job is safe, and never will be, ever again."

It's one of the reasons he's decided to try to start his own company, NaviDate, a data-driven twist on online dating sites: "It's no longer a trade-off between doing what you love and having stability. Stability is long gone, so you better do something you love!"

Achieving middle class stability and having your children do better than you, the way you had done better than your parents, has always been the American Dream, but, as Blackburn notes, mobility now is increasingly one way: "The plateaus of each step, which can be a great place to stop a bit and catch your breath, are gone. Now, it's climb, climb, climb, or start sliding back down immediately." The result: "the odds are you're going to wind up at the bottom eventually, unless you get lucky."

Luck. That's what the American Dream now rests on. It used to be about education, hard work and perseverance, but the system is rigged to such an extent now that the way to keep your head above water is to get lucky. The middle class life is now the prize on a scratch-off lottery ticket.

In November 2008, as the initial aftershocks of the economic earthquake were being felt, David Brooks predicted the rise of a new social class -- "the formerly middle class" -- made up of those who had joined the middle class at the end of the boom only to fall back due to the recession. "To them," he wrote, "the gap between where they are and where they used to be will seem wide and daunting."

But, in the year and a half since Brooks wrote this, the ranks of the formerly middle class have swelled far beyond those who joined at the tail end of the boom.

The evidence that the middle class has been consistently shorted is so overwhelming -- and the results so potentially damaging to our society -- that even bastions of establishment thinking are on alert. In a new strategy paper, The Hamilton Project -- the economic think tank founded by Robert Rubin (a big beneficiary of the shorting of the middle class) -- argues, in the Project's own words, "that the American tradition of expanding opportunity from one generation to the next is at risk because we are failing to make the necessary investments in human, physical, and environmental capital."

Of course, it's even worse than that. We are actually cutting back on our current investment in people (see the human cost of massive budget cuts in education, health care, and social services in state after state after state -- all across America).

After reading the details of the SEC's filing against Goldman Sachs, it's hard not to come away thinking: "Why would anyone ever do business with that firm again?" Likewise, after even a cursory examination of the treatment of the American middle class by the Wall Street/Washington class over the past few decades, one should also wonder why anyone would ever do business with that crowd again. And yet, there they are, still running things at the Treasury, the Fed, and the National Economic Council.

The urgent need for the reorganization of our financial system goes far beyond the upcoming debate on new financial regulations. And it goes far beyond the media's right versus left framing. It's a question about the future of our country, and whether we are going to stop the slide toward a Third World system in which there are just two classes: those at the bottom and those at the top.

A lot of people at the top of the economic food chain have done very well shorting the middle class. But the losers in those bets weren't Goldman Sachs investors -- they were millions of hard working Americans who had heard the pitch and bought into the American Dream, only to find it had been replaced by a sophisticated scam.

http://www.huffingtonpost.com/arianna-huffington/shorting-the-middle-class_b_543523.html

Friday, April 16, 2010

CHART OF THE DAY: Goldman's $12 Billion Bloodbath

Joe Weisenthal and Kamelia Angelova | Apr. 16, 2010, 4:43 PM

Today's chart isn't rocket science. The SEC announced civil fraud charges against Goldman Sachs (GS), and its shareholders proceeded to lose $12 billion.

See the pitchbook at the center of the scandal here by clicking on to the title above;

Read more: http://www.businessinsider.com/chart-of-the-day-goldman-sachs-stock-2010-4?utm_source=Triggermail&utm_medium=email&utm_campaign=CS_COTD_041610#ixzz0lJSU9hJt

Pitchbook Link;

http://www.businessinsider.com/check-out-the-66-page-presentation-on-goldmans-abacus-cdo-deal-2010-4

SEC Socks it To Goldman-S for Fraud (Finally!)

SEC Charges Goldman Sachs With Fraud in Structuring and Marketing of CDO Tied to Subprime Mortgages

FOR IMMEDIATE RELEASE

2010-59

Washington, D.C., April 16, 2010 — The Securities and Exchange Commission today charged Goldman, Sachs & Co. and one of its vice presidents for defrauding investors by misstating and omitting key facts about a financial product tied to subprime mortgages as the U.S. housing market was beginning to falter.

The SEC alleges that Goldman Sachs structured and marketed a synthetic collateralized debt obligation (CDO) that hinged on the performance of subprime residential mortgage-backed securities (RMBS). Goldman Sachs failed to disclose to investors vital information about the CDO, in particular the role that a major hedge fund played in the portfolio selection process and the fact that the hedge fund had taken a short position against the CDO.

"The product was new and complex but the deception and conflicts are old and simple," said Robert Khuzami, Director of the Division of Enforcement. "Goldman wrongly permitted a client that was betting against the mortgage market to heavily influence which mortgage securities to include in an investment portfolio, while telling other investors that the securities were selected by an independent, objective third party."

Kenneth Lench, Chief of the SEC's Structured and New Products Unit, added, "The SEC continues to investigate the practices of investment banks and others involved in the securitization of complex financial products tied to the U.S. housing market as it was beginning to show signs of distress."

The SEC alleges that one of the world's largest hedge funds, Paulson & Co., paid Goldman Sachs to structure a transaction in which Paulson & Co. could take short positions against mortgage securities chosen by Paulson & Co. based on a belief that the securities would experience credit events.

According to the SEC's complaint, filed in U.S. District Court for the Southern District of New York, the marketing materials for the CDO known as ABACUS 2007-AC1 (ABACUS) all represented that the RMBS portfolio underlying the CDO was selected by ACA Management LLC (ACA), a third party with expertise in analyzing credit risk in RMBS. The SEC alleges that undisclosed in the marketing materials and unbeknownst to investors, the Paulson & Co. hedge fund, which was poised to benefit if the RMBS defaulted, played a significant role in selecting which RMBS should make up the portfolio.

The SEC's complaint alleges that after participating in the portfolio selection, Paulson & Co. effectively shorted the RMBS portfolio it helped select by entering into credit default swaps (CDS) with Goldman Sachs to buy protection on specific layers of the ABACUS capital structure. Given that financial short interest, Paulson & Co. had an economic incentive to select RMBS that it expected to experience credit events in the near future. Goldman Sachs did not disclose Paulson & Co.'s short position or its role in the collateral selection process in the term sheet, flip book, offering memorandum, or other marketing materials provided to investors.

The SEC alleges that Goldman Sachs Vice President Fabrice Tourre was principally responsible for ABACUS 2007-AC1. Tourre structured the transaction, prepared the marketing materials, and communicated directly with investors. Tourre allegedly knew of Paulson & Co.'s undisclosed short interest and role in the collateral selection process. In addition, he misled ACA into believing that Paulson & Co. invested approximately $200 million in the equity of ABACUS, indicating that Paulson & Co.'s interests in the collateral selection process were closely aligned with ACA's interests. In reality, however, their interests were sharply conflicting.

According to the SEC's complaint, the deal closed on April 26, 2007, and Paulson & Co. paid Goldman Sachs approximately $15 million for structuring and marketing ABACUS. By Oct. 24, 2007, 83 percent of the RMBS in the ABACUS portfolio had been downgraded and 17 percent were on negative watch. By Jan. 29, 2008, 99 percent of the portfolio had been downgraded.

Investors in the liabilities of ABACUS are alleged to have lost more than $1 billion.

The SEC's complaint charges Goldman Sachs and Tourre with violations of Section 17(a) of the Securities Act of 1933, Section 10(b) of the Securities Exchange Act of 1934, and Exchange Act Rule 10b-5. The Commission seeks injunctive relief, disgorgement of profits, prejudgment interest, and financial penalties.

Click on title above for clickable links to:

Additional Materials

Litigation Release No. 21489

SEC Complaint

# # #

For more information about this enforcement action, contact:

Lorin L. Reisner

Deputy Director, SEC Enforcement Division

(202) 551-4787

Kenneth R. Lench

Chief, Structured and New Products Unit, SEC Enforcement Division

(202) 551-4938

Reid A. Muoio

Deputy Chief, Structured and New Products Unit, SEC Enforcement Division

(202) 551-4488

http://www.sec.gov/news/press/2010/2010-59.htm

FOR IMMEDIATE RELEASE

2010-59

Washington, D.C., April 16, 2010 — The Securities and Exchange Commission today charged Goldman, Sachs & Co. and one of its vice presidents for defrauding investors by misstating and omitting key facts about a financial product tied to subprime mortgages as the U.S. housing market was beginning to falter.

The SEC alleges that Goldman Sachs structured and marketed a synthetic collateralized debt obligation (CDO) that hinged on the performance of subprime residential mortgage-backed securities (RMBS). Goldman Sachs failed to disclose to investors vital information about the CDO, in particular the role that a major hedge fund played in the portfolio selection process and the fact that the hedge fund had taken a short position against the CDO.

"The product was new and complex but the deception and conflicts are old and simple," said Robert Khuzami, Director of the Division of Enforcement. "Goldman wrongly permitted a client that was betting against the mortgage market to heavily influence which mortgage securities to include in an investment portfolio, while telling other investors that the securities were selected by an independent, objective third party."

Kenneth Lench, Chief of the SEC's Structured and New Products Unit, added, "The SEC continues to investigate the practices of investment banks and others involved in the securitization of complex financial products tied to the U.S. housing market as it was beginning to show signs of distress."

The SEC alleges that one of the world's largest hedge funds, Paulson & Co., paid Goldman Sachs to structure a transaction in which Paulson & Co. could take short positions against mortgage securities chosen by Paulson & Co. based on a belief that the securities would experience credit events.

According to the SEC's complaint, filed in U.S. District Court for the Southern District of New York, the marketing materials for the CDO known as ABACUS 2007-AC1 (ABACUS) all represented that the RMBS portfolio underlying the CDO was selected by ACA Management LLC (ACA), a third party with expertise in analyzing credit risk in RMBS. The SEC alleges that undisclosed in the marketing materials and unbeknownst to investors, the Paulson & Co. hedge fund, which was poised to benefit if the RMBS defaulted, played a significant role in selecting which RMBS should make up the portfolio.

The SEC's complaint alleges that after participating in the portfolio selection, Paulson & Co. effectively shorted the RMBS portfolio it helped select by entering into credit default swaps (CDS) with Goldman Sachs to buy protection on specific layers of the ABACUS capital structure. Given that financial short interest, Paulson & Co. had an economic incentive to select RMBS that it expected to experience credit events in the near future. Goldman Sachs did not disclose Paulson & Co.'s short position or its role in the collateral selection process in the term sheet, flip book, offering memorandum, or other marketing materials provided to investors.

The SEC alleges that Goldman Sachs Vice President Fabrice Tourre was principally responsible for ABACUS 2007-AC1. Tourre structured the transaction, prepared the marketing materials, and communicated directly with investors. Tourre allegedly knew of Paulson & Co.'s undisclosed short interest and role in the collateral selection process. In addition, he misled ACA into believing that Paulson & Co. invested approximately $200 million in the equity of ABACUS, indicating that Paulson & Co.'s interests in the collateral selection process were closely aligned with ACA's interests. In reality, however, their interests were sharply conflicting.

According to the SEC's complaint, the deal closed on April 26, 2007, and Paulson & Co. paid Goldman Sachs approximately $15 million for structuring and marketing ABACUS. By Oct. 24, 2007, 83 percent of the RMBS in the ABACUS portfolio had been downgraded and 17 percent were on negative watch. By Jan. 29, 2008, 99 percent of the portfolio had been downgraded.

Investors in the liabilities of ABACUS are alleged to have lost more than $1 billion.

The SEC's complaint charges Goldman Sachs and Tourre with violations of Section 17(a) of the Securities Act of 1933, Section 10(b) of the Securities Exchange Act of 1934, and Exchange Act Rule 10b-5. The Commission seeks injunctive relief, disgorgement of profits, prejudgment interest, and financial penalties.

Click on title above for clickable links to:

Additional Materials

Litigation Release No. 21489

SEC Complaint

# # #

For more information about this enforcement action, contact:

Lorin L. Reisner

Deputy Director, SEC Enforcement Division

(202) 551-4787

Kenneth R. Lench

Chief, Structured and New Products Unit, SEC Enforcement Division

(202) 551-4938

Reid A. Muoio

Deputy Chief, Structured and New Products Unit, SEC Enforcement Division

(202) 551-4488

http://www.sec.gov/news/press/2010/2010-59.htm

Friday, April 9, 2010

2 Tax or Not 2 Tax ?

Click on title above to seee the answer and I say it is NO. What say you, fello citizens and patriots?

http://www.fff.org/blog/jghblog2010-04-08.asp

The Government DOES NOT have the power to tax our Income! Even the IRS knows that.

Cut and Paste the url below (from American Patriot Friends Network)to see a series of articles with commentary that discusses the development of the modern tax-protester movement and its social, political and legal ramifications.

http://www.apfn.org/apfn/tax.htm

(You will have to cut & paste as I havent figured out yet how to make links clickable inside the text-box. Sorry 4 the trouble, but well worth it as you will see. Lotsa reliable info there on the "Is it is or is it aint" legal thing.))

http://www.fff.org/blog/jghblog2010-04-08.asp

The Government DOES NOT have the power to tax our Income! Even the IRS knows that.

Cut and Paste the url below (from American Patriot Friends Network)to see a series of articles with commentary that discusses the development of the modern tax-protester movement and its social, political and legal ramifications.

http://www.apfn.org/apfn/tax.htm

(You will have to cut & paste as I havent figured out yet how to make links clickable inside the text-box. Sorry 4 the trouble, but well worth it as you will see. Lotsa reliable info there on the "Is it is or is it aint" legal thing.))

Thursday, April 1, 2010

China the New "Best Bet," Greedy-Sachs Says

Goldman Sachs Says China’s Hong Kong ‘H’ Shares ‘New Top Trade’

March 31, 2010, 6:03 PM EDT

April 1 (Bloomberg) -- China’s Hong Kong-listed companies are a “new top trade” at Goldman Sachs Group Inc., which said the Hang Seng China Enterprises Index will climb at least 20 percent on valuation and the outlook for economic growth.

“We are recommending a new top trade,” Dominic Wilson, an economist at Goldman Sachs in New York, wrote in a report e- mailed yesterday. “We sense that Chinese equities have fallen off investors’ radars somewhat, positioning is light, and sentiment is, at best, skeptical, making us all the more keen to get involved.”

The recommendation is Goldman Sachs’s ninth top trade for the year. The other top trades include owning Russian stocks, favoring the British pound against the New Zealand dollar, and the Polish zloty against the Japanese yen, according to a separate note e-mailed yesterday.

The H-share index has dropped 10 percent from a 17-month high in November, compared with a 2.8 percent gain for the MSCI Emerging Markets Index, on concern policy makers will curb bank lending and raise interest rates to slow growth. The H-share index’s 3.1 percent loss this year compares to a 4.9 percent gain in the Standard & Poor’s 500 Index of U.S. stocks and 2.1 percent advance in the MSCI Emerging Markets Index of 22 developing-nation stocks.

‘Long Position’

The “underperformance” of China’s H shares left their valuation at “undemanding” levels, Goldman Sachs said. The H- share index is priced at 17.8 times the reported earnings of its companies, an 11 percent discount to the MSCI Emerging Markets Index, according to data compiled by Bloomberg.

Goldman Sachs recommended a “long position” in H shares as the index that tracks their performance rises to 15,000 from 12,397.59 yesterday. China’s economy, the third largest in the world, will expand more than 11 percent this year, Goldman Sachs predicts, more than the 9.6 percent median forecast of 22 analysts surveyed by Bloomberg. Goldman Sachs’s portfolio strategists predict the H shares index will climb to 17,000 by year-end, a 37 percent jump from yesterday’s close.

“Economic growth has stayed robust and broad based,” Goldman Sachs wrote. “While interest rates will likely rise soon,” the risk from policy tightening “is much better flagged than before.”

--Editors: Eric Martin, Lester Pimentel

To contact the reporters on this story: Ye Xie in New York at yxie6@bloomberg.net

To contact the editor responsible for this story: David Papadopoulos at papadopoulos@bloomberg.net

http://www.businessweek.com/news/2010-03-31/goldman-sachs-recommends-china-s-h-shares-as-new-top-trade-.html

March 31, 2010, 6:03 PM EDT

April 1 (Bloomberg) -- China’s Hong Kong-listed companies are a “new top trade” at Goldman Sachs Group Inc., which said the Hang Seng China Enterprises Index will climb at least 20 percent on valuation and the outlook for economic growth.

“We are recommending a new top trade,” Dominic Wilson, an economist at Goldman Sachs in New York, wrote in a report e- mailed yesterday. “We sense that Chinese equities have fallen off investors’ radars somewhat, positioning is light, and sentiment is, at best, skeptical, making us all the more keen to get involved.”

The recommendation is Goldman Sachs’s ninth top trade for the year. The other top trades include owning Russian stocks, favoring the British pound against the New Zealand dollar, and the Polish zloty against the Japanese yen, according to a separate note e-mailed yesterday.

The H-share index has dropped 10 percent from a 17-month high in November, compared with a 2.8 percent gain for the MSCI Emerging Markets Index, on concern policy makers will curb bank lending and raise interest rates to slow growth. The H-share index’s 3.1 percent loss this year compares to a 4.9 percent gain in the Standard & Poor’s 500 Index of U.S. stocks and 2.1 percent advance in the MSCI Emerging Markets Index of 22 developing-nation stocks.

‘Long Position’

The “underperformance” of China’s H shares left their valuation at “undemanding” levels, Goldman Sachs said. The H- share index is priced at 17.8 times the reported earnings of its companies, an 11 percent discount to the MSCI Emerging Markets Index, according to data compiled by Bloomberg.

Goldman Sachs recommended a “long position” in H shares as the index that tracks their performance rises to 15,000 from 12,397.59 yesterday. China’s economy, the third largest in the world, will expand more than 11 percent this year, Goldman Sachs predicts, more than the 9.6 percent median forecast of 22 analysts surveyed by Bloomberg. Goldman Sachs’s portfolio strategists predict the H shares index will climb to 17,000 by year-end, a 37 percent jump from yesterday’s close.

“Economic growth has stayed robust and broad based,” Goldman Sachs wrote. “While interest rates will likely rise soon,” the risk from policy tightening “is much better flagged than before.”

--Editors: Eric Martin, Lester Pimentel

To contact the reporters on this story: Ye Xie in New York at yxie6@bloomberg.net

To contact the editor responsible for this story: David Papadopoulos at papadopoulos@bloomberg.net

http://www.businessweek.com/news/2010-03-31/goldman-sachs-recommends-china-s-h-shares-as-new-top-trade-.html

Clean Car Rule Makes History—But Auto Dealers Try to Turn Back the Clock

Over the past decade, UCS analysts, advocates, and activists have been at the forefront of a movement pushing for state and national vehicle standards that will get clean car technology off the shelf and on our roads. Our efforts have come to fruition, as the Obama administration just announced a strong final rule for national fuel economy standards, which will cut global warming pollution, reduce America's oil consumption, and save consumers billions of dollars at the gas pump.

Many automakers supported these common-sense regulations, which mark the first time in U.S. history the federal government has regulated global warming pollution under the Clean Air Act. Unfortunately, the National Automobile Dealers Association (NADA) is still trying to keep cleaner cars off our roads. Their lawyers are actively supporting attempts to block the government’s ability to regulate global warming emissions.

It’s time to tell NADA that consumers aren’t buying their lemon of a lawsuit. Send a message to your NADA state director, who is also an area auto dealer, and say that the customer is always right—American drivers want cleaner cars, not more lobbyists and lawsuits.

Take Action Today

Sincerely,

Scott Nathanson

National Field Organizer

UCS Clean Vehicles Program

Many automakers supported these common-sense regulations, which mark the first time in U.S. history the federal government has regulated global warming pollution under the Clean Air Act. Unfortunately, the National Automobile Dealers Association (NADA) is still trying to keep cleaner cars off our roads. Their lawyers are actively supporting attempts to block the government’s ability to regulate global warming emissions.

It’s time to tell NADA that consumers aren’t buying their lemon of a lawsuit. Send a message to your NADA state director, who is also an area auto dealer, and say that the customer is always right—American drivers want cleaner cars, not more lobbyists and lawsuits.

Take Action Today

Sincerely,

Scott Nathanson

National Field Organizer

UCS Clean Vehicles Program

Subscribe to:

Posts (Atom)