June 29, 1:56 PM

Author: Tim McCown, Philadelphia-Progressive-Examiner

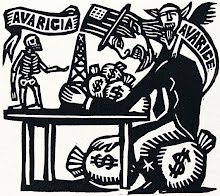

Many Conservative blogs were all worked up about Cap and Trade and how that was going to jack up everyone's energy costs. First of all, you Conservatives aren"t so gullible that you still believe that our coin operated Congress being in the hands of Democrats instead Republicans matters, do you?

If you do, let me enlighten you with the truth. Toilet paper is worth more than the Environmental Bill that Democrats are being told will strike a major blow for global climate change, as you Conservatives are being told that taxes and costs of energy will go up. Do you see anything here?

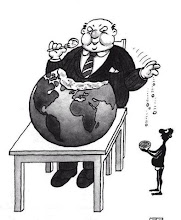

Only in America could we repackage out and out bribery as legitimate Free Speech and pretend that campaign contributions don't pervert the actual will of the people every time. For Conservatives, nothing that would actually cost business anything is in that environmental legislation. The reason is that there is nothing in there that will actually do anything, and that was true before the legislation ever got out of committee. The drama was to fool us into believing that those of us who wanted change we could believe in, were getting change and when those energy bills go up as they surely will, Conservatives will believe it was because of this bill. People we are being had, Wall Street runs this show. It is all a smoke and mirrors pretense that we the people still have a say in government.

The first rule of Wall Street is that the Free Markets mean that they are free to cheat us, con us and steal from us and there are no rules, no laws and no consequences. Finance and loans have been some of the biggest swindles and bankers our biggest swindlers, in our history.

Take coal mining or share cropping for instance. The land owners and banks owned the land they rented you or the company town you lived in. They rented you your tools, they sold you the seeds to plant, they owned the scales to weigh your crop when harvested or your coal you had dug, and they owned the stores you could shop in. Somehow fancy that, you never made enough to pay off the bill. They didn't even pay you with money in many coal towns. They" loaned" you the difference between your crop or the coal you dug and the fraudulent expenses they stuck you with and charged you interest. They made money from your labor and off your labor. Now along comes Visa and Master Card so don't get carried away thinking times have changed all that much. With all the foreclosures the concept of company town is coming back with a vengeance.

I strongly recommend you read Matt Taibbi's article in the latest issue of Rolling Stone. It is the best piece of investigative journalism I have read in a long time. When you are finished you will be angry as hell but you will see clearly the truth of what we have been fed by Corporate America since that King of Cons, Ronald Reagan was in office. Oh it includes Bill Clinton too so it is bipartisan in placing blame where it belongs.

It is no accident that we have Tim Geithner at Treasury. Robert Rubin was sold to Bill Clinton using almost word for word what Rubin and Sanford Weil said when they sold Geithner to Obama, as the only one who can handle this economy. That is because he has been trained in how to keep the con job rolling as I have said before. His job is to find the next bubble to inflate and he just gave Wall Street a several trillion dollar pump to inflate it with. As he was instructed there are no rules or regulations to stop them. Thats how you handle the economy. Oh the recovery will look grand until the phony bubble pops and Middle Class America is left holding the empty bag yet again.

Wall Street didn't handle anything but our wallets as they have acted like Count Dracula sucking the economic life blood out of this country. Here is one of the cons exposed by Matt Taibbi. You have a dime so you borrow 90 cents. Then you take that dollar and borrow nine more, then you take that ten and borrow $90 then the $100 and borrow $900.00 and so on and so on until you have borrowed millions with one dime. That is the pillar upon which these crooks have built the American economy. That is certainly not building your foundation upon a bed of rock.

My personal favorite in the Taibbi article in Rolling Stone was the Dot.com con. You put worthlessascrap.com stock out there to the public. The CEO of worthlessascrap.com knows that other CEO's will get x amount of worthlessascrap stock at $8 dollars a share in exchange for their buying x amount more of worhtlessascrap stock for $25 dollars a share.

That purchase jumps the stock on the open market up to $25 dollars a share which all those in on the action knew so they can sell the stock they got for $8 to $10 dollars a share at a profit. The average Joe on E-trade doesn't have this insider information but he sees the stocks meteoric rise and he purchases it at $25 dollars a share hoping to make a killing, because idiots like Cramer say everything will just keep going up so buy.

The insiders also know that it is worthlessascrap literally. They bail knowing it has no value, with millions in profit. The average Joe lacks this information and loses his shirt because the stock was worthlessascrap. So Conservatives, still want to invest everyone's Social Security in this financial theft scheme. My retirement is in the trash They did this with stocks, housing, they even were a significant part of the reason, through speculation, that gas reached $4.00 a gallon. So Conservatives, when you argue some of us want to punish success the only successful entrepreneurship I see is fraud and deceit.

How do you get away with it?

You deregulate so there are no rules. When someone starts to question, you howl it will cost jobs and Democrats are robbing success etc.. We have been held for blackmail by these high priced crooks who scream it will cost jobs every time we begin to set limits on their criminal activities. Personally I'm tired of being held hostage.

We are not going to get health care reform, reform of the work place, reform of Wall Street or anything else until we get the money out of politics. Our privatized system of campaign finance is an invitation to being taken. As a nation we now have government of the Corporations by the Corporations and against the American people. And when our dimwit congressman and Senators try to claim no corporations can make donations and donations can't be over $2,000.00 dollars, here's how you do it. If the NRA or any other donor wants to give big bucks like say $100,000.00 to a candidate, you find fifty constituents and give each one $2,000.00 checks and have them write a donation on their personal accounts. On Federal election forms you have fifty individual donors just like the law says. The candidate of course knows who really buttered the bread

Dick Durbin was right, banks do really own the place.

Author: Tim McCown

Tim McCown is an Examiner from Philadelphia. You can see Tim's articles on Tim's Home Page. Click on title to go there; http://www.examiner.com/x-3629-Philadelphia-Progressive-Examiner

article; http://www.examiner.com/x-3629-Philadelphia-Progressive-Examiner~y2009m6d29-Forget-We-the-People-we-are-run-by-the-Wall-Street-criminal-cartel

Tuesday, June 30, 2009

17 Blackwater Defendants Plead Guilty and were Sentenced, 5 Plead Not Guilty and will go to Trial

Report from Blackwater 22 Court appearance in Galina IL

David Stocker

June 24, 2009

Galena County Courthouse, IL --"I am a third-generation farmer from Iowa. What I did on April 27 was patriotic, and I'm proud of it," defendant Chris Gaunt, 52, from Grinnell, IA, said in her statement before sentencing.

The 22 defendants in the April 27, 2009, Blackwater trespassing action were scheduled for hearing at 10 AM. By that time, the pubic gallery was about halffilled with friends and activists from the peace movement who had come to witness the next step in the process of “throwing a shoe” at Blackwater. On April 25-27, 2009, more than 100 people came to Stockton’s Unitarian Universalist Church to participate in a two-day conference/retreat on Blackwater/ Xe that included an address by author Jeremy Scahill and training for the civil disobedience action, which ended with the arrest of 22 brave souls who tried to serve moral bankruptcy papers and an eviction notice at the N IL Blackwater site. This event, along with actions in Potrero, CA and Moyock, NC, have dragged Blackwater into the national spotlight where its actions are receiving greater scrutiny than it would like. (...)

Blackwater/Xe has been persistently developing a training facility on 80 acres at Skunk Hollow Road near Stockton, Illinois. Without public invitation, Blackwater appeared as an armed force in the aftermath of hurricane Katrina. Blackwater has also gained lucrative contracts worth billions to perform border security in Southwestern USA and is presently operating in Iraq and Afghanistan under the rebranded title Xe.

As Rock Falls IL, defendant and peace activist Fred Turk, 71 pointed out to the court, “This is part of a B/Xe strategy—to be on the ground floor of corporatization of the national police force.”

The defendants in the Galena action finally entered the courtroom at 11:30 with their attorney Edward L. Osowski, a Chicago-based attorney, familiar with political trials after working on a number of SOA trials. After some awkwardness at seating all 22 defendants in the crowded space available, the "Choice of Plea" appearance began before

Judge Kevin Ward. All were asked if they were fully aware of the charges facing them. All replied that they understood.

The court first dealt with the defendants who wished to plead not guilty. Four defendants asked for a bench trial and entered pleas of not guilty. They were Roberta, 65, and Don, 67, Thurstin-Timmerman of Park Falls WI, (former Milwaukee CWers), Lee Jankowski, 50, itinerate CW home repair person, and Becky Lambert, 25, from the Winona, MN, CW. Their trial is scheduled for September 4 and they will be represented by Edward L. Osowski.

Defendant, Michael Walli, 60, from the Duluth MN, CW, pleaded not guilty buty requested a trial by jury. Walli wearing a bright orange T-shirt with the words “Close Guantanamo,” had traveled from Washington, DC, after appearing in court there pursuant to another civil disobedience action regarding the closing of Guantanamo. As previously agreed, Walli told the Judge while he appreciated his service thus far, he no longer wished to be represented by Edward Ozowski (Osowski had told the group earlier he would not be available for a jury trial) and asked for a court-appointed attorney. Walli told the judge he is a transient missionary with an income of less than $500 per year and had no means to hire an attorney. Judge Ward initiated the process of appointing an attorney for Michael, and his case was put on hold.

The remaining 17 defendants all pleaded “guilty” to a Class B Misdemeanor Criminal Trespass charge with a maximum penalty of $1500 and six months in jail, and a minimum penalty of “court supervision.” In the pre court exchanged between judge , the attorneys and the defendants, Judge Kevin Ward had let it be known that he was going to sentence all who pleaded guilty to pay a combined court cost and fine of $250 with a six-month unsupervised probation, about half of what the State's Attorney was recommending.

After accepting the guilty pleas of all 17 remaining defendants, each defendant was allowed to make a statement before sentencing. Many took the opportunity to speak out against Blackwater and gave reasons why they felt called to do civil disobedience.

New Hope Farm CW defendant, Mary Moody, 44, described coming to the courthouse in February to meet with officials of the county and advise them of plans for the impending action. “We shared information and acted with complete transparency. We followed our agreements. This is in stark contrast to Blackwater, a private corporation which trespasses in foreign nations, enters private homes and is alleged to have taken lives of innocent people. Blackwater violates its own contracts smuggling illegal weapons into and out of Iraq. My plea is to all courts and to all citizens that the same transparency be demanded of these corporate criminals as is being demanded of us who stand before you today.”

Mona Shaw, 58, of the Des Moines CW said, “As I stand here, my heart is filled with regret. Regret for every mother who holds a folded flag, regret for mothers who bury children for lack of healthcare or proper nutrition. I regret that we live in a moral climate where our leaders no longer work for us but rather serve Corporations. We believe that the people have a heart and soul and that the day is coming when truth rather than lies will prevail. However, what I don’t regret is what I did last April 27 at the N IL Blackwater site”

Defendant, Laurel Noblette, 22, of the Champaign IL CW described her motivation, “This action was a personal choice to intervene in the only non-violent way offered to me. We are community organizers, and we represent people without a voice. I accept the penalty in exchange for the opportunity to have you hear me say that Blackwater should be stopped.

Along with speaking out against Blackwater, and knowing that the Judge was inclined to fix a $250 sentence instead of any jail time, many of the defendants stated that as being members of Catholic Worker communities, living and serving the poor as volunteers, asked the Judge for leniency in any fines or penalties.

Two defendants; Frank Cordaro, 58, and Ed Boomer, 62, both Des Moines CWers, told the judge that they would refuse to pay any fines or court costs as a sign of solidarity with the poor. Cordaro told Judge Ward, “As a sign of standing with the poor we serve, who when in similar situations end up going to jail, more often than not, for lack of money to pay their finds and court cost, I will refuse to pay any fines or court costs that may come with my sentence today.”

At the end of defendants' statements Judge Ward sentenced 15 of the defendants, excluding Cordaro and Bloomer to pay court costs of $150 plus a punitive charge of $100. The judge told the defendants that the total fine of $250 must be paid on or before September 4, 2009, for the defendants to avoid further consequence. He also gave them six months unsupervised probation.

Turning his attention to Cordaro and Bloomer, the judge made note that he heard their stated refusal to pay any fines or court costs and subsequently warned them of unfavorable consequences should they fail to pay any of the penalties of their sentence. Then Judge Ward sentenced Cordaro and Bloomer to the same sentence he gave to the other 15 defendants.

The sentence given by Judge Ward, while seeming lenient, was still more than the minimum required by law. And, defendants were not permitted to perform community service in lieu of fine as some had requested.

-------------------------------------------------

Below list of the 17 defendants who plead guilty and sentenced to pay court costs of $150 plus a fine of $100 and were gave six month unsupervised probation.

Eric Anglada, LaMotte, IA, 29 yrs old - New Hope CW Farm

Ed Bloomer, Des Moines CW, 61 yrs old

Kenny Bishop, Champaign CW, 24 yrs old

Frank Cordaro, Des Moines CW, 58 yrs old

Tyler Chen, Champaign CW, 24 yrs old

Elton Davis, Des Moines IA, 47 yrs old - former DMCW

Chris Gaunt, Grinnell, IA, 52 yrs old

Carolyn Griffeth, St Louis CW, 36 yrs old

Lee Jankowski, Dubuque, IA CW, 50 yrs old

Benjamin Johnson, Dubuque CW, 25 yrs old

Chrissy Kirchhoefer, St Louis CW, 31 yrs old

Mike Leutgeb Munson, Rockford MN, 26 yrs old - former Winona CW

Mary Moody, LaMotte, IA, 44 yrs old - New Hope CW Farm

Laurel Nobilette, Champaign CW, 22 yrs old

Nick Pickrell, Kansas City CW, 27 yrs old

Mona Shaw, Des Moines CW, 57 yrs old

Chris Watson, Champaign CW, 22 yrs old

Fred Turk, Rock Falls, IL, 71 yrs old

--------------------------------------------------

List of the 3 defendants who plead not guilty and were given a bench trial date of Sept 4th.

Becky Lambert, Winona CW, 25 yrs old

Don Thurstin-Timmerman, Park Falls WI, 67 yrs old - former Milwaukee CW

Roberta Thurstin-Timmerman, Park Falls WI, 65 yrs old - former Milwaukee CW

---------------------------------------------------

Michael Walli, Duluth CW, 60 yrs old plead not guilty and asked for a jury trial and a public defendant attonrey. Future court dates to be determined.

posted by The Editors at 5:16 PM

http://thechristianradical.blogspot.com/2009/06/17-blackwater-defendants-plead-guilty.html

David Stocker

June 24, 2009

Galena County Courthouse, IL --"I am a third-generation farmer from Iowa. What I did on April 27 was patriotic, and I'm proud of it," defendant Chris Gaunt, 52, from Grinnell, IA, said in her statement before sentencing.

The 22 defendants in the April 27, 2009, Blackwater trespassing action were scheduled for hearing at 10 AM. By that time, the pubic gallery was about halffilled with friends and activists from the peace movement who had come to witness the next step in the process of “throwing a shoe” at Blackwater. On April 25-27, 2009, more than 100 people came to Stockton’s Unitarian Universalist Church to participate in a two-day conference/retreat on Blackwater/ Xe that included an address by author Jeremy Scahill and training for the civil disobedience action, which ended with the arrest of 22 brave souls who tried to serve moral bankruptcy papers and an eviction notice at the N IL Blackwater site. This event, along with actions in Potrero, CA and Moyock, NC, have dragged Blackwater into the national spotlight where its actions are receiving greater scrutiny than it would like. (...)

Blackwater/Xe has been persistently developing a training facility on 80 acres at Skunk Hollow Road near Stockton, Illinois. Without public invitation, Blackwater appeared as an armed force in the aftermath of hurricane Katrina. Blackwater has also gained lucrative contracts worth billions to perform border security in Southwestern USA and is presently operating in Iraq and Afghanistan under the rebranded title Xe.

As Rock Falls IL, defendant and peace activist Fred Turk, 71 pointed out to the court, “This is part of a B/Xe strategy—to be on the ground floor of corporatization of the national police force.”

The defendants in the Galena action finally entered the courtroom at 11:30 with their attorney Edward L. Osowski, a Chicago-based attorney, familiar with political trials after working on a number of SOA trials. After some awkwardness at seating all 22 defendants in the crowded space available, the "Choice of Plea" appearance began before

Judge Kevin Ward. All were asked if they were fully aware of the charges facing them. All replied that they understood.

The court first dealt with the defendants who wished to plead not guilty. Four defendants asked for a bench trial and entered pleas of not guilty. They were Roberta, 65, and Don, 67, Thurstin-Timmerman of Park Falls WI, (former Milwaukee CWers), Lee Jankowski, 50, itinerate CW home repair person, and Becky Lambert, 25, from the Winona, MN, CW. Their trial is scheduled for September 4 and they will be represented by Edward L. Osowski.

Defendant, Michael Walli, 60, from the Duluth MN, CW, pleaded not guilty buty requested a trial by jury. Walli wearing a bright orange T-shirt with the words “Close Guantanamo,” had traveled from Washington, DC, after appearing in court there pursuant to another civil disobedience action regarding the closing of Guantanamo. As previously agreed, Walli told the Judge while he appreciated his service thus far, he no longer wished to be represented by Edward Ozowski (Osowski had told the group earlier he would not be available for a jury trial) and asked for a court-appointed attorney. Walli told the judge he is a transient missionary with an income of less than $500 per year and had no means to hire an attorney. Judge Ward initiated the process of appointing an attorney for Michael, and his case was put on hold.

The remaining 17 defendants all pleaded “guilty” to a Class B Misdemeanor Criminal Trespass charge with a maximum penalty of $1500 and six months in jail, and a minimum penalty of “court supervision.” In the pre court exchanged between judge , the attorneys and the defendants, Judge Kevin Ward had let it be known that he was going to sentence all who pleaded guilty to pay a combined court cost and fine of $250 with a six-month unsupervised probation, about half of what the State's Attorney was recommending.

After accepting the guilty pleas of all 17 remaining defendants, each defendant was allowed to make a statement before sentencing. Many took the opportunity to speak out against Blackwater and gave reasons why they felt called to do civil disobedience.

New Hope Farm CW defendant, Mary Moody, 44, described coming to the courthouse in February to meet with officials of the county and advise them of plans for the impending action. “We shared information and acted with complete transparency. We followed our agreements. This is in stark contrast to Blackwater, a private corporation which trespasses in foreign nations, enters private homes and is alleged to have taken lives of innocent people. Blackwater violates its own contracts smuggling illegal weapons into and out of Iraq. My plea is to all courts and to all citizens that the same transparency be demanded of these corporate criminals as is being demanded of us who stand before you today.”

Mona Shaw, 58, of the Des Moines CW said, “As I stand here, my heart is filled with regret. Regret for every mother who holds a folded flag, regret for mothers who bury children for lack of healthcare or proper nutrition. I regret that we live in a moral climate where our leaders no longer work for us but rather serve Corporations. We believe that the people have a heart and soul and that the day is coming when truth rather than lies will prevail. However, what I don’t regret is what I did last April 27 at the N IL Blackwater site”

Defendant, Laurel Noblette, 22, of the Champaign IL CW described her motivation, “This action was a personal choice to intervene in the only non-violent way offered to me. We are community organizers, and we represent people without a voice. I accept the penalty in exchange for the opportunity to have you hear me say that Blackwater should be stopped.

Along with speaking out against Blackwater, and knowing that the Judge was inclined to fix a $250 sentence instead of any jail time, many of the defendants stated that as being members of Catholic Worker communities, living and serving the poor as volunteers, asked the Judge for leniency in any fines or penalties.

Two defendants; Frank Cordaro, 58, and Ed Boomer, 62, both Des Moines CWers, told the judge that they would refuse to pay any fines or court costs as a sign of solidarity with the poor. Cordaro told Judge Ward, “As a sign of standing with the poor we serve, who when in similar situations end up going to jail, more often than not, for lack of money to pay their finds and court cost, I will refuse to pay any fines or court costs that may come with my sentence today.”

At the end of defendants' statements Judge Ward sentenced 15 of the defendants, excluding Cordaro and Bloomer to pay court costs of $150 plus a punitive charge of $100. The judge told the defendants that the total fine of $250 must be paid on or before September 4, 2009, for the defendants to avoid further consequence. He also gave them six months unsupervised probation.

Turning his attention to Cordaro and Bloomer, the judge made note that he heard their stated refusal to pay any fines or court costs and subsequently warned them of unfavorable consequences should they fail to pay any of the penalties of their sentence. Then Judge Ward sentenced Cordaro and Bloomer to the same sentence he gave to the other 15 defendants.

The sentence given by Judge Ward, while seeming lenient, was still more than the minimum required by law. And, defendants were not permitted to perform community service in lieu of fine as some had requested.

-------------------------------------------------

Below list of the 17 defendants who plead guilty and sentenced to pay court costs of $150 plus a fine of $100 and were gave six month unsupervised probation.

Eric Anglada, LaMotte, IA, 29 yrs old - New Hope CW Farm

Ed Bloomer, Des Moines CW, 61 yrs old

Kenny Bishop, Champaign CW, 24 yrs old

Frank Cordaro, Des Moines CW, 58 yrs old

Tyler Chen, Champaign CW, 24 yrs old

Elton Davis, Des Moines IA, 47 yrs old - former DMCW

Chris Gaunt, Grinnell, IA, 52 yrs old

Carolyn Griffeth, St Louis CW, 36 yrs old

Lee Jankowski, Dubuque, IA CW, 50 yrs old

Benjamin Johnson, Dubuque CW, 25 yrs old

Chrissy Kirchhoefer, St Louis CW, 31 yrs old

Mike Leutgeb Munson, Rockford MN, 26 yrs old - former Winona CW

Mary Moody, LaMotte, IA, 44 yrs old - New Hope CW Farm

Laurel Nobilette, Champaign CW, 22 yrs old

Nick Pickrell, Kansas City CW, 27 yrs old

Mona Shaw, Des Moines CW, 57 yrs old

Chris Watson, Champaign CW, 22 yrs old

Fred Turk, Rock Falls, IL, 71 yrs old

--------------------------------------------------

List of the 3 defendants who plead not guilty and were given a bench trial date of Sept 4th.

Becky Lambert, Winona CW, 25 yrs old

Don Thurstin-Timmerman, Park Falls WI, 67 yrs old - former Milwaukee CW

Roberta Thurstin-Timmerman, Park Falls WI, 65 yrs old - former Milwaukee CW

---------------------------------------------------

Michael Walli, Duluth CW, 60 yrs old plead not guilty and asked for a jury trial and a public defendant attonrey. Future court dates to be determined.

posted by The Editors at 5:16 PM

http://thechristianradical.blogspot.com/2009/06/17-blackwater-defendants-plead-guilty.html

A Topika Ambulance Co. to Charge by the Pound as Critical Care Costs Nearly Double

Some overweight Topeka patients to pay more for ambulance use

The Associated Press

TOPEKA, Kan. - A Topeka company will begin charging some overweight and critical care patients more to ride in its ambulances.

The Shawnee County Commission on Monday agreed to allow American Medical Response to raise ambulance costs for critical care patients and overweight people from $629 to $1,172.

AMR director Ken Keller says the higher fees will allow the ambulance company to pay for the extra care technician and medical equipment needed for critical care patients.

And he says the company needed to increase its charges for overweight patients to pay for more manpower and transportation equipment, including extra large and reinforced cots and a winch to help technicians load the patients into the ambulance.

He says, in general, the company will charge more for those weighing over 350 pounds, but each individual patient's size will be evaluated.

http://www.kansas.com/topstories/story/873755.html

The Associated Press

TOPEKA, Kan. - A Topeka company will begin charging some overweight and critical care patients more to ride in its ambulances.

The Shawnee County Commission on Monday agreed to allow American Medical Response to raise ambulance costs for critical care patients and overweight people from $629 to $1,172.

AMR director Ken Keller says the higher fees will allow the ambulance company to pay for the extra care technician and medical equipment needed for critical care patients.

And he says the company needed to increase its charges for overweight patients to pay for more manpower and transportation equipment, including extra large and reinforced cots and a winch to help technicians load the patients into the ambulance.

He says, in general, the company will charge more for those weighing over 350 pounds, but each individual patient's size will be evaluated.

http://www.kansas.com/topstories/story/873755.html

Ft. Riley Bribery; Kan. developer pleads guilty

By JOHN MILBURN

Associated Press Writer

TOPEKA, Kan. - A Kansas developer admitted Tuesday he tried to bribe a member of a Junction City commission to get support to build new housing for Fort Riley soldiers.

David Ray Freeman of Lawrence pleaded guilty in U.S. District Court to one count of conspiracy to commit bank fraud. Freeman's bid to develop the subdivisions were eventually approved, including one in which he reserved a nice lot in one of the subdivisions for himself.

The Army post, located 60 miles west of Topeka, will nearly double in soldiers to more than 18,500 by 2013. The Defense Department has asked surrounding communities to build additional housing, schools and other infrastructure to handle in influx.

"I gave money to a city commissioner of Junction City to influence projects that I was developing," Freeman told the court in Topeka.

Freeman, 45, has agreed to cooperate in the investigation of the bribes. Federal attorneys declined to comment about the scope of their investigation, if more indictments were coming or if any members of the Junction City Commission would be charged. The name of the commissioner hasn't been released, only referenced in court documents by a code name of "firefighter."

Freeman, who is scheduled to be sentenced Sept. 29, faces up to 30 years in prison and a fine up to $1 million. He left the courtroom Tuesday without speaking to reporters.

Prosecutors say Freeman and other Lawrence residents formed Big D Development in May 2006, with Freeman as half-owner.

Within five months, the Junction City Commission approved two agreements worth a total of $12 million allowing Big D to build subdivisions to provide housing for the influx of soldiers.

The complaint said that in 2004, Freeman became friends with a Junction City commissioner, anticipating that the area might need to build more housing. By 2006, the complaint said, he was bragging to partners in Big D that he had a commissioner "in his pocket."

In 2005, the Defense Department announced plans to return the 1st Infantry Division headquarters to Kansas from Germany. Since then, new home subdivisions have been built in Junction City and Manhattan, the two largest communities near Fort Riley.

The complaint alleges that Freeman issued a $5,000 check in May 2006 to the Junction City commissioner's wife from the account of another business with which Freeman was involved. Then, in July, Freeman issued a second, $5,000 check to the commissioner from the account of a third business, the complaint said.

The city commission approved the development agreements in July and August 2006, according to the complaint, and Freeman later reserved a "choice" lot in one of the subdivisions.

In March 2007, the complaint said, Freeman had an assistant draw and cash a check for $9,000 and deliver the money to the Junction City commissioner at a rest stop between Junction City and Topeka.

It is against federal law to knowingly structure transactions to be less than $10,000 so that a financial institution won't report it to the government, which is required.

Much of the housing development remains unfinished. Because of the frequency of soldiers deploying to Iraq and Afghanistan over the past six years, many soldiers and their families haven't moved to the region and found permanent housing. However, the 1st Infantry Division is expecting another influx of about 2,500 soldiers in the coming months, which Army officials said should create a need for more homes and apartments

http://www.kansas.com/topstories/story/873565.html

Associated Press Writer

TOPEKA, Kan. - A Kansas developer admitted Tuesday he tried to bribe a member of a Junction City commission to get support to build new housing for Fort Riley soldiers.

David Ray Freeman of Lawrence pleaded guilty in U.S. District Court to one count of conspiracy to commit bank fraud. Freeman's bid to develop the subdivisions were eventually approved, including one in which he reserved a nice lot in one of the subdivisions for himself.

The Army post, located 60 miles west of Topeka, will nearly double in soldiers to more than 18,500 by 2013. The Defense Department has asked surrounding communities to build additional housing, schools and other infrastructure to handle in influx.

"I gave money to a city commissioner of Junction City to influence projects that I was developing," Freeman told the court in Topeka.

Freeman, 45, has agreed to cooperate in the investigation of the bribes. Federal attorneys declined to comment about the scope of their investigation, if more indictments were coming or if any members of the Junction City Commission would be charged. The name of the commissioner hasn't been released, only referenced in court documents by a code name of "firefighter."

Freeman, who is scheduled to be sentenced Sept. 29, faces up to 30 years in prison and a fine up to $1 million. He left the courtroom Tuesday without speaking to reporters.

Prosecutors say Freeman and other Lawrence residents formed Big D Development in May 2006, with Freeman as half-owner.

Within five months, the Junction City Commission approved two agreements worth a total of $12 million allowing Big D to build subdivisions to provide housing for the influx of soldiers.

The complaint said that in 2004, Freeman became friends with a Junction City commissioner, anticipating that the area might need to build more housing. By 2006, the complaint said, he was bragging to partners in Big D that he had a commissioner "in his pocket."

In 2005, the Defense Department announced plans to return the 1st Infantry Division headquarters to Kansas from Germany. Since then, new home subdivisions have been built in Junction City and Manhattan, the two largest communities near Fort Riley.

The complaint alleges that Freeman issued a $5,000 check in May 2006 to the Junction City commissioner's wife from the account of another business with which Freeman was involved. Then, in July, Freeman issued a second, $5,000 check to the commissioner from the account of a third business, the complaint said.

The city commission approved the development agreements in July and August 2006, according to the complaint, and Freeman later reserved a "choice" lot in one of the subdivisions.

In March 2007, the complaint said, Freeman had an assistant draw and cash a check for $9,000 and deliver the money to the Junction City commissioner at a rest stop between Junction City and Topeka.

It is against federal law to knowingly structure transactions to be less than $10,000 so that a financial institution won't report it to the government, which is required.

Much of the housing development remains unfinished. Because of the frequency of soldiers deploying to Iraq and Afghanistan over the past six years, many soldiers and their families haven't moved to the region and found permanent housing. However, the 1st Infantry Division is expecting another influx of about 2,500 soldiers in the coming months, which Army officials said should create a need for more homes and apartments

http://www.kansas.com/topstories/story/873565.html

Etheredge Update: Hearing July 20th, 2009

Thomas Etheredge hearing set for July 20

BY BILL WILSON

The Wichita Eagle

Wild West World founder Thomas Etheredge's oft-delayed preliminary hearing has been scheduled for 2 p.m. July 20 in Sedgwick County District Court.

Etheredge, 54, is charged with 10 counts of securities fraud for his activities raising private capital from 2005 to 2007 for the struggling theme park.

He opened the park on May 5, 2007, and closed it on July 9, 2007.

He remains in the Sedgwick County Jail on $1 million bond.

-----------

Bloggers Note: What! Still in jail? Cant even afford the lousy one-mil to spring himself out? Maybe he should ask ole' Bernie if he could go his bail. lol So here is another story of just another "poor little" rich man who got caught with his fingers in the cookie jar and lost his fortune.....as the song (and my mother used to) say, "riding high in april, shot down in may." Not to forget......

"Oh what tangled webs we weave when at first we practice to decieve."

S. Sphere

http://www.kansas.com/topstories/story/874154.html#none

BY BILL WILSON

The Wichita Eagle

Wild West World founder Thomas Etheredge's oft-delayed preliminary hearing has been scheduled for 2 p.m. July 20 in Sedgwick County District Court.

Etheredge, 54, is charged with 10 counts of securities fraud for his activities raising private capital from 2005 to 2007 for the struggling theme park.

He opened the park on May 5, 2007, and closed it on July 9, 2007.

He remains in the Sedgwick County Jail on $1 million bond.

-----------

Bloggers Note: What! Still in jail? Cant even afford the lousy one-mil to spring himself out? Maybe he should ask ole' Bernie if he could go his bail. lol So here is another story of just another "poor little" rich man who got caught with his fingers in the cookie jar and lost his fortune.....as the song (and my mother used to) say, "riding high in april, shot down in may." Not to forget......

"Oh what tangled webs we weave when at first we practice to decieve."

S. Sphere

http://www.kansas.com/topstories/story/874154.html#none

Porker of the Month: Rep. Maxine Waters

Citizens Against Government Waste (CAGW) has named

Rep. Maxine Waters (D-Calif.) Porker of the Month for provoking a tussle with House Appropriations Committee Chairman David Obey (D-Wis.) over her intention to obtain an earmark for the Maxine Waters Employment Preparation Center, a facility within the Los Angeles school system. Rep. Waters’ grandiose gesture is a reminder that Congress still has not banned the practice of earmarking taxpayer funds for pork projects, including monuments, academic facilities, roads, airports and water projects, that are named after themselves. Rep. Obey appears to grasp that such narcissistic expenditures fuel the negative image of Congress and is proactively trying to keep them out of the fiscal year 2010 appropriations bills, particularly since Rep. Michael McCaul (R-Texas) has successfully attached amendments to ban such projects to several appropriations bills. To placate Rep. Waters' need for recognition and the desire of some members of Congress to leave behind a living legacy, even one that is built with pork-barrel earmarks, CAGW happily obliges, endowing Rep. Waters with the coveted June Porker of the Month.

Click on title above to go to "Citizens Against Gov't Waste" website to read more about the Porker of the Month Club and while you are there, be sure to visit the Porker Hall of Shame page;

http://www.cagw.org/site/PageServer?pagename=news_porkerofthemonth

WSU tuition to rise 8.5%; stimulus to offset some

BY Jeannine Koranda

Eagle Topeka bureau

TOPEKA — Students at state universities will see their tuition increase next year between 3.9 and 8.5 percent.

Wichita State University topped the list with an 8.5 percent rise, bringing tuition for an undergraduate student taking 15 hours to $2,248 a semester. That's an increase of $176 a semester.

The school plans to use federal stimulus money to help offset the increase.

"I don't like it," said Dale Neese, a second-year nursing student, referring to the increase. "There's nothing I can do about it."

WSU president Donald Beggs said the school will use $1.5 million in federal stimulus money to pay in-state students an automatic scholarship.

The money is part of $4.4 million the university will receive from the federal stimulus package. The remainder will go to maintenance projects that have been deferred because of the state budget crunch.

WSU is still working out the details but hopes to give in-state undergraduate students a scholarship of about $5.25 to $5.50 a credit hour.

Taking that scholarship into account, in-state students would pay about 4.5 percent more for tuition next year.

That's less than the 6 percent increase the school had originally requested in May.

"This is actually a better situation for our students," Beggs said.

On Thursday, the Board of Regents approved WSU's tuition raise as well as increases for the other five state universities.

Kansas State University's per-semester tuition rose the smallest percentage at 3.9 percent, meaning students will pay $3,093 for a semester, up from $2,977.

University of Kansas in-state tuition will jump 6 percent next year to $3,283 per semester, up from $3,097.

The school's "compact" tuition plan will increase 7 percent to $3,679. Under the program, students pay the same tuition for four years, but they start at a higher rate than standard tuition.

Despite the tuition increases and federal stimulus dollars, leaders at the state's universities have said the funds won't cover the cuts they've received.

WSU has already eliminated faculty, part-time lecturers and support staff to accommodate budget cuts, Beggs said. The tuition increase won't bring those back but could help prevent further cuts.

Donna Shank, the outgoing chairwoman of the Board of Regents, opposed revised tuition increases such as Wichita's proposal.

"I was not thrilled with the amounts from last month's meeting, so it really didn't make me inclined to approve even higher ones," she said after the meeting.

During the meeting, Shank noted that the state's budget woes were tied to Kansans' decreasing incomes and layoffs.

"People are losing their jobs and are not able to pay for school now more than ever," she said.

Other regents noted that the increases were needed to ensure state schools offered a quality education.

"It's a great buy to go to school in Kansas, in all of our regent schools, but we need more money," said regent Dan Lykins.

Regent Christine Downey-Schmidt saw quality higher education as part of the state's solution to the current economic woes.

"The only way this state will lower taxes and increase the tax base is if we educate students with a higher level of skills," she said.

http://www.kansas.com/topstories/story/868436.html

Eagle Topeka bureau

TOPEKA — Students at state universities will see their tuition increase next year between 3.9 and 8.5 percent.

Wichita State University topped the list with an 8.5 percent rise, bringing tuition for an undergraduate student taking 15 hours to $2,248 a semester. That's an increase of $176 a semester.

The school plans to use federal stimulus money to help offset the increase.

"I don't like it," said Dale Neese, a second-year nursing student, referring to the increase. "There's nothing I can do about it."

WSU president Donald Beggs said the school will use $1.5 million in federal stimulus money to pay in-state students an automatic scholarship.

The money is part of $4.4 million the university will receive from the federal stimulus package. The remainder will go to maintenance projects that have been deferred because of the state budget crunch.

WSU is still working out the details but hopes to give in-state undergraduate students a scholarship of about $5.25 to $5.50 a credit hour.

Taking that scholarship into account, in-state students would pay about 4.5 percent more for tuition next year.

That's less than the 6 percent increase the school had originally requested in May.

"This is actually a better situation for our students," Beggs said.

On Thursday, the Board of Regents approved WSU's tuition raise as well as increases for the other five state universities.

Kansas State University's per-semester tuition rose the smallest percentage at 3.9 percent, meaning students will pay $3,093 for a semester, up from $2,977.

University of Kansas in-state tuition will jump 6 percent next year to $3,283 per semester, up from $3,097.

The school's "compact" tuition plan will increase 7 percent to $3,679. Under the program, students pay the same tuition for four years, but they start at a higher rate than standard tuition.

Despite the tuition increases and federal stimulus dollars, leaders at the state's universities have said the funds won't cover the cuts they've received.

WSU has already eliminated faculty, part-time lecturers and support staff to accommodate budget cuts, Beggs said. The tuition increase won't bring those back but could help prevent further cuts.

Donna Shank, the outgoing chairwoman of the Board of Regents, opposed revised tuition increases such as Wichita's proposal.

"I was not thrilled with the amounts from last month's meeting, so it really didn't make me inclined to approve even higher ones," she said after the meeting.

During the meeting, Shank noted that the state's budget woes were tied to Kansans' decreasing incomes and layoffs.

"People are losing their jobs and are not able to pay for school now more than ever," she said.

Other regents noted that the increases were needed to ensure state schools offered a quality education.

"It's a great buy to go to school in Kansas, in all of our regent schools, but we need more money," said regent Dan Lykins.

Regent Christine Downey-Schmidt saw quality higher education as part of the state's solution to the current economic woes.

"The only way this state will lower taxes and increase the tax base is if we educate students with a higher level of skills," she said.

http://www.kansas.com/topstories/story/868436.html

Goldman Manipulation: The Rats Respond

From Jr. Deputy Accountant;

Posted: 28 Jun 2009 09:20 PM PDT

By now you've heard of Matt Taibbi's Rolling Stone piece on rampant Goldman manipulation. Goldman certainly has.

Marching out the clowns to Reuters' Felix Salmon, GS insists that everything it does is above the board under current regulations. Well of course it is. We argue that the regulations are built with Goldman in mind, idiots. Great argument though from GS' Lucas van Praag:

Having read your piece about Matt Taibbi’s article in Rolling Stone, I wanted to set the record straight, particularly about “regulatory capture”.

Background: Under the Commodity Exchange Act, the CFTC (for agricultural futures) or exchanges (for energy/metals futures) established speculative position limits. As much as anything else, the limits are intended to prevent market imbalances that would result in failures of the ultimate settlement of the futures contracts.

The CFTC rules exempt “bona fide hedging” transactions from these spec limits. A bona fide hedging transaction was originally understood to be an actual producer/consumer who was selling or buying the underlying commodity and wanted to hedge risk of the price moving up or down. In 1991, J. Aron wanted to enter into one of its first commodity index swap transactions with a pension fund. In order to hedge our exposure on the swap, we wanted to buy futures on the commodities in the index. We applied to the CFTC for exemption from position limits on the theory that even if we weren’t buying the commodity, we had offsetting exposure (in our swap) that put us in a balanced/price neutral position. The CFTC agreed with our argument and granted exemption. By the way, each of the then Commissioners signed off, so it was hardly a secret…

The CFTC published a report in August 2008, indicating that there were few instances when entities would have exceeded spec limits, had they applied to OTC positions.

Yesterday, as you probably know, the Senate Permanent Sub-Committee on Investigations issued a report on wheat futures in which they concluded that divergence between prices for actual wheat v. wheat futures is being caused solely by index investment. The Committee’s recommendation is that hedge exemptions which support indices should be phased out.

Not quite so recently, the elimination of Glass Steagall doesn’t exactly provide a robust argument for regulatory capture. And Taibbi’s bubble case doesn’t stand up to serious scrutiny either. To give just two examples, even with the worst will in the world, the blame for creating the internet bubble cannot credibly be laid at our door, and we could hardly be described as having been a major player in the mortgage market, unlike so many of our current and former competitors.

Taibbi’s article is a compilation of just about every conspiracy theory ever dreamed up about Goldman Sachs, but what real substance is there to support the theories?

We reject the assertion that we are inflators of bubbles and profiteers in busts, and we are painfully conscious of the importance of being a force for good.

And so Goldman shrinks off, defeated, allowing JPM to reign as top rat?

From Jr. Deputy Accountant;

Posted: 28 Jun 2009 09:20 PM PDT

By now you've heard of Matt Taibbi's Rolling Stone piece on rampant Goldman manipulation. Goldman certainly has.

Marching out the clowns to Reuters' Felix Salmon, GS insists that everything it does is above the board under current regulations. Well of course it is. We argue that the regulations are built with Goldman in mind, idiots. Great argument though from GS' Lucas van Praag:

Having read your piece about Matt Taibbi’s article in Rolling Stone, I wanted to set the record straight, particularly about “regulatory capture”.

Background: Under the Commodity Exchange Act, the CFTC (for agricultural futures) or exchanges (for energy/metals futures) established speculative position limits. As much as anything else, the limits are intended to prevent market imbalances that would result in failures of the ultimate settlement of the futures contracts.

The CFTC rules exempt “bona fide hedging” transactions from these spec limits. A bona fide hedging transaction was originally understood to be an actual producer/consumer who was selling or buying the underlying commodity and wanted to hedge risk of the price moving up or down. In 1991, J. Aron wanted to enter into one of its first commodity index swap transactions with a pension fund. In order to hedge our exposure on the swap, we wanted to buy futures on the commodities in the index. We applied to the CFTC for exemption from position limits on the theory that even if we weren’t buying the commodity, we had offsetting exposure (in our swap) that put us in a balanced/price neutral position. The CFTC agreed with our argument and granted exemption. By the way, each of the then Commissioners signed off, so it was hardly a secret…

The CFTC published a report in August 2008, indicating that there were few instances when entities would have exceeded spec limits, had they applied to OTC positions.

Yesterday, as you probably know, the Senate Permanent Sub-Committee on Investigations issued a report on wheat futures in which they concluded that divergence between prices for actual wheat v. wheat futures is being caused solely by index investment. The Committee’s recommendation is that hedge exemptions which support indices should be phased out.

Not quite so recently, the elimination of Glass Steagall doesn’t exactly provide a robust argument for regulatory capture. And Taibbi’s bubble case doesn’t stand up to serious scrutiny either. To give just two examples, even with the worst will in the world, the blame for creating the internet bubble cannot credibly be laid at our door, and we could hardly be described as having been a major player in the mortgage market, unlike so many of our current and former competitors.

Taibbi’s article is a compilation of just about every conspiracy theory ever dreamed up about Goldman Sachs, but what real substance is there to support the theories?

We reject the assertion that we are inflators of bubbles and profiteers in busts, and we are painfully conscious of the importance of being a force for good.

And so Goldman shrinks off, defeated, allowing JPM to reign as top rat?

Monday, June 29, 2009

Another Dirty Politician Exposed: Monica Conyers Off to Jail?

Monica Conyers,

wife of powerful Democratic congressman John Conyers,

resigned from the Detroit city council Monday after admitting she took cash bribes in exchange for her vote on a city contract.

Monday, June 29, 2009

DETROIT -- Detroit city councilwoman Monica Conyers has resigned from office after admitting she took cash bribes from a Houston-based company in exchange for her vote on a lucrative city contract.

Conyers, the wife of powerful Democratic congressman John Conyers, submitted her letter of resignation to the city clerk's office Monday. Her resignation takes effect July 6.

The 44-year-old Conyers admitted she took money from Synagro Technologies in 2007 in exchange for her vote on a city sludge contract. Prosecutors said John Conyers knew nothing of his wife's wrongdoing.

Monica Conyers faces up to five years in prison at her sentencing. She did not immediately respond to a phone message Monday seeking comment.

http://www.foxnews.com/politics/2009/06/29/monica-conyers-resigns-detroit-city-council-following-bribery-conviction/

wife of powerful Democratic congressman John Conyers,

resigned from the Detroit city council Monday after admitting she took cash bribes in exchange for her vote on a city contract.

Monday, June 29, 2009

DETROIT -- Detroit city councilwoman Monica Conyers has resigned from office after admitting she took cash bribes from a Houston-based company in exchange for her vote on a lucrative city contract.

Conyers, the wife of powerful Democratic congressman John Conyers, submitted her letter of resignation to the city clerk's office Monday. Her resignation takes effect July 6.

The 44-year-old Conyers admitted she took money from Synagro Technologies in 2007 in exchange for her vote on a city sludge contract. Prosecutors said John Conyers knew nothing of his wife's wrongdoing.

Monica Conyers faces up to five years in prison at her sentencing. She did not immediately respond to a phone message Monday seeking comment.

http://www.foxnews.com/politics/2009/06/29/monica-conyers-resigns-detroit-city-council-following-bribery-conviction/

Bernard Madoff sentenced to 150 years for vast fraud, likely to remain imprisoned for life

By TOM HAYS and LARRY NEUMEISTER AP

Last update: June 29, 2009 - 3:32 PM

NEW YORK - A federal judge rejected Bernard Madoff's plea for leniency Monday, sentencing the 71-year-old swindler to spend the rest of his life in prison for an "extraordinarily evil" fraud that took a "staggering toll" on thousands of victims.

U.S. District Judge Denny Chin cited the unprecedented nature of the multibillion-dollar fraud as he sentenced Madoff to the maximum of 150 years in prison, a term comparable only to those given in the past to terrorists, traitors and the most violent criminals. There is no parole in federal prison so Madoff will most likely die there.

"Here the message must be sent that Mr. Madoff's crimes were extraordinarily evil and that this kind of manipulation of the system is not just a bloodless crime that takes place on paper, but one instead that takes a staggering toll," said Chin.

The massive Ponzi scheme run by Madoff since at least the early 1990s demolished the life savings of thousands of people, wrecked charities and shook confidence in the U.S. financial system.

The sentence reflected a growing tendency over the last decade to give white-collar criminals lengthy prison terms. But nothing before has come close to the time given Madoff — an outcome that prompted scattered applause and whoops from a group of burned former clients in a packed Manhattan courtroom.

The judge noted that not one of the more than 100 letters he received supported Madoff or described any good deeds he had done.

"The absence of such support is telling," Chin said.

Chin announced the sentence with Madoff standing at the defense table, wearing a dark suit, white shirt and a tie, and looking thinner than his last court appearance in March. He gave no noticeable reaction when the sentence was announced.

He also showed no emotion though he looked down earlier in the hearing as he listened to nine victims spend nearly an hour venting their despair and anger. Some openly wept or raised their voices, labeling Madoff a "monster," "a true beast" and an "evil low-life."

"Life has been a living hell. It feels like the nightmare we can't wake from," said Carla Hirshhorn.

"He stole from the rich. He stole from the poor. He stole from the in between. He had no values," said Tom Fitzmaurice. "He cheated his victims out of their money so he and his wife Ruth could live a life of luxury beyond belief."

Dominic Ambrosino called it an "indescribably heinous crime" and urged a long prison sentence so he "will know he is imprisoned in much the same way he imprisoned us and others."

He added: "In a sense, I would like somebody in the court today to tell me how long is my sentence."

Sheryl Weinstein, a certified accountant, said Madoff was effective because he seemed normal.

"But underneath the facade is a true beast," she said. "He should not be given the opportunity to blend so seamlessly into our society again."

When asked by the judge whether he had anything to say, Madoff slowly stood, leaned forward on the defense table and spoke in a monotone for about 10 minutes. At various times, he referred to his monumental fraud as a "problem," "an error of judgment" and "a tragic mistake."

He claimed he and his wife were tormented, saying she "cries herself to sleep every night, knowing all the pain and suffering I have caused," he said. "That's something I live with, as well."

He then finally looked at the victims lining the first row of the gallery.

"I will turn and face you," he said mechanically. "I'm sorry. I know that doesn't help you."

His immediately family did not attend the sentencing. But Ruth Madoff — often a target of victims' scorn since her husband's arrest — broke her silence afterward by issuing a statement through her lawyer. She said she, too, had been misled.

"I am embarrassed and ashamed," she said. "Like everyone else, I feel betrayed and confused. The man who committed this horrible fraud is not the man whom I have known for all these years."

Prosecutor Lisa Baroni said Madoff deserved a life sentence because he "stole ruthlessly and without remorse."

Outside court, some victims said it was time to move on.

"He stole my money. He didn't steal my life," said Ron Weinstein, whose wife spoke in court. "I'm not going to sit around and mope about it."

Madoff, who has been jailed since March, already has taken a severe financial hit: Last week, a judge issued a preliminary $171 billion forfeiture order stripping Madoff of all his personal property, including real estate, investments, and $80 million in assets his wife Ruth had claimed were hers. The order left her with $2.5 million that couldn't be tied to the fraud.

The terms require the Madoffs to sell a $7 million Manhattan apartment where Ruth Madoff still lives. An $11 million estate in Palm Beach, Fla., a $4 million home in Montauk and a $2.2 million boat will be put on the market as well.

Before Madoff became a symbol of Wall Street greed, he earned a reputation as a trusted money manager with a Midas touch. Even as the market fluctuated, clients of his secretive investment advisory business — from Florida retirees to celebrities such as Steven Spielberg, actor Kevin Bacon and Hall of Fame pitcher Sandy Koufax — for decades enjoyed steady double-digit returns.

But late last year, Madoff made a dramatic confession: Authorities say he pulled his sons aside and told them it was "all just one big lie."

Madoff pleaded guilty in March to securities fraud and other charges, saying he was "deeply sorry and ashamed." He insisted that he acted alone, describing a separate wholesale stock-trading firm run by his sons and brother as honest and legitimate.

Aside from an accountant accused of cooking Madoff's books, no one else has been criminally charged. But the family, including his wife, and brokerage firms who recruited investors have come under intense scrutiny by the FBI, regulators and a court-appointed trustee overseeing the liquidation of Madoff's assets.

The trustee and prosecutors have sought to go after assets to compensate thousands of victims who have filed claims against Madoff. How much is available to pay them remains unknown, though it's expected to be only a fraction of the astronomical losses associated with the fraud.

The $171 billion forfeiture figure used by prosecutors merely mirrors the amount they estimate that, over decades, "flowed into the principal account to perpetrate the Ponzi scheme." The statements sent to investors showing their accounts were worth as much as $65 billion were fiction.

The investigation has found that in reality, Madoff never made any investments, instead using the money from new investors to pay returns to existing clients — and to finance a lavish lifestyle for his family. The actual loss so far has been put at $13.2 billion. But the judge said that was a conservative estimate and noted that even Madoff told his sons in December it was a $50 billion fraud.

He also showed no emotion though he looked down earlier in the hearing as he listened to nine victims spend nearly an hour venting their despair and anger. Some openly wept or raised their voices, labeling Madoff a "monster," "a true beast" and an "evil low-life."

"Life has been a living hell. It feels like the nightmare we can't wake from," said Carla Hirshhorn.

"He stole from the rich. He stole from the poor. He stole from the in between. He had no values," said Tom Fitzmaurice. "He cheated his victims out of their money so he and his wife Ruth could live a life of luxury beyond belief."

Dominic Ambrosino called it an "indescribably heinous crime" and urged a long prison sentence so he "will know he is imprisoned in much the same way he imprisoned us and others."

He added: "In a sense, I would like somebody in the court today to tell me how long is my sentence."

Sheryl Weinstein, a certified accountant, said Madoff was effective because he seemed normal.

"But underneath the facade is a true beast," she said. "He should not be given the opportunity to blend so seamlessly into our society again."

When asked by the judge whether he had anything to say, Madoff slowly stood, leaned forward on the defense table and spoke in a monotone for about 10 minutes. At various times, he referred to his monumental fraud as a "problem," "an error of judgment" and "a tragic mistake."

He claimed he and his wife were tormented, saying she "cries herself to sleep every night, knowing all the pain and suffering I have caused," he said. "That's something I live with, as well."

He then finally looked at the victims lining the first row of the gallery.

"I will turn and face you," he said mechanically. "I'm sorry. I know that doesn't help you."

His immediately family did not attend the sentencing. But Ruth Madoff — often a target of victims' scorn since her husband's arrest — broke her silence afterward by issuing a statement through her lawyer. She said she, too, had been misled.

"I am embarrassed and ashamed," she said. "Like everyone else, I feel betrayed and confused. The man who committed this horrible fraud is not the man whom I have known for all these years."

Prosecutor Lisa Baroni said Madoff deserved a life sentence because he "stole ruthlessly and without remorse."

Outside court, some victims said it was time to move on.

"He stole my money. He didn't steal my life," said Ron Weinstein, whose wife spoke in court. "I'm not going to sit around and mope about it."

Madoff, who has been jailed since March, already has taken a severe financial hit: Last week, a judge issued a preliminary $171 billion forfeiture order stripping Madoff of all his personal property, including real estate, investments, and $80 million in assets his wife Ruth had claimed were hers. The order left her with $2.5 million that couldn't be tied to the fraud.

The terms require the Madoffs to sell a $7 million Manhattan apartment where Ruth Madoff still lives. An $11 million estate in Palm Beach, Fla., a $4 million home in Montauk and a $2.2 million boat will be put on the market as well.

Before Madoff became a symbol of Wall Street greed, he earned a reputation as a trusted money manager with a Midas touch. Even as the market fluctuated, clients of his secretive investment advisory business — from Florida retirees to celebrities such as Steven Spielberg, actor Kevin Bacon and Hall of Fame pitcher Sandy Koufax — for decades enjoyed steady double-digit returns.

But late last year, Madoff made a dramatic confession: Authorities say he pulled his sons aside and told them it was "all just one big lie."

Madoff pleaded guilty in March to securities fraud and other charges, saying he was "deeply sorry and ashamed." He insisted that he acted alone, describing a separate wholesale stock-trading firm run by his sons and brother as honest and legitimate.

Aside from an accountant accused of cooking Madoff's books, no one else has been criminally charged. But the family, including his wife, and brokerage firms who recruited investors have come under intense scrutiny by the FBI, regulators and a court-appointed trustee overseeing the liquidation of Madoff's assets.

The trustee and prosecutors have sought to go after assets to compensate thousands of victims who have filed claims against Madoff. How much is available to pay them remains unknown, though it's expected to be only a fraction of the astronomical losses associated with the fraud.

The $171 billion forfeiture figure used by prosecutors merely mirrors the amount they estimate that, over decades, "flowed into the principal account to perpetrate the Ponzi scheme." The statements sent to investors showing their accounts were worth as much as $65 billion were fiction.

The investigation has found that in reality, Madoff never made any investments, instead using the money from new investors to pay returns to existing clients — and to finance a lavish lifestyle for his family. The actual loss so far has been put at $13.2 billion. But the judge said that was a conservative estimate and noted that even Madoff told his sons in December it was a $50 billion fraud.

Click on title above to see article and leave comments;

http://www.startribune.com/business/49424027.html?elr=KArksLckD8EQDUoaEyqyP4O:DW3ckUiD3aPc:_Yyc:aUUX

Heres mine;

Gamblers Lament & Retributative Justice

As for the "Crying Victims," ..call me cold-hearted but I dont feel sorry for gamblers who lose their money. Also, who are these "poor" he supposedly robbed? I dont know of any poor folk (and I do know alot of them as am one myself) who can afford to play the market. They generally stick to church bingos, state lotteries, and local horse & dogs tracks and the like, to gamble away their money. I mean common now, really,...who ever heard of a truely poor person with a "portfolio" of any kind? In any case, I do not care for or feel sorry for the "poor little" sobbing-rich who dont give a dam about the rest of the world, regardless. If bad things happen to them, like going broke, being "found-out," or dying early, I attribute it to retributative justice and applaud it.

Another thought. I wonder if any of these "victims" will be eligible for compensation through any Crime Victims Assistance Program? If so, I wonder who will pay for it (yeah right)

posted by madangry on Jun. 29, 09 at 4:38 PM |

Last update: June 29, 2009 - 3:32 PM

NEW YORK - A federal judge rejected Bernard Madoff's plea for leniency Monday, sentencing the 71-year-old swindler to spend the rest of his life in prison for an "extraordinarily evil" fraud that took a "staggering toll" on thousands of victims.

U.S. District Judge Denny Chin cited the unprecedented nature of the multibillion-dollar fraud as he sentenced Madoff to the maximum of 150 years in prison, a term comparable only to those given in the past to terrorists, traitors and the most violent criminals. There is no parole in federal prison so Madoff will most likely die there.

"Here the message must be sent that Mr. Madoff's crimes were extraordinarily evil and that this kind of manipulation of the system is not just a bloodless crime that takes place on paper, but one instead that takes a staggering toll," said Chin.

The massive Ponzi scheme run by Madoff since at least the early 1990s demolished the life savings of thousands of people, wrecked charities and shook confidence in the U.S. financial system.

The sentence reflected a growing tendency over the last decade to give white-collar criminals lengthy prison terms. But nothing before has come close to the time given Madoff — an outcome that prompted scattered applause and whoops from a group of burned former clients in a packed Manhattan courtroom.

The judge noted that not one of the more than 100 letters he received supported Madoff or described any good deeds he had done.

"The absence of such support is telling," Chin said.

Chin announced the sentence with Madoff standing at the defense table, wearing a dark suit, white shirt and a tie, and looking thinner than his last court appearance in March. He gave no noticeable reaction when the sentence was announced.

He also showed no emotion though he looked down earlier in the hearing as he listened to nine victims spend nearly an hour venting their despair and anger. Some openly wept or raised their voices, labeling Madoff a "monster," "a true beast" and an "evil low-life."

"Life has been a living hell. It feels like the nightmare we can't wake from," said Carla Hirshhorn.

"He stole from the rich. He stole from the poor. He stole from the in between. He had no values," said Tom Fitzmaurice. "He cheated his victims out of their money so he and his wife Ruth could live a life of luxury beyond belief."

Dominic Ambrosino called it an "indescribably heinous crime" and urged a long prison sentence so he "will know he is imprisoned in much the same way he imprisoned us and others."

He added: "In a sense, I would like somebody in the court today to tell me how long is my sentence."

Sheryl Weinstein, a certified accountant, said Madoff was effective because he seemed normal.

"But underneath the facade is a true beast," she said. "He should not be given the opportunity to blend so seamlessly into our society again."

When asked by the judge whether he had anything to say, Madoff slowly stood, leaned forward on the defense table and spoke in a monotone for about 10 minutes. At various times, he referred to his monumental fraud as a "problem," "an error of judgment" and "a tragic mistake."

He claimed he and his wife were tormented, saying she "cries herself to sleep every night, knowing all the pain and suffering I have caused," he said. "That's something I live with, as well."

He then finally looked at the victims lining the first row of the gallery.

"I will turn and face you," he said mechanically. "I'm sorry. I know that doesn't help you."

His immediately family did not attend the sentencing. But Ruth Madoff — often a target of victims' scorn since her husband's arrest — broke her silence afterward by issuing a statement through her lawyer. She said she, too, had been misled.

"I am embarrassed and ashamed," she said. "Like everyone else, I feel betrayed and confused. The man who committed this horrible fraud is not the man whom I have known for all these years."

Prosecutor Lisa Baroni said Madoff deserved a life sentence because he "stole ruthlessly and without remorse."

Outside court, some victims said it was time to move on.

"He stole my money. He didn't steal my life," said Ron Weinstein, whose wife spoke in court. "I'm not going to sit around and mope about it."

Madoff, who has been jailed since March, already has taken a severe financial hit: Last week, a judge issued a preliminary $171 billion forfeiture order stripping Madoff of all his personal property, including real estate, investments, and $80 million in assets his wife Ruth had claimed were hers. The order left her with $2.5 million that couldn't be tied to the fraud.

The terms require the Madoffs to sell a $7 million Manhattan apartment where Ruth Madoff still lives. An $11 million estate in Palm Beach, Fla., a $4 million home in Montauk and a $2.2 million boat will be put on the market as well.

Before Madoff became a symbol of Wall Street greed, he earned a reputation as a trusted money manager with a Midas touch. Even as the market fluctuated, clients of his secretive investment advisory business — from Florida retirees to celebrities such as Steven Spielberg, actor Kevin Bacon and Hall of Fame pitcher Sandy Koufax — for decades enjoyed steady double-digit returns.

But late last year, Madoff made a dramatic confession: Authorities say he pulled his sons aside and told them it was "all just one big lie."

Madoff pleaded guilty in March to securities fraud and other charges, saying he was "deeply sorry and ashamed." He insisted that he acted alone, describing a separate wholesale stock-trading firm run by his sons and brother as honest and legitimate.

Aside from an accountant accused of cooking Madoff's books, no one else has been criminally charged. But the family, including his wife, and brokerage firms who recruited investors have come under intense scrutiny by the FBI, regulators and a court-appointed trustee overseeing the liquidation of Madoff's assets.

The trustee and prosecutors have sought to go after assets to compensate thousands of victims who have filed claims against Madoff. How much is available to pay them remains unknown, though it's expected to be only a fraction of the astronomical losses associated with the fraud.

The $171 billion forfeiture figure used by prosecutors merely mirrors the amount they estimate that, over decades, "flowed into the principal account to perpetrate the Ponzi scheme." The statements sent to investors showing their accounts were worth as much as $65 billion were fiction.

The investigation has found that in reality, Madoff never made any investments, instead using the money from new investors to pay returns to existing clients — and to finance a lavish lifestyle for his family. The actual loss so far has been put at $13.2 billion. But the judge said that was a conservative estimate and noted that even Madoff told his sons in December it was a $50 billion fraud.

He also showed no emotion though he looked down earlier in the hearing as he listened to nine victims spend nearly an hour venting their despair and anger. Some openly wept or raised their voices, labeling Madoff a "monster," "a true beast" and an "evil low-life."

"Life has been a living hell. It feels like the nightmare we can't wake from," said Carla Hirshhorn.

"He stole from the rich. He stole from the poor. He stole from the in between. He had no values," said Tom Fitzmaurice. "He cheated his victims out of their money so he and his wife Ruth could live a life of luxury beyond belief."

Dominic Ambrosino called it an "indescribably heinous crime" and urged a long prison sentence so he "will know he is imprisoned in much the same way he imprisoned us and others."

He added: "In a sense, I would like somebody in the court today to tell me how long is my sentence."

Sheryl Weinstein, a certified accountant, said Madoff was effective because he seemed normal.

"But underneath the facade is a true beast," she said. "He should not be given the opportunity to blend so seamlessly into our society again."

When asked by the judge whether he had anything to say, Madoff slowly stood, leaned forward on the defense table and spoke in a monotone for about 10 minutes. At various times, he referred to his monumental fraud as a "problem," "an error of judgment" and "a tragic mistake."

He claimed he and his wife were tormented, saying she "cries herself to sleep every night, knowing all the pain and suffering I have caused," he said. "That's something I live with, as well."

He then finally looked at the victims lining the first row of the gallery.

"I will turn and face you," he said mechanically. "I'm sorry. I know that doesn't help you."

His immediately family did not attend the sentencing. But Ruth Madoff — often a target of victims' scorn since her husband's arrest — broke her silence afterward by issuing a statement through her lawyer. She said she, too, had been misled.

"I am embarrassed and ashamed," she said. "Like everyone else, I feel betrayed and confused. The man who committed this horrible fraud is not the man whom I have known for all these years."

Prosecutor Lisa Baroni said Madoff deserved a life sentence because he "stole ruthlessly and without remorse."

Outside court, some victims said it was time to move on.

"He stole my money. He didn't steal my life," said Ron Weinstein, whose wife spoke in court. "I'm not going to sit around and mope about it."

Madoff, who has been jailed since March, already has taken a severe financial hit: Last week, a judge issued a preliminary $171 billion forfeiture order stripping Madoff of all his personal property, including real estate, investments, and $80 million in assets his wife Ruth had claimed were hers. The order left her with $2.5 million that couldn't be tied to the fraud.

The terms require the Madoffs to sell a $7 million Manhattan apartment where Ruth Madoff still lives. An $11 million estate in Palm Beach, Fla., a $4 million home in Montauk and a $2.2 million boat will be put on the market as well.

Before Madoff became a symbol of Wall Street greed, he earned a reputation as a trusted money manager with a Midas touch. Even as the market fluctuated, clients of his secretive investment advisory business — from Florida retirees to celebrities such as Steven Spielberg, actor Kevin Bacon and Hall of Fame pitcher Sandy Koufax — for decades enjoyed steady double-digit returns.