Saturday, October 29, 2011

Thursday, October 27, 2011

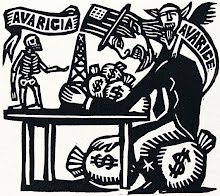

Meet the 0.01 Percent: War Profiteers

While the growing Occupy movement targets the 1 Percent, we want to introduce you to the elite among the gang of the superrich: the war profiteers. Help give your local Occupy group the tools they need to fight corporate power by sharing our new video with them and posting it on your social networks.

War industry CEOs make tens of millions of dollars a year, putting them in the top 0.01 percent of income earners in the U.S.

•Northrop Grumman CEO Wes Bush made $22.84 million last year.

•Lockheed Martin CEO Robert Stevens made $21.89 million.

•Boeing CEO James McNerney: $19.4 million.

These guys use their corporations’ massive lobbying dollars to keep their job-killing gravy train rolling. Last year, their companies spent a whopping $46 million on lobbying, corrupting our politics and ensuring that their bank accounts continue to fatten at our expense. These executives are some of the main reasons why we're wasting so much on war instead of rebuilding our own nation here at home.

We have been deeply inspired by the incredible activism of the Occupy movement, so we created this new video to help highlight a piece of their messaging that's essential to getting our country back on track: We have to end wars for profit.

Help us expose these war profiteers for what they are: the 0.01 Percent. Find your local Occupy group on Facebook and ask them to show our latest video at their events and on their Livestreams. Then, visit our Facebook page to tell us how it went!

Sincerely,

Derrick Crowe, Robert Greenwald

and the Brave New Foundation team

War industry CEOs make tens of millions of dollars a year, putting them in the top 0.01 percent of income earners in the U.S.

•Northrop Grumman CEO Wes Bush made $22.84 million last year.

•Lockheed Martin CEO Robert Stevens made $21.89 million.

•Boeing CEO James McNerney: $19.4 million.

These guys use their corporations’ massive lobbying dollars to keep their job-killing gravy train rolling. Last year, their companies spent a whopping $46 million on lobbying, corrupting our politics and ensuring that their bank accounts continue to fatten at our expense. These executives are some of the main reasons why we're wasting so much on war instead of rebuilding our own nation here at home.

We have been deeply inspired by the incredible activism of the Occupy movement, so we created this new video to help highlight a piece of their messaging that's essential to getting our country back on track: We have to end wars for profit.

Help us expose these war profiteers for what they are: the 0.01 Percent. Find your local Occupy group on Facebook and ask them to show our latest video at their events and on their Livestreams. Then, visit our Facebook page to tell us how it went!

Sincerely,

Derrick Crowe, Robert Greenwald

and the Brave New Foundation team

Thursday, October 20, 2011

Wednesday, October 19, 2011

Tuesday, October 18, 2011

The Feds Secret Bailouts

WHO IS KEEPING TRACK OF THE TRILLIONS?

Join "The Federal Reserve Awareness Project"

http://dailybail.com/home/there-are-no-words-to-describe-the-following-part-ii.html

Join "The Federal Reserve Awareness Project"

http://dailybail.com/home/there-are-no-words-to-describe-the-following-part-ii.html

"Platinum Citizenship," or What Geithner Did

About a decade ago, I read an article in The Onion, "U.S. Offers PlatinumPlus Preferred Citizenship". Apparently, Tim Geithner did too, because from 2007-2011, this is the policy framework that he designed and executed, first as President of the New York Federal Reserve, and then as Treasury Secretary. Now, unequal democracy is not a new story, in many ways it's systemic and goes back hundreds of years. But what we're going to see in part this week is how Geithner deserves special recognition as sort of this decade's champion of making this system more explicit and entrenched.

What we're going to see this week, when the Government Accountability Office releases a more detailed version of an audit of the Federal Reserve's actions during that period, is more details on how this system worked. So let me give you some context on what the Fed bailouts meant, the details to match the persuasive message of the protesters in Zuccotti Park and around the world.

This is first and foremost a political story. It's a story of how bought government has changed what it means to be a citizen. So if you haven't sign our petition yet at www.GetMoneyOut.com, I hope this convinces you to do so.

The overall stats of the effects of the crisis are clear - median American pay has dropped by 10% since 2007, but on the high end, the rich have never been more powerful.

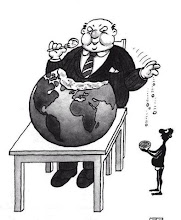

I'm not interested in a sob story about inequality, I want to talk about what Geithner *did*, structurally to bring about this situation. We're all aware of the two tiered political system in which protesters can be run over by police scooters but marauders in suits are put on the President's jobs council to chuckle nervously at Occupy Wall Street. But behind the political inequality lies a new order of credit allocation. Tim Geithner created a two-tiered monetary system, a kind of money they have which you can't get. He wasn't alone in doing this. Financial institutions spent hundreds of millions of dollars influencing federal officials to coalesce a bailout while politicians treated them as a special class of super Americans. But he more than anyone else in the crisis period was the central figure in the creation of our current aristocratic monetary order.

Let's start with the two types of money.

In late 2008, there were two types of people who had huge debts and depreciating collateral. Both types accrued their debts through the subprime mortgage crisis. Homeowners with fixed mortgages sat on rapidly depreciating homes in neighborhoods rife with foreclosures. Once the music stopped, they couldn't borrow against their homes at all, but if they wanted to get credit through credit cards, the interest rate could be upwards of 30%. This is sad, but it's not inherently immoral. It's what happens in a typical financial panic. At the time, bankers also had depreciating assets - they owned subprime mortgage debt, and they had fixed obligations as well. But if they wanted to borrow, the Federal Reserve and the Treasury made sure that they could as much credit as they wanted, against whatever collateral they had, for basically nothing. For instance, the Fed accepted almost $500 billion of CCC rated junk as collateral in loans. In other words, if you had a suburban tract home in the Inland Empire with a mortgage and a home equity line of credit, you were out of luck. But if you owned the debt on the home equity line of credit on that same suburban tract home home, you could have easily gone to the discount window or one of the emergency lending facilities and gotten cash with basically no interest charged.

In Group One are millions of Americans. In Group Two are Goldman Sachs, Citigroup, and big American banks, European banks like Dexia, and a whole set of others who had access to the Fed, like the the Bank of Libya, and the wives of Wall Street titans (who had set up special purpose vehicles to take advantage of Fed lending). If you lost your job in 2009, too bad. If you had some savings at the bank or you are a retiree that relies on fixed income bonds, good luck getting more than 1% on your money. But if you were a hedge fund titan who realized that Bernanke had put a taxpayer guarantee against the entire banking system, you were swept up in high stock market returns from 2009-2010.

Sometimes this was even explicit; Geithner created one program in 2009, called the Public-Private Investment Program. Under this program, investors would buy toxic assets, but the government would protect them against much of the downside risk with public funds. In a deal with Citigroup, the Federal Reserve and Treasury took a little less than $300 billion of downside risk on "ring-fenced" bad assets. Oddly, there was no list of the assets when the deal was drawn up, that list would be created later. This is the equivalent of telling a friend if he lends you $25,000 now and you don't pay him back, you'll give him some of your random stuff, whatever you have lying around, later.

While these institutions were pleading with federal officials for bailouts, they were filling their coffers with campaign contributions and paying millions to swarm Capitol Hill to convince officials to bail them out.

And it worked.

During this same time period, Citi Group, which received $300 billion in tax dollars from the United States Treasury, spent more than approximately $13 million to influence lawmakers. Goldman Sachs spent $9 million on buying lawmakers in 2008.

And yes, there are individual scandals, like the government paying out a hundred cents on the dollar for credit default swaps that Goldman Sachs bought from AIG. That was simply a cash award to Goldman. There was Jamie Dimon of JP Morgan pawning off $30 billion of crappy Bear Stearns assets on the New York Federal Reserve, even as he sat on the board of the New York Federal Reserve. And there are the absurdly corrupt aspects of the bailouts, like the fact that the Fed subcontracted much of the actual work. The GAO bloodlessly noted that "most of the contracts, including 8 of the 10 highest-value contracts, were awarded noncompetitively, primarily due to exigent circumstances." Exigent? The upper tier even has its own language. There's also this excruciatingly corrupt point, which few have noticed: "FRBNY's existing restrictions on its employees' financial interests did not specifically prohibit investments in certain nonbank institutions that received emergency assistance." Yup, New York Fed employees could buy stock in companies they knew would benefit from their actions, as long as those companies were not banks. There has been no investigation, as far as I can tell, of whether they did so.

It's not the scandals that matter, or rather, it's that the scandals are the new norm that matters. The larger context here, what the Occupiers are protesting, is that Tim Geithner formalized a financial elite and gave them special rights they had not previously had, notably a government guarantee for their investing, rights which ordinary people don't get. You can see this in bank borrowing spreads; large banks get a subsidy of $34 billion of dollars a year, simply because investors think their bonds are backed by the US government. This is now written into law - Dodd-Frank requires regulators to draw up a list of systemically significant firms. These are pretty explicitly firms that are too big to fail.

Behind these investing advantages are legal advantages. No elite bankers have been prosecuted for the financial crisis, or the foreclosure crisis. NONE. And no, it's not hard to prosecute bankers, especially when they admit violating laws that are easily understandable and carry up to a year in jail, like the law saying you can't foreclose on active duty troops. This is something JP Morgan admitted doing 18 times in a Congressional hearing, yet the bank apparently got off with an apology. US Attorneys are busy prosecuting low level borrower scams, in a shameful display of how the Justice system has now become nothing but a sinecure for ambitious legal servants of the new class of American oligarchs. Meanwhile, if you're a homeowner with an underwater mortgage, you can't discharge your debt in bankruptcy, the way that corporations can or wealthy people can with second (or third or fourth) homes. And if a bank forges a document, or two or three or four, and uses it to foreclose without holding your mortgage note, well, no biggie. You have no rights as a debtor, but the bank has supreme rights as a creditor. Their money counts, yours does not.

Dylan Ratigan

http://www.huffingtonpost.com/dylan-ratigan/platinum-citizenship_b_1015571.html

What we're going to see this week, when the Government Accountability Office releases a more detailed version of an audit of the Federal Reserve's actions during that period, is more details on how this system worked. So let me give you some context on what the Fed bailouts meant, the details to match the persuasive message of the protesters in Zuccotti Park and around the world.

This is first and foremost a political story. It's a story of how bought government has changed what it means to be a citizen. So if you haven't sign our petition yet at www.GetMoneyOut.com, I hope this convinces you to do so.

The overall stats of the effects of the crisis are clear - median American pay has dropped by 10% since 2007, but on the high end, the rich have never been more powerful.

I'm not interested in a sob story about inequality, I want to talk about what Geithner *did*, structurally to bring about this situation. We're all aware of the two tiered political system in which protesters can be run over by police scooters but marauders in suits are put on the President's jobs council to chuckle nervously at Occupy Wall Street. But behind the political inequality lies a new order of credit allocation. Tim Geithner created a two-tiered monetary system, a kind of money they have which you can't get. He wasn't alone in doing this. Financial institutions spent hundreds of millions of dollars influencing federal officials to coalesce a bailout while politicians treated them as a special class of super Americans. But he more than anyone else in the crisis period was the central figure in the creation of our current aristocratic monetary order.

Let's start with the two types of money.

In late 2008, there were two types of people who had huge debts and depreciating collateral. Both types accrued their debts through the subprime mortgage crisis. Homeowners with fixed mortgages sat on rapidly depreciating homes in neighborhoods rife with foreclosures. Once the music stopped, they couldn't borrow against their homes at all, but if they wanted to get credit through credit cards, the interest rate could be upwards of 30%. This is sad, but it's not inherently immoral. It's what happens in a typical financial panic. At the time, bankers also had depreciating assets - they owned subprime mortgage debt, and they had fixed obligations as well. But if they wanted to borrow, the Federal Reserve and the Treasury made sure that they could as much credit as they wanted, against whatever collateral they had, for basically nothing. For instance, the Fed accepted almost $500 billion of CCC rated junk as collateral in loans. In other words, if you had a suburban tract home in the Inland Empire with a mortgage and a home equity line of credit, you were out of luck. But if you owned the debt on the home equity line of credit on that same suburban tract home home, you could have easily gone to the discount window or one of the emergency lending facilities and gotten cash with basically no interest charged.

In Group One are millions of Americans. In Group Two are Goldman Sachs, Citigroup, and big American banks, European banks like Dexia, and a whole set of others who had access to the Fed, like the the Bank of Libya, and the wives of Wall Street titans (who had set up special purpose vehicles to take advantage of Fed lending). If you lost your job in 2009, too bad. If you had some savings at the bank or you are a retiree that relies on fixed income bonds, good luck getting more than 1% on your money. But if you were a hedge fund titan who realized that Bernanke had put a taxpayer guarantee against the entire banking system, you were swept up in high stock market returns from 2009-2010.

Sometimes this was even explicit; Geithner created one program in 2009, called the Public-Private Investment Program. Under this program, investors would buy toxic assets, but the government would protect them against much of the downside risk with public funds. In a deal with Citigroup, the Federal Reserve and Treasury took a little less than $300 billion of downside risk on "ring-fenced" bad assets. Oddly, there was no list of the assets when the deal was drawn up, that list would be created later. This is the equivalent of telling a friend if he lends you $25,000 now and you don't pay him back, you'll give him some of your random stuff, whatever you have lying around, later.

While these institutions were pleading with federal officials for bailouts, they were filling their coffers with campaign contributions and paying millions to swarm Capitol Hill to convince officials to bail them out.

And it worked.

During this same time period, Citi Group, which received $300 billion in tax dollars from the United States Treasury, spent more than approximately $13 million to influence lawmakers. Goldman Sachs spent $9 million on buying lawmakers in 2008.

And yes, there are individual scandals, like the government paying out a hundred cents on the dollar for credit default swaps that Goldman Sachs bought from AIG. That was simply a cash award to Goldman. There was Jamie Dimon of JP Morgan pawning off $30 billion of crappy Bear Stearns assets on the New York Federal Reserve, even as he sat on the board of the New York Federal Reserve. And there are the absurdly corrupt aspects of the bailouts, like the fact that the Fed subcontracted much of the actual work. The GAO bloodlessly noted that "most of the contracts, including 8 of the 10 highest-value contracts, were awarded noncompetitively, primarily due to exigent circumstances." Exigent? The upper tier even has its own language. There's also this excruciatingly corrupt point, which few have noticed: "FRBNY's existing restrictions on its employees' financial interests did not specifically prohibit investments in certain nonbank institutions that received emergency assistance." Yup, New York Fed employees could buy stock in companies they knew would benefit from their actions, as long as those companies were not banks. There has been no investigation, as far as I can tell, of whether they did so.

It's not the scandals that matter, or rather, it's that the scandals are the new norm that matters. The larger context here, what the Occupiers are protesting, is that Tim Geithner formalized a financial elite and gave them special rights they had not previously had, notably a government guarantee for their investing, rights which ordinary people don't get. You can see this in bank borrowing spreads; large banks get a subsidy of $34 billion of dollars a year, simply because investors think their bonds are backed by the US government. This is now written into law - Dodd-Frank requires regulators to draw up a list of systemically significant firms. These are pretty explicitly firms that are too big to fail.

Behind these investing advantages are legal advantages. No elite bankers have been prosecuted for the financial crisis, or the foreclosure crisis. NONE. And no, it's not hard to prosecute bankers, especially when they admit violating laws that are easily understandable and carry up to a year in jail, like the law saying you can't foreclose on active duty troops. This is something JP Morgan admitted doing 18 times in a Congressional hearing, yet the bank apparently got off with an apology. US Attorneys are busy prosecuting low level borrower scams, in a shameful display of how the Justice system has now become nothing but a sinecure for ambitious legal servants of the new class of American oligarchs. Meanwhile, if you're a homeowner with an underwater mortgage, you can't discharge your debt in bankruptcy, the way that corporations can or wealthy people can with second (or third or fourth) homes. And if a bank forges a document, or two or three or four, and uses it to foreclose without holding your mortgage note, well, no biggie. You have no rights as a debtor, but the bank has supreme rights as a creditor. Their money counts, yours does not.

Dylan Ratigan

http://www.huffingtonpost.com/dylan-ratigan/platinum-citizenship_b_1015571.html

Wednesday, September 7, 2011

Congress Giving Millions of Foreclosed Homes To Wall Street Slumlords

Congress Giving Millions of Foreclosed Homes To Wall Street Slumlords

Great news, everybody: After deliberately failing to help millions of American families stuck in vulture mortgages, the U.S. government is now giving those foreclosed homes to Wall Street for pennies on the dollar so that Wall Street can then rent the now-vacant foreclosures back to the same people pushed out during the Wall Street-caused housing bubble collapse. Wall Street stands to make an immense profit by becoming, overnight, the “largest improved real-estate owners in the world.” Who says capitalism doesn’t work, with a little help from the government by taking away the property of the working class and giving it to billionaires who pay no taxes? Who says that?

The Street/RealMoney.com reports on this innovative solution to the problem of millions of foreclosed homes currently not providing income for Goldman Sachs:

The largest transfer of wealth from the public to private sector is about to begin. The federal government will be bulk-selling the massive portfolio of foreclosed homes now owned by HUD, Fannie Mae and Freddie Mac to private investors — vulture funds.

These homes, which are now the property of the U.S. government, the U.S. taxpayer, and U.S. citizens collectively, are going to be sold to private investor conglomerates at extraordinarily large discounts to real value. You and I will not be allowed to participate. These investors will come from the private-equity and hedge-fund community, Goldman Sachs and its derivatives, as well as foreign sovereign wealth funds that can bring a billion dollars or more to each transaction.

In the process, these investors will instantaneously become the largest improved real estate owners and landlords in the world. The U.S. taxpayer will get pennies on the dollar for these homes and then be allowed to rent them back at market rates.

http://wonkette.com/451867/congress-giving-millions-of-foreclosed-homes-to-wall-street-slumlords

Aug. 30, 2011

__._,_.___

Great news, everybody: After deliberately failing to help millions of American families stuck in vulture mortgages, the U.S. government is now giving those foreclosed homes to Wall Street for pennies on the dollar so that Wall Street can then rent the now-vacant foreclosures back to the same people pushed out during the Wall Street-caused housing bubble collapse. Wall Street stands to make an immense profit by becoming, overnight, the “largest improved real-estate owners in the world.” Who says capitalism doesn’t work, with a little help from the government by taking away the property of the working class and giving it to billionaires who pay no taxes? Who says that?

The Street/RealMoney.com reports on this innovative solution to the problem of millions of foreclosed homes currently not providing income for Goldman Sachs:

The largest transfer of wealth from the public to private sector is about to begin. The federal government will be bulk-selling the massive portfolio of foreclosed homes now owned by HUD, Fannie Mae and Freddie Mac to private investors — vulture funds.

These homes, which are now the property of the U.S. government, the U.S. taxpayer, and U.S. citizens collectively, are going to be sold to private investor conglomerates at extraordinarily large discounts to real value. You and I will not be allowed to participate. These investors will come from the private-equity and hedge-fund community, Goldman Sachs and its derivatives, as well as foreign sovereign wealth funds that can bring a billion dollars or more to each transaction.

In the process, these investors will instantaneously become the largest improved real estate owners and landlords in the world. The U.S. taxpayer will get pennies on the dollar for these homes and then be allowed to rent them back at market rates.

http://wonkette.com/451867/congress-giving-millions-of-foreclosed-homes-to-wall-street-slumlords

Aug. 30, 2011

__._,_.___

Tuesday, August 16, 2011

Monday, August 1, 2011

Monday, July 18, 2011

Thursday, July 14, 2011

Saturday, July 9, 2011

Saturday, July 2, 2011

oBOMBa Banned?

Major Obama Sponsor Tried to Ban This Message

After Putting $803,436 in His Campaign Coffer, they Attempted to Keep Americans From Seeing

This Critical Warning From a Nobel-Prize Winning Economist and Trusted Adviser to

President Reagan! See What They Tried to Ban

Dear Newsmax Reader,

It pays to have friends in powerful places.

Especially if you are the president of the United States.

You see, recently we ramped up efforts to get the word out concerning a very dire and serious assessment of our nation’s economic future.

We put together an investigative presentation that documented the work of a man that President Reagan turned to in the 1980s to help America recover from the stagflation brought on by the Carter administration.

This Nobel Prize-winning economist foretold with prophetic accuracy EXACTLY what President Obama and Ben Bernanke have been up to . . .

And the Pandora’s Box of economic dangers they have unleashed on the United States.

The message was so important that President Reagan himself once described the man’s work as “a Survival Kit for You, for Our Nation, and for Freedom.”

Nevertheless, when a major Obama donor — Google — saw this presentation, they asked us to revise it to something “less controversial.”

Despite their attempts to keep it from being shown, you can still see it for yourself today!

Launch a private airing of it right now by clicking here; http://w3.newsmax.com/a/money_mischief/video2.cfm?s=al&promo_code=C899-1

Aaron DeHoog

Financial Publisher

Newsmax and Moneynews

After Putting $803,436 in His Campaign Coffer, they Attempted to Keep Americans From Seeing

This Critical Warning From a Nobel-Prize Winning Economist and Trusted Adviser to

President Reagan! See What They Tried to Ban

Dear Newsmax Reader,

It pays to have friends in powerful places.

Especially if you are the president of the United States.

You see, recently we ramped up efforts to get the word out concerning a very dire and serious assessment of our nation’s economic future.

We put together an investigative presentation that documented the work of a man that President Reagan turned to in the 1980s to help America recover from the stagflation brought on by the Carter administration.

This Nobel Prize-winning economist foretold with prophetic accuracy EXACTLY what President Obama and Ben Bernanke have been up to . . .

And the Pandora’s Box of economic dangers they have unleashed on the United States.

The message was so important that President Reagan himself once described the man’s work as “a Survival Kit for You, for Our Nation, and for Freedom.”

Nevertheless, when a major Obama donor — Google — saw this presentation, they asked us to revise it to something “less controversial.”

Despite their attempts to keep it from being shown, you can still see it for yourself today!

Launch a private airing of it right now by clicking here; http://w3.newsmax.com/a/money_mischief/video2.cfm?s=al&promo_code=C899-1

Aaron DeHoog

Financial Publisher

Newsmax and Moneynews

Saturday, June 25, 2011

Sunday, May 22, 2011

Not Too Big to Assail: Fed Subpoenas Expected @ Goldman-Sachs

http://gamutnews.com/20110521/5914/not-too-big-to-assail-federal-subpoenas-expected-at-goldman-sachs.html

Though I dont hold out much hope of anything coming of this....the S&C has let the Big Bank$Ter$ off the hook too many times in the past.

These proceedings will have no teeth until and unless MUCH more regulation of the banking industry is done in real effort to eridicate some of the illegal and/or immoral / unethical practices they do that got US into this financial meltdown mess...particularly in the sub-prime mortgage backed securities area.

Though I dont hold out much hope of anything coming of this....the S&C has let the Big Bank$Ter$ off the hook too many times in the past.

These proceedings will have no teeth until and unless MUCH more regulation of the banking industry is done in real effort to eridicate some of the illegal and/or immoral / unethical practices they do that got US into this financial meltdown mess...particularly in the sub-prime mortgage backed securities area.

Wednesday, May 18, 2011

Tuesday, May 3, 2011

Saturday, April 23, 2011

Friday, April 15, 2011

Wednesday, April 13, 2011

Sunday, April 10, 2011

Thursday, March 24, 2011

Sunday, March 20, 2011

Friday, March 18, 2011

Profiting from Crisis; Japan's Woes a Boon for Global Economy

The massive crisis in Japan — sparked by an earthquake, worsened by a tsunami, and compounded by radiation leaks at nuclear power plants — isn’t just a disaster for the people of Japan. It also panicked investors around the globe.

And now I’m seeing stories about how Japan’s disaster could weigh on the global economy. And that may be true. But let me offer an alternative point of view … that Japan’s crisis could be a boost for the global economy.

First, some facts. According to the IMF, the global economy grew 5% in 2010, and is expected to grow 4.4% in 2011 and 4.5% in 2012.

Very few analysts are of the opinion that the disaster will undo the 4+% rate of global growth expected this year, or that the setback that the Japanese economy may suffer will be anything but a temporary one.

Japan is one of the world’s economic engines … but its importance is dropping. It’s the world’s #4 economy after the European Union, the United States and China.

The Bad News IS Bad

The earthquake and tsunami damaged roads, ports, airports and factories, disrupting the shipment of goods in and out of the country. Four medium-sized container ports on Japan’s northeast coast were so severely damaged that they are not expected to resume operations for months or even years.

Certain commodities are particularly vulnerable. Japan used up half a million ounces of platinum and 750,000 ounces of palladium in the new cars it built last year. Exports of new Japanese cars could be delayed while the ports are straightened out, and Japan has lost 23% of its electrical power as its nuclear power plants have shut down. Demand for base metals, particularly zinc and nickel, could also take a hit.

And the manufactured components that Japan ships to the United States, Europe and elsewhere are sold alone and also used in other manufacturing. For example, Japan is a major supplier of flash memory chips, commonly used in portable electronics. Delays in shipping could impact big buyers such as Intel, the world’s biggest semiconductor company, and Texas Instruments.

So you can see how this could disrupt manufacturing around the world.

Internal Sponsorship

Fed Chairman Ben Bernanke and the G-20 Nations

Might Use this Investment to

Help Solve the Global Financial Crisis …

In this time-sensitive research report, Larry Edelson will show you why he believes smart investments in this sector could double, triple and even QUADRUPLE your money in the next 12–24 months — while almost everyone else is losing their shirts in other investments. Go to our website to access your copy now (Click link to article at bottom of page)

Now for the Bullish Side

•Japan is the world’s third-largest consumer of oil (4.4 million barrels of oil per day). In the short-term, Japan could use less oil, sending prices lower. Lower oil prices should help the economies of the rest of the world accelerate, or at least put off the risk of a global recession caused by an oil shock.

•Japan will have to rebuild. That means it’s going to be importing like mad. I’m talking about aluminum, copper, steel and nickel … not to mention wood, paper, and food.

•Japan is the #1 market for exports of U.S. corn (Japan bought nearly 15 million tons of U.S. corn in 2009-2010). In the short-term, livestock operations in Japan are going to suffer, and that will lower Japan’s corn demand. But in the intermediate-term, not only will those livestock producers come back online, but Japan is probably going to have to import more corn and other grains as it rehabilitates its swamped farmland and broken infrastructure.

•Good news for natural gas: Japan has shut down 11 nuclear reactors with a total capacity of 9.7 gigawatts — the equivalent of 200,000 barrels of oil a day, or 4.5% of Japan’s consumption. Even if some of those reactors come online, I think nuclear power is dead in Japan for years to come. This should be a boost for natural gas, a commodity that has suffered from oversupply recently.

•A flood of easy money. Japan’s central bank injected a whopping 26.5 trillion yen (about $324 billion) into its financial system in the first three days of this week, in a bid to provide stimulus and prop up the economy and financial system. And they’re probably not done yet! All that cash has to go somewhere — my guess is we’re going to see commodity prices float higher on that flood of money.

The Best Investment May Be Japan Itself

We already saw bargain-hunting investors dive into Japanese stocks Wednesday, scooping up shares of beaten-down companies. I think they’re premature — the selling in Japan may not be over yet. Give me a few days when we don’t have more bad news on one of Japan’s nuclear power plants. Then maybe I’ll be ready to buy.

But consider: In 1995, Japan was hit by a devastating quake that killed more than 6,400 people, about 4,600 of them in the city of Kobe. Within 15 months of the quake, manufacturing in Japan returned to normal levels.

The Japanese are a tough, resilient, industrious people. I am sure that not only can they bounce back from this, but they can rebound strongly.

To be sure, one fly in the ointment is how Japan is going to finance all this reconstruction. The government is expected to spend at least $200 billion, and the Japanese government’s debt is already an alarming 225% of the country’s economic output.

But as long as governments can create paper and pass it off as money — and there’s no sign that’s going to end any time soon — Japan should be okay.

http://www.uncommonwisdomdaily.com/how-japan%e2%80%99s-woes-could-boost-the-global-economy-11547?FIELD9=1

And now I’m seeing stories about how Japan’s disaster could weigh on the global economy. And that may be true. But let me offer an alternative point of view … that Japan’s crisis could be a boost for the global economy.

First, some facts. According to the IMF, the global economy grew 5% in 2010, and is expected to grow 4.4% in 2011 and 4.5% in 2012.

Very few analysts are of the opinion that the disaster will undo the 4+% rate of global growth expected this year, or that the setback that the Japanese economy may suffer will be anything but a temporary one.

Japan is one of the world’s economic engines … but its importance is dropping. It’s the world’s #4 economy after the European Union, the United States and China.

The Bad News IS Bad

The earthquake and tsunami damaged roads, ports, airports and factories, disrupting the shipment of goods in and out of the country. Four medium-sized container ports on Japan’s northeast coast were so severely damaged that they are not expected to resume operations for months or even years.

Certain commodities are particularly vulnerable. Japan used up half a million ounces of platinum and 750,000 ounces of palladium in the new cars it built last year. Exports of new Japanese cars could be delayed while the ports are straightened out, and Japan has lost 23% of its electrical power as its nuclear power plants have shut down. Demand for base metals, particularly zinc and nickel, could also take a hit.

And the manufactured components that Japan ships to the United States, Europe and elsewhere are sold alone and also used in other manufacturing. For example, Japan is a major supplier of flash memory chips, commonly used in portable electronics. Delays in shipping could impact big buyers such as Intel, the world’s biggest semiconductor company, and Texas Instruments.

So you can see how this could disrupt manufacturing around the world.

Internal Sponsorship

Fed Chairman Ben Bernanke and the G-20 Nations

Might Use this Investment to

Help Solve the Global Financial Crisis …

In this time-sensitive research report, Larry Edelson will show you why he believes smart investments in this sector could double, triple and even QUADRUPLE your money in the next 12–24 months — while almost everyone else is losing their shirts in other investments. Go to our website to access your copy now (Click link to article at bottom of page)

Now for the Bullish Side

•Japan is the world’s third-largest consumer of oil (4.4 million barrels of oil per day). In the short-term, Japan could use less oil, sending prices lower. Lower oil prices should help the economies of the rest of the world accelerate, or at least put off the risk of a global recession caused by an oil shock.

•Japan will have to rebuild. That means it’s going to be importing like mad. I’m talking about aluminum, copper, steel and nickel … not to mention wood, paper, and food.

•Japan is the #1 market for exports of U.S. corn (Japan bought nearly 15 million tons of U.S. corn in 2009-2010). In the short-term, livestock operations in Japan are going to suffer, and that will lower Japan’s corn demand. But in the intermediate-term, not only will those livestock producers come back online, but Japan is probably going to have to import more corn and other grains as it rehabilitates its swamped farmland and broken infrastructure.

•Good news for natural gas: Japan has shut down 11 nuclear reactors with a total capacity of 9.7 gigawatts — the equivalent of 200,000 barrels of oil a day, or 4.5% of Japan’s consumption. Even if some of those reactors come online, I think nuclear power is dead in Japan for years to come. This should be a boost for natural gas, a commodity that has suffered from oversupply recently.

•A flood of easy money. Japan’s central bank injected a whopping 26.5 trillion yen (about $324 billion) into its financial system in the first three days of this week, in a bid to provide stimulus and prop up the economy and financial system. And they’re probably not done yet! All that cash has to go somewhere — my guess is we’re going to see commodity prices float higher on that flood of money.

The Best Investment May Be Japan Itself

We already saw bargain-hunting investors dive into Japanese stocks Wednesday, scooping up shares of beaten-down companies. I think they’re premature — the selling in Japan may not be over yet. Give me a few days when we don’t have more bad news on one of Japan’s nuclear power plants. Then maybe I’ll be ready to buy.

But consider: In 1995, Japan was hit by a devastating quake that killed more than 6,400 people, about 4,600 of them in the city of Kobe. Within 15 months of the quake, manufacturing in Japan returned to normal levels.

The Japanese are a tough, resilient, industrious people. I am sure that not only can they bounce back from this, but they can rebound strongly.

To be sure, one fly in the ointment is how Japan is going to finance all this reconstruction. The government is expected to spend at least $200 billion, and the Japanese government’s debt is already an alarming 225% of the country’s economic output.

But as long as governments can create paper and pass it off as money — and there’s no sign that’s going to end any time soon — Japan should be okay.

http://www.uncommonwisdomdaily.com/how-japan%e2%80%99s-woes-could-boost-the-global-economy-11547?FIELD9=1

Thursday, March 17, 2011

Wednesday, March 16, 2011

Tuesday, March 15, 2011

WikiLeaks BOA Files Released

http://blogs.forbes.com/halahtouryalai/2011/03/14/bank-of-america-e-mail-leaks-are-here-how-much-will-they-hurt/

Hey Julian, thanks for the info but when are you going to release all of your Israel files?

Hey Julian, thanks for the info but when are you going to release all of your Israel files?

Wednesday, March 9, 2011

Monday, March 7, 2011

Sunday, March 6, 2011

Saturday, March 5, 2011

Wednesday, March 2, 2011

Tuesday, March 1, 2011

Monday, February 28, 2011

Sunday, February 27, 2011

Saturday, February 26, 2011

Budget Crisis? Duh, Tax the Rich!

Article; Budget Crisis? Duh, Tax the Rich!

Support a "Robin Hood" Tax for Big-Bank$ and Corporation$;

http://www.youtube.com/watch?v=qYtNwmXKIvM

Support a "Robin Hood" Tax for Big-Bank$ and Corporation$;

http://www.youtube.com/watch?v=qYtNwmXKIvM

Friday, February 25, 2011

Saturday, February 19, 2011

Friday, February 18, 2011

Thursday, February 17, 2011

Wednesday, February 16, 2011

Obomba Budget FAIL: Politicians Postulate, Capitalisim FAIL

Democracy FAIL as poor, un-and-under employed left out in cold; http://www.truth-out.org/on-president-obamas-budget67777

Monday, February 14, 2011

Moore on Capitalism, A Love Affair; Told to "Cool It" on Sen. Dodd

http://www.youtube.com/watch?v=sh0cBFZ1FXY&feature=related

See comment:

"The US is border line 3rd world for some of its citizens in part...low wages, poor health care, no jobs, corrupt govt bodies and poor education. But dont worry they have their A/C, Microwaves and Cell phones to make them feel better.Too bad they cant afford to buy food to put in the microwave or pay the eletricty bill for the A/C when it comes or when sick call a doctor on a cell phone."

See comment:

"The US is border line 3rd world for some of its citizens in part...low wages, poor health care, no jobs, corrupt govt bodies and poor education. But dont worry they have their A/C, Microwaves and Cell phones to make them feel better.Too bad they cant afford to buy food to put in the microwave or pay the eletricty bill for the A/C when it comes or when sick call a doctor on a cell phone."

Sunday, February 13, 2011

Friday, February 11, 2011

Wall Street, Banks, and American Foreign Policy" by Murray N. Rothbard

Murray Rothbard's 1984 analysis of modern American history as a great power struggle between economic elites, between the House of Morgan and the Rockefeller interests, culminates in the following conclusion: "the financial power elite can sleep well at night regardless of who wins in 1984." By the time you get there, the conclusion seems understated indeed, for what we have here is a sweeping and compressed history of 20th century politics from a power elite point of view. It represents a small and highly specialized sample of Rothbard's vast historical knowledge coming together with a lifetime devoted to methodological individualism in the social sciences. It appeared first in 1984, in the thick of the Reagan years, in a small financial publication called World Market Perspective. It was printed for a larger audience by the Center for Libertarian Studies in 1995, and appears in 2005 online for the first time.

Theoreticians Left and Right are constantly referring to abstract "forces" when they examine and attempt to explain historical patterns. Applying the principle of methodological individualism – which attributes all human action to individual actors – and the economic principles of the Austrian School, Rothbard formulated a trenchant overview of the American elite and the history of the modern era.

Rothbard's analysis flows, first, from the basic principles of Austrian economics, particularly the Misesian analysis of banking and the origin of the business cycle. This issue is also discussed and elaborated on in one of his last books, The Case Against the Fed (Mises Institute, 1995). Here, the author relates the history of how the Federal Reserve System came to be foisted on the unsuspecting American people by a high-powered alliance of banking interests. Rothbard's economic analysis is clear, concise, and wide-ranging, covering the nature of money, the genesis of government paper money, the inherent instability (and essential fraudulence) of fractional reserve banking, and the true causes of the business cycle.

As Rothbard explains in his economic writings, the key is in understanding that money is a commodity, like any other, and thus subject to the laws of the market. A government-granted monopoly in this, the very lifeblood of the economic system, is a recipe for inflation, a debased currency – and the creation of a permanent plutocracy whose power is virtually unlimited.

The Free Online eBook; http://mises.org/rothbard/WSBanks.pdf

Theoreticians Left and Right are constantly referring to abstract "forces" when they examine and attempt to explain historical patterns. Applying the principle of methodological individualism – which attributes all human action to individual actors – and the economic principles of the Austrian School, Rothbard formulated a trenchant overview of the American elite and the history of the modern era.

Rothbard's analysis flows, first, from the basic principles of Austrian economics, particularly the Misesian analysis of banking and the origin of the business cycle. This issue is also discussed and elaborated on in one of his last books, The Case Against the Fed (Mises Institute, 1995). Here, the author relates the history of how the Federal Reserve System came to be foisted on the unsuspecting American people by a high-powered alliance of banking interests. Rothbard's economic analysis is clear, concise, and wide-ranging, covering the nature of money, the genesis of government paper money, the inherent instability (and essential fraudulence) of fractional reserve banking, and the true causes of the business cycle.

As Rothbard explains in his economic writings, the key is in understanding that money is a commodity, like any other, and thus subject to the laws of the market. A government-granted monopoly in this, the very lifeblood of the economic system, is a recipe for inflation, a debased currency – and the creation of a permanent plutocracy whose power is virtually unlimited.

The Free Online eBook; http://mises.org/rothbard/WSBanks.pdf

Saturday, February 5, 2011

Friday, February 4, 2011

Thursday, February 3, 2011

Tuesday, February 1, 2011

Monday, January 31, 2011

Saturday, January 29, 2011

Thursday, January 27, 2011

Wednesday, January 26, 2011

$hitiGroup CEO Pandit Gets Giant Pay Raise

Successfully completed probation, now earning more than $1 per year; http://www.marketwatch.com/story/citi-ceo-pandit-gets-giant-pay-raise-2011-01-21

Tuesday, January 25, 2011

After a Flash of Wins, Stocks Slip

After its longest winning period since 2007 in the S&P 500 index, U.S. stocks dipped. Goldman Sachs Group and Citigroup did not meet analysts’ estimates. Housing failed to meet forecast too;

http://www.financialfeed.net/after-a-flash-of-wins-stocks-slip/851729/

http://www.financialfeed.net/after-a-flash-of-wins-stocks-slip/851729/

Monday, January 24, 2011

Friday, January 21, 2011

Old Lady Writes Letter of Complaint to Her Bank

TRUE ! 98 year old lady writes to her BANK ! MUST READ!!!

Subject: Senior moment - A 98 year old woman in the UK wrote this to her bank.

The bank manager thought it amusing enough to have it published in the Times.

Dear Sir,

I am writing to thank you for bouncing my cheque with which I endeavoured to pay my plumber last month. By my calculations, three nanoseconds must have elapsed between his presenting the cheque and the arrival in my account of the funds needed to honour it. I refer, of course, to the automatic monthly deposit of my Pension, an arrangement, which, I admit, has been in place for only thirty eight years. You are to be commended for seizing that brief window of opportunity, and also for debiting my account £30 by way of penalty for the inconvenience caused to your bank.

My thankfulness springs from the manner in which this incident has caused me to rethink my errant financial ways. I noticed that whereas I personally attend to your telephone calls and letters, but when I try to contact you, I am confronted by the impersonal, overcharging, pre-recorded, faceless entity which your bank has become. From now on, I, like you, choose only to deal with a flesh-and-blood person. My mortgage and loan payments will therefore and hereafter no longer be automatic, but will arrive at your bank by cheque, addressed personally and confidentially to an employee at your bank whom you must nominate. Be aware that it is an offence under the Postal Act for any other person to open such an envelope.

Please find attached an Application Contact Status which I require your chosen employee to complete. I am sorry it runs to eight pages, but in order that I know as much about him or her as your bank knows about me, there is no alternative. Please note that all copies of his or her medical history must be countersigned by a Solicitor, and the mandatory details of his/her financial situation (income, debts, assets and liabilities) must be accompanied by documented proof. In due course, I will issue your employee with PIN number which he/she must quote in dealings with me. I regret that it cannot be shorter than 28 digits but, again, I have modelled it on the number of button presses required of me to access my account balance on your phone bank service. As they say, imitation is the sincerest form of flattery. Let me level the playing field even further. When you call me, press buttons as follows:

1. To make an appointment to see me.

2. To query a missing payment.

3. To transfer the call to my living room in case I am there.

4. To transfer the call to my bedroom in case I am sleeping.

5. To transfer the call to my toilet in case I am attending to nature.

6. To transfer the call to my mobile phone if I am not at home.

7. To leave a message on my computer (a password to access my computer is required.

A password will be communicated to you at a later date to the Authorized Contact.)

8. To return to the main menu and to listen to options 1 through to 8.

9. To make a general complaint or inquiry, the contact will then be put on hold, pending the attention of my automated answering service. While this may, on occasion, involve a lengthy wait, uplifting music will play for the duration of the call.

Regrettably, but again following your example, I must also levy an establishment fee to cover the setting up of this new arrangement.

May I wish you a happy, if ever so slightly less prosperous, New Year.

Your Humble Client

(Remember: This was written by a 98 year old woman; DOESN'T SHE MAKE YOU PROUD!)

What are your comments?

SEE BEYOND THIS REALITY, AND INTO THE NEXT GALACTIC REALITY WITH INDIAN IN THE MACHINE http://soundclick.com/indianinthemachine

Subject: Senior moment - A 98 year old woman in the UK wrote this to her bank.

The bank manager thought it amusing enough to have it published in the Times.

Dear Sir,

I am writing to thank you for bouncing my cheque with which I endeavoured to pay my plumber last month. By my calculations, three nanoseconds must have elapsed between his presenting the cheque and the arrival in my account of the funds needed to honour it. I refer, of course, to the automatic monthly deposit of my Pension, an arrangement, which, I admit, has been in place for only thirty eight years. You are to be commended for seizing that brief window of opportunity, and also for debiting my account £30 by way of penalty for the inconvenience caused to your bank.

My thankfulness springs from the manner in which this incident has caused me to rethink my errant financial ways. I noticed that whereas I personally attend to your telephone calls and letters, but when I try to contact you, I am confronted by the impersonal, overcharging, pre-recorded, faceless entity which your bank has become. From now on, I, like you, choose only to deal with a flesh-and-blood person. My mortgage and loan payments will therefore and hereafter no longer be automatic, but will arrive at your bank by cheque, addressed personally and confidentially to an employee at your bank whom you must nominate. Be aware that it is an offence under the Postal Act for any other person to open such an envelope.

Please find attached an Application Contact Status which I require your chosen employee to complete. I am sorry it runs to eight pages, but in order that I know as much about him or her as your bank knows about me, there is no alternative. Please note that all copies of his or her medical history must be countersigned by a Solicitor, and the mandatory details of his/her financial situation (income, debts, assets and liabilities) must be accompanied by documented proof. In due course, I will issue your employee with PIN number which he/she must quote in dealings with me. I regret that it cannot be shorter than 28 digits but, again, I have modelled it on the number of button presses required of me to access my account balance on your phone bank service. As they say, imitation is the sincerest form of flattery. Let me level the playing field even further. When you call me, press buttons as follows:

1. To make an appointment to see me.

2. To query a missing payment.

3. To transfer the call to my living room in case I am there.

4. To transfer the call to my bedroom in case I am sleeping.

5. To transfer the call to my toilet in case I am attending to nature.

6. To transfer the call to my mobile phone if I am not at home.

7. To leave a message on my computer (a password to access my computer is required.

A password will be communicated to you at a later date to the Authorized Contact.)

8. To return to the main menu and to listen to options 1 through to 8.

9. To make a general complaint or inquiry, the contact will then be put on hold, pending the attention of my automated answering service. While this may, on occasion, involve a lengthy wait, uplifting music will play for the duration of the call.

Regrettably, but again following your example, I must also levy an establishment fee to cover the setting up of this new arrangement.

May I wish you a happy, if ever so slightly less prosperous, New Year.

Your Humble Client

(Remember: This was written by a 98 year old woman; DOESN'T SHE MAKE YOU PROUD!)

What are your comments?

SEE BEYOND THIS REALITY, AND INTO THE NEXT GALACTIC REALITY WITH INDIAN IN THE MACHINE http://soundclick.com/indianinthemachine

Wednesday, January 19, 2011

US and State Judges Likely among Swiss Bank Accounts Holders

Los Angeles, January 17 – in view of the pending WikiLeaks release of Swiss banking data, Human Rights Alert (NGO) and Joseph Zernik, PhD, suggest that significant number of US and state judges are likely to be among US citizens holding numbered bank accounts in Switzerland.

Review of numerous cases in the US and state courts shows a tight alliance between judges and large financial institutions, in disregard of the judges’ oaths of office, through the conduct of alleged Fraud on the Courts in litigations involving financial institutions. Such conduct undermines the stated US government efforts to establish honest and effectual banking regulation.

Growing body of evidence suggests that both US and state judges have accepted financial benefits from large financial institutions. In 2008 Dr Zernik filed requests with California Judge Terry Friedman (Los Angeles Superior Court), US Judge Virginia Phillips, and US Magistrate Carla Woehrle (US District Court, Central District of California) for statements on the record regarding financial benefits to them or family members residing with them from such institutions (pursuant to the California Code of Judicial Ethics). All three refused to provide such statements.

In 2009 whistle-blower Bradley Birkenfeld led to the discovery that an estimated 40,000 US wealthy citizens were holding Swiss numbered accounts with UBS-AG. Birkenfeld was swiftly sentenced by a US court to years in federal prison. He was never able to collect rewards provided by the False Claims Act and stated US policies, which could have amounted to billions of US dollars. The criminal prosecution of the culprits - banking executives - was never materialized, and the US government negotiated an agreement with the Swiss government, according to which the names of the vast majority of the offenders were never released by UBS-AG.

Regardless of mounting credible evidence of racketeering by Bank of America and its senior executives, including Brian Moynihan, US banking regulation agencies refuse to take action. It is claimed that conduct of such agencies is caused, at least in part, from the realization that under conditions that prevail today in the US courts, there is no way to prosecute banking executives.

Human Rights Alert suggests that US officials in general, and state and US judges, in particular, are likely to be among the Swiss accounts holders. Moreover, a Swiss law, which would prohibit deposits by US government officers while in office in Swiss bank accounts, is likely to materially affect restoration of US government and US financial markets integrity and stability.

Through the pending release of both US and Swiss banking records WikiLeaks is therefore likely to support effective banking regulation in the United States, where US agencies and the US courts are acting in disregard of the law.

LINKS:

[i] 11-01-17 Swiss Whistle Blower Hands Bank Data to WikiLeaks

http://www.scribd.com/doc/47052191/

[ii] Zernik, Joseph: Securities and Exchange Commission v Bank of America Corporation - Pretense Litigation and Pretense Banking Regulation in the United States

http://www.scribd.com/doc/44663232/

[iii] 11-01-10 Request for investigation/impeachment proceedings, in re: US Judge JED RAKOFF and Clerk RUBY KRAJICK, US District Court, Southern District of New York, Conduct of Securities and Exchange Committee v Bank of America Corporation (1:09-cv-06829) s

http://www.scribd.com/doc/46616530/

[iv] 09-08-25 UBS AG Whistle Blower Birkenfeld Imprisoned

http://www.scribd.com/doc/47053350/

[v] 10-05-05 Countrywide, Bank of America (NYSE:BAC), and its President Brian Moynihan - Compilation of Records - Evidence of Racketeering

http://www.scribd.com/doc/30975368/

[vi] 10-06-11 Complaints Filed with Office of Comptroller of the Currency and SEC against Countrywide, Bank of America (NYSE:BAC), and Brian Moynihan - alleging fraud on shareholders, on banking regulators, and on the US taxpayer

http://www.scribd.com/doc/32907453/

[vii] 10-05-05 Chairs of US Congress Committees of the Judiciary and Banking Are Requested to Join Senator Feinstein’s Inquiries on Comptroller of the Currency and US Dept of Justice Inspector General

http://www.scribd.com/doc/30979882/

Review of numerous cases in the US and state courts shows a tight alliance between judges and large financial institutions, in disregard of the judges’ oaths of office, through the conduct of alleged Fraud on the Courts in litigations involving financial institutions. Such conduct undermines the stated US government efforts to establish honest and effectual banking regulation.

Growing body of evidence suggests that both US and state judges have accepted financial benefits from large financial institutions. In 2008 Dr Zernik filed requests with California Judge Terry Friedman (Los Angeles Superior Court), US Judge Virginia Phillips, and US Magistrate Carla Woehrle (US District Court, Central District of California) for statements on the record regarding financial benefits to them or family members residing with them from such institutions (pursuant to the California Code of Judicial Ethics). All three refused to provide such statements.

In 2009 whistle-blower Bradley Birkenfeld led to the discovery that an estimated 40,000 US wealthy citizens were holding Swiss numbered accounts with UBS-AG. Birkenfeld was swiftly sentenced by a US court to years in federal prison. He was never able to collect rewards provided by the False Claims Act and stated US policies, which could have amounted to billions of US dollars. The criminal prosecution of the culprits - banking executives - was never materialized, and the US government negotiated an agreement with the Swiss government, according to which the names of the vast majority of the offenders were never released by UBS-AG.

Regardless of mounting credible evidence of racketeering by Bank of America and its senior executives, including Brian Moynihan, US banking regulation agencies refuse to take action. It is claimed that conduct of such agencies is caused, at least in part, from the realization that under conditions that prevail today in the US courts, there is no way to prosecute banking executives.

Human Rights Alert suggests that US officials in general, and state and US judges, in particular, are likely to be among the Swiss accounts holders. Moreover, a Swiss law, which would prohibit deposits by US government officers while in office in Swiss bank accounts, is likely to materially affect restoration of US government and US financial markets integrity and stability.

Through the pending release of both US and Swiss banking records WikiLeaks is therefore likely to support effective banking regulation in the United States, where US agencies and the US courts are acting in disregard of the law.

LINKS:

[i] 11-01-17 Swiss Whistle Blower Hands Bank Data to WikiLeaks

http://www.scribd.com/doc/47052191/

[ii] Zernik, Joseph: Securities and Exchange Commission v Bank of America Corporation - Pretense Litigation and Pretense Banking Regulation in the United States

http://www.scribd.com/doc/44663232/

[iii] 11-01-10 Request for investigation/impeachment proceedings, in re: US Judge JED RAKOFF and Clerk RUBY KRAJICK, US District Court, Southern District of New York, Conduct of Securities and Exchange Committee v Bank of America Corporation (1:09-cv-06829) s

http://www.scribd.com/doc/46616530/

[iv] 09-08-25 UBS AG Whistle Blower Birkenfeld Imprisoned

http://www.scribd.com/doc/47053350/

[v] 10-05-05 Countrywide, Bank of America (NYSE:BAC), and its President Brian Moynihan - Compilation of Records - Evidence of Racketeering

http://www.scribd.com/doc/30975368/

[vi] 10-06-11 Complaints Filed with Office of Comptroller of the Currency and SEC against Countrywide, Bank of America (NYSE:BAC), and Brian Moynihan - alleging fraud on shareholders, on banking regulators, and on the US taxpayer

http://www.scribd.com/doc/32907453/

[vii] 10-05-05 Chairs of US Congress Committees of the Judiciary and Banking Are Requested to Join Senator Feinstein’s Inquiries on Comptroller of the Currency and US Dept of Justice Inspector General

http://www.scribd.com/doc/30979882/

Friday, January 14, 2011

Thursday, January 13, 2011

Lets Make Money

http://www.youtube.com/watch?v=z66gCiT7sCY&feature=related

http://www.youtube.com/watch?v=z66gCiT7sCY&feature=related"I thought this was going to be a whimpering thing about fiat currency, but I was totally wrong. This is a complex narrative which really seeks to stab at the heart of the issues it confronts. The imagery is portrayed in a stark manner, you ...get the sense that the auteur behind the lenses is interested in letting the pictures explain the circumstances rather than relying entirely on dialogue or talking heads. The interviewees are also well selected. There a conscious effort to place experienced people at the heart of the story rather that critics or other people indirectly associated with the issues. Whatever your politics this is worth watchin"

-Anthony

In this 1 1/2 hr. documentarty you will learn just a few of the tough tactics multinational corporations use to bully third world countries who are desperate and are willing to accept slave wages and appallingly poor working conditions that are dangerous and deadly for employees.

Children are also sold to homes where they work and are often sexually abused. Construction of civil projects is another area where children work.

Children are seen working on the streets as vendors, shoe shiners, beggars, prostitutes and pimps. Nepalese children are trafficked into India and sold to work in the carpet making industry and sex industry.

In part 2 they discuss rising costs and the comparison of wages between workers in India and Europe. The reality is that these large multinational corporations make billions in profits while the poor worker works longer hours for less money. These corrupt corporations falsely claim they cannot afford to pay workers more money when the truth is that they take advantage of the poor to their great advantage.

Bonded labour is a serious issue in Nepal. Bonded labour occurs when a child is left with a debt from their parents or is used as collateral for a loan by their parents that they cannot repay. The exploited child is then forced into working for the lender to pay their parent's debt.

More than 43 per cent of all cocoa beans are harvested from this area and the Ivory Coast. More than one third of the Ivory Coast's economy is acquired from cocoa bean exports and child slave labour.

It is estimated that there are 2.6 million child workers in Nepal. Children are forced to work in sweatshops for long hours and in horrible conditions that can cause serious injury and death.

Child slave labour is a severe problem on cocoa farms. Slave traffickers steal children from third world countries and sell them to countries like Cote d'Ivoire. Most children are stolen from Mali, South Africa. These children are tricked into cooperating with traffickers and are deceived into believing they will be better off. In Africa, nearly 200,000 children are trafficked every year. They are under fed, live in poor conditions and are forced to work day and night.

Many industries use cheap child slave labour in third world countries to make larger profits. Children are forced to work as prostitutes and street vendors, on farms, and in homes, mines and sweatshops producing shoes, clothing and toys. 22,000 children die by labour related disasters each year.

Children earn about six cents per hour in Bangladesh.

Sweatshops in Bangladesh are notorious for fires and poor safety.

Slavery is a form of forced labour in which people are considered to be, or treated as, the property of others. Slaves can be held against their will from the time of their capture, purchase or birth, and deprived of the right to leave, to refuse to work, or to receive compensation such as wages.

In 2003, there were 246 million child slave labourers worldwide, including Bangladesh, China, India, Mali, Nepal, Salvador, Thailand, the Philippines and countless other countries.

The Canadian government has a choice and can borrow interest free money from the Bank of Canada. The Bank of Canada can offer provincial and municipal governments funding at rates that are well below private bank rates.

All countries, on behalf of their citizens, borrow as debt at substantial interest from private banks. More than half of your income tax dollars service the interest on the debt.

In just three years (2007-2009), all federal debt repayment in Canada since 1997 was wiped-out.

The Bank of Canada creates 5% of the money supply in Canada. The private banking system creates 95% as debt at substantial interest. The private banking system has succeeded in privatizing the money supply in Canada. Banks create money out of nothing.

From 2005 to 2009, Canadian taxpayers paid $350+ billion in interest on the national debt.

In fiscal year 2008-2009 the Canadian federal debt was $463.7 billion.

On March 31, 2010, Canada's federal debt increased to $519.6 billion or $15,000+ for every man, woman and child.

The Canadian federal debt grows by $153 million every day.

Queen Elizabeth II is the legal owner of one sixth of the land on the Earth's surface, more than any other individual or nation. This amounts to a total of 6.6 billion acres (27 million km²) in 32 countries.

37.5% of the Earth is owned by 147 states.

21% of the Earth is owned by 26 people.

41% of the Earth is owned by 1% or less of the population on Earth.

85% of the Earth's population own nothing.

Source: Kevin Cahill, "Who Owns the World: The Hidden Facts Behind Landownership"

This is the prime reason why those living in western nations' economies, and standards of living, are plummeting so severely. Western economies will not improve. Globalization, as indicated here, is a race to the bottom for the working classes.

- hplaserjet2001

Friday, January 7, 2011

Tuesday, January 4, 2011

Saturday, January 1, 2011

How Many Millionaires in Congress?

In comparison to the rest of US,.....ALL of them !!

http://marketplace.publicradio.org//display/web/2010/09/07/am-how-many-millionaires-are-in-congress/

http://marketplace.publicradio.org//display/web/2010/09/07/am-how-many-millionaires-are-in-congress/

Ethics Committe Lets Dodd Off the Hook: Dismisses Charges

Washington (CNN) -- The Senate Ethics Committee has dismissed a complaint of alleged corruption by retiring Democratic Sen. Christopher Dodd of Connecticut, according to statements Wednesday from Dodd and the group the filed the complaint.

Judicial Watch, which describes itself as a conservative public interest group that investigates and prosecutes government corruption, said it was notified on December 20 by the Senate Select Committee on Ethics, known as the Ethics Committee, about the dismissal of its complaint.

According to the Judicial Watch statement, the complaint filed in April 2009 alleged that Dodd helped Edward Downe Jr. "obtain a reduced sentence and ultimately a full presidential pardon for tax and securities crimes" from former President Bill Clinton in exchange for a below-market sales price on a property in Ireland co-owned by Downe.

The statement said the Senate ethics panel responded that "there is not sufficient substantial credible evidence of improper conduct or violation within its jurisdiction to warrant further action."

In his statement, Dodd said the Judicial Watch complaint was "nothing but a baseless, politically motivated accusation."

"Even during a Congress when Republicans and Democrats did not agree on much, the Senate Ethics Committee -- made up of an equal number of Republicans and Democrats -- dismissed this complaint after a careful 20-month review of the facts." Dodd's statement said. "After this lengthy review, we appreciate the Ethics Committee's conclusion that this attack was wholly without merit."

Tom Fitton, the Judicial Watch president, called the Senate panel's decision "shameful."

"The Senate Ethics Committee sat on our complaint for nearly two years, and then dismissed it out of hand days before Dodd's Senate career ends," Fitton said in the group's statement.

Members of the Senate Ethics Committee are Chairwoman Barbara Boxer, D-California; Vice Chairman Johnny Isakson, R-Georgia; Democrats Mark Pryor of Arkansas and Sherrod Brown of Ohio, and Republicans Pat Roberts of Kansas and James Risch of Idaho.

CNN's Ted Barrett and Tom Cohen contributed to this report.

http://www.cnn.com/2010/POLITICS/12/29/senate.dodd.ethics/index.html

Judicial Watch, which describes itself as a conservative public interest group that investigates and prosecutes government corruption, said it was notified on December 20 by the Senate Select Committee on Ethics, known as the Ethics Committee, about the dismissal of its complaint.

According to the Judicial Watch statement, the complaint filed in April 2009 alleged that Dodd helped Edward Downe Jr. "obtain a reduced sentence and ultimately a full presidential pardon for tax and securities crimes" from former President Bill Clinton in exchange for a below-market sales price on a property in Ireland co-owned by Downe.

The statement said the Senate ethics panel responded that "there is not sufficient substantial credible evidence of improper conduct or violation within its jurisdiction to warrant further action."

In his statement, Dodd said the Judicial Watch complaint was "nothing but a baseless, politically motivated accusation."

"Even during a Congress when Republicans and Democrats did not agree on much, the Senate Ethics Committee -- made up of an equal number of Republicans and Democrats -- dismissed this complaint after a careful 20-month review of the facts." Dodd's statement said. "After this lengthy review, we appreciate the Ethics Committee's conclusion that this attack was wholly without merit."

Tom Fitton, the Judicial Watch president, called the Senate panel's decision "shameful."

"The Senate Ethics Committee sat on our complaint for nearly two years, and then dismissed it out of hand days before Dodd's Senate career ends," Fitton said in the group's statement.

Members of the Senate Ethics Committee are Chairwoman Barbara Boxer, D-California; Vice Chairman Johnny Isakson, R-Georgia; Democrats Mark Pryor of Arkansas and Sherrod Brown of Ohio, and Republicans Pat Roberts of Kansas and James Risch of Idaho.

CNN's Ted Barrett and Tom Cohen contributed to this report.

http://www.cnn.com/2010/POLITICS/12/29/senate.dodd.ethics/index.html

Subscribe to:

Posts (Atom)