Saturday, May 29, 2010

Friday, May 28, 2010

Senate Approves $60 Billion For War, While House Cuts $24 Billion For Unemployed Workers And State Aid

STEPHEN OHLEMACHER and ANDREW TAYLOR 05/27/10 10:31 PM

WASHINGTON — The Senate easily passed an almost $60 billion war funding bill Thursday, but anxiety over out-of-control budget deficits led House leaders to drop tens of billions of dollars in spending from a separate catchall bill anchored by an extension of jobless benefits.

Confronted with a rebellion by Democratic moderates, House leaders planned to dump overboard $24 billion in aid to states and allow generous health insurance subsidies for laid-off workers to expire. The changes were an effort to round up votes to extend unemployment benefits and renew more than 50 popular tax breaks that expired last year.

Help for doctors facing a big cut in Medicare reimbursements would also be dropped from the measure, aides and lobbyists said, and is unlikely to be resurrected by a vote on Friday.

Democrats will miss their self-imposed deadline of passing the jobless benefits measure before Memorial Day, even if the House passes the bill Friday. The Senate announced Thursday that it will not hold any more votes until senators return from their holiday break June 7.

The steps by House leaders could reduce the deficit impact of the bill to as little as $30 billion or so in hopes of winning over moderate "Blue Dog" Democrats unhappy about adding to the deficit as the national debt is on the verge of topping $13 trillion. A version circulated last week would have added $134 billion to the deficit.

One Blue Dog, Rep. Henry Cuellar, D-Texas, said he would probably vote for a slimmed down version of the bill.

"The bigness issue and the deficit issue has been addressed," Cuellar said.

Across the Capitol, Senate Democrats had far better success in advancing the war funding bill, which would pay for President Barack Obama's 30,000 troop increase in Afghanistan.

A dozen Republicans, including GOP leader Mitch McConnell of Kentucky, joined Democrats in a 67-28 vote to pass the bill. Two anti-war Democrats, Sens. Ron Wyden of Oregon and Russ Feingold of Wisconsin, opposed it.

The war funding bill also includes $5 billion to replenish disaster aid accounts, and there's money for Haitian earthquake relief and aid to U.S. allies in the fight against terror.

The war funding measure has been kept relatively clean of add-ons that could draw GOP opposition – to the frustration of liberal Democrats such as Sen. Tom Harkin of Iowa, the top Senate sponsor of a $23 billion plan to help school districts avoid teacher layoffs as local revenues remain weak. Facing sure defeat, Harkin declined to offer the plan to the war funding bill.

Thousands of people are set to begin losing jobless benefits when an extension of unemployment insurance expires next week. A 65 percent subsidy for health insurance benefits for the unemployed under the COBRA program also expires.

The benefits extensions are part of a sweeping package of unfinished business that lawmakers had hope to complete before their Memorial Day recess to avoid the embarrassment of letting them lapse before going on vacation. Efforts to pass short-term extensions to buy time were doomed to fail since they would require the agreement of all 100 senators.

Democratic leaders cut the package of spending and tax cuts Wednesday by about $50 billion – to $143 billion – in an attempt to pick up votes. Thursday's moves could whack more than $50 billion more from the measure.

It's a tough vote for lawmakers who want to help constituents hit hard by the recession but are wary of being labeled big spenders. The economy is starting to pick up, but unemployment is still high as the nation continues to struggle from the loss of more than 8 million jobs. At the same time, angst over deficit spending is growing as midterm congressional elections near in November.

Senate Majority Leader Harry Reid, D-Nev., said that the Senate would not vote on the House tax and spending measure and announced the Senate would shortly adjourn for the Memorial Day recess.

The expanded jobless benefits provide up to 99 weeks of payments in many states, at a cost of nearly $40 billion. The benefits are part of a bill that includes a one-year extension of about 50 popular tax breaks that expired at the end of last year and a delay in scheduled cuts in Medicare payments to doctors.

It was looking grim Thursday night for a proposal to delay the scheduled 21 percent cut in payments until 2012, which would cost nearly $22 billion. The plan was to be dropped from the bill, and a separate vote on putting it back was thought likely to fail.

The cost of the bill would be partially offset by tax increases on investment fund managers, oil companies and some international businesses. The tax increases total about $57 billion over the next decade. Changes giving underfunded pensions more time to improve their finances would raise $2 billion.

Also in the House, Appropriations Committee Chairman David Obey, D-Wis., called off a vote on a far larger version of the war funding bill that added the $23 billion to help school districts avoid teacher layoffs, along with $6 billion to make up for a funding shortfall in grants for low-income college students. An Obey spokesman blamed the busy floor schedule and ongoing uncertainty over the jobless benefits bill. Appropriations panel Republicans had vowed to offer a raft of politically painful amendments.

http://www.huffingtonpost.com/2010/05/28/senate-approves-60-billio_n_592923.html?ir=Daily Brief

WASHINGTON — The Senate easily passed an almost $60 billion war funding bill Thursday, but anxiety over out-of-control budget deficits led House leaders to drop tens of billions of dollars in spending from a separate catchall bill anchored by an extension of jobless benefits.

Confronted with a rebellion by Democratic moderates, House leaders planned to dump overboard $24 billion in aid to states and allow generous health insurance subsidies for laid-off workers to expire. The changes were an effort to round up votes to extend unemployment benefits and renew more than 50 popular tax breaks that expired last year.

Help for doctors facing a big cut in Medicare reimbursements would also be dropped from the measure, aides and lobbyists said, and is unlikely to be resurrected by a vote on Friday.

Democrats will miss their self-imposed deadline of passing the jobless benefits measure before Memorial Day, even if the House passes the bill Friday. The Senate announced Thursday that it will not hold any more votes until senators return from their holiday break June 7.

The steps by House leaders could reduce the deficit impact of the bill to as little as $30 billion or so in hopes of winning over moderate "Blue Dog" Democrats unhappy about adding to the deficit as the national debt is on the verge of topping $13 trillion. A version circulated last week would have added $134 billion to the deficit.

One Blue Dog, Rep. Henry Cuellar, D-Texas, said he would probably vote for a slimmed down version of the bill.

"The bigness issue and the deficit issue has been addressed," Cuellar said.

Across the Capitol, Senate Democrats had far better success in advancing the war funding bill, which would pay for President Barack Obama's 30,000 troop increase in Afghanistan.

A dozen Republicans, including GOP leader Mitch McConnell of Kentucky, joined Democrats in a 67-28 vote to pass the bill. Two anti-war Democrats, Sens. Ron Wyden of Oregon and Russ Feingold of Wisconsin, opposed it.

The war funding bill also includes $5 billion to replenish disaster aid accounts, and there's money for Haitian earthquake relief and aid to U.S. allies in the fight against terror.

The war funding measure has been kept relatively clean of add-ons that could draw GOP opposition – to the frustration of liberal Democrats such as Sen. Tom Harkin of Iowa, the top Senate sponsor of a $23 billion plan to help school districts avoid teacher layoffs as local revenues remain weak. Facing sure defeat, Harkin declined to offer the plan to the war funding bill.

Thousands of people are set to begin losing jobless benefits when an extension of unemployment insurance expires next week. A 65 percent subsidy for health insurance benefits for the unemployed under the COBRA program also expires.

The benefits extensions are part of a sweeping package of unfinished business that lawmakers had hope to complete before their Memorial Day recess to avoid the embarrassment of letting them lapse before going on vacation. Efforts to pass short-term extensions to buy time were doomed to fail since they would require the agreement of all 100 senators.

Democratic leaders cut the package of spending and tax cuts Wednesday by about $50 billion – to $143 billion – in an attempt to pick up votes. Thursday's moves could whack more than $50 billion more from the measure.

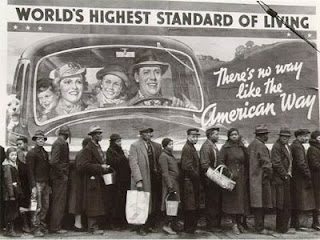

It's a tough vote for lawmakers who want to help constituents hit hard by the recession but are wary of being labeled big spenders. The economy is starting to pick up, but unemployment is still high as the nation continues to struggle from the loss of more than 8 million jobs. At the same time, angst over deficit spending is growing as midterm congressional elections near in November.

Senate Majority Leader Harry Reid, D-Nev., said that the Senate would not vote on the House tax and spending measure and announced the Senate would shortly adjourn for the Memorial Day recess.

The expanded jobless benefits provide up to 99 weeks of payments in many states, at a cost of nearly $40 billion. The benefits are part of a bill that includes a one-year extension of about 50 popular tax breaks that expired at the end of last year and a delay in scheduled cuts in Medicare payments to doctors.

It was looking grim Thursday night for a proposal to delay the scheduled 21 percent cut in payments until 2012, which would cost nearly $22 billion. The plan was to be dropped from the bill, and a separate vote on putting it back was thought likely to fail.

The cost of the bill would be partially offset by tax increases on investment fund managers, oil companies and some international businesses. The tax increases total about $57 billion over the next decade. Changes giving underfunded pensions more time to improve their finances would raise $2 billion.

Also in the House, Appropriations Committee Chairman David Obey, D-Wis., called off a vote on a far larger version of the war funding bill that added the $23 billion to help school districts avoid teacher layoffs, along with $6 billion to make up for a funding shortfall in grants for low-income college students. An Obey spokesman blamed the busy floor schedule and ongoing uncertainty over the jobless benefits bill. Appropriations panel Republicans had vowed to offer a raft of politically painful amendments.

http://www.huffingtonpost.com/2010/05/28/senate-approves-60-billio_n_592923.html?ir=Daily Brief

Sunday, May 23, 2010

Fix America First Why Dont We

....the government of the United States is not the champion of freedom, but rather the perpetuator of exploitation and oppression against the peoples of the world and against a large part of its own population."

http://dontreadthattrashreadthis.blogspot.com/

http://dontreadthattrashreadthis.blogspot.com/

ObombA Begs US for $$$ ....

to help in the fight for financial reform;

http://publikeye.blogspot.com/2010/05/obomba-begs-us-for-to-fight-for.html

http://publikeye.blogspot.com/2010/05/obomba-begs-us-for-to-fight-for.html

Friday, May 21, 2010

Chevron

In 2008, Chevron paid more than $40 billion to the governments of countries around the world – most of it entirely in secret.

Chevron drills for oil in places where millions of families struggle on less than $1 a day. (See Chevron in Ecuador) That $40 billion could have supported schools, health care and food programs –so where did it go?

Chevron knows exactly how much it paid to each country. But they won't say. And without any information on these secret payments, poor communities can't demand their fair share – to send their children to school, create jobs and escape poverty and hunger.

Tell Chevron to open the books on its secret payments so that the world can follow the money and help put it toward real development.

In less than a week, Chevron will hold its annual shareholder meeting. This is our moment to demand that Chevron finally come clean. Greater transparency and accountability will stabilize countries and help Chevron in the long run.

Chevron won't even provide a basic accounting of how much money goes to each country – so there's no transparency, no accountability, and no way for poor people to call for their fair share.

That means people whose lands are yielding up billions of dollars in oil revenues still face chronic hunger and poverty. It means some officials remain free to enrich themselves with no public oversight. This makes it hard for citizens and watchdog groups to follow the money and keep officials honest.

Our partner, Oxfam America, has met with Chevron multiple times, but they keep refusing to disclose. So they have filed a shareholder proposal for Chevron's May 26th annual meeting, by which shareholders can exercise their rights and ask Chevron to open the books on its secret payments – and in partnership with Oxfam America we're also making it easy for people like you to put direct pressure on Chevron.

Other oil and mining companies disclose this information, and Chevron should join them – especially since more transparency will actually help Chevron in the long run by stabilizing countries. If the company agrees to change its policies, it could be a watershed moment across the oil, gas, and mining industries.

Tell Chevron to stop the back-room deals that open the door to corruption and keep people in poverty.

Chevron advertises itself as a protector of the planet. So why isn't it agreeing to let the public see what it pays to foreign governments?

your help, we can pressure Chevron to make a real change in its policies – and help millions of poor people in the process. Please share this alert with your friends and family.

Thank you,

- The Change.org team in partnership with Oxfam America

Chevron drills for oil in places where millions of families struggle on less than $1 a day. (See Chevron in Ecuador) That $40 billion could have supported schools, health care and food programs –so where did it go?

Chevron knows exactly how much it paid to each country. But they won't say. And without any information on these secret payments, poor communities can't demand their fair share – to send their children to school, create jobs and escape poverty and hunger.

Tell Chevron to open the books on its secret payments so that the world can follow the money and help put it toward real development.

In less than a week, Chevron will hold its annual shareholder meeting. This is our moment to demand that Chevron finally come clean. Greater transparency and accountability will stabilize countries and help Chevron in the long run.

Chevron won't even provide a basic accounting of how much money goes to each country – so there's no transparency, no accountability, and no way for poor people to call for their fair share.

That means people whose lands are yielding up billions of dollars in oil revenues still face chronic hunger and poverty. It means some officials remain free to enrich themselves with no public oversight. This makes it hard for citizens and watchdog groups to follow the money and keep officials honest.

Our partner, Oxfam America, has met with Chevron multiple times, but they keep refusing to disclose. So they have filed a shareholder proposal for Chevron's May 26th annual meeting, by which shareholders can exercise their rights and ask Chevron to open the books on its secret payments – and in partnership with Oxfam America we're also making it easy for people like you to put direct pressure on Chevron.

Other oil and mining companies disclose this information, and Chevron should join them – especially since more transparency will actually help Chevron in the long run by stabilizing countries. If the company agrees to change its policies, it could be a watershed moment across the oil, gas, and mining industries.

Tell Chevron to stop the back-room deals that open the door to corruption and keep people in poverty.

Chevron advertises itself as a protector of the planet. So why isn't it agreeing to let the public see what it pays to foreign governments?

your help, we can pressure Chevron to make a real change in its policies – and help millions of poor people in the process. Please share this alert with your friends and family.

Thank you,

- The Change.org team in partnership with Oxfam America

Wednesday, May 19, 2010

oBOMBa & Bernanke's Secret War on the Dollar

The report that they DO NOT want you to see;

The shocking proof: Your buying power, your quality of life and your family’s future are being quietly but callously SACRIFICED on the altar of political convenience.

Here’s why Obama’s Fed chief, Benjamin S. Bernanke, is intentionally destroying the value of every dollar you earn and have saved or invested …

Read more....ag=B2-welcome">http://finance.uncommonwisdomdaily.com/war-on-the-dollar/free-report/?sc=G100&ec=A97652>ag=B2-welcome

Here’s why Obama’s Fed chief, Benjamin S. Bernanke, is intentionally destroying the value of every dollar you earn and have saved or invested …

Read more....ag=B2-welcome">http://finance.uncommonwisdomdaily.com/war-on-the-dollar/free-report/?sc=G100&ec=A97652>ag=B2-welcome

oBOMBaCa$h & the Global Elite

Rich and powerful: Obama and the global super-elite

The US President's bank balance has been buoyant since he took office. But he is still some way short of rivalling the very richest world leaders

By David Usborne

Wednesday, 19 May 2010

Now the nation knows. That doggy in the White House window is worth $1,600 (£1,100). Pretty pricey for a pooch – but then he is part of a household that is worth many millions of dollars, according to the latest financial disclosures filed, as US law requires, by the First Couple, Barack and Michelle Obama.

The forms, posted for all to see on the internet, are a window into the not inconsiderable wealth of America's top family, generated partly by royalties from the president's two memoirs, Dreams of My Father and The Audacity of Hope.

Last year, they earned him between $2m and $10m. His assets are between $2.3m and $7.7m – the forms show ranges of value rather than specific figures.

Related articles

More Americas News

Search the news archive for more stories

Joe Biden, the Vice President, seems to have a much leaner financial cushion. His form reveals that he received a signed first edition of a James Joyce book, Anna Livia Plurabelle, from a fan last year worth $3,500. He lists his overall assets at between only $155,029 and $675,000.

It might behove a political leader to go to the dog pound for a puppy rather than indulge in so expensive a pedigreed pet. Happily for Mr Obama, this animal – Bo, a Portuguese water dog – is listed as a gift. He was presented to the Obamas by the late Senator Edward Kennedy

Also entered in the documents are the $1.4m Mr Obama received from the Nobel committee for the peace prize he won last year and – more importantly – his decision to donate all of it to charity. The value of the prize medal and diploma, if anyone is wondering, is "not readily ascertainable", the form says.

Under the Ethics in Government Act of 1978, all top federal officials are required annually to disclose their financial interests.

Thus we can see that Mr Obama has an impressive range of assets including in stocks, college education funds for his two daughters, mutual funds, bank accounts and bonds.

In these days of deep distrust of Washington and politicians generally, it might be better for the likes of Mr Obama to be able to demonstrate relative penury.

Leaders the world over try to claim proximity to the "ordinary voter"; large fortunes can be an impediment.

The carefully crafted image of Sarah Palin, the former governor of Alaska, as a spokesperson for working Americans has taken a hit recently, for instance, with revelations that her recent book, burgeoning TV career and work on the speaking circuit has earned her about $12m.

Even the elections in Britain saw an attempt by some to paint then candidate, now Prime Minister, David Cameron, as a member of the elite and therefore out of touch.

A 2008 News of the World report put Mr Cameron's personal fortune at £3.2m. Both he and his wife, Samantha, whose mother is Viscountess Astor, stand to gain more through future inheritances.

Too much cash in the attic may pose greater difficulties for a parliamentary leader, however, than for a president, who is both politician and head of state. Assuming it is honestly gained (and is not swollen by the plundering of taxpayer pockets), being rich need not be a problem, especially if yours not a socialist state.

In Chile, voters had no difficulty recently electing Sebastian Pinera as their new president, whose first task upon taking office was to dispose of his $1.5bn stake in the national airline, Lan Chile.

That Mr Cameron concluded his first cabinet meeting with an announcement that he and all his ministers would be taking a 5 per cent pay cut was a sign that he is wary of the connection between public appreciation of politicians and what they earn, particularly in a time of austerity. The biggest scandal in British politics in recent years, after all, was about MPs and fiddled expenses.

It helps Mr Obama that most of his fortune is coming not from the public purse – he is paid a salary of $400,000 a year – or from a past career, say on Wall Street, but from the two books. It is the voters, after all, who have been buying them.

TWENTY RICHEST WORLD LEADERS

1. King of Thailand, £20bn

The longest-serving monarch in the world as well as the richest, 82-year-old King Bhumibol Adulyadej's wealth includes large amounts of land and property. However the Thai government has disputed his position as the wealthiest head of state, saying that much of this is not part of his personal wealth. Regardless of his personal finances, in a country where the rural poor are currently locked in violent protests against an unpopular government, he remains a universally loved figure.

2. Sultan of Brunei, £13.5bn

Brunei's oil and gas reserves have kept the Sultan among the world's richest, and he spends accordingly: as well as having a love for luxury cars, for his 50th birthday in 1996 he hired Michael Jackson to perform.

3. Khalifa bin Zayed Al Nahyan (President of UAE), £12bn

As the ruler of Abu Dhabi, Sheikh Khalifa has been a driving force during its recent spending spree in its attempts to establish itself as a cultural hub. A pro-Western moderniser and camel-racing fan.

4. King of Saudi Arabia, £11.5bn

Saudi Arabia's vast oil reserves are behind the wealth of King Abdullah, whose grandeur is such that he has a city named after him – King Abdullah Economic City – currently being constructed on the west coast of the country.

5. Silvio Berlusconi, £6bn

Varied business interests – including television stations, magazines and his beloved AC Milan – have made the Italian prime minister a very rich man indeed. His many critics charge that he has used his political career to maximise that wealth.

6. Hans-Adam II, Prince of Liechtenstein, £2.5bn

The fortune of Liechtenstein's monarch comes from the royal family's ownership of the country's LGT Bank, and the prince owns palaces and land in Austria. He expanded his power in the tiny country in a 2003 referendum.

7. Emir of Qatar £1.4bn

The head of a country with the world's third largest natural gas reserves, Sheikh Hamad bin Khalifa Al Thani's expensive tastes include art as well as horse and camel racing. His $137m loan in 1996 was crucial to the founding of the Al Jazeera news network.

8. Asif Ali Zardari, President of Pakistan, £1.2bn

Nicknamed "Mr 10 per cent" thanks to the corruption allegations that have dogged him, Benazir Bhutto's widower is accused by the National Accountability Bureau of holding $1.5bn in assets abroad.

9= Prince Albert II of Monaco, £700m

Assets of the wealthy Grimaldi family includes art, real estate and Société des Bains de Mer, which owns Monaco's casinos. Prince Albert, a lifelong bachelor with two illegitimate children, is the son of Hollywood actress Grace Kelly.

9= Sebastián Piñera, President of Chile, £700m

Responsible for the introduction of the credit card to Chile, Pinera sold many of his investments when he became president last year. He agreed to give up a television station under pressure over conflicts of interest this week.

11. Sultan of Oman, £470m

Sultan Qaboos, who came to power when he overthrew his father in 1970, suffered considerable losses in the credit crunch, but remains vastly wealthy. The Sandhurst graduate has used his fortune to finance the restoration of mosques across the country.

12. Teodoro Obiang Nguema Mbasogo, President of Equatorial Guinea, £400m

Once labelled Africa's worst dictator, he deposited half a billion dollars from the national treasury into private family accounts in 2003 to "fight corruption".

13. The Queen, £300m

Even excluding state-owned properties like Windsor Castle and national treasures like the royal art collection, and despite the downturn, the Queen's homes, business interests, horses, art collection and jewellery have kept her personal fortunes in rude health.

14. Emir of Kuwait, £270m

Unlike most other Gulf leaders, Sheikh Sabah's fortune depends on a stipend from the state – which he took steps to increase considerably by passing a law that adjusted it from $25m to $188m annually after he acceded to the throne in 2006.

15. Queen Beatrix of the Netherlands, £135m

Although her mother put the family's major cultural assets into national trusts, Beatrix is still worth about $200m. Her family gets an allowance of €5.6m a year – plus €93m or so in expenses.

16. King Mswati III of Swaziland, £68m

As the sole trustee of a $10bn national fund, Mswati augments his personal wealth with state money. Each of his 13 brides has a palace, a retinue and a BMW; meanwhile, two thirds of the country live in poverty.

17. Kevin Rudd, Prime Minister of Australia, £41m

Although Rudd's own background is in bureaucracy, he enjoys considerable wealth as the husband of Therese Rein, an entrepreneur who sold her recruitment business in 2007 to avoid conflicts of interest.

18. John Key, New Zealand Prime Minister, £25m

The former investment banker amassed a tidy sum before entering politics with the right-wing National Party in 2002. He owns properties in London and Hawaii as well as his home country.

19. Lee Myung-bak, President of South Korea, £16m

Lee came from a poverty-stricken background to rise at Hyundai until he became chief executive. Cleared of fraud shortly before his inauguration in 2008.

20. Milo Djukanovic, President of Montenegro, £10m

Mysteriously wealthy, he denies allegations that he was involved in a lucrative tobacco smuggling ring.

Toby Green

http://www.independent.co.uk/news/world/politics/rich-and-powerful-obama-and-the-global-superelite-1976403.html

The US President's bank balance has been buoyant since he took office. But he is still some way short of rivalling the very richest world leaders

By David Usborne

Wednesday, 19 May 2010

Now the nation knows. That doggy in the White House window is worth $1,600 (£1,100). Pretty pricey for a pooch – but then he is part of a household that is worth many millions of dollars, according to the latest financial disclosures filed, as US law requires, by the First Couple, Barack and Michelle Obama.

The forms, posted for all to see on the internet, are a window into the not inconsiderable wealth of America's top family, generated partly by royalties from the president's two memoirs, Dreams of My Father and The Audacity of Hope.

Last year, they earned him between $2m and $10m. His assets are between $2.3m and $7.7m – the forms show ranges of value rather than specific figures.

Related articles

More Americas News

Search the news archive for more stories

Joe Biden, the Vice President, seems to have a much leaner financial cushion. His form reveals that he received a signed first edition of a James Joyce book, Anna Livia Plurabelle, from a fan last year worth $3,500. He lists his overall assets at between only $155,029 and $675,000.

It might behove a political leader to go to the dog pound for a puppy rather than indulge in so expensive a pedigreed pet. Happily for Mr Obama, this animal – Bo, a Portuguese water dog – is listed as a gift. He was presented to the Obamas by the late Senator Edward Kennedy

Also entered in the documents are the $1.4m Mr Obama received from the Nobel committee for the peace prize he won last year and – more importantly – his decision to donate all of it to charity. The value of the prize medal and diploma, if anyone is wondering, is "not readily ascertainable", the form says.

Under the Ethics in Government Act of 1978, all top federal officials are required annually to disclose their financial interests.

Thus we can see that Mr Obama has an impressive range of assets including in stocks, college education funds for his two daughters, mutual funds, bank accounts and bonds.

In these days of deep distrust of Washington and politicians generally, it might be better for the likes of Mr Obama to be able to demonstrate relative penury.

Leaders the world over try to claim proximity to the "ordinary voter"; large fortunes can be an impediment.

The carefully crafted image of Sarah Palin, the former governor of Alaska, as a spokesperson for working Americans has taken a hit recently, for instance, with revelations that her recent book, burgeoning TV career and work on the speaking circuit has earned her about $12m.

Even the elections in Britain saw an attempt by some to paint then candidate, now Prime Minister, David Cameron, as a member of the elite and therefore out of touch.

A 2008 News of the World report put Mr Cameron's personal fortune at £3.2m. Both he and his wife, Samantha, whose mother is Viscountess Astor, stand to gain more through future inheritances.

Too much cash in the attic may pose greater difficulties for a parliamentary leader, however, than for a president, who is both politician and head of state. Assuming it is honestly gained (and is not swollen by the plundering of taxpayer pockets), being rich need not be a problem, especially if yours not a socialist state.

In Chile, voters had no difficulty recently electing Sebastian Pinera as their new president, whose first task upon taking office was to dispose of his $1.5bn stake in the national airline, Lan Chile.

That Mr Cameron concluded his first cabinet meeting with an announcement that he and all his ministers would be taking a 5 per cent pay cut was a sign that he is wary of the connection between public appreciation of politicians and what they earn, particularly in a time of austerity. The biggest scandal in British politics in recent years, after all, was about MPs and fiddled expenses.

It helps Mr Obama that most of his fortune is coming not from the public purse – he is paid a salary of $400,000 a year – or from a past career, say on Wall Street, but from the two books. It is the voters, after all, who have been buying them.

TWENTY RICHEST WORLD LEADERS

1. King of Thailand, £20bn

The longest-serving monarch in the world as well as the richest, 82-year-old King Bhumibol Adulyadej's wealth includes large amounts of land and property. However the Thai government has disputed his position as the wealthiest head of state, saying that much of this is not part of his personal wealth. Regardless of his personal finances, in a country where the rural poor are currently locked in violent protests against an unpopular government, he remains a universally loved figure.

2. Sultan of Brunei, £13.5bn

Brunei's oil and gas reserves have kept the Sultan among the world's richest, and he spends accordingly: as well as having a love for luxury cars, for his 50th birthday in 1996 he hired Michael Jackson to perform.

3. Khalifa bin Zayed Al Nahyan (President of UAE), £12bn

As the ruler of Abu Dhabi, Sheikh Khalifa has been a driving force during its recent spending spree in its attempts to establish itself as a cultural hub. A pro-Western moderniser and camel-racing fan.

4. King of Saudi Arabia, £11.5bn

Saudi Arabia's vast oil reserves are behind the wealth of King Abdullah, whose grandeur is such that he has a city named after him – King Abdullah Economic City – currently being constructed on the west coast of the country.

5. Silvio Berlusconi, £6bn

Varied business interests – including television stations, magazines and his beloved AC Milan – have made the Italian prime minister a very rich man indeed. His many critics charge that he has used his political career to maximise that wealth.

6. Hans-Adam II, Prince of Liechtenstein, £2.5bn

The fortune of Liechtenstein's monarch comes from the royal family's ownership of the country's LGT Bank, and the prince owns palaces and land in Austria. He expanded his power in the tiny country in a 2003 referendum.

7. Emir of Qatar £1.4bn

The head of a country with the world's third largest natural gas reserves, Sheikh Hamad bin Khalifa Al Thani's expensive tastes include art as well as horse and camel racing. His $137m loan in 1996 was crucial to the founding of the Al Jazeera news network.

8. Asif Ali Zardari, President of Pakistan, £1.2bn

Nicknamed "Mr 10 per cent" thanks to the corruption allegations that have dogged him, Benazir Bhutto's widower is accused by the National Accountability Bureau of holding $1.5bn in assets abroad.

9= Prince Albert II of Monaco, £700m

Assets of the wealthy Grimaldi family includes art, real estate and Société des Bains de Mer, which owns Monaco's casinos. Prince Albert, a lifelong bachelor with two illegitimate children, is the son of Hollywood actress Grace Kelly.

9= Sebastián Piñera, President of Chile, £700m

Responsible for the introduction of the credit card to Chile, Pinera sold many of his investments when he became president last year. He agreed to give up a television station under pressure over conflicts of interest this week.

11. Sultan of Oman, £470m

Sultan Qaboos, who came to power when he overthrew his father in 1970, suffered considerable losses in the credit crunch, but remains vastly wealthy. The Sandhurst graduate has used his fortune to finance the restoration of mosques across the country.

12. Teodoro Obiang Nguema Mbasogo, President of Equatorial Guinea, £400m

Once labelled Africa's worst dictator, he deposited half a billion dollars from the national treasury into private family accounts in 2003 to "fight corruption".

13. The Queen, £300m

Even excluding state-owned properties like Windsor Castle and national treasures like the royal art collection, and despite the downturn, the Queen's homes, business interests, horses, art collection and jewellery have kept her personal fortunes in rude health.

14. Emir of Kuwait, £270m

Unlike most other Gulf leaders, Sheikh Sabah's fortune depends on a stipend from the state – which he took steps to increase considerably by passing a law that adjusted it from $25m to $188m annually after he acceded to the throne in 2006.

15. Queen Beatrix of the Netherlands, £135m

Although her mother put the family's major cultural assets into national trusts, Beatrix is still worth about $200m. Her family gets an allowance of €5.6m a year – plus €93m or so in expenses.

16. King Mswati III of Swaziland, £68m

As the sole trustee of a $10bn national fund, Mswati augments his personal wealth with state money. Each of his 13 brides has a palace, a retinue and a BMW; meanwhile, two thirds of the country live in poverty.

17. Kevin Rudd, Prime Minister of Australia, £41m

Although Rudd's own background is in bureaucracy, he enjoys considerable wealth as the husband of Therese Rein, an entrepreneur who sold her recruitment business in 2007 to avoid conflicts of interest.

18. John Key, New Zealand Prime Minister, £25m

The former investment banker amassed a tidy sum before entering politics with the right-wing National Party in 2002. He owns properties in London and Hawaii as well as his home country.

19. Lee Myung-bak, President of South Korea, £16m

Lee came from a poverty-stricken background to rise at Hyundai until he became chief executive. Cleared of fraud shortly before his inauguration in 2008.

20. Milo Djukanovic, President of Montenegro, £10m

Mysteriously wealthy, he denies allegations that he was involved in a lucrative tobacco smuggling ring.

Toby Green

http://www.independent.co.uk/news/world/politics/rich-and-powerful-obama-and-the-global-superelite-1976403.html

Tuesday, May 18, 2010

Stone, Douglas on their return to Wall Street

By Peter Howell

Taken aback by reception to familiar '80s movie, its makers figure the time is right for Gordon Gekko's return

CANNES, FRANCE-Normally when Hollywood comes to Cannes, it's not to preach the virtues of restraint or sober second thought.

This is the town where no one blinks at $1,500-per-night hotel rooms or $10 sips of espresso. There is also something incongruous about millionaire actors and directors pleading the cause of workers and common folk.

So there was a surreal quality about Friday's proletarian news conference following the Cannes Film Festival world debut of Wall Street: Money Never Sleeps, Oliver Stone's belated follow-up to his 1987 drama of corporate greed.

A lot of things have happened in the past 23 years, including 9/11 and an economic crisis or three. The thinking of Stone and his leading man Michael Douglas has changed. Their world view has broadened considerably, and they're no longer snickering about the more venal aspects of Gordon Gekko, the corporate raider, played to sneering perfection by Douglas, who became an immortal villain with his "greed is good" boasting and ruthless money deals.

Now the older and more thoughtful Douglas and Stone seem almost guilty about Gekko, and how he became an unwitting symbol of success for many impressionable viewers of the original Wall Street.

"Well, I think Oliver and I both were pretty stunned, after the first one, how they perceived Gekko," said Douglas, 65.

"He's an insider trader, a guy who destroyed companies - a very, very well-written villain, and people are attracted to villains. We just never anticipated that all these MBAs, all these people in business school, would be ranting and raving that this was the person they wanted to be.

"And yet, 23 years later, I imagine that a lot of these MBA students are heading up these investment banking companies because the greed has not stopped. It's become legal."

Stone, 63, whose father was a stock trader, said he was initially reluctant to revisit Gekko and his era, "because I didn't want to celebrate that culture of wealth ... it just seemed to be getting worse and worse. There was no reason to make a movie.

"After the (2008 economic) crash, of course, all bets were off because, really, it was a major heart attack. It was a triple bypass. I think they put a stent in, but I'm not sure if they've solved it.

"So this is serious, and it puts the whole world in a new perspective. It's time to come back and get Gordon Gekko."

Rather than make a movie about Gekko exploiting the 2008 money meltdown, which the film does address, Stone wanted his Wall Street sequel to address the toll that unchallenged capitalism takes on families.

Gekko has a daughter, played by Carey Mulligan, who is involved with up-and-coming trader Jake Moore (Shia LaBeouf), who seems almost a contradiction in terms: he wants to get filthy rich by peddling clean green energy technology.

Gekko's motives aren't immediately clear in Wall Street: Money Never Sleeps, but he's not the obvious villain of the piece. He's trying to get his life back together, and reunite with his estranged daughter, after spending eight years in prison on convictions for various financial crimes.

The real bad guy in the film is Josh Brolin's Bretton James, a billionaire investment banker who seems to be picking up where his old pal (and now enemy) Gekko left off.

Brolin sees his character as a cautionary example of someone blinded by greed.

"The theme of the first movie is 'greed is good' and the theme of this one is 'more,' " Brolin said.

"There's no end to the possibilities of accumulation. Having myself traded, on a very small level, I understand what it is to get caught up in that moment of greed where you go, 'I understand the kids are upstairs and they need to eat, but I need 15 more minutes because I may make that much more money. And then they'll be able to eat more' ...

"To tap into that greed and allow yourself to lose your identity and reconfigure your identity within that is, morally, completely bereft."

Many people accused Stone and Douglas of celebrating the cowboy capitalism of the 1980s with Wall Street. That may have been true then, but it's certainly not the case with the sequel, scheduled for wide release on Sept. 24. Stone in particular seems genuinely concerned about where the world is headed, and what it means to average workers.

"It seems we got drunk (on greed)," Stone said.

"In 1987, I thought (capitalism) was going to correct itself, I really did ... but it got worse ...

"Stock holders and CEOs made money, but working people did not. There's tremendous inequality and injustice in that and that has to be corrected."

In his personal life, as a happily married man with two young additions to his family, Douglas is anything but a Gordon Gekko. Outside of acting, he works closely with the United Nations as an official ambassador of peace, promoting nuclear disarmament. He's not happy with the current slow pace of change, in all aspects of global renewal.

"It's pretty disappointing," Douglas said.

"The area I work on, which is the elimination of nuclear weapons, there seems to be some great movement going ahead but as you do look at the greed, at the oil spills, the volcanic ash, the Earth seems to be speaking back."

Are people ready for a Gordon Gekko who wants to build rather than smash? We'll see.

http://license.icopyright.net/user/viewContent.act?clipid=498841333

Taken aback by reception to familiar '80s movie, its makers figure the time is right for Gordon Gekko's return

CANNES, FRANCE-Normally when Hollywood comes to Cannes, it's not to preach the virtues of restraint or sober second thought.

This is the town where no one blinks at $1,500-per-night hotel rooms or $10 sips of espresso. There is also something incongruous about millionaire actors and directors pleading the cause of workers and common folk.

So there was a surreal quality about Friday's proletarian news conference following the Cannes Film Festival world debut of Wall Street: Money Never Sleeps, Oliver Stone's belated follow-up to his 1987 drama of corporate greed.

A lot of things have happened in the past 23 years, including 9/11 and an economic crisis or three. The thinking of Stone and his leading man Michael Douglas has changed. Their world view has broadened considerably, and they're no longer snickering about the more venal aspects of Gordon Gekko, the corporate raider, played to sneering perfection by Douglas, who became an immortal villain with his "greed is good" boasting and ruthless money deals.

Now the older and more thoughtful Douglas and Stone seem almost guilty about Gekko, and how he became an unwitting symbol of success for many impressionable viewers of the original Wall Street.

"Well, I think Oliver and I both were pretty stunned, after the first one, how they perceived Gekko," said Douglas, 65.

"He's an insider trader, a guy who destroyed companies - a very, very well-written villain, and people are attracted to villains. We just never anticipated that all these MBAs, all these people in business school, would be ranting and raving that this was the person they wanted to be.

"And yet, 23 years later, I imagine that a lot of these MBA students are heading up these investment banking companies because the greed has not stopped. It's become legal."

Stone, 63, whose father was a stock trader, said he was initially reluctant to revisit Gekko and his era, "because I didn't want to celebrate that culture of wealth ... it just seemed to be getting worse and worse. There was no reason to make a movie.

"After the (2008 economic) crash, of course, all bets were off because, really, it was a major heart attack. It was a triple bypass. I think they put a stent in, but I'm not sure if they've solved it.

"So this is serious, and it puts the whole world in a new perspective. It's time to come back and get Gordon Gekko."

Rather than make a movie about Gekko exploiting the 2008 money meltdown, which the film does address, Stone wanted his Wall Street sequel to address the toll that unchallenged capitalism takes on families.

Gekko has a daughter, played by Carey Mulligan, who is involved with up-and-coming trader Jake Moore (Shia LaBeouf), who seems almost a contradiction in terms: he wants to get filthy rich by peddling clean green energy technology.

Gekko's motives aren't immediately clear in Wall Street: Money Never Sleeps, but he's not the obvious villain of the piece. He's trying to get his life back together, and reunite with his estranged daughter, after spending eight years in prison on convictions for various financial crimes.

The real bad guy in the film is Josh Brolin's Bretton James, a billionaire investment banker who seems to be picking up where his old pal (and now enemy) Gekko left off.

Brolin sees his character as a cautionary example of someone blinded by greed.

"The theme of the first movie is 'greed is good' and the theme of this one is 'more,' " Brolin said.

"There's no end to the possibilities of accumulation. Having myself traded, on a very small level, I understand what it is to get caught up in that moment of greed where you go, 'I understand the kids are upstairs and they need to eat, but I need 15 more minutes because I may make that much more money. And then they'll be able to eat more' ...

"To tap into that greed and allow yourself to lose your identity and reconfigure your identity within that is, morally, completely bereft."

Many people accused Stone and Douglas of celebrating the cowboy capitalism of the 1980s with Wall Street. That may have been true then, but it's certainly not the case with the sequel, scheduled for wide release on Sept. 24. Stone in particular seems genuinely concerned about where the world is headed, and what it means to average workers.

"It seems we got drunk (on greed)," Stone said.

"In 1987, I thought (capitalism) was going to correct itself, I really did ... but it got worse ...

"Stock holders and CEOs made money, but working people did not. There's tremendous inequality and injustice in that and that has to be corrected."

In his personal life, as a happily married man with two young additions to his family, Douglas is anything but a Gordon Gekko. Outside of acting, he works closely with the United Nations as an official ambassador of peace, promoting nuclear disarmament. He's not happy with the current slow pace of change, in all aspects of global renewal.

"It's pretty disappointing," Douglas said.

"The area I work on, which is the elimination of nuclear weapons, there seems to be some great movement going ahead but as you do look at the greed, at the oil spills, the volcanic ash, the Earth seems to be speaking back."

Are people ready for a Gordon Gekko who wants to build rather than smash? We'll see.

http://license.icopyright.net/user/viewContent.act?clipid=498841333

Thursday, May 13, 2010

POLITICANS AGAINST FINANCIAL REFORM

"LEANING" NO

(Won't Commit)

Evan Bayh (D-Ind.)

Thomas Carper (D-Del.)

Kirsten Gillibrand (D-N.Y.)

Kay Hagan (D-N.C.)

Amy Klobuchar (D-Minn.)

Ben Nelson (D-Neb.)

John Rockefeller (D-W.V.)

Charles Schumer (D-N.Y.)

Arlen Specter (D-Pa.)

Mark Warner (D-Va.)

OPPOSE

David Vitter (R-La.)

EVERYONE ELSE supports it!

http://www.citizen.org/where-senators-stand

(Won't Commit)

Evan Bayh (D-Ind.)

Thomas Carper (D-Del.)

Kirsten Gillibrand (D-N.Y.)

Kay Hagan (D-N.C.)

Amy Klobuchar (D-Minn.)

Ben Nelson (D-Neb.)

John Rockefeller (D-W.V.)

Charles Schumer (D-N.Y.)

Arlen Specter (D-Pa.)

Mark Warner (D-Va.)

OPPOSE

David Vitter (R-La.)

EVERYONE ELSE supports it!

http://www.citizen.org/where-senators-stand

Schumer "Leaning No" on Financial reform Bill!

http://www.citizen.org/where-senators-stand

As the bill gets ready to go to the floor, Chuck Schumer "uncommitted" and in "non-communicado!"

Still trying to get a straight ans from any one of his offices

As the bill gets ready to go to the floor, Chuck Schumer "uncommitted" and in "non-communicado!"

Still trying to get a straight ans from any one of his offices

Tuesday, May 11, 2010

Ben Bernanke's Great Big Lie

The Federal Reserve's Robbing You Blind...

Dear Concerned Individual,

"The U.S. Government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost," said Federal Reserve Chairman Ben Bernanke on November 21, 2002.

Saying that the U.S. Government could "…produce as many U.S. dollars as it wishes at essentially no cost" is a great big lie. Because there is a cost – it’s inflation.

And it costs you, and every citizen, by robbing them blind of the purchasing power of their dollars.

Since taking the helm of the Federal Reserve in 2006, this is precisely what Bernanke's done...he's printed money like there's no tomorrow. In fact, he's more than doubled the Fed's balance sheet while pushing the federal funds rate to near zero.

What this means is, Bernanke's methodically debauching the dollar to bailout the banks and stimulate the economy. Moreover, this means the dollars in your paycheck, savings, and retirement account, are being watered down to that of a cheap Budweiser beer.

But that's not all...

Warning: This is NOT for Everyone

Just so you know what you're getting into... Before continuing on, we must warn you:

This is NOT for everyone.

In fact, it may not be for you.

But if...

You've had enough of all the government bailouts, stimulus, and spending bills...and are doubtful it'll do a lick for the economy (Hint: it won't...in fact, it'll make things worse)...

You've watched in shock and awe as the stock market has run up 60 percent since its March 9, 2009 low and are considering getting back in the market (Hint: don't do it. This will go down as the all time sucker's rally)

You've suspected the global financial and economic crisis will send the world economy -- including the United States -- tail spinning into another Great Depression (Hint: it already is)...

You've asked "What gives with all these bank failures? And is my bank next?" (Hint: it's practically guaranteed)...

You're concerned the mortgage meltdown will only get worse (Hint: it's only just begun...Alt-A's are next)...

You wonder where all the "liquidity" the Fed "injected" into the system to "calm" the markets came from. And what the heck is "liquidity" anyway? (Hint: it's not what you think it is)...

You suspect the price of gas will once again explode over $4 per gallon...or more (Hint: you ain't seen nothing yet)...

You watched in awe as McMansion homes sprouted like alfalfa...sold at insane prices...and are outraged that we now have to bailout the wall street fat cats like AIG that insured these loans for people who couldn't really afford them to begin with. What gives?

You wonder why practically all the manufacturing jobs have been sent offshore due to "globalization"...

And why all the top U.S. companies are companies that don't make anything...but just shuffle paper.

You dislike filling out "government forms"...and distrust all the government meddling in your private affairs...

All in all, if you look around you and see a world that doesn't quite add up to what you're being told by politicians...the news media...and your broker...

Then you have absolutely, without a doubt, come to the right place...

For we have insights...we have opinions...and we have answers!

And even if you're not so sure about these things, please read on. For you soon may find them to be of utmost importance to the lives of you and your family in the very near future.

That's why we have created the FREE Great Depression Online E-Newsletter;-----------

So that you can discover and be informed of the many perilous financial and economic hazards that are increasing by the day -- hazards that could produce another Great Depression and wipe out what's left of America's middle class in the process. To offer insights into what you can do to protect your hard earned wealth and your family from the coming crisis...and to provide ideas for acquiring massive profits along the way. And to help you explore if this is an opportunity you think you may possibly be interest in...

I'd like to give you a FREE Copy of an important Report. It's called The Great Middle Class Wipe Out -- Avoid Disaster as Economic Bust Wipes Out America's Middle Class. Inside you'll discover the causes of the Great Depression, the difference between recession and depression, cures for the great depression, how to survive the Great Depression...and more.

What's more, this important Report is yours FREE when you subscribe to the FREE Great Depression Online E-Newsletter.

But that's not all. when you subscribe to the Great Depression Online today, you'll receive...

FREE 7-Day Course and Three Bonus Reports

When You Subscribe Today!

That's right. When you subscribe today, you'll receive...

FREE 7-Day Course - Discover why we are headed for another Great Depression. Why this time it could be much, Much, Worse. And what you can do to protect your hard earned wealth and family from the coming economic calamity.

FREE Bonus Report No. 1 - "The Great Middle Class Wipe Out -- Avoid Disaster as Economic Bust Wipes Out America's Middle Class" e-book. Inside you'll discover the causes of the Great Depression, the difference between recession and depression, cures for the great depression, how to survive the Great Depression...and more.

FREE Bonus Report No. 2 - "First Steps in Banking" 50th Anniversary Edition e-book. The licensing fee to publish this Special 50th Anniversary, which first ran in 1957 in the famed British satire magazine, Punch, cost us $202.26.

FREE Bonus Report No. 3 - "The Dutch Tulip Mania" e-book. This fascinating tale of human folly is a must have for every astute market observer. And the wisdom it contains could save you a fortune.

What's more, your subscription to the Great Depression Online is FREE!

When you subscribe to the Great Depression Online, you'll receive an e-mail confirmation.

Following your confirmation, you'll receive an e-mail that includes links to access and download the three FREE Bonus Reports as e-books. You'll be able to save them, print them, and refer to them again...and again...and again.

And on the following day you'll get Day 1 of 7 of the FREE 7-Day Course in your e-mail inbox.

You will also begin receiving issues of the Great Depression Online E-Newsletter. New issues are published twice-weekly; every Tuesday and Friday.

And here's all you need to do to subscribe, click link below and then;

http://www.greatdepressioncourse.com/course.htm

Simply input your e-mail address into the subscribe box below, and you'll be on your way to discovering these very important insights today.

We Respect Your Privacy

We Will Not Share Your Email

With Anyone Else

If you're thinking, "Hey. Should I trust these folks with my email address?"

Let me assure you that we despise SPAM too. For this reason, we have taken special measures to respect and ensure the privacy of your email address...

We use a third party email delivery service provided by AWeber Communications, Inc. You can follow this link to learn more about their Zero Tolerance Anti-Spam Policy.

To respect your privacy and ensure that you do want to hear from us, we require subscription "Conformation" via email.

Every email that is sent includes an "unsubscribe" link. If you no longer want to receive email from us, simply click on the "unsubscribe" link.

And most importantly, we will not sell, rent, or share your email address with anyone. Period!

So what are you waiting for -- FREE 7-Day Course and Three Bonus Report When You Subscribe to the Great Depression Online Today!

Sincerely,

M.N. Gordon, Editor

Great Depression Online

P.S. The Great Depression Online is published by Direct Expressions LLC. To learn more about the many exciting publications we offer, please visit www.directexpressions.com.

Copyright © 2009 Direct Expressions LLC. All Rights Reserved.

Direct Expressions LLC. 2201 N. Lakewood Blvd., Ste. D # 675. Long Beach, CA 90815

Phone: (562) 498-3270. Website: www.directexpressions.com Email: info@directexpressions.com

Discover the Real Cause of the Great Depression.

http://www.greatdepressioncourse.com/course.htm

Dear Concerned Individual,

"The U.S. Government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost," said Federal Reserve Chairman Ben Bernanke on November 21, 2002.

Saying that the U.S. Government could "…produce as many U.S. dollars as it wishes at essentially no cost" is a great big lie. Because there is a cost – it’s inflation.

And it costs you, and every citizen, by robbing them blind of the purchasing power of their dollars.

Since taking the helm of the Federal Reserve in 2006, this is precisely what Bernanke's done...he's printed money like there's no tomorrow. In fact, he's more than doubled the Fed's balance sheet while pushing the federal funds rate to near zero.

What this means is, Bernanke's methodically debauching the dollar to bailout the banks and stimulate the economy. Moreover, this means the dollars in your paycheck, savings, and retirement account, are being watered down to that of a cheap Budweiser beer.

But that's not all...

Warning: This is NOT for Everyone

Just so you know what you're getting into... Before continuing on, we must warn you:

This is NOT for everyone.

In fact, it may not be for you.

But if...

You've had enough of all the government bailouts, stimulus, and spending bills...and are doubtful it'll do a lick for the economy (Hint: it won't...in fact, it'll make things worse)...

You've watched in shock and awe as the stock market has run up 60 percent since its March 9, 2009 low and are considering getting back in the market (Hint: don't do it. This will go down as the all time sucker's rally)

You've suspected the global financial and economic crisis will send the world economy -- including the United States -- tail spinning into another Great Depression (Hint: it already is)...

You've asked "What gives with all these bank failures? And is my bank next?" (Hint: it's practically guaranteed)...

You're concerned the mortgage meltdown will only get worse (Hint: it's only just begun...Alt-A's are next)...

You wonder where all the "liquidity" the Fed "injected" into the system to "calm" the markets came from. And what the heck is "liquidity" anyway? (Hint: it's not what you think it is)...

You suspect the price of gas will once again explode over $4 per gallon...or more (Hint: you ain't seen nothing yet)...

You watched in awe as McMansion homes sprouted like alfalfa...sold at insane prices...and are outraged that we now have to bailout the wall street fat cats like AIG that insured these loans for people who couldn't really afford them to begin with. What gives?

You wonder why practically all the manufacturing jobs have been sent offshore due to "globalization"...

And why all the top U.S. companies are companies that don't make anything...but just shuffle paper.

You dislike filling out "government forms"...and distrust all the government meddling in your private affairs...

All in all, if you look around you and see a world that doesn't quite add up to what you're being told by politicians...the news media...and your broker...

Then you have absolutely, without a doubt, come to the right place...

For we have insights...we have opinions...and we have answers!

And even if you're not so sure about these things, please read on. For you soon may find them to be of utmost importance to the lives of you and your family in the very near future.

That's why we have created the FREE Great Depression Online E-Newsletter;-----------

So that you can discover and be informed of the many perilous financial and economic hazards that are increasing by the day -- hazards that could produce another Great Depression and wipe out what's left of America's middle class in the process. To offer insights into what you can do to protect your hard earned wealth and your family from the coming crisis...and to provide ideas for acquiring massive profits along the way. And to help you explore if this is an opportunity you think you may possibly be interest in...

I'd like to give you a FREE Copy of an important Report. It's called The Great Middle Class Wipe Out -- Avoid Disaster as Economic Bust Wipes Out America's Middle Class. Inside you'll discover the causes of the Great Depression, the difference between recession and depression, cures for the great depression, how to survive the Great Depression...and more.

What's more, this important Report is yours FREE when you subscribe to the FREE Great Depression Online E-Newsletter.

But that's not all. when you subscribe to the Great Depression Online today, you'll receive...

FREE 7-Day Course and Three Bonus Reports

When You Subscribe Today!

That's right. When you subscribe today, you'll receive...

FREE 7-Day Course - Discover why we are headed for another Great Depression. Why this time it could be much, Much, Worse. And what you can do to protect your hard earned wealth and family from the coming economic calamity.

FREE Bonus Report No. 1 - "The Great Middle Class Wipe Out -- Avoid Disaster as Economic Bust Wipes Out America's Middle Class" e-book. Inside you'll discover the causes of the Great Depression, the difference between recession and depression, cures for the great depression, how to survive the Great Depression...and more.

FREE Bonus Report No. 2 - "First Steps in Banking" 50th Anniversary Edition e-book. The licensing fee to publish this Special 50th Anniversary, which first ran in 1957 in the famed British satire magazine, Punch, cost us $202.26.

FREE Bonus Report No. 3 - "The Dutch Tulip Mania" e-book. This fascinating tale of human folly is a must have for every astute market observer. And the wisdom it contains could save you a fortune.

What's more, your subscription to the Great Depression Online is FREE!

When you subscribe to the Great Depression Online, you'll receive an e-mail confirmation.

Following your confirmation, you'll receive an e-mail that includes links to access and download the three FREE Bonus Reports as e-books. You'll be able to save them, print them, and refer to them again...and again...and again.

And on the following day you'll get Day 1 of 7 of the FREE 7-Day Course in your e-mail inbox.

You will also begin receiving issues of the Great Depression Online E-Newsletter. New issues are published twice-weekly; every Tuesday and Friday.

And here's all you need to do to subscribe, click link below and then;

http://www.greatdepressioncourse.com/course.htm

Simply input your e-mail address into the subscribe box below, and you'll be on your way to discovering these very important insights today.

We Respect Your Privacy

We Will Not Share Your Email

With Anyone Else

If you're thinking, "Hey. Should I trust these folks with my email address?"

Let me assure you that we despise SPAM too. For this reason, we have taken special measures to respect and ensure the privacy of your email address...

We use a third party email delivery service provided by AWeber Communications, Inc. You can follow this link to learn more about their Zero Tolerance Anti-Spam Policy.

To respect your privacy and ensure that you do want to hear from us, we require subscription "Conformation" via email.

Every email that is sent includes an "unsubscribe" link. If you no longer want to receive email from us, simply click on the "unsubscribe" link.

And most importantly, we will not sell, rent, or share your email address with anyone. Period!

So what are you waiting for -- FREE 7-Day Course and Three Bonus Report When You Subscribe to the Great Depression Online Today!

Sincerely,

M.N. Gordon, Editor

Great Depression Online

P.S. The Great Depression Online is published by Direct Expressions LLC. To learn more about the many exciting publications we offer, please visit www.directexpressions.com.

Copyright © 2009 Direct Expressions LLC. All Rights Reserved.

Direct Expressions LLC. 2201 N. Lakewood Blvd., Ste. D # 675. Long Beach, CA 90815

Phone: (562) 498-3270. Website: www.directexpressions.com Email: info@directexpressions.com

Discover the Real Cause of the Great Depression.

http://www.greatdepressioncourse.com/course.htm

Saturday, May 8, 2010

Friday, May 7, 2010

The Collapse of the Middle Class

Originally published in BuzzFlash in 2004; http://www.buzzflash.com/contributors/03/09/04_sanders.html

A BUZZFLASH GUEST COMMENTARY

by Rep. Bernie Sanders

The corporate media doesn't talk about it much, but the United States is rapidly on its way to becoming three separate nations.

First, there are a small number of incredibly wealthy people who own and control more and more of our country. Second, there is a shrinking middle class in which ordinary people are, in most instances, working longer hours for lower wages and benefits. Third, an increasing number of Americans are living in abject poverty -- going hungry and sleeping out on the streets.

There has always been a wealthy elite in this country, and there has always been a gap between the rich and the poor. But the disparities in wealth and income that currently exist in this country have not been seen in over a hundred years. Today, the richest 1 percent own more wealth than the bottom 95 percent, and the CEOs of large corporations earn more than 500 times what their average employees make. The nation's 13,000 wealthiest families, 1/100th of one percent of the population, receive almost as much income as the poorest 20 million families in America.

While the rich get richer and receive huge tax breaks from the White House, the middle class is struggling to keep its head above water. The unemployment rate rose to a nine-year high of 6.4 percent in June, 2003. There are now 9.4 million unemployed, up more than 3 million since just before Bush became President. Since March, 2001, we have lost over 2.7 million jobs in the private sector, including two million decent-paying manufacturing jobs -- ten percent of our manufacturing sector. Frighteningly, the hemorrhaging of decent paying jobs is now moving into the white-collar sector. Forrester Research Inc. predicts that at least 3.3 million information technology jobs will be lost to low-wage countries by 2015 with the expansion of digitization, the internet and high-speed data networks.

But understanding the pain and anxiety of the middle class requires going beyond the unemployment numbers. There are tens of millions of fully employed Americans who today earn, in inflation adjusted-dollars, less money than they received 30 years ago. In 1973, private-sector workers in the United States were paid on average $9.08 an hour. Today, in real wages, they are paid $8.33 per hour -- more than 8 percent lower. Manufacturing jobs that once paid a living wage are now being done in China, Mexico and other low-wage countries as corporate America ships its plants abroad.

With Wal-Mart replacing General Motors as our largest employer, many workers in the service economy not only earn low wages but also receive minimal benefits. Further, as the cost of health insurance and prescription drugs soar, more and more employers are forcing workers to assume a greater percentage of their health care costs. It is not uncommon now that increases in health care costs surpass the wage increases that workers receive -- leaving them even further behind. With the support of the Bush Administration many companies are also reducing the pensions they promised to their older workers -- threatening the retirement security of millions of Americans.

One of the manifestations of the collapse of the middle class is the increased number of hours that Americans are now forced to work in order to pay the bills. Today, the average American employee works, by far, the longest hours of any worker in the industrialized world. And the situation is getting worse. According to statistics from the International Labor Organization the average American last year worked 1,978 hours, up from 1,942 hours in 1990 -- an increase of almost a week of work. We are now putting more hours into our work than at any time since the 1920s. Sixty-five years after the formal establishment of the 40-hour work week under the Fair Labor Standards Act, almost 40 percent of Americans now work more than 50 hours a week.

And if the middle class is having it tough, what about the 33 million people in our society who are living in poverty, up 1.3 million in the past two years? What about the 11 million trying to make it on a pathetic minimum wage of $5.15 an hour? What about the 42 million who lack any health insurance? What about the 3.5 million people who will experience homelessness in this year, 1.3 million of them children? What about the elderly who can't afford the outrageously high cost of the prescription drugs they need? What about the veterans who are on VA waiting lists for their health care?

This country needs to radically rethink our national priorities. The middle class is the backbone of America and it cannot be allowed to disintegrate. We need to revitalize American democracy, and create a political climate where government makes decisions which reflect the needs of all the people, and not just wealthy campaign contributors. We need to see the middle class expand, not collapse.

A BUZZFLASH GUEST COMMENTARY

* * *

Rep. Bernie Sanders of Vermont is the only Independent in the U.S. House.

A BUZZFLASH GUEST COMMENTARY

by Rep. Bernie Sanders

The corporate media doesn't talk about it much, but the United States is rapidly on its way to becoming three separate nations.

First, there are a small number of incredibly wealthy people who own and control more and more of our country. Second, there is a shrinking middle class in which ordinary people are, in most instances, working longer hours for lower wages and benefits. Third, an increasing number of Americans are living in abject poverty -- going hungry and sleeping out on the streets.

There has always been a wealthy elite in this country, and there has always been a gap between the rich and the poor. But the disparities in wealth and income that currently exist in this country have not been seen in over a hundred years. Today, the richest 1 percent own more wealth than the bottom 95 percent, and the CEOs of large corporations earn more than 500 times what their average employees make. The nation's 13,000 wealthiest families, 1/100th of one percent of the population, receive almost as much income as the poorest 20 million families in America.

While the rich get richer and receive huge tax breaks from the White House, the middle class is struggling to keep its head above water. The unemployment rate rose to a nine-year high of 6.4 percent in June, 2003. There are now 9.4 million unemployed, up more than 3 million since just before Bush became President. Since March, 2001, we have lost over 2.7 million jobs in the private sector, including two million decent-paying manufacturing jobs -- ten percent of our manufacturing sector. Frighteningly, the hemorrhaging of decent paying jobs is now moving into the white-collar sector. Forrester Research Inc. predicts that at least 3.3 million information technology jobs will be lost to low-wage countries by 2015 with the expansion of digitization, the internet and high-speed data networks.

But understanding the pain and anxiety of the middle class requires going beyond the unemployment numbers. There are tens of millions of fully employed Americans who today earn, in inflation adjusted-dollars, less money than they received 30 years ago. In 1973, private-sector workers in the United States were paid on average $9.08 an hour. Today, in real wages, they are paid $8.33 per hour -- more than 8 percent lower. Manufacturing jobs that once paid a living wage are now being done in China, Mexico and other low-wage countries as corporate America ships its plants abroad.

With Wal-Mart replacing General Motors as our largest employer, many workers in the service economy not only earn low wages but also receive minimal benefits. Further, as the cost of health insurance and prescription drugs soar, more and more employers are forcing workers to assume a greater percentage of their health care costs. It is not uncommon now that increases in health care costs surpass the wage increases that workers receive -- leaving them even further behind. With the support of the Bush Administration many companies are also reducing the pensions they promised to their older workers -- threatening the retirement security of millions of Americans.

One of the manifestations of the collapse of the middle class is the increased number of hours that Americans are now forced to work in order to pay the bills. Today, the average American employee works, by far, the longest hours of any worker in the industrialized world. And the situation is getting worse. According to statistics from the International Labor Organization the average American last year worked 1,978 hours, up from 1,942 hours in 1990 -- an increase of almost a week of work. We are now putting more hours into our work than at any time since the 1920s. Sixty-five years after the formal establishment of the 40-hour work week under the Fair Labor Standards Act, almost 40 percent of Americans now work more than 50 hours a week.

And if the middle class is having it tough, what about the 33 million people in our society who are living in poverty, up 1.3 million in the past two years? What about the 11 million trying to make it on a pathetic minimum wage of $5.15 an hour? What about the 42 million who lack any health insurance? What about the 3.5 million people who will experience homelessness in this year, 1.3 million of them children? What about the elderly who can't afford the outrageously high cost of the prescription drugs they need? What about the veterans who are on VA waiting lists for their health care?

This country needs to radically rethink our national priorities. The middle class is the backbone of America and it cannot be allowed to disintegrate. We need to revitalize American democracy, and create a political climate where government makes decisions which reflect the needs of all the people, and not just wealthy campaign contributors. We need to see the middle class expand, not collapse.

A BUZZFLASH GUEST COMMENTARY

* * *

Rep. Bernie Sanders of Vermont is the only Independent in the U.S. House.

Thursday, May 6, 2010

Foul Play Afoot in Global Metals Markets

Dear Townhall Subscribers,

Many of you have been watching the following story unfold via independent media sources for the past few days. We here at Gainesville Coins wanted to be sure we knew how the events would play out so we could better report how these occurrences would affect you, the precious metals investor. We can now confidently say there is foul play afoot in global precious metals markets, and we want you to be informed.

The Start of the Suspicion

On March 23rd, 2010, independent metals trader Andrew Maguire contacted Gold Anti-Trust Action Committee (GATA) director Adrian Douglas to make him aware of illegal activity which he thought was planned to transpire a few days later when the COMEX April Call Options expired. On March 26th, 2010, Mr. Maguire’s car was mysteriously struck by a hit-and-run vehicle. Luckily both he and his wife, who spent the day shopping together, were rushed to the hospital, and discharged the following day with only minor injuries.

This was not the first time Maguire predicted market-wide price manipulation. On February 3rd, 2010, he wrote an e-mail warning Eliud Ramirez, senior investigator for the Commodity Futures Trading Commission (CFTC) of a similarly illegal large-scale price manipulation within the silver market.