Saturday, October 29, 2011

Thursday, October 27, 2011

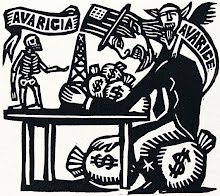

Meet the 0.01 Percent: War Profiteers

While the growing Occupy movement targets the 1 Percent, we want to introduce you to the elite among the gang of the superrich: the war profiteers. Help give your local Occupy group the tools they need to fight corporate power by sharing our new video with them and posting it on your social networks.

War industry CEOs make tens of millions of dollars a year, putting them in the top 0.01 percent of income earners in the U.S.

•Northrop Grumman CEO Wes Bush made $22.84 million last year.

•Lockheed Martin CEO Robert Stevens made $21.89 million.

•Boeing CEO James McNerney: $19.4 million.

These guys use their corporations’ massive lobbying dollars to keep their job-killing gravy train rolling. Last year, their companies spent a whopping $46 million on lobbying, corrupting our politics and ensuring that their bank accounts continue to fatten at our expense. These executives are some of the main reasons why we're wasting so much on war instead of rebuilding our own nation here at home.

We have been deeply inspired by the incredible activism of the Occupy movement, so we created this new video to help highlight a piece of their messaging that's essential to getting our country back on track: We have to end wars for profit.

Help us expose these war profiteers for what they are: the 0.01 Percent. Find your local Occupy group on Facebook and ask them to show our latest video at their events and on their Livestreams. Then, visit our Facebook page to tell us how it went!

Sincerely,

Derrick Crowe, Robert Greenwald

and the Brave New Foundation team

War industry CEOs make tens of millions of dollars a year, putting them in the top 0.01 percent of income earners in the U.S.

•Northrop Grumman CEO Wes Bush made $22.84 million last year.

•Lockheed Martin CEO Robert Stevens made $21.89 million.

•Boeing CEO James McNerney: $19.4 million.

These guys use their corporations’ massive lobbying dollars to keep their job-killing gravy train rolling. Last year, their companies spent a whopping $46 million on lobbying, corrupting our politics and ensuring that their bank accounts continue to fatten at our expense. These executives are some of the main reasons why we're wasting so much on war instead of rebuilding our own nation here at home.

We have been deeply inspired by the incredible activism of the Occupy movement, so we created this new video to help highlight a piece of their messaging that's essential to getting our country back on track: We have to end wars for profit.

Help us expose these war profiteers for what they are: the 0.01 Percent. Find your local Occupy group on Facebook and ask them to show our latest video at their events and on their Livestreams. Then, visit our Facebook page to tell us how it went!

Sincerely,

Derrick Crowe, Robert Greenwald

and the Brave New Foundation team

Thursday, October 20, 2011

Wednesday, October 19, 2011

Tuesday, October 18, 2011

The Feds Secret Bailouts

WHO IS KEEPING TRACK OF THE TRILLIONS?

Join "The Federal Reserve Awareness Project"

http://dailybail.com/home/there-are-no-words-to-describe-the-following-part-ii.html

Join "The Federal Reserve Awareness Project"

http://dailybail.com/home/there-are-no-words-to-describe-the-following-part-ii.html

"Platinum Citizenship," or What Geithner Did

About a decade ago, I read an article in The Onion, "U.S. Offers PlatinumPlus Preferred Citizenship". Apparently, Tim Geithner did too, because from 2007-2011, this is the policy framework that he designed and executed, first as President of the New York Federal Reserve, and then as Treasury Secretary. Now, unequal democracy is not a new story, in many ways it's systemic and goes back hundreds of years. But what we're going to see in part this week is how Geithner deserves special recognition as sort of this decade's champion of making this system more explicit and entrenched.

What we're going to see this week, when the Government Accountability Office releases a more detailed version of an audit of the Federal Reserve's actions during that period, is more details on how this system worked. So let me give you some context on what the Fed bailouts meant, the details to match the persuasive message of the protesters in Zuccotti Park and around the world.

This is first and foremost a political story. It's a story of how bought government has changed what it means to be a citizen. So if you haven't sign our petition yet at www.GetMoneyOut.com, I hope this convinces you to do so.

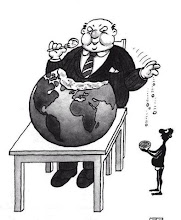

The overall stats of the effects of the crisis are clear - median American pay has dropped by 10% since 2007, but on the high end, the rich have never been more powerful.

I'm not interested in a sob story about inequality, I want to talk about what Geithner *did*, structurally to bring about this situation. We're all aware of the two tiered political system in which protesters can be run over by police scooters but marauders in suits are put on the President's jobs council to chuckle nervously at Occupy Wall Street. But behind the political inequality lies a new order of credit allocation. Tim Geithner created a two-tiered monetary system, a kind of money they have which you can't get. He wasn't alone in doing this. Financial institutions spent hundreds of millions of dollars influencing federal officials to coalesce a bailout while politicians treated them as a special class of super Americans. But he more than anyone else in the crisis period was the central figure in the creation of our current aristocratic monetary order.

Let's start with the two types of money.

In late 2008, there were two types of people who had huge debts and depreciating collateral. Both types accrued their debts through the subprime mortgage crisis. Homeowners with fixed mortgages sat on rapidly depreciating homes in neighborhoods rife with foreclosures. Once the music stopped, they couldn't borrow against their homes at all, but if they wanted to get credit through credit cards, the interest rate could be upwards of 30%. This is sad, but it's not inherently immoral. It's what happens in a typical financial panic. At the time, bankers also had depreciating assets - they owned subprime mortgage debt, and they had fixed obligations as well. But if they wanted to borrow, the Federal Reserve and the Treasury made sure that they could as much credit as they wanted, against whatever collateral they had, for basically nothing. For instance, the Fed accepted almost $500 billion of CCC rated junk as collateral in loans. In other words, if you had a suburban tract home in the Inland Empire with a mortgage and a home equity line of credit, you were out of luck. But if you owned the debt on the home equity line of credit on that same suburban tract home home, you could have easily gone to the discount window or one of the emergency lending facilities and gotten cash with basically no interest charged.

In Group One are millions of Americans. In Group Two are Goldman Sachs, Citigroup, and big American banks, European banks like Dexia, and a whole set of others who had access to the Fed, like the the Bank of Libya, and the wives of Wall Street titans (who had set up special purpose vehicles to take advantage of Fed lending). If you lost your job in 2009, too bad. If you had some savings at the bank or you are a retiree that relies on fixed income bonds, good luck getting more than 1% on your money. But if you were a hedge fund titan who realized that Bernanke had put a taxpayer guarantee against the entire banking system, you were swept up in high stock market returns from 2009-2010.

Sometimes this was even explicit; Geithner created one program in 2009, called the Public-Private Investment Program. Under this program, investors would buy toxic assets, but the government would protect them against much of the downside risk with public funds. In a deal with Citigroup, the Federal Reserve and Treasury took a little less than $300 billion of downside risk on "ring-fenced" bad assets. Oddly, there was no list of the assets when the deal was drawn up, that list would be created later. This is the equivalent of telling a friend if he lends you $25,000 now and you don't pay him back, you'll give him some of your random stuff, whatever you have lying around, later.

While these institutions were pleading with federal officials for bailouts, they were filling their coffers with campaign contributions and paying millions to swarm Capitol Hill to convince officials to bail them out.

And it worked.

During this same time period, Citi Group, which received $300 billion in tax dollars from the United States Treasury, spent more than approximately $13 million to influence lawmakers. Goldman Sachs spent $9 million on buying lawmakers in 2008.

And yes, there are individual scandals, like the government paying out a hundred cents on the dollar for credit default swaps that Goldman Sachs bought from AIG. That was simply a cash award to Goldman. There was Jamie Dimon of JP Morgan pawning off $30 billion of crappy Bear Stearns assets on the New York Federal Reserve, even as he sat on the board of the New York Federal Reserve. And there are the absurdly corrupt aspects of the bailouts, like the fact that the Fed subcontracted much of the actual work. The GAO bloodlessly noted that "most of the contracts, including 8 of the 10 highest-value contracts, were awarded noncompetitively, primarily due to exigent circumstances." Exigent? The upper tier even has its own language. There's also this excruciatingly corrupt point, which few have noticed: "FRBNY's existing restrictions on its employees' financial interests did not specifically prohibit investments in certain nonbank institutions that received emergency assistance." Yup, New York Fed employees could buy stock in companies they knew would benefit from their actions, as long as those companies were not banks. There has been no investigation, as far as I can tell, of whether they did so.

It's not the scandals that matter, or rather, it's that the scandals are the new norm that matters. The larger context here, what the Occupiers are protesting, is that Tim Geithner formalized a financial elite and gave them special rights they had not previously had, notably a government guarantee for their investing, rights which ordinary people don't get. You can see this in bank borrowing spreads; large banks get a subsidy of $34 billion of dollars a year, simply because investors think their bonds are backed by the US government. This is now written into law - Dodd-Frank requires regulators to draw up a list of systemically significant firms. These are pretty explicitly firms that are too big to fail.

Behind these investing advantages are legal advantages. No elite bankers have been prosecuted for the financial crisis, or the foreclosure crisis. NONE. And no, it's not hard to prosecute bankers, especially when they admit violating laws that are easily understandable and carry up to a year in jail, like the law saying you can't foreclose on active duty troops. This is something JP Morgan admitted doing 18 times in a Congressional hearing, yet the bank apparently got off with an apology. US Attorneys are busy prosecuting low level borrower scams, in a shameful display of how the Justice system has now become nothing but a sinecure for ambitious legal servants of the new class of American oligarchs. Meanwhile, if you're a homeowner with an underwater mortgage, you can't discharge your debt in bankruptcy, the way that corporations can or wealthy people can with second (or third or fourth) homes. And if a bank forges a document, or two or three or four, and uses it to foreclose without holding your mortgage note, well, no biggie. You have no rights as a debtor, but the bank has supreme rights as a creditor. Their money counts, yours does not.

Dylan Ratigan

http://www.huffingtonpost.com/dylan-ratigan/platinum-citizenship_b_1015571.html

What we're going to see this week, when the Government Accountability Office releases a more detailed version of an audit of the Federal Reserve's actions during that period, is more details on how this system worked. So let me give you some context on what the Fed bailouts meant, the details to match the persuasive message of the protesters in Zuccotti Park and around the world.

This is first and foremost a political story. It's a story of how bought government has changed what it means to be a citizen. So if you haven't sign our petition yet at www.GetMoneyOut.com, I hope this convinces you to do so.

The overall stats of the effects of the crisis are clear - median American pay has dropped by 10% since 2007, but on the high end, the rich have never been more powerful.

I'm not interested in a sob story about inequality, I want to talk about what Geithner *did*, structurally to bring about this situation. We're all aware of the two tiered political system in which protesters can be run over by police scooters but marauders in suits are put on the President's jobs council to chuckle nervously at Occupy Wall Street. But behind the political inequality lies a new order of credit allocation. Tim Geithner created a two-tiered monetary system, a kind of money they have which you can't get. He wasn't alone in doing this. Financial institutions spent hundreds of millions of dollars influencing federal officials to coalesce a bailout while politicians treated them as a special class of super Americans. But he more than anyone else in the crisis period was the central figure in the creation of our current aristocratic monetary order.

Let's start with the two types of money.

In late 2008, there were two types of people who had huge debts and depreciating collateral. Both types accrued their debts through the subprime mortgage crisis. Homeowners with fixed mortgages sat on rapidly depreciating homes in neighborhoods rife with foreclosures. Once the music stopped, they couldn't borrow against their homes at all, but if they wanted to get credit through credit cards, the interest rate could be upwards of 30%. This is sad, but it's not inherently immoral. It's what happens in a typical financial panic. At the time, bankers also had depreciating assets - they owned subprime mortgage debt, and they had fixed obligations as well. But if they wanted to borrow, the Federal Reserve and the Treasury made sure that they could as much credit as they wanted, against whatever collateral they had, for basically nothing. For instance, the Fed accepted almost $500 billion of CCC rated junk as collateral in loans. In other words, if you had a suburban tract home in the Inland Empire with a mortgage and a home equity line of credit, you were out of luck. But if you owned the debt on the home equity line of credit on that same suburban tract home home, you could have easily gone to the discount window or one of the emergency lending facilities and gotten cash with basically no interest charged.

In Group One are millions of Americans. In Group Two are Goldman Sachs, Citigroup, and big American banks, European banks like Dexia, and a whole set of others who had access to the Fed, like the the Bank of Libya, and the wives of Wall Street titans (who had set up special purpose vehicles to take advantage of Fed lending). If you lost your job in 2009, too bad. If you had some savings at the bank or you are a retiree that relies on fixed income bonds, good luck getting more than 1% on your money. But if you were a hedge fund titan who realized that Bernanke had put a taxpayer guarantee against the entire banking system, you were swept up in high stock market returns from 2009-2010.

Sometimes this was even explicit; Geithner created one program in 2009, called the Public-Private Investment Program. Under this program, investors would buy toxic assets, but the government would protect them against much of the downside risk with public funds. In a deal with Citigroup, the Federal Reserve and Treasury took a little less than $300 billion of downside risk on "ring-fenced" bad assets. Oddly, there was no list of the assets when the deal was drawn up, that list would be created later. This is the equivalent of telling a friend if he lends you $25,000 now and you don't pay him back, you'll give him some of your random stuff, whatever you have lying around, later.

While these institutions were pleading with federal officials for bailouts, they were filling their coffers with campaign contributions and paying millions to swarm Capitol Hill to convince officials to bail them out.

And it worked.

During this same time period, Citi Group, which received $300 billion in tax dollars from the United States Treasury, spent more than approximately $13 million to influence lawmakers. Goldman Sachs spent $9 million on buying lawmakers in 2008.

And yes, there are individual scandals, like the government paying out a hundred cents on the dollar for credit default swaps that Goldman Sachs bought from AIG. That was simply a cash award to Goldman. There was Jamie Dimon of JP Morgan pawning off $30 billion of crappy Bear Stearns assets on the New York Federal Reserve, even as he sat on the board of the New York Federal Reserve. And there are the absurdly corrupt aspects of the bailouts, like the fact that the Fed subcontracted much of the actual work. The GAO bloodlessly noted that "most of the contracts, including 8 of the 10 highest-value contracts, were awarded noncompetitively, primarily due to exigent circumstances." Exigent? The upper tier even has its own language. There's also this excruciatingly corrupt point, which few have noticed: "FRBNY's existing restrictions on its employees' financial interests did not specifically prohibit investments in certain nonbank institutions that received emergency assistance." Yup, New York Fed employees could buy stock in companies they knew would benefit from their actions, as long as those companies were not banks. There has been no investigation, as far as I can tell, of whether they did so.

It's not the scandals that matter, or rather, it's that the scandals are the new norm that matters. The larger context here, what the Occupiers are protesting, is that Tim Geithner formalized a financial elite and gave them special rights they had not previously had, notably a government guarantee for their investing, rights which ordinary people don't get. You can see this in bank borrowing spreads; large banks get a subsidy of $34 billion of dollars a year, simply because investors think their bonds are backed by the US government. This is now written into law - Dodd-Frank requires regulators to draw up a list of systemically significant firms. These are pretty explicitly firms that are too big to fail.

Behind these investing advantages are legal advantages. No elite bankers have been prosecuted for the financial crisis, or the foreclosure crisis. NONE. And no, it's not hard to prosecute bankers, especially when they admit violating laws that are easily understandable and carry up to a year in jail, like the law saying you can't foreclose on active duty troops. This is something JP Morgan admitted doing 18 times in a Congressional hearing, yet the bank apparently got off with an apology. US Attorneys are busy prosecuting low level borrower scams, in a shameful display of how the Justice system has now become nothing but a sinecure for ambitious legal servants of the new class of American oligarchs. Meanwhile, if you're a homeowner with an underwater mortgage, you can't discharge your debt in bankruptcy, the way that corporations can or wealthy people can with second (or third or fourth) homes. And if a bank forges a document, or two or three or four, and uses it to foreclose without holding your mortgage note, well, no biggie. You have no rights as a debtor, but the bank has supreme rights as a creditor. Their money counts, yours does not.

Dylan Ratigan

http://www.huffingtonpost.com/dylan-ratigan/platinum-citizenship_b_1015571.html

Subscribe to:

Posts (Atom)